Korea has shown a unique presence in the global crypto market. However, the benefits of this enthusiasm are flowing overseas, not staying domestic. An estimated 160 trillion won left for foreign CEXs in 2025 alone. This report analyzes why capital outflows are accelerating.

Key Takeaways

An estimated 160 trillion won flowed to foreign CEXs in 2025, and fee revenue is moving offshore with it.

The core driver is asymmetry in investment opportunities. Foreign CEXs capture early profits through derivatives and pre-markets.

Simply blocking is not the answer. Capital may scatter to regulatory blind spots. Korea needs to allow innovation within manageable boundaries.

1. Korean Crypto Investors Move to Binance

Korea holds a unique position in the global cryptocurrency market. Over 10 million people invest in crypto. This represents roughly 20% of the entire population and nearly matches the 14 million domestic stock investors.

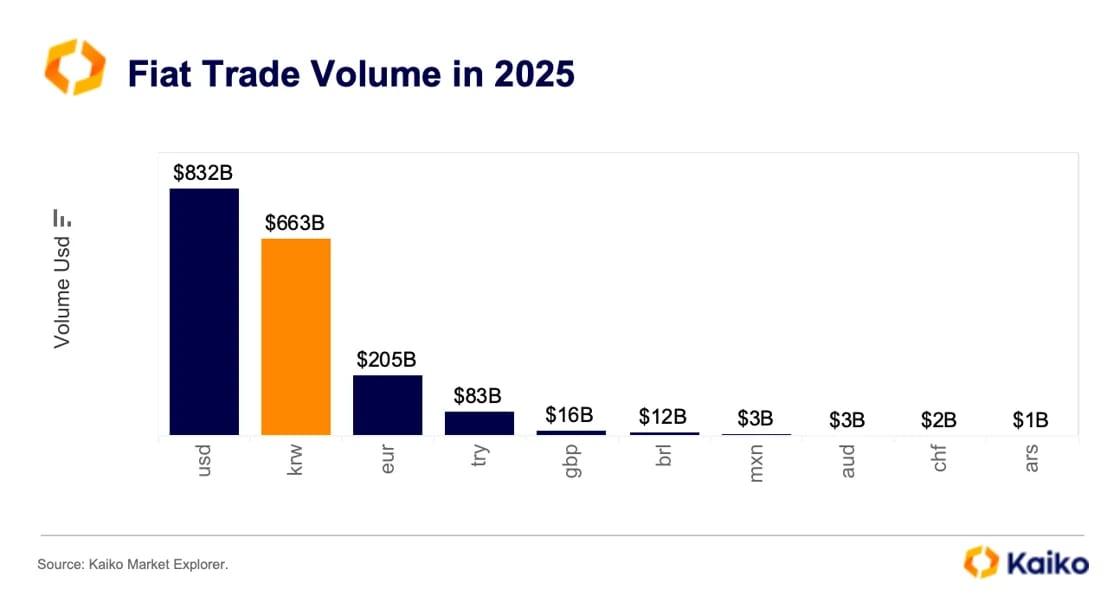

Trading volume reflects this massive participation. According to crypto data analytics firm Kaiko, Korean won-based trading volume rivals the U.S. dollar among global fiat currencies. It sometimes even surpasses it. This is an exceptional figure for a single national currency.

This investment fervor has fueled rapid growth in the domestic exchange industry. Upbit and Bithumb now generate revenues in the trillions of won and have become industry giants. Cryptocurrency has established itself as a primary investment asset alongside stocks and real estate.

However, this growth has stalled. Korean investors still trade crypto actively, but they are changing where they trade. Fewer use domestic CEXs like Upbit and Bithumb. Instead, more turn to foreign CEXs such as Binance and Bybit. Simply put, investment demand remains strong, but foreign CEXs now capture that demand.

