Bitcoin has seen a slight increase in exchange holdings in the short term, but the overall medium-term trend continues to be one of outflow, leading to a wait-and-see approach.

According to CoinGlass, as of 3:30 PM on the 29th, the total Bitcoin holdings on major exchanges were approximately 2,497,966 BTC.

There was a net outflow of 1,687.50 BTC over the past day, 2,885.16 BTC over the past week, and 49,935.18 BTC over the past month. While some exchanges experienced short-term inflows, the weekly and monthly trends still show a clear net outflow pattern.

Coinbase Pro holds the largest balance among major exchanges, holding 797,469 BTC. It recorded a daily net inflow of 91.27 BTC and a weekly net outflow of 6,207.29 BTC.

Binance holds 654,661 BTC. With a daily net outflow of 392.39 BTC and a weekly net inflow of 1,785.67 BTC, the short-term outflows were followed by a partial reversal of inflows on a weekly basis.

Bitfinex holds 412,799 BTC and has the most stable inflow among major exchanges, with a daily net inflow of 166.62 BTC and a weekly net inflow of 783.69 BTC.

Daily Net Inflows: Bybit (+509 BTC), Bitfinex (+167 BTC), Coinbase Pro (+91 BTC)

Daily Net Outflows: Kraken (-1,116 BTC) OKX (-426 BTC) Binance (-392 BTC)

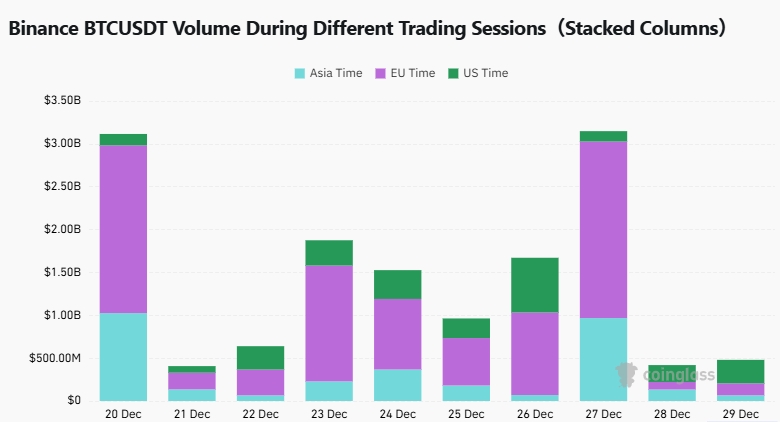

Binance BTCUSDT trading volume was recorded at $66.52 million during Asian hours, $139.11 million during European hours, and $274.56 million during American hours.

Compared to the previous day (Asia $134.34 million, Europe $87.55 million, and the US $197.12 million), the Asian market decreased by 50.5%, while the European market increased by 58.9% and the US market also increased by 39.3%.

Looking at regional trends, trading volumes in Asian time zones plummeted by half, demonstrating a clear contraction. Conversely, trading volumes in European and American time zones increased significantly, indicating a shift in financial activity toward Western markets. In particular, trading volumes in the US time zone increased the most, indicating that the American market has become the center of short-term liquidity.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.