Midnight (NIGHT), a security project linked to Cardano, has fallen by approximately 6% over the past 7 days but has risen by nearly 7% in the last 24 hours. This week Chia into two opposing trends, reflecting deep tug-of-war on the chart as well as in on-chain data. Optimism from retail investors is quite evident, while large whales are selling heavily, which could cause a price collapse if Midnight doesn't reclaim the $0.101 level with strong momentum.

The price is currently fluctuating around $0.093. The trend remains quite weak until there is a clearer confirmation signal.

Large whales sell when retail investors buy when prices fall.

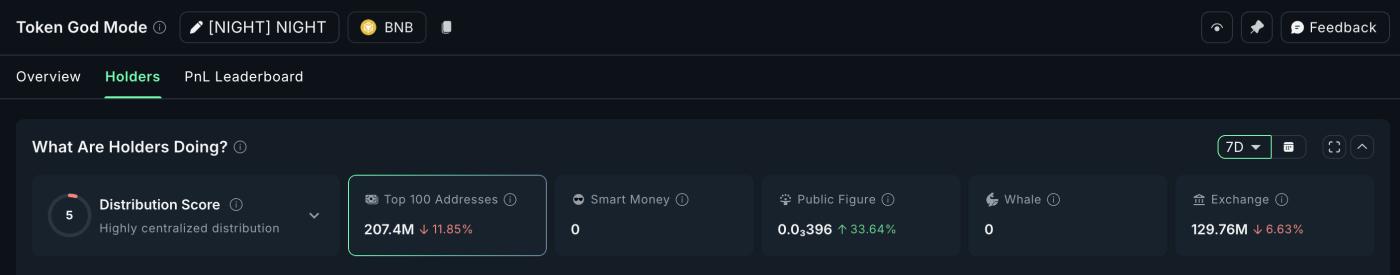

On the BNB Chain, the 100 largest NIGHT holders (the whales) reduced their NIGHT holdings by 11.85%. Their total NIGHT holdings decreased to 207.4 million NIGHT, meaning they sold 27.9 million NIGHT. At the current price, that's approximately $2.7 million withdrawn from their wallets. This development increases the likelihood of a trend reversal upwards.

However, the NIGHT balance on the exchange reflects the opposite story. The amount of NIGHT on the exchange has decreased by 6.63% in seven days, currently standing at 129.76 million NIGHT. This is equivalent to approximately 9.2 million NIGHT, or about $920,000, as retail investors continuously accumulate holdings when prices fall. Even so, the amount sold by large whales remains nearly three times higher than the amount bought by retail investors.

Whales Sell NIGHT: Nansen

Whales Sell NIGHT: NansenWant more analysis on Token like this? You can sign up for editor Harsh Notariya's daily Crypto newsletter here .

The flow of money from retail investors is clearly evident on the chart. The On-Balance Volume (OBV) indicator, which shows buying pressure based on the direction of volume, has risen to a new high and broken through the trend line. This divergence occurred as the Midnight price continuously created lower highs from December 21st to December 29th, 2023. This suggests that retail investors are accumulating strongly despite continued selling by whales.

Volume Breakout Confirms Retail Interest: TradingView

Volume Breakout Confirms Retail Interest: TradingViewHowever, despite the rising momentum from retail investors, the amount of NIGHT shares Dump by whales still predominates.

Derivative data shows a Longing trend, but a trap zone still exists.

The Derivative market also reflects this Chia .

