Welcome to the US Crypto News morning bulletin—a quick summary of the most important developments in the crypto market for the day.

Brew yourself a cup of coffee and let's review the volatility that swept across global markets this past weekend. Silver prices surged and then plummeted, fueling rumors of behind-the-scenes problems with highly leveraged positions. While precious metals traders struggled to adjust, Bitcoin quietly bucked the trend, suggesting it wasn't just a simple price fluctuation but potentially a significant liquidation shift.

Crypto news of the day: Silver price volatility, banking rumors, and Bitcoin buying activity — Here's what to look for.

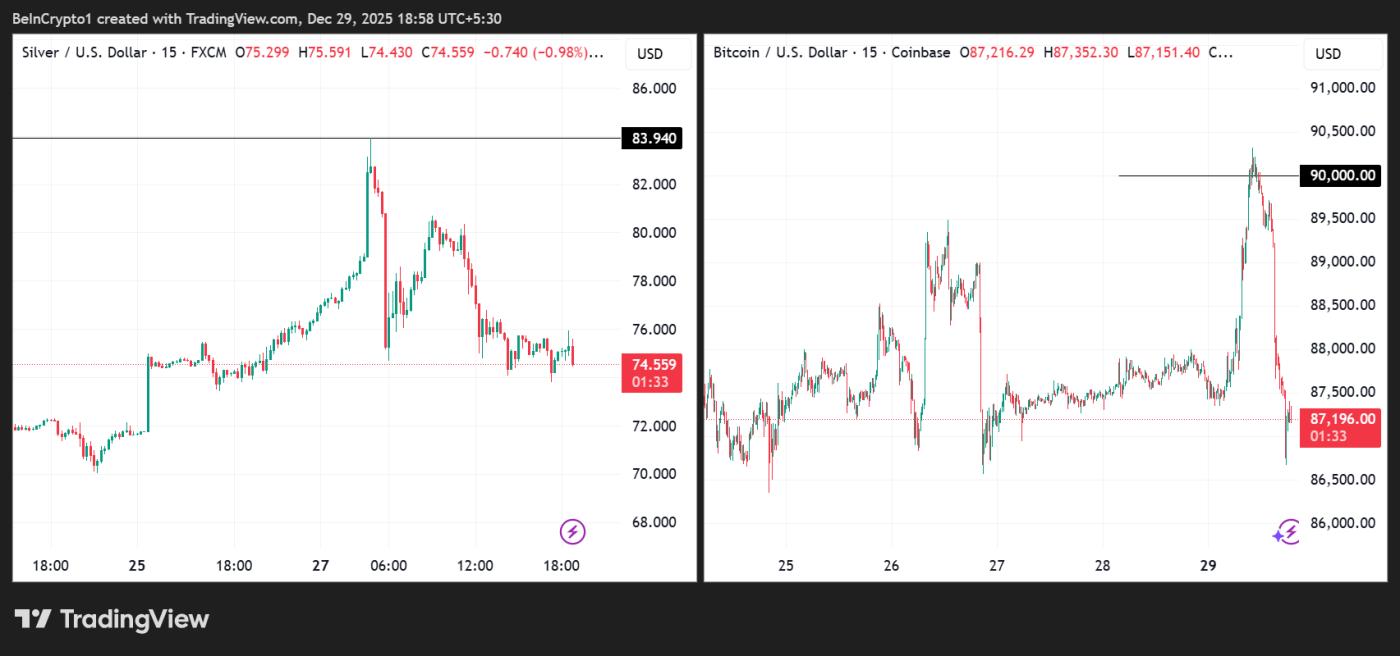

The silver market was in turmoil over the weekend, and Bitcoin traders were watching closely. With a shock surge revealing significant leverage in the commodity market,silver prices surpassed an all-time high of nearly $84 before plummeting more than 10% in just one hour.

The speed and scale of this reversal shook the Futures Contract market, leading to increased margin trading and renewed concerns about systemic risk, while Bitcoin was quietly being accumulated by retail investors.