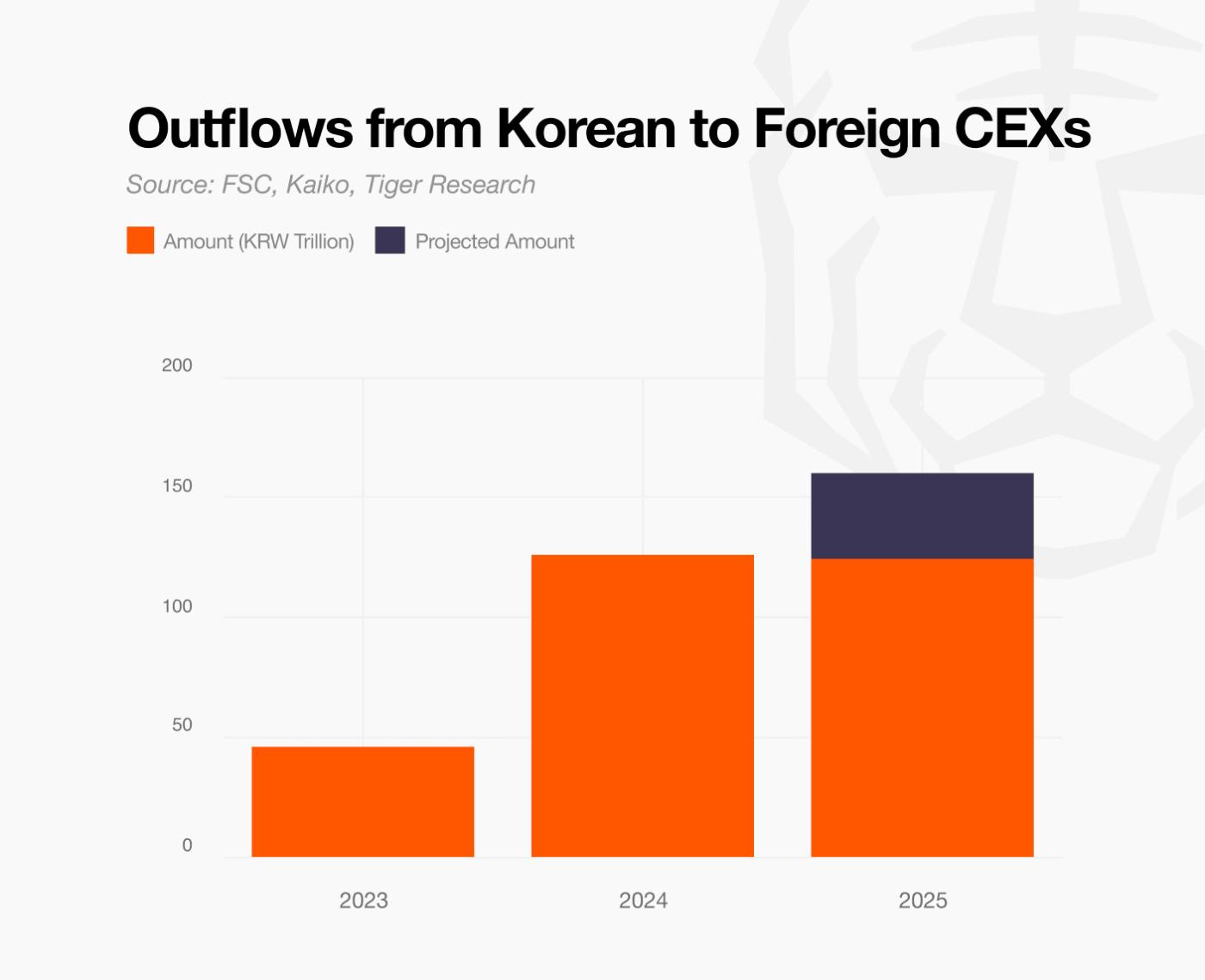

From January to September 2025, approximately 124 trillion won flowed from domestic CEXs to foreign CEXs. This figure has nearly tripled compared to 2023 outflows. If this trend continues, total outflows for 2025 could reach approximately 160 trillion won.

Dive deep into Asia’s Web3 market with Tiger Research. Be among the 23,000+ pioneers who receive exclusive market insights.

