Introduction:

Prediction markets are evolving from "trading tools" into a repeatedly cited decision-making signal layer. As data from platforms like Polymarket and Kalshi is increasingly used by mainstream media, financial terminals, and AI systems, the market's focus is no longer on the wins and losses of individual bets, but rather on the consensus itself, weighted by capital. Based on CGV Research's long-term tracking of prediction markets, AI agents, compliant finance, and information infrastructure, this article presents 26 key predictions for the development of prediction markets in 2026 from five dimensions: structure, products, AI, business models, and regulation.

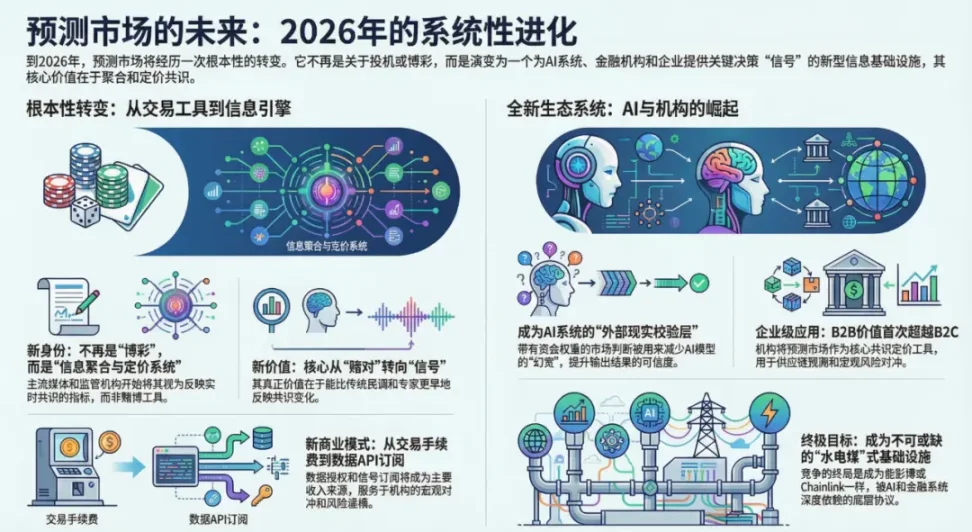

Today, prediction markets are gradually transforming from a "fringe financial experiment" into a foundational layer for information, capital, and decision-making systems. In 2024–2025, the market witnessed the explosion of platforms such as Polymarket and Kalshi; in 2026, the market may face the systemic evolution of prediction markets as a "new type of information infrastructure."

Based on two years of continuous research on prediction markets, AI agents, crypto finance, and compliance trends, the CGV research team has provided 26 predictions for 2026.

I. Structural Trend Judgment

1. Prediction markets will no longer be defined as "gambling" or "derivatives" in 2026.

It will be redefined as a decentralized information aggregation and pricing system. By 2025, platforms like Polymarket and Kalshi had accumulated over $270 billion in trading volume. Mainstream media outlets such as CNN, Bloomberg, and Google Finance widely integrated its probability data, citing it as an instant consensus indicator rather than gambling odds. Academic research (such as analyses from Vanderbilt University and the University of Chicago) shows that prediction markets outperform traditional polls in political and general events. By 2026, with traditional financial giants like ICE investing in Polymarket and distributing its data to global institutions, regulators (such as the CFTC) are expected to further view it as an information aggregation tool, driving a paradigm shift from a "gambling label" to a "decentralized pricing system."

2. The core value of market prediction lies not in "winning the bet," but in the "signals."

Ultimately, the market pays the price for the ability to anticipate changes in consensus. In 2025, Polymarket and Kalshi predicted probability changes in Federal Reserve decisions and sporting events 1-2 weeks ahead of mainstream economists and polls. Their reports showed that their Brier scores significantly outperformed polls and expert predictions, with a Brier score of 0.0604 significantly better than the "good" standard of 0.125 and the "excellent" standard of 0.1. Furthermore, as trading volume increased and predictions became more accurate, the Brier scores improved. By 2026, with the surge in institutional hedging demand (such as using probability signals to hedge overall risk), platform data will be more widely embedded in financial terminals, and the value of these signals will far exceed trading returns, becoming an instant "public opinion indicator" for institutions and the media.

3. Predicting that the market will shift from an "event-level" to a "state-level" approach.

It's not just about "who will win," but about "what state the world is in." In 2025, the platform launched persistent state markets, such as "2026 Bitcoin price range" or "recession probability," and open interest (OI) surged from a low at the beginning of the year to over several billion dollars; Kalshi's overall market share rose rapidly. By 2026, long-term state markets are expected to dominate liquidity, aggregate structural consensus, and provide persistent pricing of the world's state, rather than being driven by a single event.