At the heart of this turmoil were unverified rumors circulating on social media about a major bank failing to meet massive margin requirements and being forced into liquidation by a Futures Contract in the early hours of December 28, 2023.

According to rumors, the losses relate to hundreds of millions of ounces of Short silver positions and an urgent liquidation need of over $2 billion. As of December 29, 2023, no regulatory body or major news outlet had confirmed the bank's bankruptcy.

Nevertheless, the market's reaction is undeniable.

The volatility in silver prices this time was enormous, even in the world of commodities. Silver prices surged to a record high of $83.75 shortly after the contract opened, then plummeted to $75.15 in just 70 minutes.

Silver (XAG) price performance. Source: TradingView

Silver (XAG) price performance. Source: TradingView“…witnessing firsthand $4 billion in Longing positions evaporate in just over an hour…was one of the fastest ‘wipes’ I’ve ever seen. Liquidation completely disappeared as prices plummeted, and all buy orders were instantly wiped out,” analyst Shanaka Anslem Chia .

As volatility escalated, CME announced a sharp increase in the margin requirement for almost all precious metals products.

This decision shows that exchanges are acting very aggressively to limit leverage immediately after periods of significant volatility. This pattern is not new and frequently occurs in both commodity and crypto markets whenever major tensions arise.

Bitcoin sees inflow of funds as leverage in metals breaks down.

While investors in the precious metals market were wiped out, Bitcoin unexpectedly surged in price. Crypto Rover points out that when the price of silver dropped nearly 11%, the prices of crypto Token simultaneously broke through, suggesting this wasn't new Capital , but rather a shift from other markets .

That's right, the price of Bitcoin immediately surged just as silver began to plummet, even briefly touching the psychological threshold of $90,000. The coincidence is striking:

- Positions with high leverage were forced to liquidate.

- Margin requirements have skyrocketed.

- The forced liquidation took place on a large scale, and

- Capital is flowing to other, safer havens.

Regardless of whether the bank collapse rumors are true or not, what has happened shows that whenever the traditional leveraged market is strained, money tends to flow into Bitcoin.

Some analysts advised investors not to focus too much on rumors. Shanaka then pointed to a more credible but less-noticed piece of data than the crash news: JPMorgan reported unrealized losses of nearly $4.9 billion in silver and had shifted from a large Short position to holding nearly 750 million ounces of physical silver.

“The collapse news may be fictitious,” he wrote , “but JPMorgan’s change of position status has been filed with the SEC.”

This distinction is crucial for crypto investors. The key is not the sensational headlines, but how quickly liquidation flows away when leverage collapses.

When the silver Derivative market is in turmoil, Bitcoin behaves less like a speculative asset and more like a "pressure Dump valve" for Capital flows.

Daily chart

Silver and Bitcoin price performance. Source: TradingView

Silver and Bitcoin price performance. Source: TradingViewAlpha is concise.

Here's a summary of some of the crypto news in the US today that you should pay attention to:

- XRP price appears to be plummeting —but retail investors are quietly acting in the opposite direction.

- China's digital yuan will begin to be subject to interest rates under the new policy framework in 2026 .

- Ethereum Staking queue surpasses exit queue after three months—What's next for ETH?

- Three signals from the gold market suggest that Bitcoin's price may be heading towards a Dip .

- Is America about to resolve the chaos in the crypto market? The Lummis Act could change everything.

- Hyperliquid reveals HYPE Unlocks— What's in store for January 6th?

Market overview before the market opens regarding crypto-related stocks.

| Company | Closing price as of December 26th | Overview of the pre-trading session |

| Strategy (MSTR) | 158.81 USD | 156.85 USD (-1.23%) |

| Coinbase (COIN) | 236.90 USD | 234.78 USD (-0.89%) |

| Galaxy Digital Holdings (GLXY) | 23.40 USD | 23.20 USD (-0.85%) |

| MARA Holdings (MARA) | 9.59 USD | 9.48 USD (-1.15%) |

| Riot Platforms (RIOT) | 13.44 USD | 13.22 USD (-1.64%) |

| Core Scientific (CORZ) | 15.29 USD | 15.07 USD (-1.44%) |