2. As Capital Flows Out, Fees Flow With It

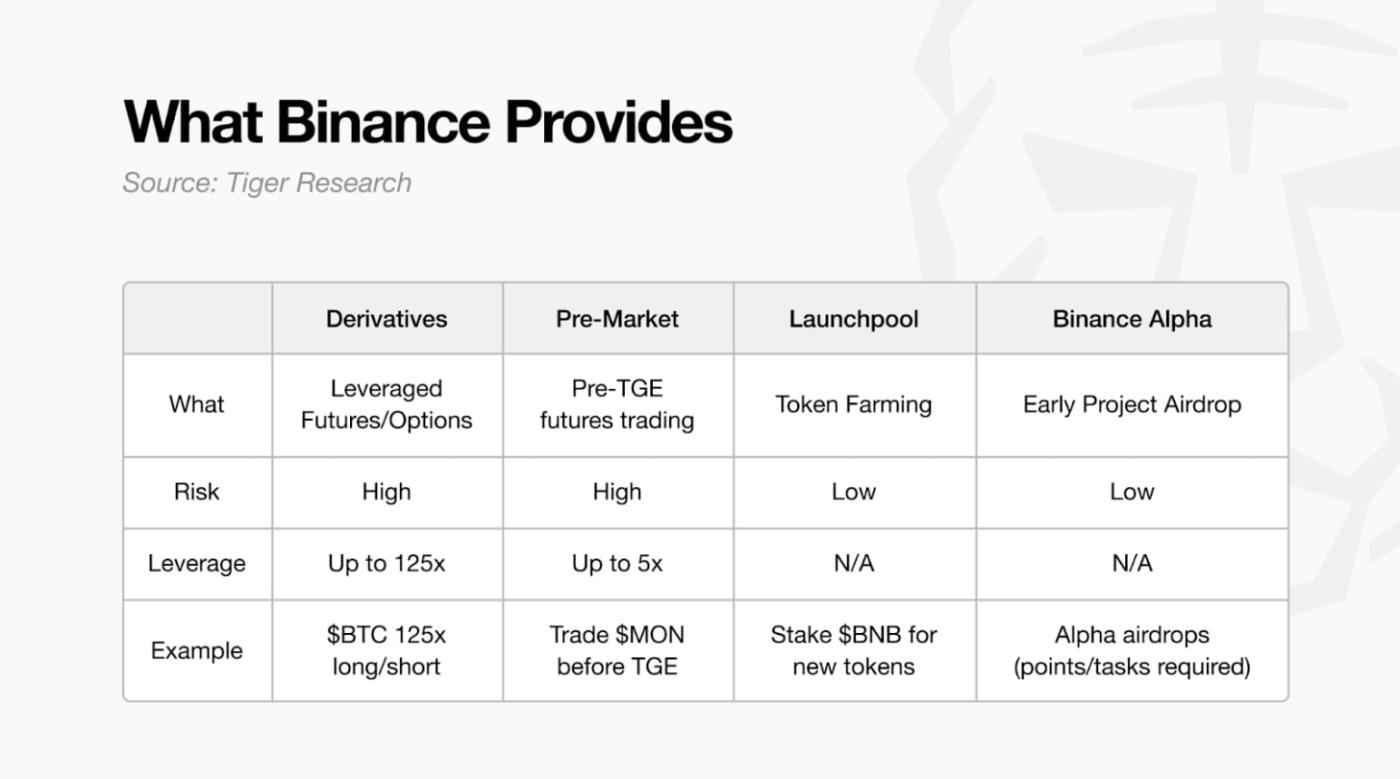

The main reason Korean investors move funds to foreign CEXs is the gap in investment opportunities. Domestic CEXs face strict regulations that limit them to spot trading. Foreign CEXs fill this gap with diverse options including leveraged derivatives.

