XRP price has remained under pressure for several weeks recently, despite several unsuccessful attempts at recovery. As 2025 draws to a close, the altcoin continues to be dominated by a downward trend after a year that was generally mildly negative.

Weak spot buying demand and caution among retail investors have hampered price rebounds. However, institutional interest remains the main factor stabilizing XRP prices, preventing further declines despite continuous selling pressure.

XRP is a preferred choice for institutions.

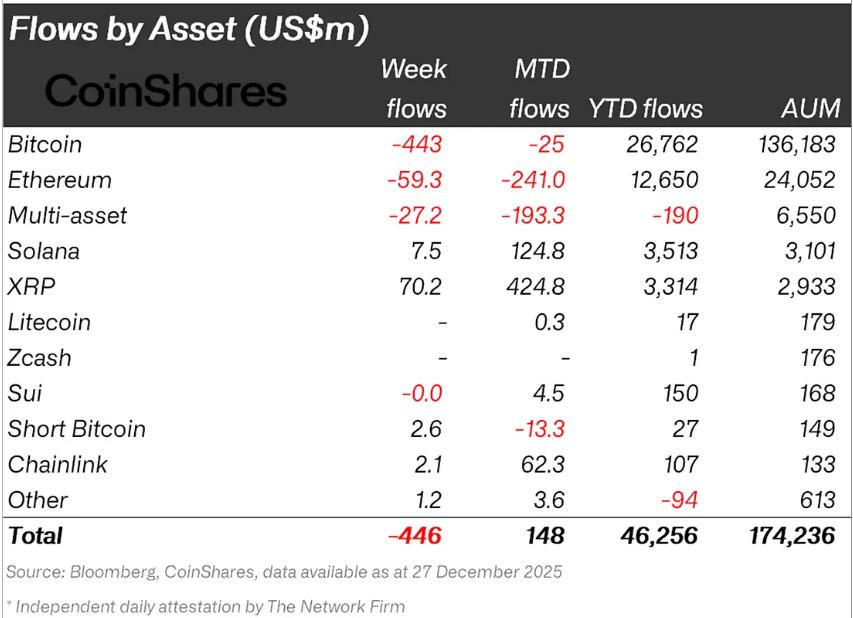

Institutional investors are the most stable source of funding for XRP throughout 2025. According to data from CoinShares, in the week ending December 27, 2025, XRP recorded $70 million in inflows. Since the beginning of the month, total inflows have reached $424 million, demonstrating that institutions continue to allocate Capital even as prices fall.

Notably, XRP outperformed other major cryptocurrencies during the same period. Bitcoin saw net outflows of $25 million, while Ethereum lost a staggering $241 million.

Want more analysis on similar Token ? Sign up for the daily Crypto Newsletter from Editor Harsh Notariya here .

The amount of XRP held by institutions. Source: CoinShares

The amount of XRP held by institutions. Source: CoinSharesFor the entire year, XRP attracted a total of $3.3 billion in inflows, demonstrating that institutional confidence remains stable despite the volatility and general legal issues in the crypto market.

XRP ETFs demonstrate strength.

