Although Zcash has no intention of replacing Bitcoin as a transparent and sound currency, it is forming an independent "privacy premium" value logic and market narrative by filling the design gaps in Bitcoin's privacy protection.

Written by: @0xYoussef_

Compiled by: AididiaoJP, Foresight News

Of all crypto assets outside of Bitcoin and Ethereum, ZEC (Zcash) experienced the most significant shift in perception regarding its monetary attributes in 2025. For years, ZEC was not considered a mainstream monetary asset, but rather a niche privacy coin. However, with increasing surveillance of Bitcoin and accelerating institutionalization, privacy is no longer just a preference for a minority, but has once again become a core attribute of currency.

Bitcoin proved that non-sovereign digital currencies can operate globally, but it failed to retain the privacy we're accustomed to when using physical cash. Every transaction is broadcast on a transparent public ledger, viewable by anyone through a block explorer. Ironically, this tool, intended to challenge the traditional financial system, has inadvertently created a financial "panopticon."

Zcash combines Bitcoin's monetary policy with the privacy features of physical cash through zero-knowledge proof cryptography. Currently, no other digital asset offers the proven and deterministic privacy guarantees that Zcash's latest shielded pool provides. This makes Zcash a valuable and difficult-to-replicate form of private currency. We believe the market's repricing of ZEC relative to BTC reflects its status as an ideal private cryptocurrency, making it a hedge against the risks of rising surveillance states and the institutionalization of Bitcoin.

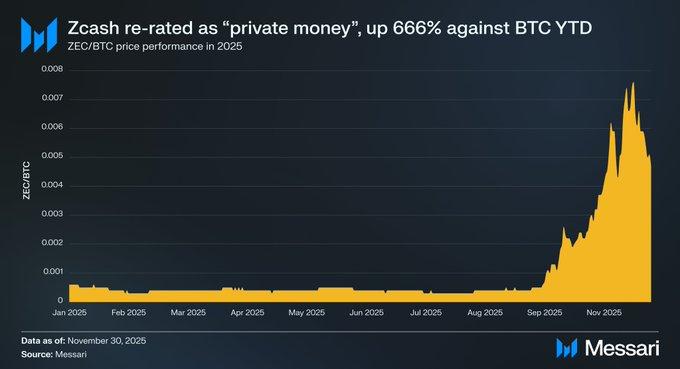

This year, ZEC's price against Bitcoin has surged 666%, reaching a market capitalization of $7 billion, briefly surpassing Monero (XMR) to become the most valuable privacy coin. This relative strength indicates that the market is viewing ZEC alongside XMR as viable private cryptocurrencies.

Bitcoin's privacy dilemma

Bitcoin is highly unlikely to adopt a shielded pool architecture, therefore the view that Bitcoin will eventually absorb Zcash's value is untenable. Bitcoin is known for its conservative culture, emphasizing the stability and solidification of its protocol to reduce the attack surface and maintain the integrity of the currency. Embedding privacy features at the protocol level would require modifications to Bitcoin's core architecture, potentially introducing inflationary vulnerabilities that could damage its monetary credibility. Zcash, on the other hand, is willing to take this risk because privacy is a core value proposition of its.

Implementing zero-knowledge proof cryptography at the base layer also reduces the scalability of the blockchain because it requires the use of "invalid symbols" and hash notes to prevent double-spending, potentially leading to "state bloat" in the long run. Invalid symbols form a continuously growing "list," which can eventually make running a full node extremely resource-intensive. Forcing nodes to store a large and ever-growing set of invalid symbols undermines Bitcoin's decentralized nature, as the barrier to entry for running a node increases over time.

Furthermore, unless a soft fork supporting zero-knowledge proofs (such as OP_CAT) emerges, no Bitcoin layer-2 network can fully inherit Bitcoin's security while providing Zcash-level privacy. Existing solutions either introduce trusted intermediaries (consortium model), accept lengthy and interactive withdrawal delays (BitVM model), or completely transfer execution and security to another system (sovereign rollup). As long as this situation remains unchanged, no existing path can achieve Zcash's level of privacy while maintaining Bitcoin's security, which reinforces ZEC's unique value as a private cryptocurrency.

