The crypto market in 2025 has officially come to an end. This year has been filled with many dramatic events, from the US president's cryptocurrency launch to the epic liquidation, all of which made 2025 an extraordinary year. Looking back, we pick up those outrageous and absurd moments of the year as Easter eggs at the end of a certain point, and as a commemoration of how we, in this "casino," this amusement park, this experimental field, still "lived" to the end of the year. Hopefully, we can see that in the end, it was the origin of all the absurdity this year, something even more absurd than "hot weather turning cold wallets into hot wallets."

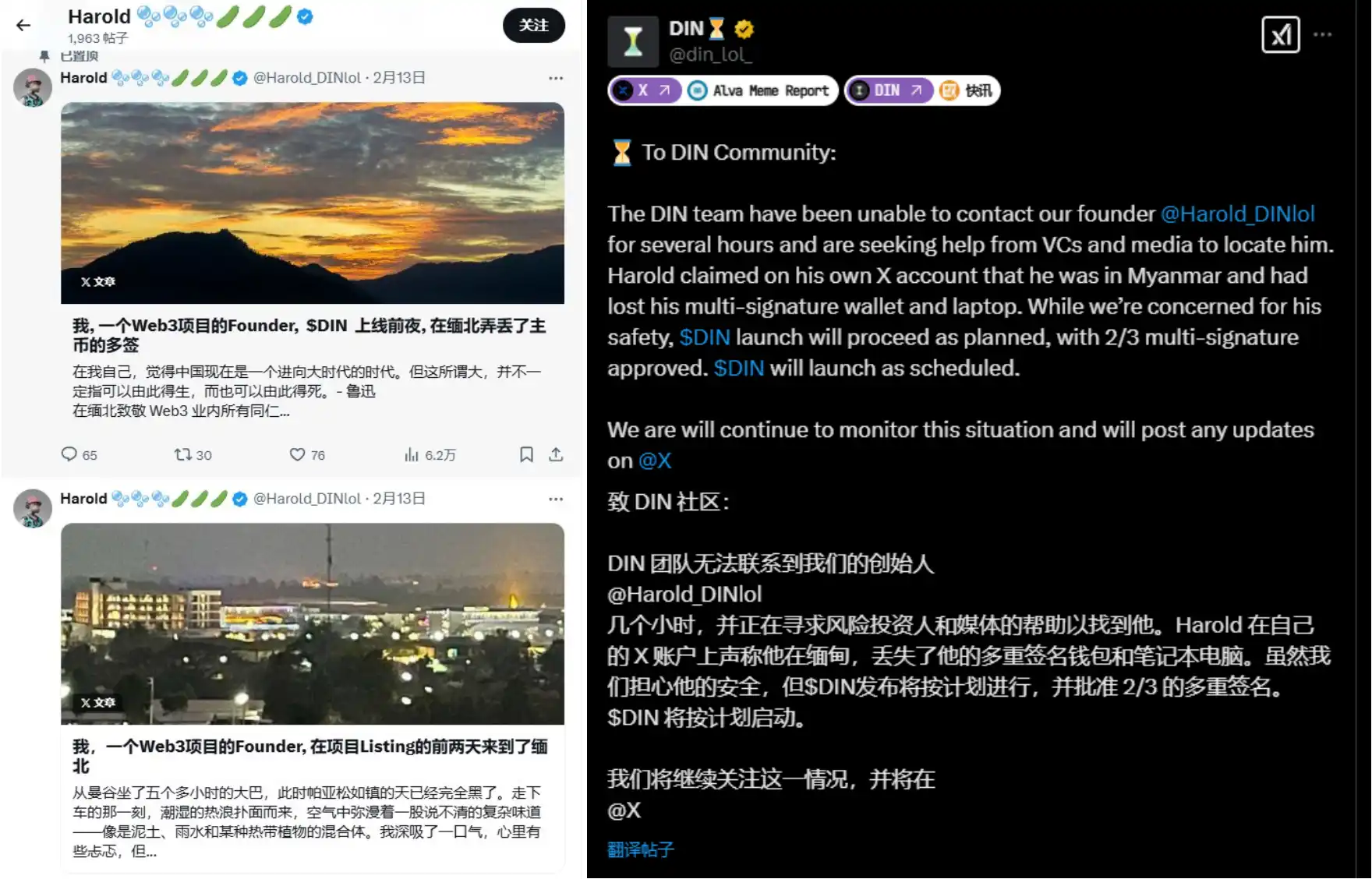

The founder of TGE went missing that day, claiming he lost multiple signatures of the main currency in northern Myanmar.