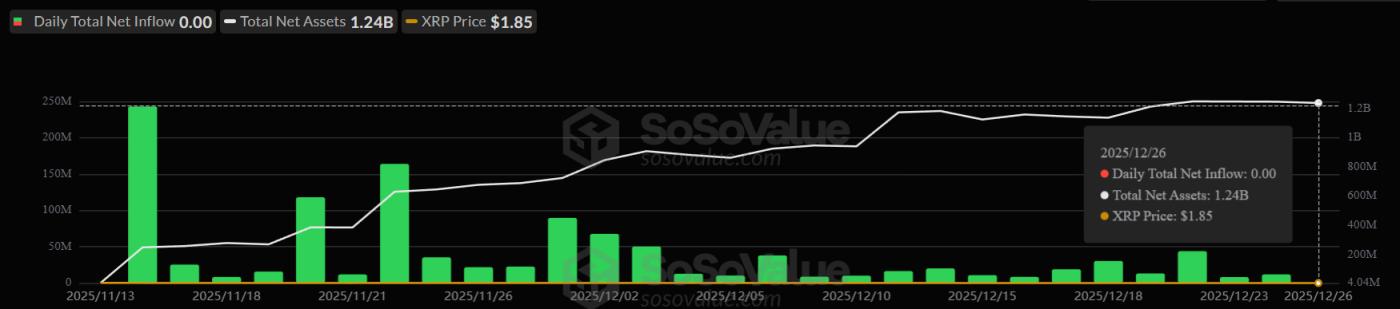

Institutional support has extended beyond traditional investment products, especially since the launch of the XRP ETF earlier this year. Since its inception , the XRP ETF has not recorded a single day of net Capital . There was only one trading session with no inflow, demonstrating strong investor demand.

Inflow of funds into XRP ETF. Source: SoSoValue

Inflow of funds into XRP ETF. Source: SoSoValueIn an interview with BeInCrypto, Ray Youssef, CEO of the NoOnes app, stated that organizations are implementing long-term, clearly structured strategies.

“The accumulation of XRP in early December was a proactive tactic by many investors to capitalize on the upward momentum from the ETF. Similar to previous Bitcoin and Ethereum ETF phases, institutions often accumulate holdings before the price fully reflects the event,” Youssef Chia .

In addition, he believes that XRP is XEM a highly volatile asset, but also has great growth potential.

“[This] is thanks to the increasing institutional participation in XRP trading, which helps to popularize the Token more widely. Although the price hasn't really taken off yet, many traders still XEM the current price levels as attractive entry points, expecting growth when the ETF trend becomes clearer,” Youssef added.

Investors who hold XRP but are not willing to hold it long-term.

