As 2025 draws to a close, the Ethereum network will experience a key turning point: validators "entering the queue" will reverse and surpass "leaving the queue".

This means that after months of market activity, the amount of funds attempting to stake Ethereum to become validators has far exceeded the amount of funds wanting to unstake and leave the market.

This change is not merely a numerical shift; it is a barometer of market sentiment and network fundamentals, signifying that the selling pressure that has persisted for months is gradually easing. It also indicates that, driven by multiple factors such as the return of confidence among some institutions, the upgrade and optimization of Pectra, and the clearing of DeFi leverage, the Ethereum network is entering a new cycle of security enhancement and capital accumulation.

Reversal of the Ethereum validator queue

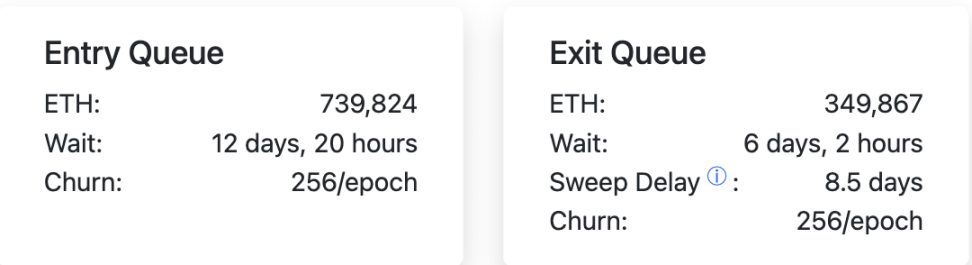

According to the latest data from the Ethereum Validator Queue, approximately 739,824 ETH are currently in the queue waiting to enter the network, with an estimated waiting time of 12 days and 20 hours; only 349,867 ETH have exited the queue, and it will take about 6 days to clear them.

In addition, the current total amount of Ethereum staked is approximately 35.5 million ETH, accounting for 29.27% of the total supply, and the number of active validators has reached 983,600.

What is a validator queue? Why is it important?

Under the Ethereum Proof-of-Stake (PoS) mechanism, in order to ensure the stability of consensus, the protocol stipulates that nodes cannot join and leave at will, but are regulated through the "Churn Limit" mechanism.

Currently, the maximum number of validators that can join (activate) or leave per epoch (approximately 6 minutes and 24 seconds) is set at 256 ETH, which is equivalent to a processing capacity of approximately 57,600 ETH per day.

- Entry Queue: A queue for those who stake 32 ETH to apply to become a validator. Queue growth indicates strong staking demand and investor confidence in long-term returns.

- Exit Queue: A queue for users to withdraw funds. Queue growth typically indicates selling pressure, liquidity needs, or deleveraging.

Therefore, the validator queue is not only an indicator of network health, but also a barometer of market sentiment.

How will the validator queue change in 2025?