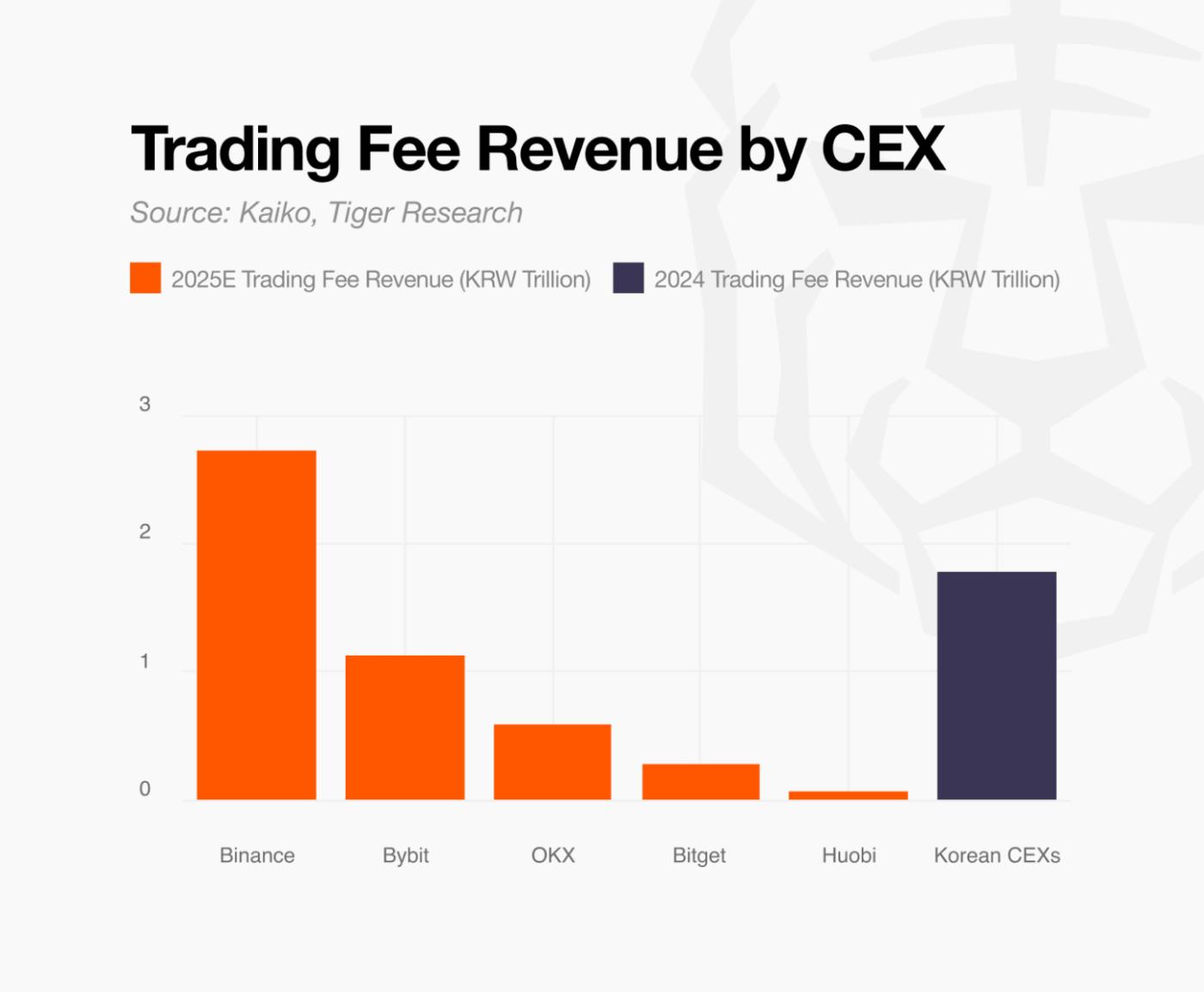

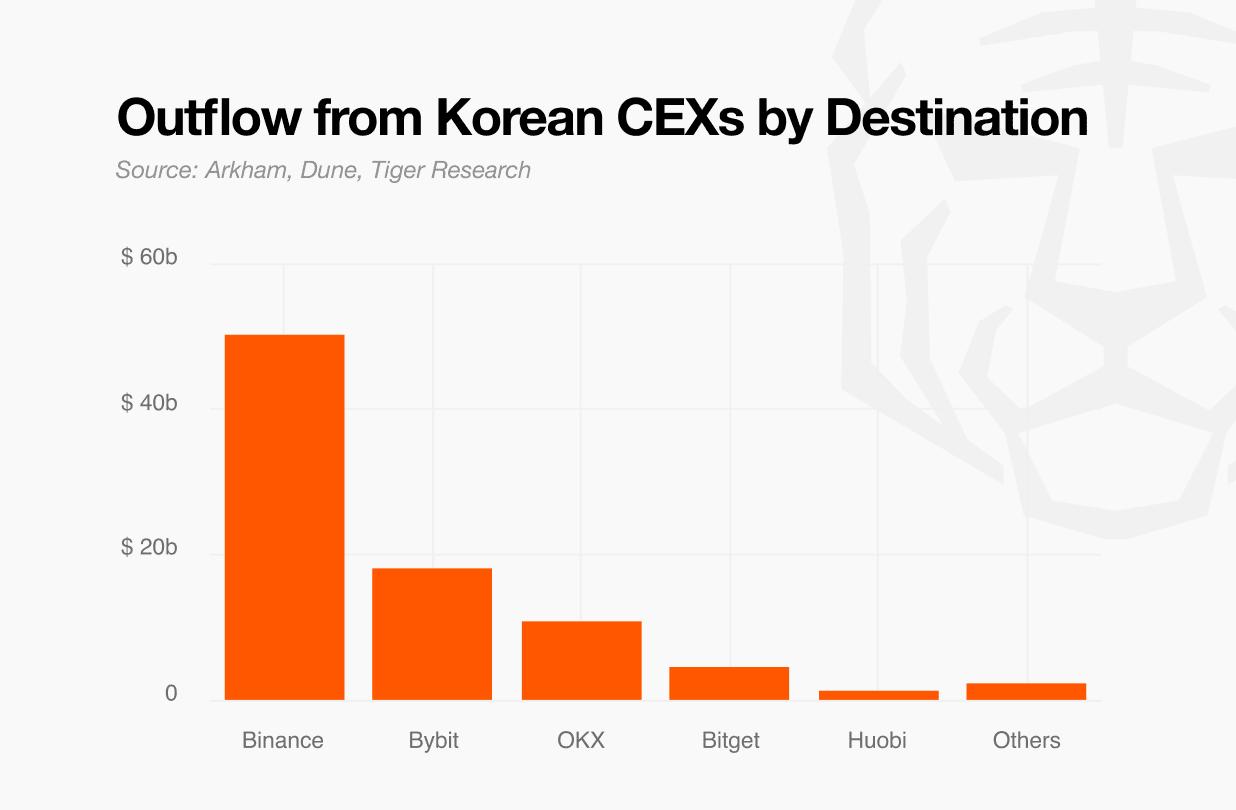

The problem extends beyond capital outflows. When trading happens overseas, fee revenue goes overseas too. Based on this year’s outflow data, estimated fee revenues for each CEX are as follows: Binance at approximately 2.73 trillion won, Bybit at 1.12 trillion won, OKX at 580 billion won, Bitget at 270 billion won, and Huobi at 70 billion won.

These five foreign CEXs earned an estimated 4.77 trillion won (≈ $3.36 billion) in fee revenue from Korean investors. This is 2.7 times the combined operating revenue of Korea’s top five domestic CEXs (Upbit, Bithumb, Coinone, Korbit, and Gopax) last year, which totaled 1.78 trillion won. This goes beyond simple capital outflows. The profit structure of Korea’s crypto industry itself is shifting overseas.

3. Why Capital Is Shifting to Foreign CEXs Faster

The 160 trillion won outflow is already substantial, but this trend will likely accelerate. Korean investor behavior and foreign CEX listing strategies are driving this together.

Korea’s crypto market has long centered on altcoins rather than Bitcoin or Ethereum. Altcoins account for 70-80% of trading volume on domestic CEXs. This far exceeds the global average of around 50%. Korean investors have repeatedly profited from short-term trades in low-cap, high-volatility assets.