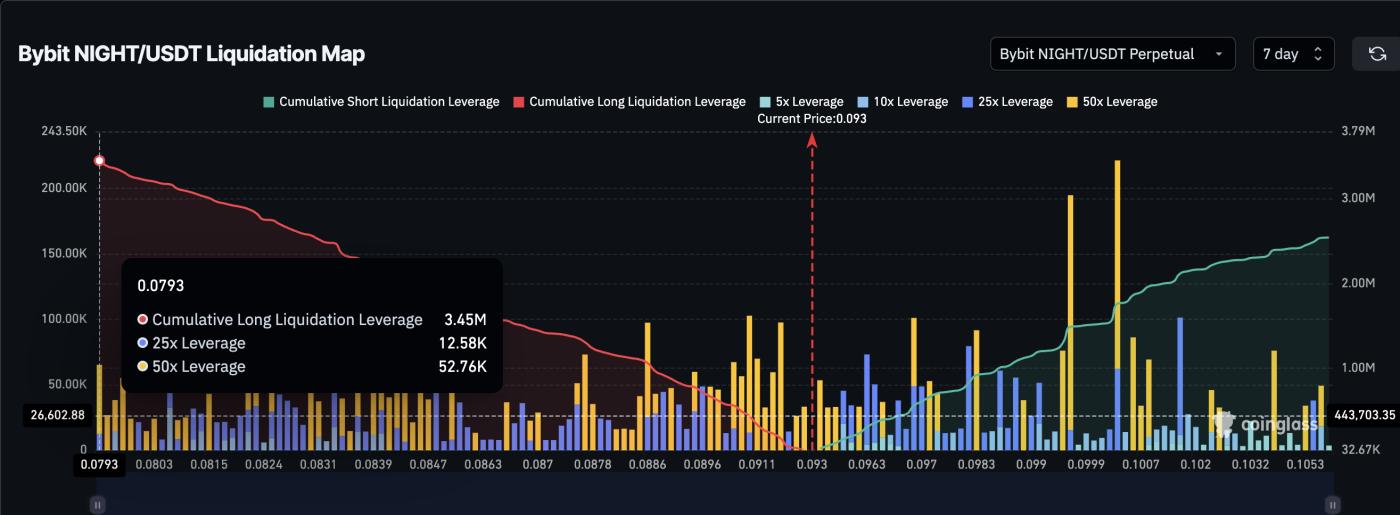

On Bybit, the NIGHT- USDT perp contract recorded liquidation leverage on the Longing side of approximately $3.45 million, higher than the Short side at $2.54 million. Longing positions accounted for nearly 57% of the total liquidated volume. This reflects the optimistic sentiment of retail investors but also makes them vulnerable if the price of NIGHT suddenly drops sharply.

Liquidation map: Coinglass

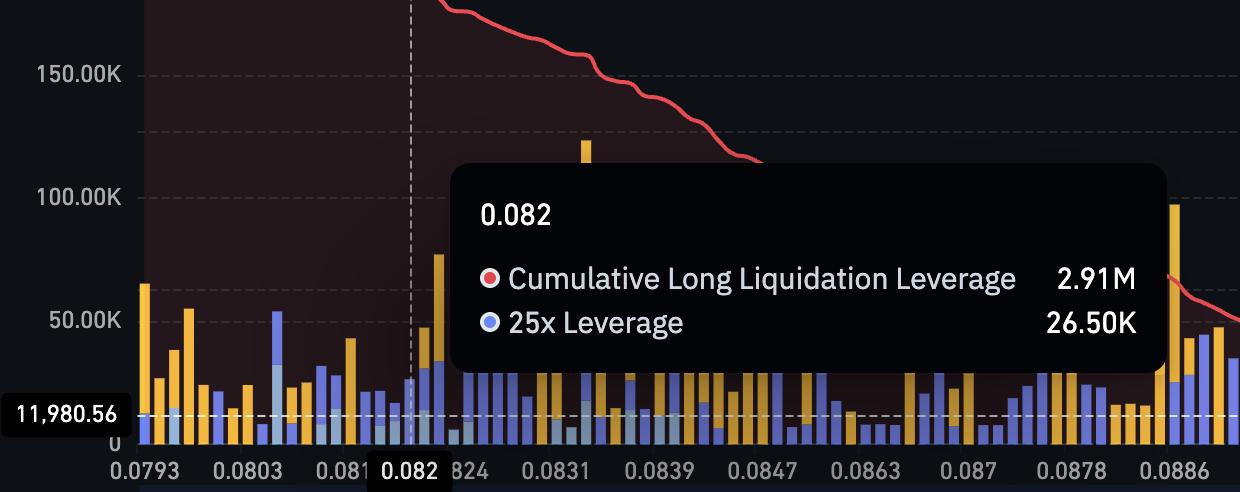

Liquidation map: CoinglassThe liquidation map shows a dangerous zone at $0.082. If the price NIGHT falls to this zone (which also appears on the price chart), nearly $2.91 million worth of Longing positions will be forcibly closed. This represents over 84% of the current Longing positions at risk of liquidation. If this scenario occurs, selling pressure will increase sharply and could cause the price to fall even faster.

Key Liquidation Cluster: Coinglass

Key Liquidation Cluster: CoinglassWith large whales continuously selling and Derivative contracts remaining mostly in Longing positions, the downside risk will be higher than most retail investors anticipate.

The midnight price will determine the next development.

Midnight (NIGHT) is currently trading around $0.093. A break above $0.101 would test the 0.618 Fibonacci level, a significant psychological barrier. A close above $0.109 would confirm the upward momentum, potentially leading to a move toward $0.119 and opening up new price exploration territory. For sustained gains, large whales need to slow their selling pace.

If the price fails to break above $0.101, selling pressure from large whales could cause further declines. Losing the $0.082 mark would trigger a major liquidation zone, potentially sending the price down to $0.071. This would negate any short-term recovery expectations.

Midnight Price Analysis: TradingView

Midnight Price Analysis: TradingViewCurrently, Midnight's price is caught between retail investor optimism and profit-taking by large whales. Whichever side will determine the next trend in the coming period. If NIGHT fails to hold the $0.101 level ($0.10 as mentioned in the title), the Midnight Express rally could stall before the market witnesses a stronger price surge.