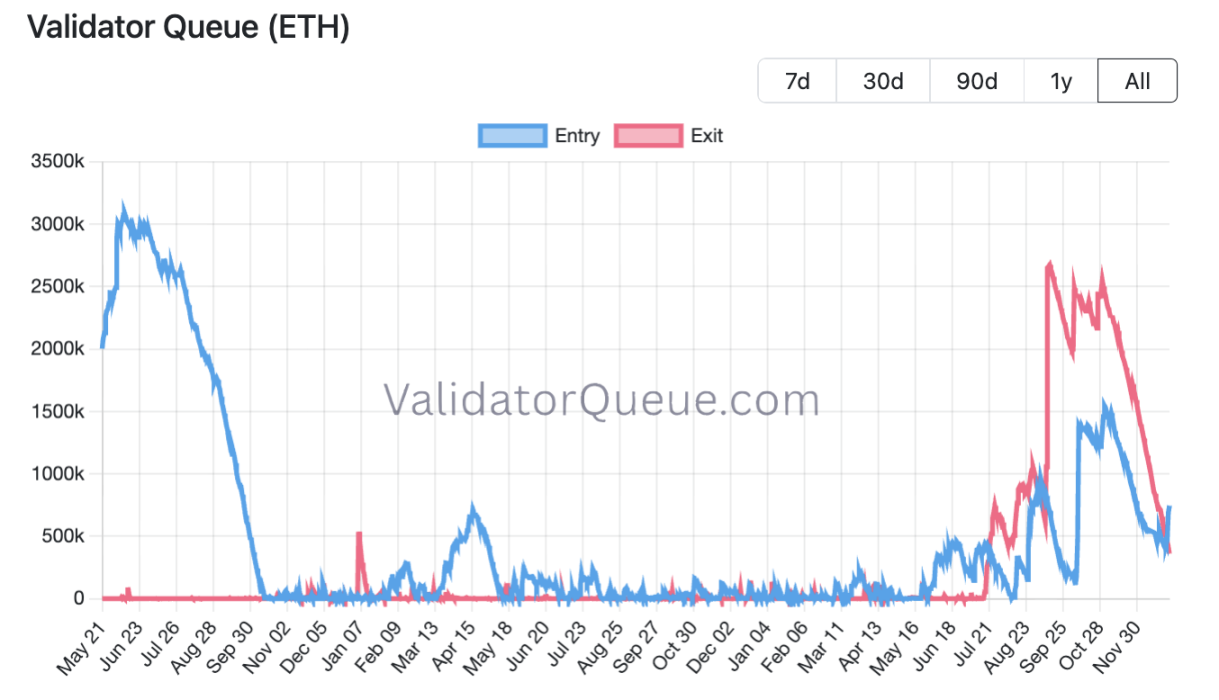

Throughout 2025, the Ethereum validator queue experienced dramatic fluctuations:

- From the first half of the year to autumn: the exit queue reached record highs multiple times, mainly due to institutional rotation, profit-taking, DeFi deleveraging (such as the surge in Aave lending rates leading to the liquidation of stETH cyclical lending), and individual security incidents (such as Kiln's exit from all Ethereum validator nodes in September). In mid-September, the exit queue peaked at 2.67 million ETH, with a waiting time of up to 46 days.

- September-October: "Entering the queue" briefly took the lead, but was subsequently dominated by "Leaving the queue".

- November: "Entry queue" grew back to over 1.5 million ETH, but "Exit queue" once reached over 2.5 million ETH.

- End of December: The "entering queue" has reversed, with approximately 739,824 ETH currently queuing to enter the network, while only 349,867 ETH are leaving the queue.

Four core driving forces behind the December reversal

This reversal is not accidental, but rather the result of the combined effects of capital, technology, and the macro environment.

Large-scale pledging by treasury companies such as BitMine

Just two days before the reversal (December 25-27), BitMine had staked a total of 342,560 ETH (approximately $1 billion), directly driving the queue reversal.

Furthermore, BitMine has previously stated that it plans to launch a dedicated staking infrastructure, the Made in the USA Validator Network (MAVAN), in the first quarter of 2026, demonstrating its long-term commitment to the Ethereum staking ecosystem.

Meanwhile, another leading treasury company, SharpLink, has pledged nearly 100% of its ETH, further fueling the inflow of funds.

Despite the severe challenges currently facing the crypto treasury sector, with some institutions slowing down their ETH accumulation and even cases like ETHZilla reducing their holdings and cashing out, the large-scale investments by leading players such as BitMine and SharpLink have largely stabilized the foundation of the Ethereum staking ecosystem.

Pectra upgrades and optimizes the staking experience.

The Pectra upgrade implemented in May 2025 introduced key improvements through EIP-7251: increasing the maximum effective validator balance from 32 ETH to 2048 ETH, and enabling reward compounding and validator consolidation. This reduced the operational costs for institutions managing tens of thousands of validator nodes and provided technical convenience for the entry of large funds.

Kiln's restaking open

Kiln experienced a mass exodus of validators following a security incident in September 2025. While it's unclear when Kiln will resume staking, data from Beaconcha.in shows that Kiln currently holds a 1.68% share of the Ethereum staking ecosystem.

DeFi deleveraging is nearing its end.

Previously, in June and July, rising Aave lending rates forced the stETH cyclical leverage strategy to liquidate, triggering a period of selling pressure. Recently, as the deleveraging process has gradually cleared, the related exit demand has gradually subsided, and market demand is now dominated by inflows.

Some institutions are buying on dips.

The market has been adjusting for several days, and some institutions are optimistic about the long-term value of ETH. Trend Research is preparing to use $1 billion to continue increasing its ETH holdings. On December 25th, Ai Yi verified with Jack Yi himself that the true cost of ETH held by Trend Research since November is approximately $3150, meaning that the current unrealized loss on the 645,000 ETH held is approximately $143 million. After the subsequent $1 billion investment, the average cost of ETH is expected to be controlled at approximately $3050.

summary

The reversal of Ethereum validators "entering the queue" over "leaving the queue" marks the initial formation of a net inflow-dominated staking pattern for the first time since July. This change is not merely a numerical leap, but a key signal of rebuilding market confidence. Of course, whether this leading trend can be sustained and solidified remains to be seen.

While Ethereum spot ETFs have not yet shown significant net inflows, the improvement in on-chain fundamentals is evident. As Joseph Chalom, co-CEO of SharpLink Gaming, stated this month, the surge in stablecoins, tokenized RWAs, and the growing interest from sovereign wealth funds could drive Ethereum's TVL to grow tenfold by 2026.

As we approach the end of 2025, is Ethereum ready for a surge in 2026? Only time will tell.