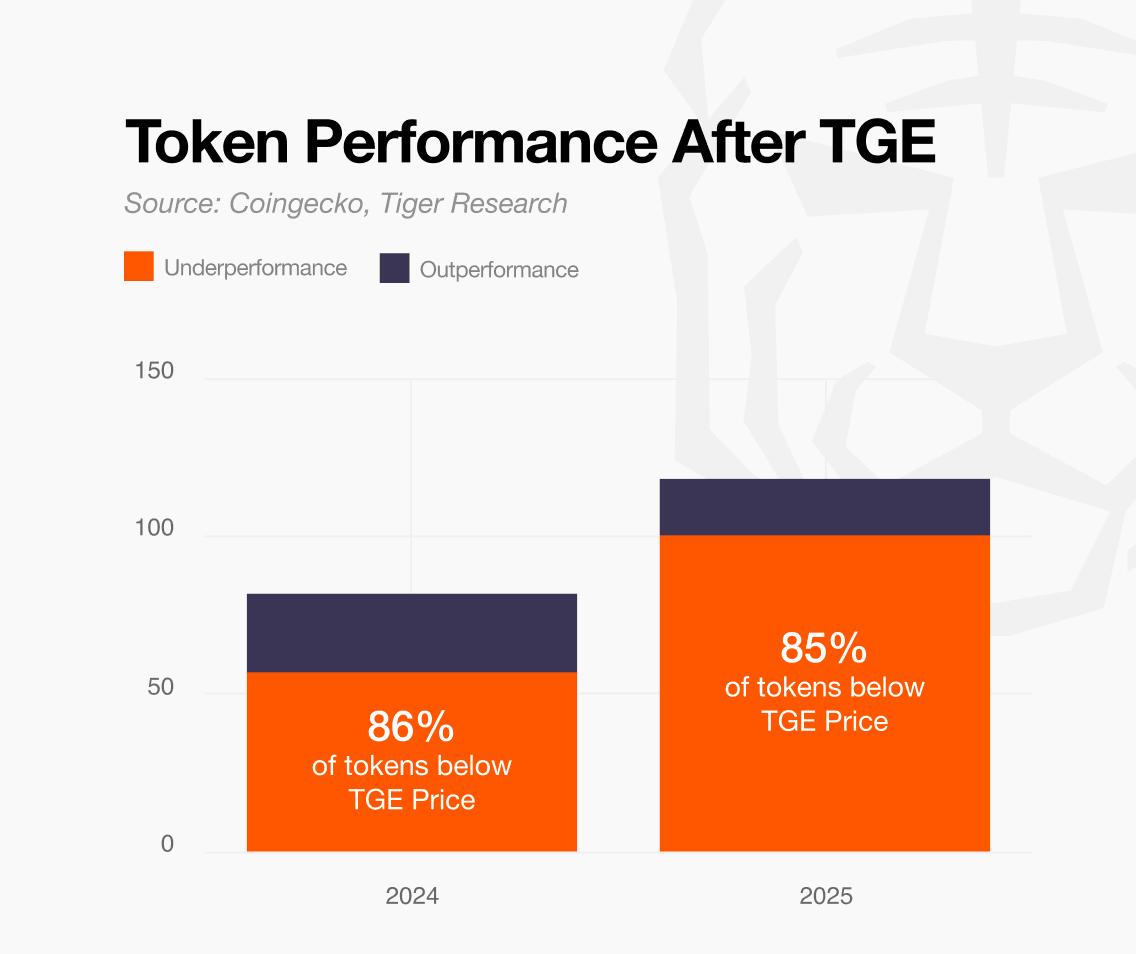

However, this strategy no longer works. In the past, altcoins performed well even after TGE. Now, most projects peak right after TGE and decline rapidly. The bigger problem is timing. By the time domestic CEXs list tokens, the rally on foreign CEXs has already ended. Korean investors often enter during the downturn. As this pattern repeats, a perception spreads: “Domestic listings are already too late.”

Investors are adjusting their strategies. Some buy tokens on foreign CEXs first, then sell for profit when domestic CEXs list them at higher prices. The longer domestic CEXs delay listings, the stronger the demand to take positions overseas first. Others turn to leveraged derivatives to offset declining altcoin returns. As long as domestic CEXs cannot offer derivatives, this demand flows entirely overseas.