In February, the DIN team announced that they had been unable to contact project founder Harold for several hours and were seeking assistance from venture capital firms and the media to confirm his whereabouts. Based on Harold's previous statements on social media, he appeared to be in Myanmar and claimed to have lost his multisignature wallet and laptop. Despite the founder's temporary absence, the DIN team stated that the token issuance plan was unaffected. TGE has currently received two-thirds multisignature approval and is expected to launch as scheduled. Some community members believe this incident has brought unexpected buzz to the project, while others have questioned the narrative of "founder missing, wallet lost, yet the project still proceeding normally," suspecting a possible deliberate publicity stunt.

A zkLend hacker mistakenly clicked on a phishing website, resulting in a second theft of stolen funds. The hacker has requested cooperation with zkLend to recover the funds.

In April, the zkLend hacker (the original case occurred in February) accidentally clicked on a phishing website while trying to use Tornado Cash, resulting in the theft of 2,930 ETH. The hacker subsequently sent an on-chain message to zkLend stating, "Hi, I intended to transfer funds to Tornado Cash, but I accidentally used a phishing website and lost all my funds. I'm devastated. I'm deeply sorry for the chaos and losses caused. All 2,930 ETH have been taken by the website's operators. I have no coins left. Please focus your efforts on those website operators to see if you can recover some of the funds."

On the same day, zkLend issued an official statement saying that the phishing website appeared to have been operating for over five years. At this stage, the security team had no conclusive evidence of a connection between the phishing website and the attackers. As a precaution, zkLend has included these new wallet addresses from the phishing website in its fund tracking efforts for real-time monitoring, and is in contact with CEXs and authorities. The team will continue its efforts to trace these funds.

Zerebro founder fakes death and releases timed suicide note

In May, a video clip of Jeffy Yu, co-founder of Zerebro, committing suicide by shooting himself during a live stream circulated online. At the time, many people viewed it as a sensationalist live stream similar to the one involving Pump.Fun, just another "story" staged by meme developers to attract attention. On the afternoon of May 6, a screenshot of Jeffy Yu's obituary circulated on social media, and people began to connect it with the "suicide clip" from two days earlier.

As attention grew, the market capitalization of its associated meme token, LLJEFFY, surged, briefly exceeding $30 million. However, on the evening of the 6th, several KOLs exposed the scheme, revealing that Jeffy Yu had sent a detailed letter to an early investor, detailing it as a meticulously planned "fake death exit." Jeffy Yu stated that due to persistent harassment from his ex-partner, malicious disclosure of his personal information, and online hate, he chose to "permanently exit" by faking his death. In the letter, he admitted it was the "only way" to avoid a price crash for the project's token. This incident is considered the first instance of a "fake death exit strategy" in cryptocurrency history.

Clanker partner's identity was exposed after he allegedly stole project funds and attended an offline meeting.

In May, Clanker, an AI token issuer on Base, announced the termination of its partnership with core developer proxystudio (@proxystudio.eth). Team member Jack Dishman stated in the announcement that the Clanker team only recently became aware of proxystudio's past misconduct.

What truly lends this news story a touch of absurdity is the protagonist's multiple identities. proxystudio is actually Gabagool.eth, a figure known for his on-chain detective work in the early DeFi scene. In 2022, this on-chain detective was exposed for abusing his position to embezzle approximately $350,000 from the wallet of his team, Velodrome, only returning most of the funds after pressure from the community and the project.

Even more bizarrely, Gabagool wasn't exposed again through on-chain data, but rather recognized offline by a former colleague at the FarCon event. According to multiple media reports, Aerodrome founder Alex Cutler recognized proxystudio as Gabagool from back then at the event. This old case was then unearthed overnight, and the Clanker team quickly issued an announcement that they had "parted ways."

A Bitcoin wallet resets a user's wallet balance to zero.

In June, several community users reported that their Bitcoin Lightning Network wallets, Alby, appeared to have had their balances deducted by the platform. Alby's official terms of service, updated in March 2025, stated: "Users who have been notified for more than a year to withdraw excess funds from older Alby accounts created in 2023 or earlier using a shared wallet architecture will be subject to further notice. To more effectively manage these long-term inactive accounts, the right to deduct the entire remaining balance from the account after 12 consecutive months of no transaction activity (i.e., no completed transactions) is reserved."

Alby, redefining the wallet.

Paxos mistakenly minted 300 trillion PYUSD coins, which were then urgently destroyed. This amount is equivalent to more than twice the total global debt.

In October, stablecoin issuer Paxos minted 300 trillion PYUSD stablecoins pegged 1:1 to the US dollar. After discovering the error, it took 22 minutes to burn all the tokens.

Based on their dollar-pegged value, the total value of these burned tokens reached approximately $300 trillion. In comparison, according to the International Monetary Fund, this amount is more than twice the combined GDP of all countries in the world.

Blockchain can solve the global debt problem in just one minute.

A painter who can't draw candlestick charts isn't a good market maker.