Hedging Central Bank Digital Currencies (CBDCs)

The advent of central bank digital currencies (CBDCs) has further intensified the urgent demand for privacy-preserving currencies. Half of the world's countries are researching or have already launched CBDCs. CBDCs are programmable, meaning issuers can not only track every transaction but also control how, when, and where funds are used. Funds can be set to be used only at specific merchants or within specific geographic areas.

This may sound like a dystopian fantasy, but the weaponization of the financial system is already a reality:

- Nigeria (2020): During the EndSARS protests against police violence, the Central Bank of Nigeria froze the bank accounts of key protest organizers and women's rights groups, forcing the movement to turn to cryptocurrency to keep running.

- United States (2020-2025): Regulators and large banks have implemented "debanking" measures on legitimate but politically unpopular industries (such as oil and gas, firearms, adult content, and cryptocurrencies) citing "reputational risk" and ideology. This issue has become so serious that the White House has ordered a review, and a 2025 research report by the Office of the Comptroller of the Currency (OCC) documented such systemic restrictions on legitimate industries.

- Canada (2022): During the "Freedom Cycling" protests, the Canadian government invoked the Emergency Act to freeze the bank and crypto accounts of protesters and even small donors without a court order. The Royal Canadian Mounted Police even blacklisted 34 self-custodied crypto wallet addresses, demanding that all regulated exchanges cease trading with these addresses. This demonstrates that Western democracies are also willing to weaponize their financial systems to suppress political dissent.

In an era where currency can be programmed to control individuals, Zcash offers a clear exit strategy. However, Zcash is not only about circumventing CBDCs; it is also becoming increasingly necessary to protect Bitcoin itself.

Hedging the "capture" risk of Bitcoin

As influential advocates Naval Ravikant and Balaji Srinivasan have stated, Zcash is an "insurance policy" for upholding Bitcoin's vision of financial freedom.

Bitcoin is rapidly concentrating in the hands of centralized entities. Centralized exchanges (holding approximately 3 million BTC), ETFs (approximately 1.3 million BTC), and publicly traded companies (approximately 829,000 BTC) collectively hold approximately 5.1 million BTC, representing 24% of the total supply.

This concentration means that 24% of the Bitcoin supply is vulnerable to regulatory seizure, mirroring the centralized conditions relied upon by the U.S. government when it confiscated gold in 1933. The executive order at that time forced U.S. citizens to surrender more than $100 worth of gold to the Federal Reserve, which then exchanged it for paper money at the official exchange rate of $20.67 per ounce. This process was enforced through the banking system, not by force.

For Bitcoin, the mechanism would be similar. Regulators wouldn't need to obtain your private keys; they only need legal jurisdiction over the custodian to seize 24% of the supply. In this scenario, a government could simply issue enforcement orders to institutions like BlackRock and Coinbase, forcing these legally obligated companies to freeze and transfer their held Bitcoins. Overnight, nearly a quarter of the Bitcoin supply could be effectively "nationalized" without any code cracking. While this is an extreme case, its possibility cannot be entirely ruled out.

Given the transparency of blockchain technology, self-custody is no longer a foolproof solution. Any Bitcoin withdrawn from a KYC-verified exchange or brokerage account could be traced and seized, as the "traces of funds" could ultimately lead governments to the final destination of these tokens.

Bitcoin holders can convert their assets into Zcash to sever the custody chain and "isolate" their wealth from surveillance. Once funds enter Zcash's shielded pool, the target address becomes a cryptographic "black hole" for outside observers. Regulatory agencies can track funds leaving the Bitcoin network but cannot know their final destination, thus making the assets "invisible" to state actors. While converting them into fiat currency and depositing them in banks remains a bottleneck, the assets themselves possess censorship resistance and are difficult to actively trace. Of course, the strength of this anonymity depends entirely on the security of the user's actions—if an address is reused before shielding or funds are obtained through KYC-compliant exchanges, a permanent traceable link is established.

The Road to Mainstream Applications

The demand for private currencies has always existed; Zcash simply struggled to reach a broad user base in the past. For years, the protocol was hampered by high memory requirements, lengthy proof times, and cumbersome desktop setups, making shielded transactions slow and unfriendly to most users. Recent infrastructure breakthroughs have systematically removed these barriers, paving the way for mass adoption.