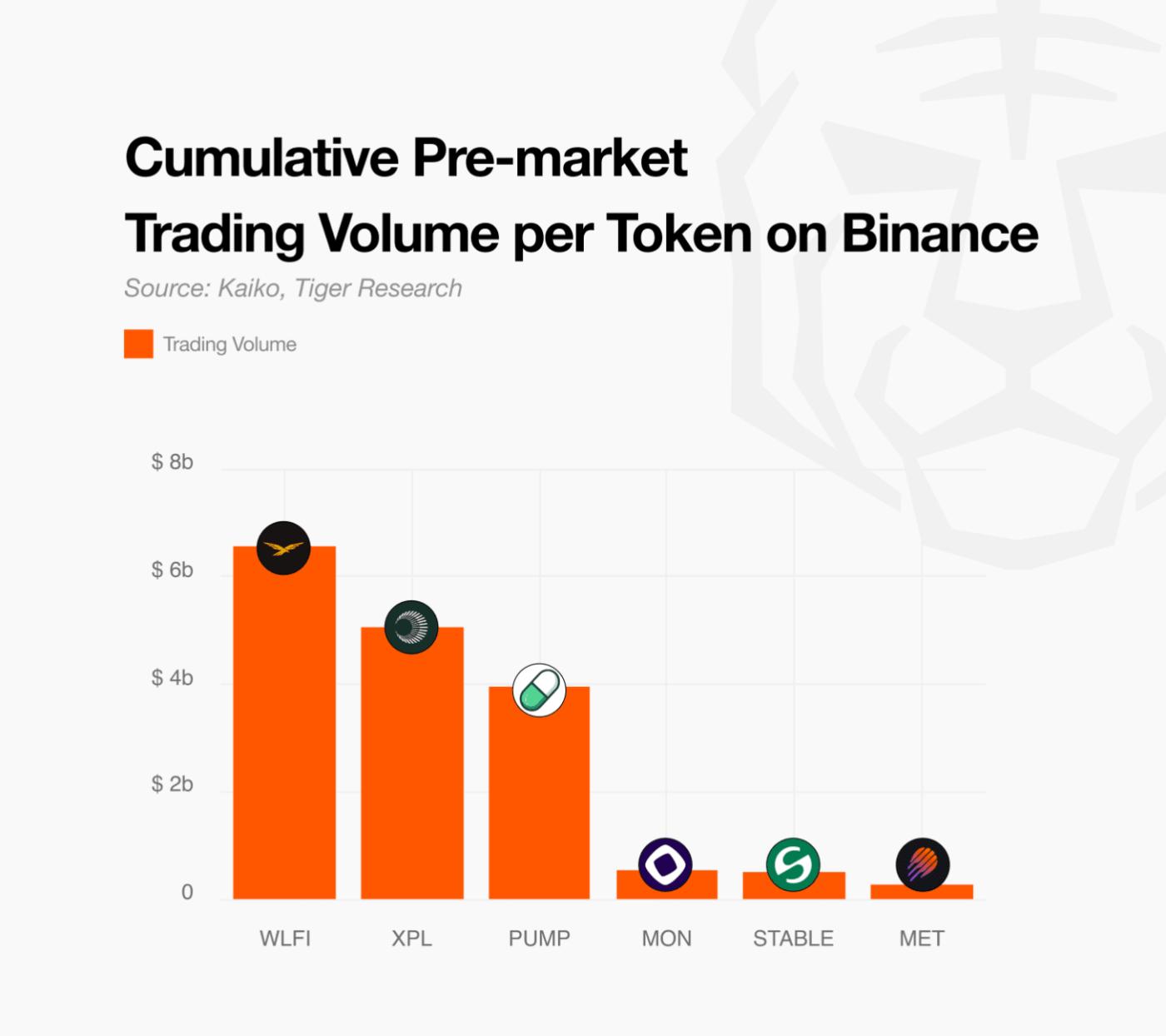

Foreign CEXs compete aggressively to capture and amplify this demand. Their futures listing speed is overwhelming. Futures trading requires no actual asset holdings, so exchanges can list new tokens immediately. In 2025, Binance listed around 230 futures contracts, 8.5 times more than spot listings. It does not stop there. Some exchanges including Binance operate pre-markets that enable trading before TGE. They capture the market at the earliest stage when investor interest peaks.

While domestic CEXs navigate heavy spot listing procedures under strict regulations, Binance absorbs early profits and liquidity through flexible tools like futures and pre-markets. The gap will only widen structurally. Structural constraints on domestic CEXs, shifting investor strategies, and proactive moves by foreign CEXs all converge. Capital outflows will accelerate further.

4. What Should Korea Do?

Korea could consider blocking unlicensed foreign CEXs. However, this approach may not actually stop capital outflows. Workarounds exist, and simple blocking offers only a temporary fix.