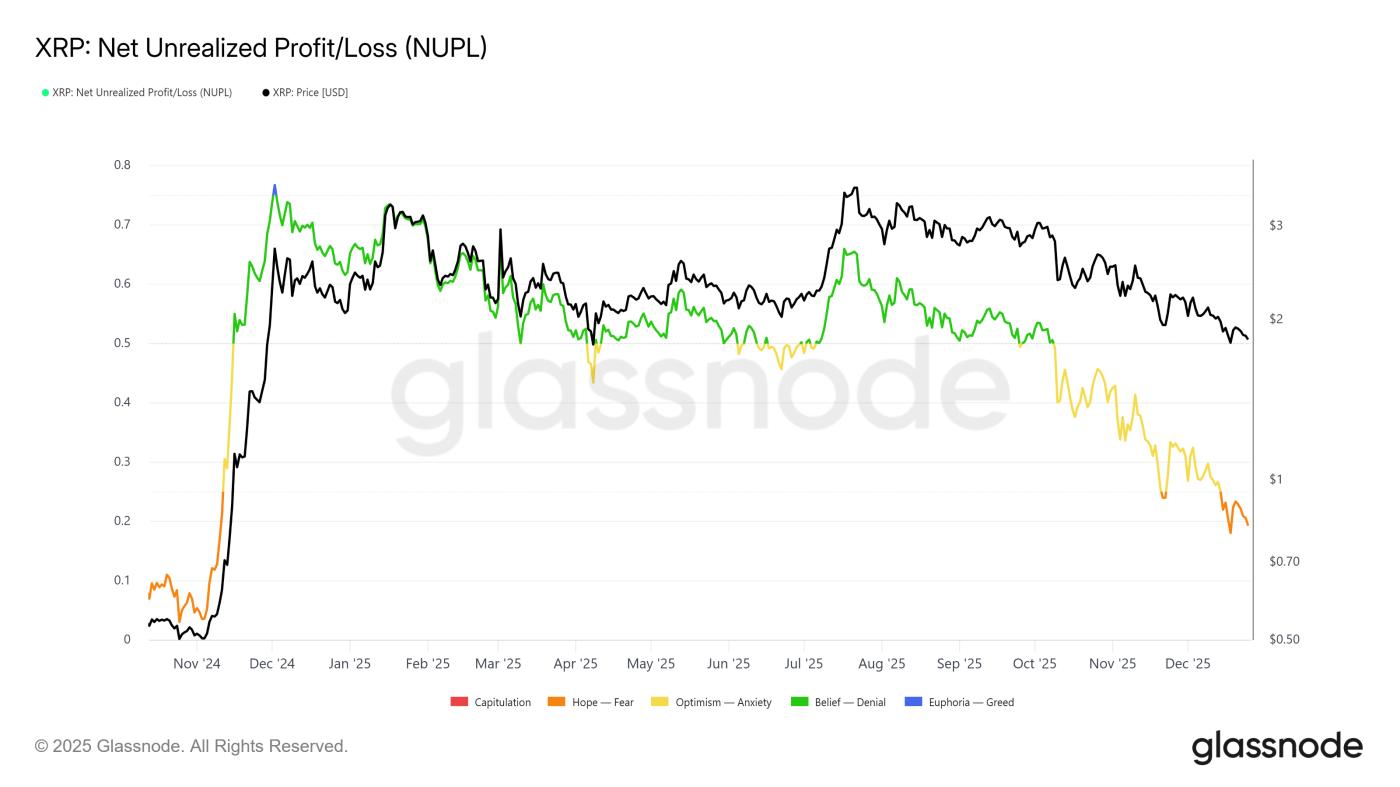

Longing-term holders remain a crucial factor heading into 2026. History shows this group plays a balancing Vai in the market during periods of high volatility. Throughout the past year, this group has alternately accumulated and distributed XRP, demonstrating hesitation about its medium-term prospects .

XRP NUPL Index. Source: Glassnode

XRP NUPL Index. Source: GlassnodeBy Q4 2025, selling pressure will prevail among long-term investors. This indicates a lack of confidence among them – those who are usually patient through turbulent times. If this sentiment persists into 2026, XRP prices could face even greater downward pressure. Strong selling from long-term holders can sometimes lead to prolonged periods of accumulation or deeper corrections.

XRP price could get off to a gentle start in 2026.

XRP is currently trading around $1.87 at the time of writing, after losing 38% of its value in Q4 2025. Year-to-date, the altcoin has fallen 9.7% from its opening price. December saw no significant recovery, further contributing to the negative market sentiment towards the end of the year.

However, 2026 could have its own unique developments. Ray Youssef predicts that January, as well as the entire first quarter, could be relatively bleak for XRP .

“ XRP is likely to continue trading sideways, in the range of $2 to $2.50 in January and Q1 2026, unless there is truly significant macroeconomic news. The market has yet to recover from the prolonged volatility and geopolitical conflicts that have strained global trade. The continuous delevering and shift to a defensive stance means investors are hesitant to open large positions until the risk of instability significantly decreases,” Youssef commented.

The bigger goal remains to recover recent losses. To re-establish an uptrend structure, XRP needs to maintain above $3.00, and then there will be a chance to advance towards its historical high of $3.66.

The possibility of a price drop remains to be considered if selling pressure intensifies. If the price continues to trade sideways and demand remains weak, XRP could fall further. If the support level at $1.79 is clearly broken, the $1.50 price zone will be vulnerable to retesting. This would invalidate the neutral-bullish theory and solidify the dominance of the bears.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewSeasonal factors also require investors to exercise more caution.

“XRP failed to outperform in December due to a weak market structure. Decreased liquidation , weak risk appetite, and a sell-off fueled by the bursting AI bubble that spread to high-risk assets and the entire digital asset market meant that the expected favorable seasonal effects didn't materialize. The fourth quarter was one of the worst quarters for the crypto market in almost seven years,” Youssef commented.

