Ethereum (ETH) is attempting to break out of a bearish pattern. Ethereum is currently trading around $3,016, up approximately 2.3% over the past 24 hours and just under 2% away from a key threshold that could change market sentiment.

The market is quite thin at the end of the year, so this surge is happening at a sensitive time. The question now is quite simple: Can ETH prevail over the bears, or is this just another false rally?

The Vai Vai and shoulders pattern is facing resistance.

On the daily chart, ETH is forming a “head and Vai” pattern, a structure that typically signals a bearish trend if the price breaks through the neckline. Here, the neckline is around $2,809. If the price actually breaks through this area, ETH could fall by another 20% according to the pattern's forecast.

Want to stay updated on Token like this? Sign up for editor Harsh Notariya's daily newsletter here .

ETH downside risk: TradingView

ETH downside risk: TradingViewHowever, achieving such a significant drop is not easy at all.

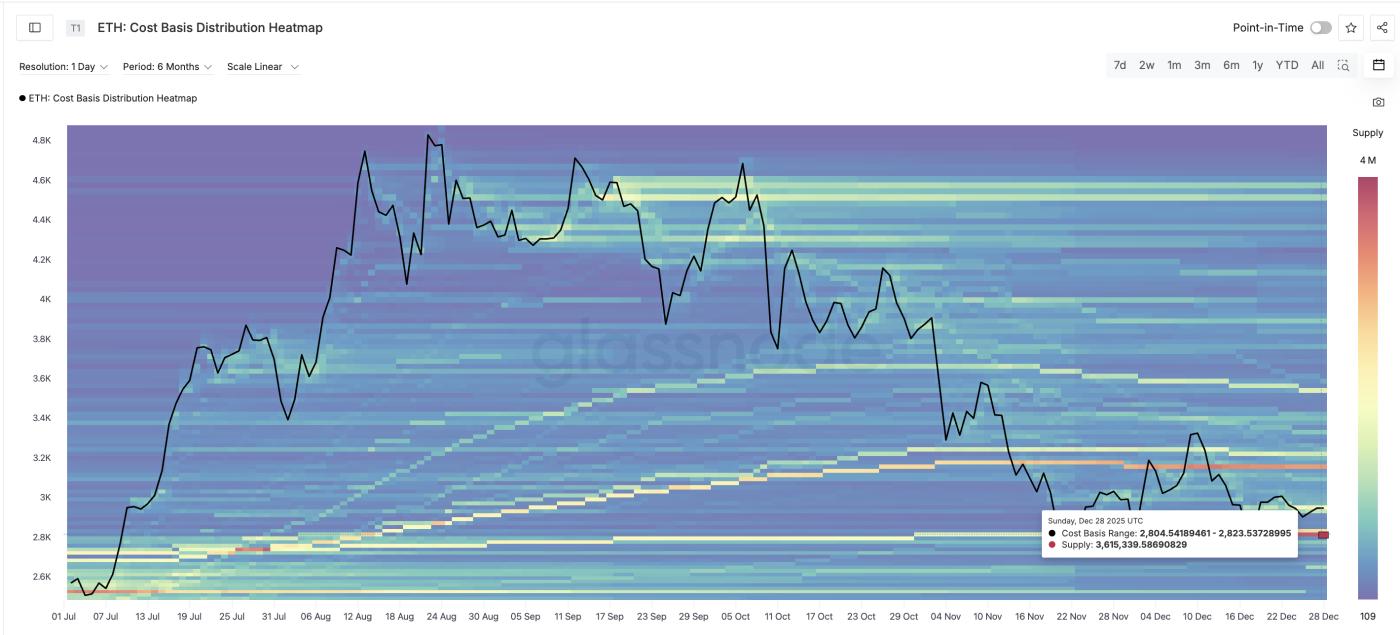

Based on the “cost base temperature,” there is a strong supply concentration zone between $2,804 and $2,823, currently holding approximately 3.6 million ETH. This is an area where many investors previously bought in. When the price returns to this zone, many investors will typically try to hold or support the price. This concentration zone means the risk of a Ethereum price drop remains, but the likelihood of that is somewhat reduced.

Strong support in the neck area: Glassnode

Strong support in the neck area: GlassnodeIn summary, bearish signals are still present, but the bears cannot easily push prices down much further.

Whales are buying as long-term short positions fall by 98%.

There are two notable on-chain changes supporting ETH's recovery momentum.

Whales (excluding exchanges) have increased their holdings from 100.65 million ETH on December 28th to 101.05 million ETH currently.

In total, approximately 400,000 ETH were purchased. At the current price, this represents a purchase worth approximately $1.2 billion in just 24 hours.

Sharks are buying near support levels: Santiment

Sharks are buying near support levels: SantimentThis surge coincided with ETH price recovery from the right Vai of a head-and Vai pattern. When large holder buy when the price is at risk of a correction, it's often a signal of confidence in the market. At the same time, the amount of "old" coins (held in wallets for 365 days to 2 years) sold has sharply decreased from 45,846 ETH on December 27th to just 1,076 ETH today.

This means that the volume of long-standing coins sold has decreased by 98%. This metric measures the amount of long-standing coins that are moved out of wallets and back into circulation in the market.

Long-term Ethereum holder are selling less: Santiment

Long-term Ethereum holder are selling less: SantimentThe reduced movement of coins means that long-term holder are no longer selling when the price rises. This reduces selling pressure, allowing whales to continue accumulating, supporting the price recovery. With both whales buying and long-term holder limiting selling, the supply and demand balance is tilting towards an upward trend.

Ethereum's price only needs one more push to break through the bears' resistance.

ETH is currently trading around $3,016. The first key level is $3,069, only about 2% away from the current price. If ETH closes above $3,069, the short-term downtrend will be broken.

If it continues to break through, the bearish pattern's invalidation zone is at $3,449. This is the peak of the head-and- Vai pattern. ETH closing above $3,449 would invalidate the bearish pattern, shifting control to the buyers.

Ethereum Price Analysis: TradingView

Ethereum Price Analysis: TradingViewBelow, the $2,809 level remains a neckline of support, and a breach of this level could trigger a further 20% drop. In that case, ETH could fall below $2,623 first, invalidating the breakout setup. Currently, ETH is caught between these two scenarios, but momentum and supply behavior favor the buyers if they can break above $3,069.