Competition between blockchains has escalated to the level of "transaction ranking," which directly impacts market makers' order spreads and market depth.

The demand for a "universal blockchain" has been disproven. Current competition between blockchains focuses on two levels:

1) Build an "application chain" based on existing mature businesses, so that blockchain can supplement existing businesses in processes such as settlement;

2) Competition at the "transaction ranking" level.

This article focuses on the second level.

The ranking directly affects the behavior of market makers. This is the core issue.

What is transaction sorting?

On the blockchain, a user's transaction is not immediately written to a block; instead, it first enters a "mempool." At any given time, there may be tens of thousands of transactions, and the sequencer, validators, or miners must determine which one to write.

1) Which transactions are included in the next block?

2) In what order are these transactions arranged?

The process of "determining the order" is the transaction sorting, which directly affects the transaction costs, MEV status, transaction success rate, and fairness of on-chain users.

For example, when the network is congested, the ordering determines whether a transaction can be quickly recorded on the blockchain or waits indefinitely in the mempool.

For high-frequency traders such as market makers, the effectiveness of order cancellations is more important than the success of order placements. The priority of processing order cancellation orders directly affects whether market makers dare to provide deep liquidity.

Last cycle, everyone was focused on TPS, believing that as long as the speed was fast enough, it would improve on-chain transaction settlement. But as it turns out, in addition to speed, market makers' risk pricing is equally important.

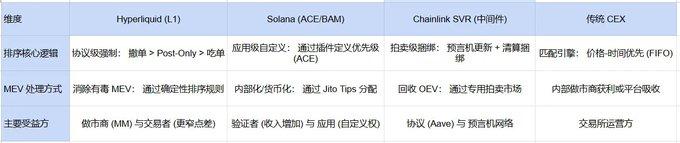

In centralized exchanges, trade matching strictly follows the "price-time priority" principle. Market makers, in this high-certainty environment, can provide deep order book liquidity with extremely narrow slippage.

On-chain, after a transaction enters the Mempool waiting area, nodes select transactions based on their gas levels, which creates opportunities to increase gas levels to suppress existing pending orders.

Assuming Trump's price is $4.5, market makers place buy orders at $4.4 and sell orders at $4.6 to provide market depth. However, the Trump exchange price suddenly crashes to $4.

At this point, the on-chain market maker wanted to cancel its $4.40 order, but was thwarted by a high-frequency trader who increased the gas price—buying at $4 and then selling back to the market maker at $4.40.

Therefore, market makers can only reduce risk by widening the price spread.

The goal of next-generation sorting innovation is to transform from "general sorting" to "application-aware sorting".

The sorting layer can understand transaction intent and sort transactions according to pre-defined fairness rules, rather than solely based on gas fees.

1) Specify the sorting method at the consensus layer.

A prime example is Hyperliquid. It prioritizes order cancellations and post-only transactions at its consensus layer, breaking the gas priority principle.

For market makers, being able to exit the market is paramount. During periods of sharp price fluctuations, order cancellation requests are always executed before other people's buy/sell requests.

Market makers fear being targeted by attackers. Hyperliquid ensures that order cancellations always take priority – when prices fall, market makers cancel their orders, and the system forces these cancellations to be processed first, allowing market makers to successfully mitigate risk.

On October 11th, the day of the price crash, Hyperliquid market makers remained online, with spreads of 0.01–0.05%. This was because the market makers knew they could exit the market.

2) Add a new sorting method to the sorting layer.

For example, Solana has Application Controlled Execution (ACE). Jito Labs' BAM (Block Assembly Marketplace) introduces dedicated BAM nodes responsible for the collection, filtering, and sorting of transactions.

The nodes run in a Trusted Execution Environment (TEE), ensuring the privacy of transaction data and the fairness of the sorting.

Through ACE, DEXs on Solana (such as Jupiter, Drift, and Phoenix) can register custom sorting rules with BAM nodes. Examples include market maker priority (similar to Hyperliquid) and conditional liquidity.

In addition, Prop AMM proprietary market makers, represented by HumidiFi, are also innovations at the ordering level. They utilize Nozomi to connect directly with major validators, reducing latency and completing transactions.

During actual transactions, HumidiFi's off-chain servers monitor prices on various platforms. Oracles communicate with on-chain contracts to inform them of the situation. Nozomi acts as a VIP channel, allowing orders to be cancelled effectively before they are executed.

3) Utilize MEV facilities and private access routes

Chainlink SVR (Smart Value Recapture) focuses on the attribution of value (MEV) generated by ordering.

By deeply integrating with oracle data, the ordering and value allocation of liquidation transactions are redefined. After a Chainlink node generates a price update, it sends it through two channels:

1) Public channel: Sends to the standard on-chain aggregator (as a backup, but with a slight delay in SVR mode to allow for the auction window).

2) Private Channel (Flashbots MEV-Share): Sends to auction markets that support MEV-Share.

In this way, the auction proceeds (i.e. the amount that searchers are willing to pay) triggered by oracle price fluctuations and the liquidation of lending protocols no longer belong exclusively to miners, but are mostly captured by the SVR protocol.

Summarize

If TPS is the entry ticket, then having only TPS is far from enough. Customizing the sorting logic may not just be an innovation, but an essential step in putting transactions on the blockchain.

This may also be the beginning of DEX surpassing CEX.