The cryptocurrency market's capital reallocation pattern is clearly revealed, with the inflow of funds based on euros and Korean won, coupled with large-scale movements between stablecoins and a net inflow centered on Bitcoin.

According to Cryptometer data as of the 29th, a total of $21.3 million in EUR-based funds have flowed in, of which $12.9 million went to USDC and $8.4 million went to BTC.

USD-based fund inflows totaled $13.2 million. $7.8 million flowed into ETH, with other funds distributed to ADA, ZEC, and other cryptocurrencies.

Korean Won (KRW)-based funds saw a total inflow of $12.7 million, distributed in the following order: BTC $5.1 million, ETH $3.4 million, SOL $2.5 million, and XRP $1.7 million. Turkish Lira (TRY)-based inflows amounted to $3.9 million.

A total of $296.3 million in liquidity moved through USDT. USDC accounted for the largest portion, at $203.2 million, followed by BTC at $30.9 million, SOL at $24 million, and BNB at $9.3 million. The remainder was distributed among a variety of altcoins, including TRX, XPL, TON, and ENA.

USDC saw a massive inflow of $216.2 million, while limited outflows were observed, including $8.4 million for ETH and $3.7 million for USDE.

The total amount of funds flowing through FDUSD was calculated to be $75.8 million. Of this, the largest inflow was into BTC at $40.5 million, followed by ETH at $22.3 million, BNB at $7 million, SOL at $3 million, and XRP at $1.5 million.

Looking at the final inflows by asset, BTC emerged as the largest absorber, with a total inflow of $88.2 million. This was followed by ETH at $48.8 million, SOL at $34.4 million, and BNB at $18.6 million.

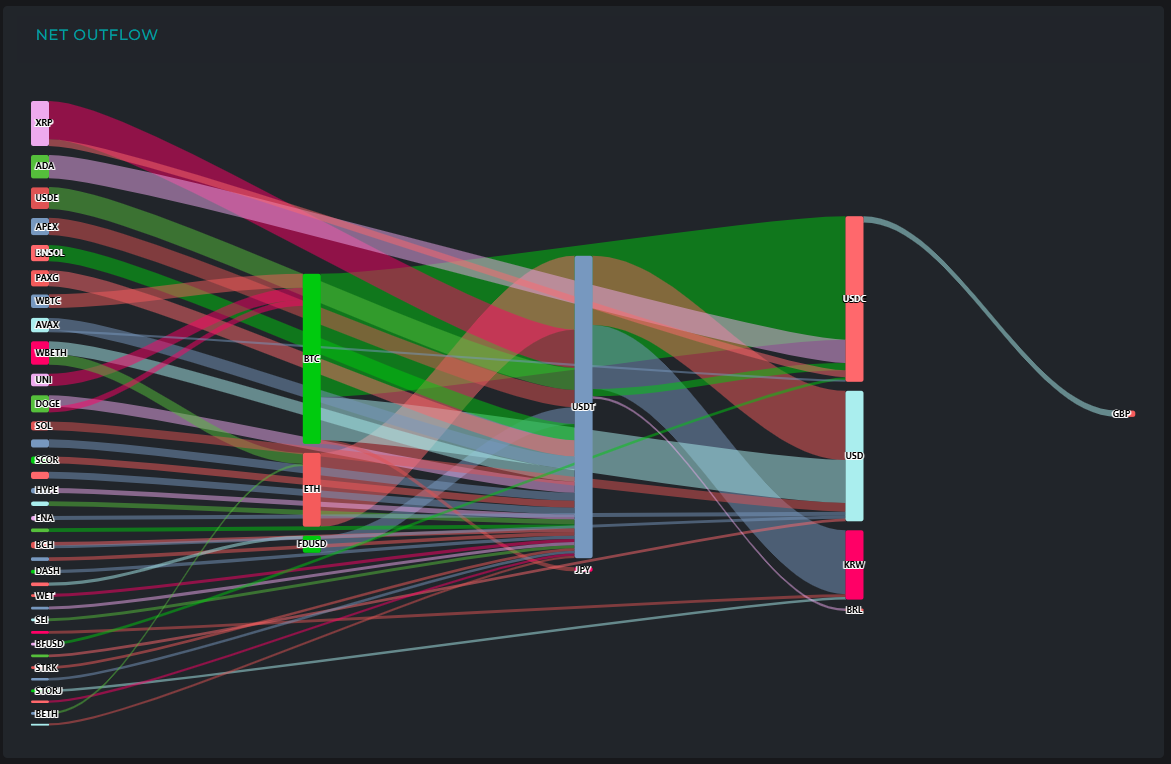

A total of $38.8 million was withdrawn from Bitcoin (BTC), of which $28.1 million went to USDC and $9.8 million to USD, increasing the proportion of cash assets.

Selling activity was also observed on Ethereum (ETH). ETH-based funds primarily flowed into USDT, with the outflow amounting to $14.1 million. At the same time, $3.8 million of FDUSD also moved into USDT, indicating a shift among stablecoins.

Among altcoins, XRP saw the most notable outflows. A total of $10.1 million flowed out of XRP, with $8.5 million flowing into USDT and $1.6 million flowing into USDC.

ADA also saw a $5.3 million outflow to USDC, while $5 million USDE was converted to USDT. Additionally, $3.9 million from APEX, $3.7 million from BNSOL, and $3.6 million from PAXG were transferred to USDT.

Selling pressure was also observed in wrapped assets. $3.2 million was converted to BTC from WBTC, and a total of $5.3 million flowed out of WBETH, distributed among $2.8 million in USDT and $2.5 million in ETH. Relatively shallow outflows also occurred in AVAX, UNI, DOGE, SOL, SCOR, HYPE, and ENA.

USDT acted as the largest source of inflows on this day, with a total inflow of $65.5 million. Of this, $15.8 million flowed into USD and $14.8 million into KRW.

A total of $37.8 million USDC, $29.8 million USD, and $16 million KRW were inflowed, and some cash flow was confirmed with $1.4 million of the British Pound moving.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.