Quantitative trading is completely outclassed. When Altcoin manipulators can draw lines at will, the candlestick charts you see will look like this:

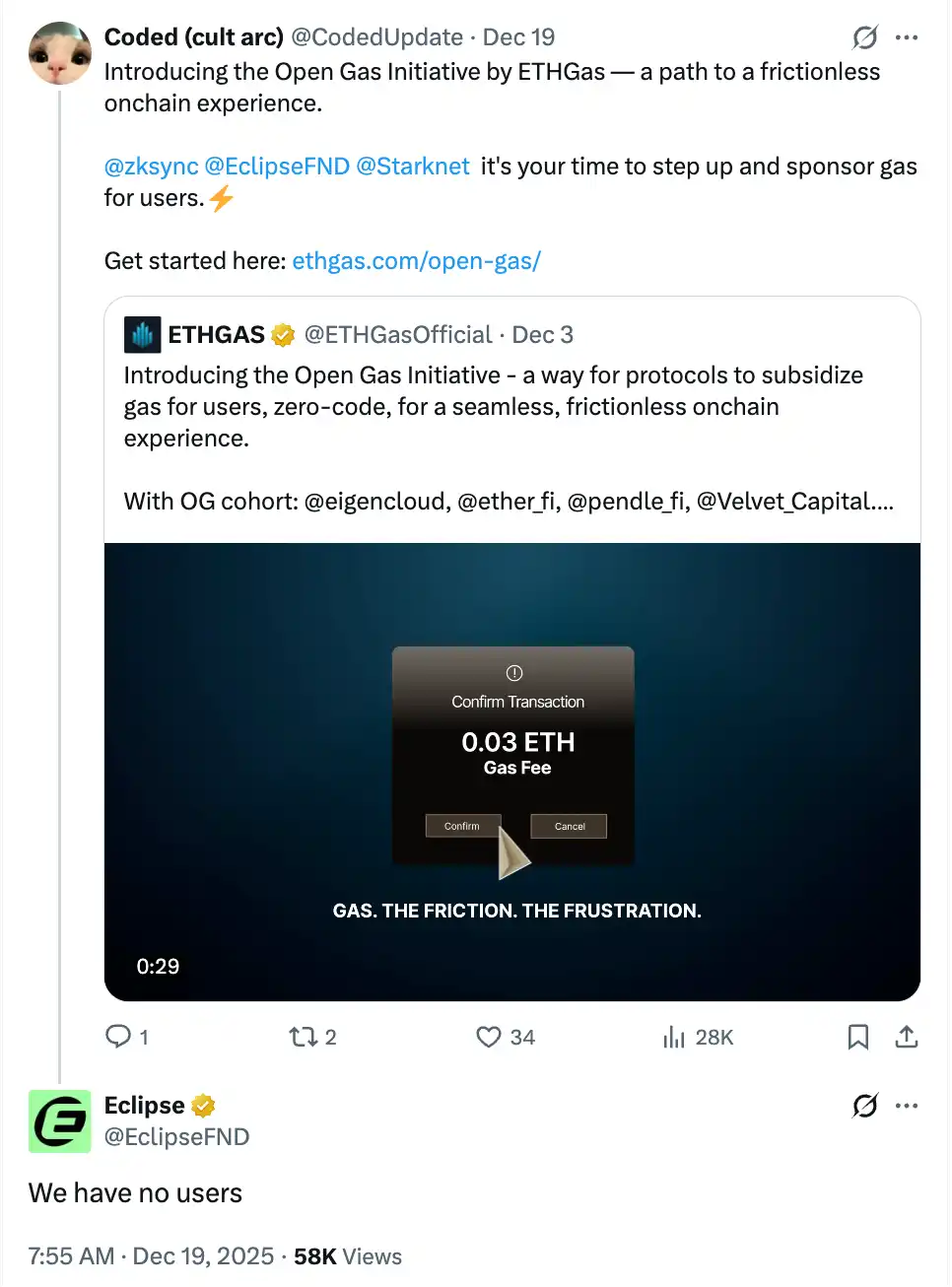

Eclipse: We have no users

Since its inception, the Eclipse project has been embroiled in numerous controversies, from its founder being embroiled in sexual assault scandals to multiple changes in leadership and CEO. Not long ago, Eclipse posted on social media that it was part of a 36-month sociological study conducted by Harvard University. "Our study is now complete. Thank you for your time and cooperation." And now, in a post introducing its new project ETHGAS, the official Eclipse account bluntly stated, "We have no users."

Trump's wife issues cryptocurrency

Everyone stand up.

No words can describe how absurd it is that Trump's wife launched her own name-based token, MELANIA, in the middle of the night after her husband did. If the cryptocurrency industry had a pillar of shame, MELANIA would be engraved at the very top, a disgrace to the entire industry.