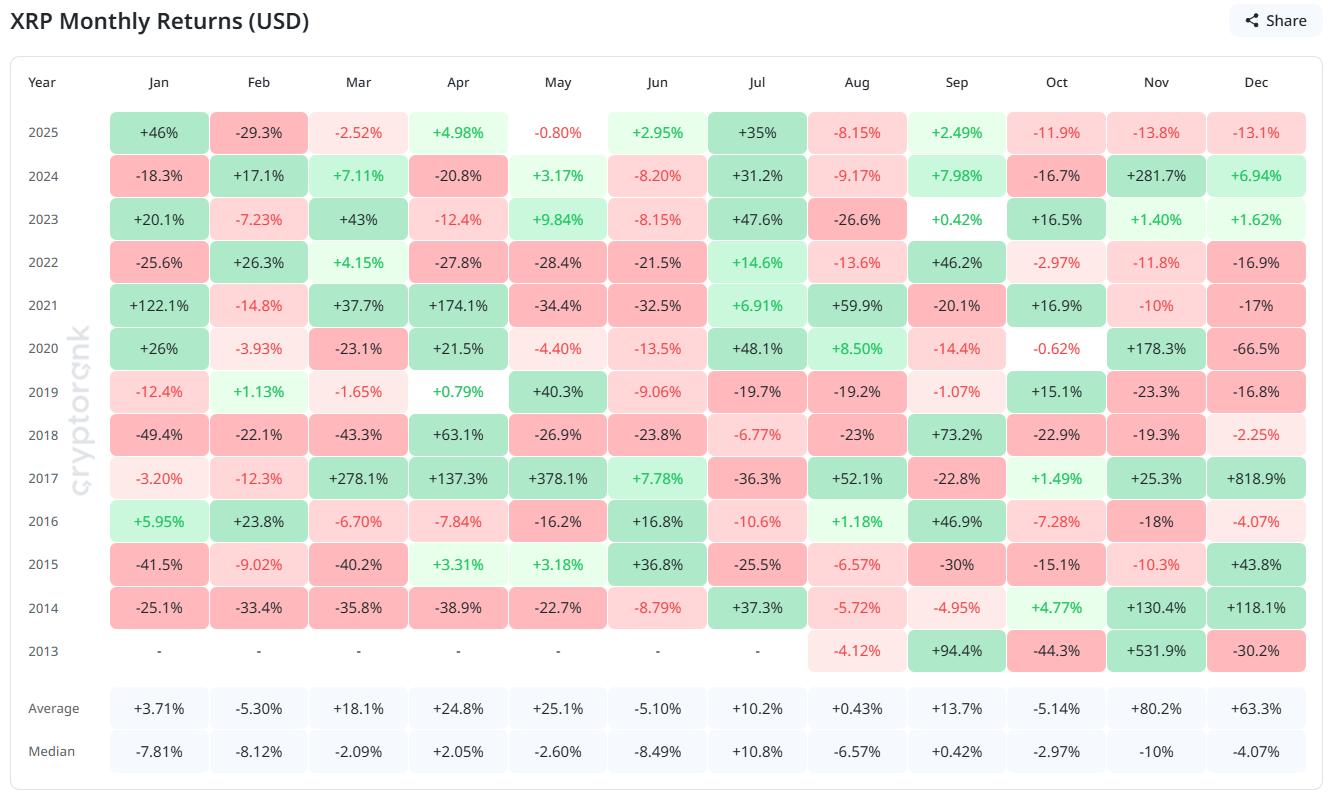

Historical data on XRP 's performance over the past 12 years shows that January Medium a 3% return. However, the median return is down 7.8%, indicating that XRP consistently underperforms this month.

XRP's monthly returns. Source: CryptoRank

XRP's monthly returns. Source: CryptoRankTherefore, if market sentiment and investor behavior do not change significantly, XRP price forecasts suggest that the price may face significant challenges in the early months of 2026 before a clearer trend is established.