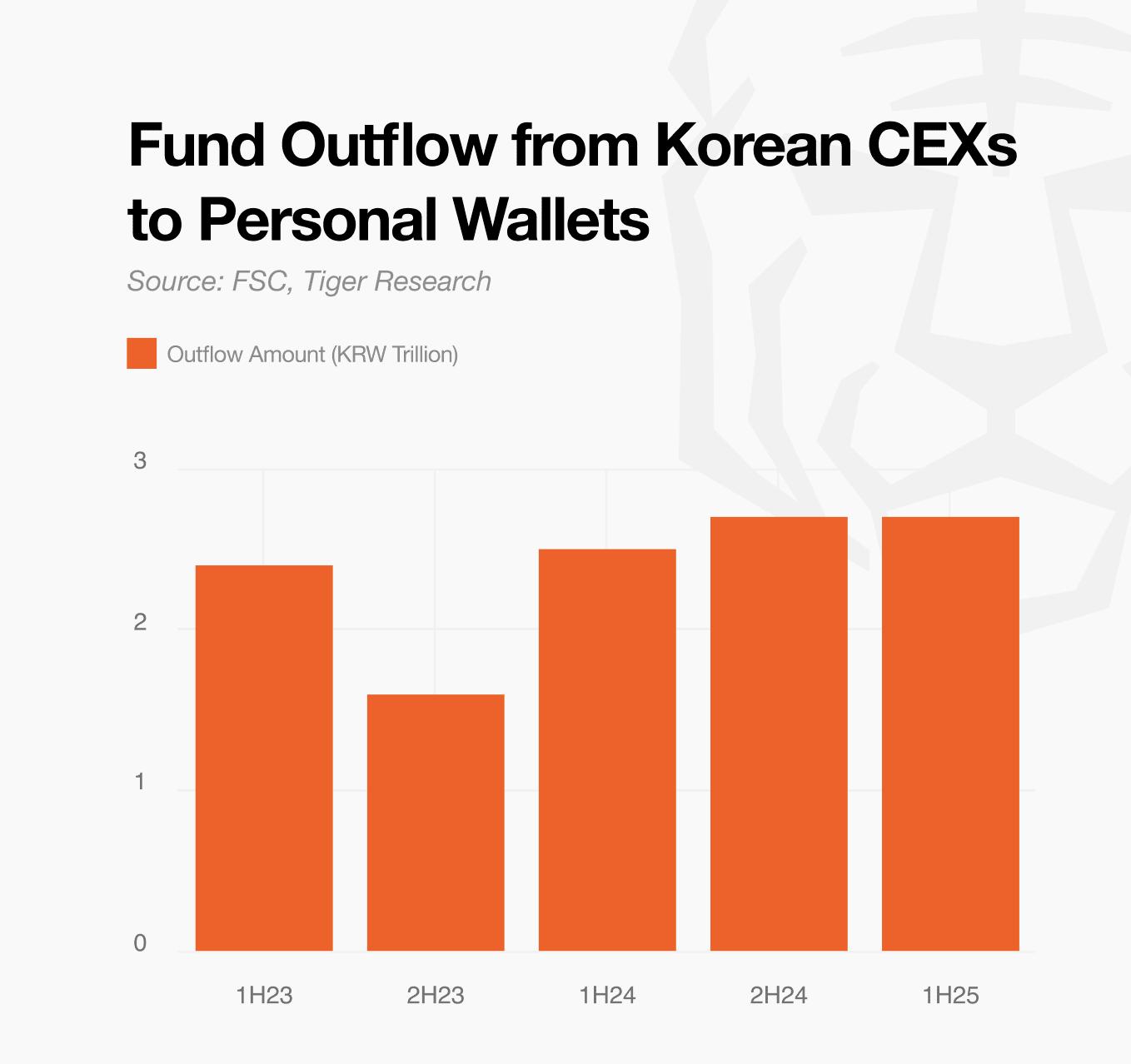

Stricter regulations may also push capital toward decentralized exchanges. In the global market, DEX spot trading volume relative to CEXs has steadily risen. DEXs attract users because anyone can access them without KYC and hold assets directly. In Korea, approximately 2.7 trillion won moved to personal wallets like MetaMask in the first half of 2025 alone. Pressuring CEXs may accelerate this trend.

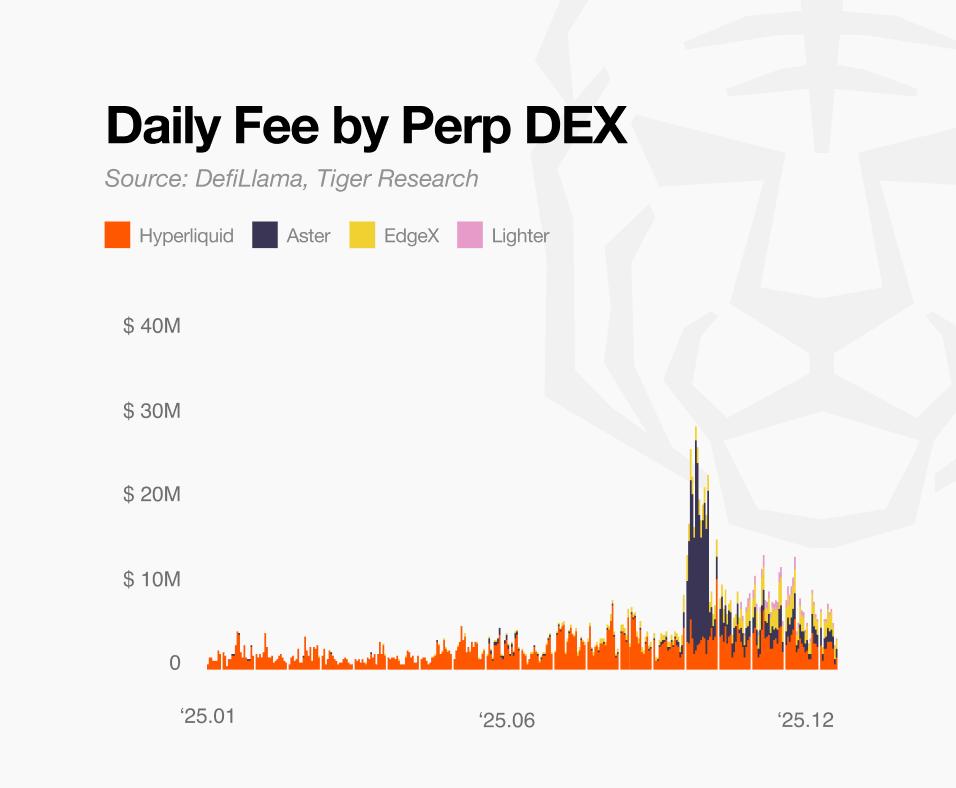

DEX growth extends beyond spot markets. Decentralized perpetual futures exchanges (Perp DEXs) have grown rapidly with record trading volumes. Platforms now offer competitive execution speed, user experience, and liquidity. Korean investors increasingly choose Perp DEXs. Even if Korea blocks unlicensed foreign CEXs, capital will likely scatter into the unregulated decentralized space rather than return home.

Simply tightening regulations will not solve this. Regulations exist to protect investors, but excessive enforcement pushes capital and trading outside of oversight. Strict regulations also limit product diversification and technical experimentation in the domestic market. Despite high trading volume and participation, the industry struggles to expand its ecosystem and build global competitiveness.