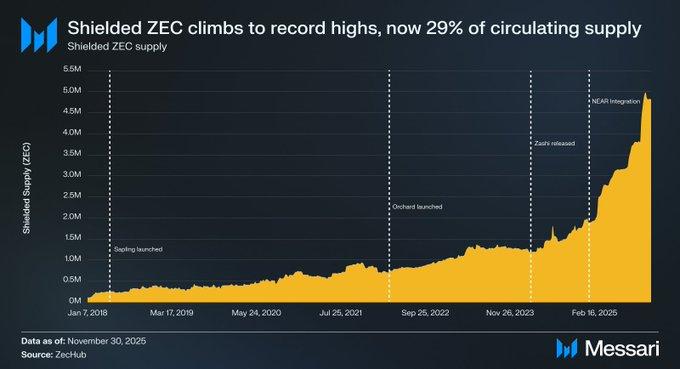

- Sapling upgrade: Reduces memory requirements by 97% (to approximately 40MB) and proof time by 81% (to approximately 7 seconds), laying the foundation for shielded transactions on mobile devices.

- Orchard Upgrade and Halo 2: After addressing speed issues, trusted settings remain a concern for the privacy community. By adopting Halo 2, the Orchard upgrade eliminates Zcash's reliance on trusted settings, making it completely trustless. The introduction of "Unified Addresses" combines transparent and masked addresses, eliminating the need for users to manually select address types.

- Zashi Wallet: In March 2024, Electric Coin Company released the mobile wallet Zashi. It utilizes the abstraction of a unified address to simplify the process of blocking transactions to just a few clicks on the screen, making privacy the default user experience.

- NEAR Intents Integration: Solves the final link in the distribution channel. Users can now directly exchange supported assets (such as BTC and ETH) for shielded ZEC within Zashi without going through centralized exchanges. NEAR Intents also allows users to use shielded ZEC as a source of funds to pay any supported asset to any address on 20 blockchains.

These improvements combined enabled Zcash to bypass historical obstacles, access global liquidity, and precisely meet market demands.

Future Outlook

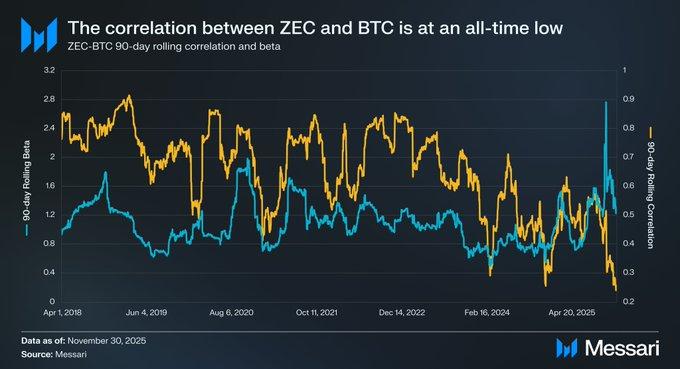

Since 2019, the rolling correlation between ZEC and BTC has been declining, from a high of 0.90 to a recent low of 0.24. Meanwhile, ZEC's rolling beta relative to BTC has risen to an all-time high, meaning that despite the weakening correlation, ZEC's price volatility is increasingly sensitive to (amplified by) BTC's volatility. This divergence suggests that the market is beginning to assign a unique "privacy premium" to Zcash's privacy protections.

Looking ahead, we expect ZEC's performance to be driven by this "privacy premium," which is the value that markets place on financial anonymity in an era of increasingly sophisticated surveillance and the weaponization of the global financial system.

We believe the likelihood of ZEC surpassing BTC is extremely low. Bitcoin, with its transparent supply and undeniable auditability, has become the most robust form of cryptocurrency. In contrast, Zcash always faces the inherent trade-offs of privacy coins: protecting privacy through a cryptographic ledger sacrifices auditability and introduces the theoretical risk of undetected supply inflation (inflation loopholes) within the shielded pool—a risk that Bitcoin's transparent ledger explicitly eliminates.

Nevertheless, Zcash can carve out its own niche without replacing BTC. These two assets are not competitors solving the same problem, but rather serving different use cases within the cryptocurrency space. BTC positions itself as sound money, optimizing transparency and security; ZEC, as private money, optimizes confidentiality and financial privacy. In this sense, ZEC's success lies not in replacing BTC, but in complementing it by providing attributes that Bitcoin deliberately lacks.