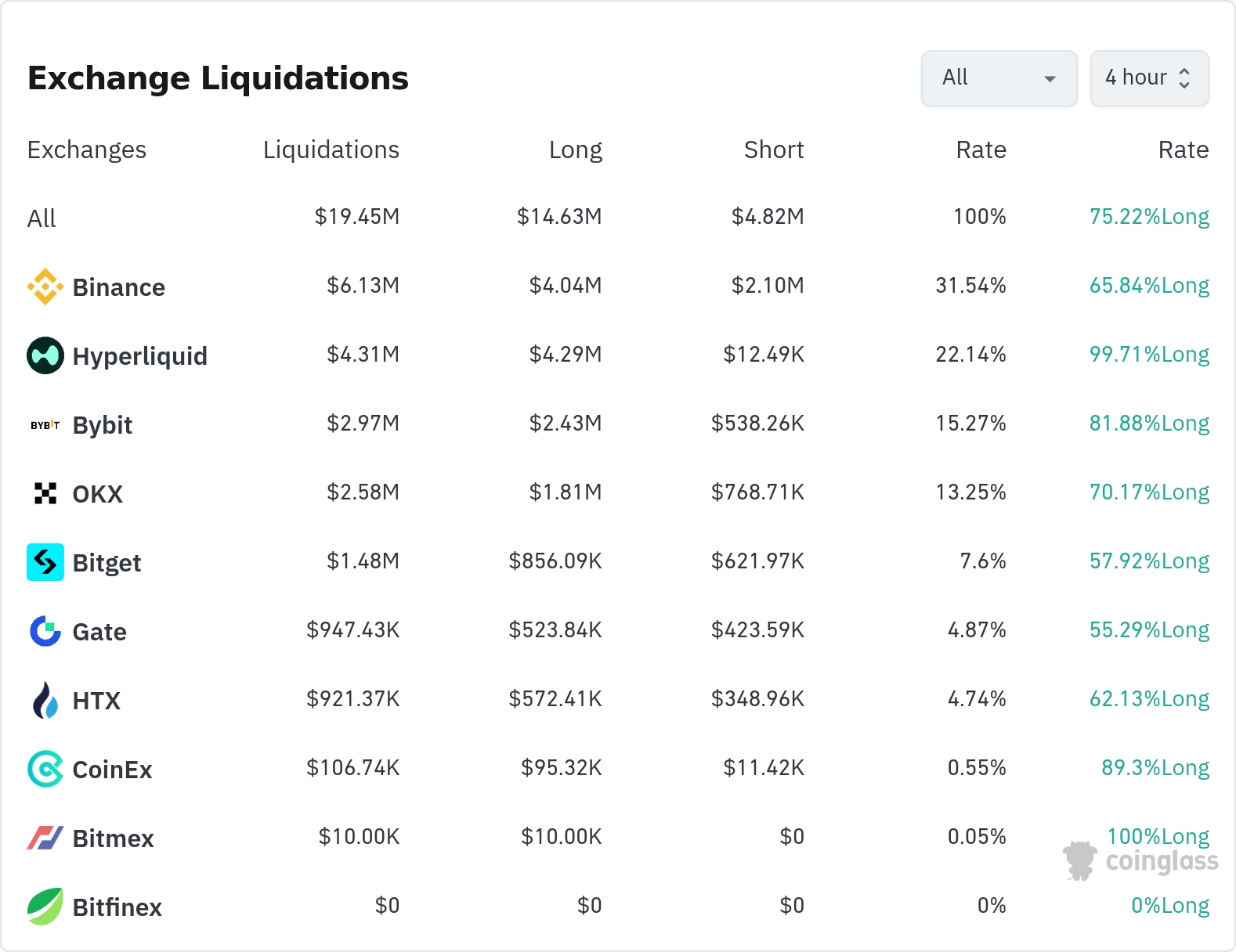

Approximately $194.5 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently aggregated data, long positions accounted for 75.22% of liquidated positions.

Binance saw the most liquidations over the past four hours, with a total of $6.13 million (31.52% of the total). Long positions accounted for 65.84% of this liquidation.

The second exchange with the most liquidations was Hyperliquid, with $4.31 million (22.16%) of positions liquidated, and the long position ratio was a staggering 99.71%.

Bybit recorded liquidations of approximately $2.97 million (15.27%), with the long position ratio at 81.88%.

On OKX, liquidations of $2.58 million (13.26%) occurred, and the long position ratio was recorded at 70.17%.