Korea does not need to block foreign CEXs or impose unconditional regulatory crackdowns. It needs a flexible regulatory framework that embraces innovation within manageable boundaries. Major countries are integrating crypto into mainstream finance. Korea must find a realistic balance that considers both investor protection and industry competitiveness.

Methodology

This analysis estimates the annual trading fees Korean crypto investors pay to foreign CEXs. We used exchange data from Kaiko and blockchain analytics platforms including Arkham Intelligence and Dune

We estimated the 2025 foreign outflow at approximately 160 trillion won based on exchange trading volume data and Financial Services Commission statistics. To calculate fees, we applied both a top-down approach based on Korean investor share within foreign CEXs and a bottom-up approach tracking actual fund flows. We cross-verified the two results.

CASE 1: Market Share-Based Estimate (Top-down)

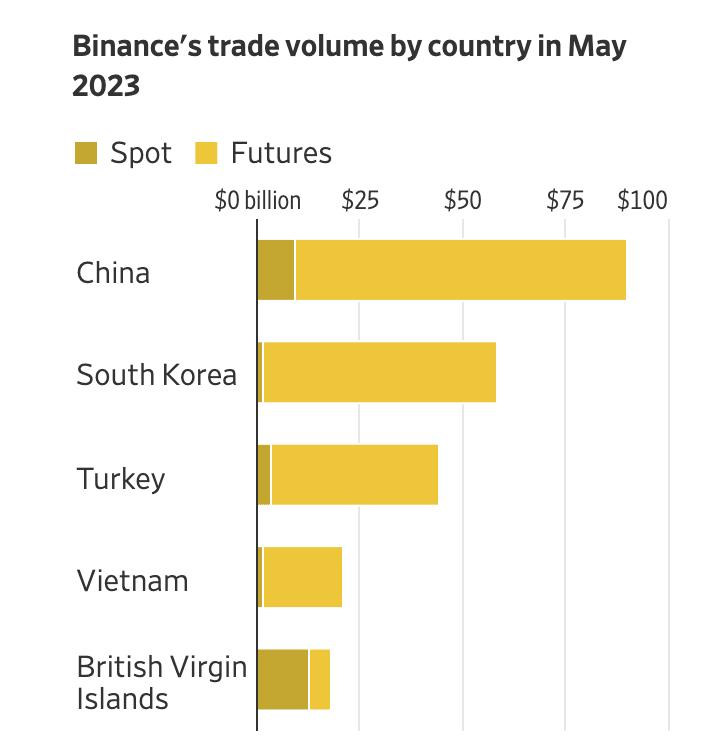

The top-down approach uses a key benchmark from a 2023 Wall Street Journal report: Korean traders account for 13% of Binance trading volume. According to WSJ, over 99% of Korean activity on foreign CEXs focuses on futures trading. Since derivatives trading unavailable domestically drives foreign CEX usage, this analysis calculates fees based on futures volume only.

[Fee Calculation Formula] Total Fees = Binance Total Futures Volume × Korean User Share (%) × Average Fee Rate × Exchange Rate

Since 2023, outflows have accelerated (estimated at 160 trillion won in 2025). The current Korean share likely exceeds 13%. However, global user growth and market expansion also occurred during this period. We set share scenarios as follows:

Conservative (Bear): 15% – Global market grew faster than Korea

Aggressive (Bull): 25% – Korean inflows exceeded the global average

Applying Binance’s 2025 futures volume of $27.5 trillion, average fee rate of 0.035%, and exchange rate of 1,420 won, Korean investors pay Binance an estimated 2.05 trillion won annually under the conservative scenario and 3.417 trillion won under the aggressive scenario.

CASE 2: Fund Flow-Based Estimate (Bottom-up)

The bottom-up approach calculates fees by tracking actual fund flows. We used on-chain wallet data to trace assets moving from domestic to foreign CEXs, then calculated fees based on this data.

This analysis uses the previously estimated annual foreign outflow of 160 trillion won. Applying wallet labeling data to calculate inflow ratios by exchange, we found 57.7% of total outflows went to Binance, approximately 92.3 trillion won.

However, principal inflows alone cannot determine fees. Actual trading volume depends on how frequently and how much investors trade with those funds. We applied two variables to estimate this: velocity and futures adjustment coefficient.

To calculate velocity, we referenced the Financial Services Commission’s “H1 2025 Survey Result on Virtual Asset Service Providers.” The report states Korean investors hold approximately 98.9 trillion won in total assets under management. Analyzing domestic CEX trading volume data, we found investors trade approximately twice their assets monthly. This equals roughly 24 times annually. We applied this velocity assuming Korean investors maintain similar trading behavior on foreign CEXs.

Domestic data reflects spot trading without leverage. We needed adjustments for Binance’s high-leverage derivatives environment. Our Binance data analysis showed futures trading frequency is 2.3 times higher than spot, and average trade size is 1.5 times larger. Combined, futures trading volume is approximately 3.52 times that of spot.

[Fee Calculation Formula] Total Fees = (Binance Inflow Principal × Annual Velocity × Futures Adjustment Coefficient) × Average Fee Rate

Applying this formula, Korean investors pay Binance an estimated 2.73 trillion won annually. This falls within the top-down estimate range of 2.05 trillion won to 3.42 trillion won.

Dive deep into Asia’s Web3 market with Tiger Research. Be among the 23,000+ pioneers who receive exclusive market insights.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.