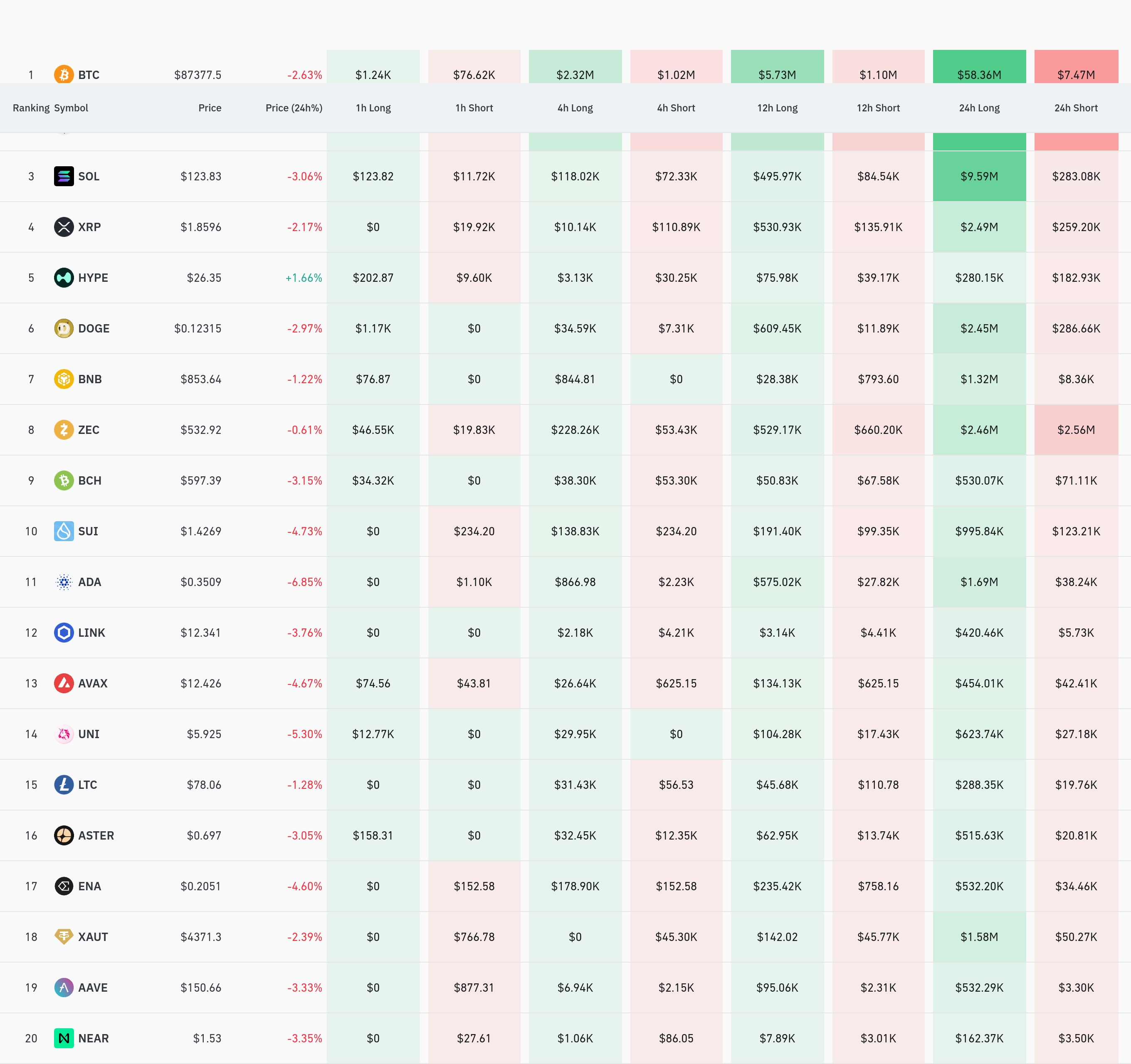

By coin, Bitcoin (BTC) positions saw the most liquidations. Approximately $65.83 million worth of Bitcoin positions were liquidated over a 24-hour period, with $2.32 million in long positions and $1.02 million in short positions liquidated over a 4-hour period.

Ethereum (ETH) saw approximately $41.04 million worth of positions liquidated over the past 24 hours.

Solana (SOL) recorded approximately $9.9 million in liquidations over the past 24 hours, with $118,000 in long positions and $72,000 in short positions liquidated over the past 4 hours.

Notably, ZEC (Zet Cash) saw significant liquidation of long positions worth $228,000 and short positions worth $53,000 over a 4-hour period, with positions worth $5.02 million liquidated over a 24-hour period.

Dogecoin (DOGE) also saw the liquidation of long positions worth $34,600 and short positions worth $0.73,000 over the course of 4 hours.

Additionally, major coins such as FARTCOIN and LIT also saw significant liquidations of $4.74 million each in 24 hours.

In particular, the BEAT token recorded a high liquidation volume of $5.88 million over 24 hours, which is smaller than that of the large altcoin SOL, but is still a significant figure relative to its market capitalization.

In the cryptocurrency market, "liquidation" refers to the forced closure of leveraged positions when traders fail to meet margin requirements. This liquidation data shows a concentration of long positions, suggesting the market has recently been under downward pressure.

Article Summary by TokenPost.ai

🔎 Market Interpretation

- Approximately $194.5 million in leveraged positions were liquidated over 24 hours.

Long positions accounted for 75.22% of total liquidations, suggesting excessive optimism in a bear market.

- 99.71% of Hyperliquid positions are long, confirming one-sided positioning concentrated on specific exchanges.

💡 Strategy Points

Bitcoin and Ethereum had the largest liquidations, at $65.83 million and $41.04 million, respectively.

- Increased liquidations of certain altcoins, such as ZEC, signal increased volatility for those coins.

- The large-scale liquidation of main coins such as FARTCOIN, LIT, and BEAT suggests a possible decline in speculative fever.

📘 Glossary

- Liquidation: Forced closure of a position when the margin maintenance rate in leveraged trading falls below the reference level.

- Long Position: A position purchased in anticipation of an asset price rise.

- Short Position: A position sold in anticipation of a decline in asset price.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.