4. Prediction markets will serve as an "external reality validation layer" for AI systems.

AI is no longer just referencing data, but rather "judgments weighted by funding." In 2025, benchmark tests on the Prophet Arena showed that AI models achieved accuracy comparable to prediction markets in real-world event predictions. Kalshi and Grok collaborated, and Polymarket generated AI summaries, using funding-weighted probabilities as a verification measure to reduce AI illusions. By 2026, with the maturity of protocols such as RSS3 MCP by the end of the year, prediction market probabilities will widely serve AI world model updates, forming a closed loop of reality-market-model, and enhancing the credibility of AI outputs.

5. For the first time, information, capital, and judgment will be integrated into a closed loop within the same system.

This is the fundamental difference between prediction markets and social media and news platforms. In 2025, Polymarket data was integrated with Bloomberg and Google Finance, forming an efficient loop of information input → pricing → judgment output; unlike Twitter's unincentivized opinions, the funding mechanism ensures the authenticity of judgments. By 2026, this closed loop is expected to extend to corporate risk control and policy evaluation, generating externality value. Prediction markets, distinct from simple content platforms, will become a new type of decision-making infrastructure.

6. Prediction markets are no longer a "niche sector" in the crypto industry.

It will be integrated into the larger narrative of AI × Finance × Decision-Making Infrastructure. By 2025, ICE's $2 billion investment in Polymarket and Kalshi's valuation of $11 billion will be significant, with traditional giants like DraftKings and Robinhood launching prediction products; total transaction volume will exceed $270 billion, and data streams will be embedded in mainstream terminals. By 2026, with accelerated institutional adoption and AI integration, the prediction market is expected to shift from a crypto niche to a core narrative of AI × Finance × Decision-Making, similar to Chainlink's position in the oracle space.

II. Product Form Judgment

7. The single-event prediction market will enter its mature stage in 2026.

The space for innovation lies not in the UI, but in the structure. In 2025, the overall trading volume of the prediction market reached approximately $270 billion, with Polymarket contributing over $200 billion and Kalshi over $170 billion. Single-event markets (such as sporting events, macro indicators, and political events) dominated, but the monthly growth rate slowed later, with a peak at the end of the year followed by an adjustment. The focus of innovation shifted to the underlying structure. For example, the LiquidityTree model of the Azuro protocol continues to optimize efficient liquidity management and profit and loss distribution. By 2026, such infrastructure upgrades are expected to drive single-event markets into a stable depth phase, supporting larger-scale institutional participation.

8. Markets characterized by multiple events will become the mainstream.

Prediction is no longer a single point, but rather a joint pricing of a set of related variables. In 2025, Kalshi's "combos" multi-leg trading feature gained widespread popularity, supporting the combination of sports outcomes and overall events, significantly attracting institutional hedging; conditional market experiments (such as event-linked probabilities) further improved pricing accuracy and depth. By 2026, with clearer regulations and accelerated inflows of institutional funds, multi-event combinations are expected to become the mainstream approach, enabling complex risk management and diversified exposure, and significantly expanding overall trading depth.

9. The "Long-horizon Market" begins to emerge.

Predicting structural outcomes 6 months, 1 year, or even 3 years into the future. In 2025, Polymarket and Kalshi expanded their year-end market forecasts to include Bitcoin price ranges and economic indicators, with Open Interest (OI) rising from a low at the beginning of the year to over several billion dollars; similar protocols introduced position lending mechanisms to alleviate capital lock-up. By 2026, long-cycle markets are expected to dominate some liquidity, providing more reliable structural consensus aggregation, and Open Interest is expected to double again, attracting long-term institutional hedging.

10. Prediction markets will be embedded in more non-trading products.

Research tools, risk control systems, and decision-making back-ends, rather than front-end trading. In November 2025, Google Finance deeply integrated Kalshi and Polymarket data, supporting Gemini AI in generating probability analysis and charts; Bloomberg and other platforms followed suit, exploring signal integration. By 2026, this embedding trend is expected to be fully deepened, with predicted probabilities becoming the standard input layer for overall research, corporate risk control, and decision-making back-ends, shifting from front-end trading to institutional-level tools. CNN and CNBC also signed a multi-year cooperation agreement with Kalshi in December 2025 to embed probability data into financial programs (such as "Squawk Box" and "Fast Money") and news reports.

11. The value of the B2B forecasting market will surpass that of the B2C market for the first time.

Enterprises and institutions need "consensus pricing" more than individual investors. In 2025, the accuracy of internal enterprise application cases (such as supply chain and project management forecasting) continued to outperform traditional methods; with the surge in institutional hedging demand for aggregate and sporting events, the proportion of B2B transactions increased significantly. By 2026, the value of B2B is expected to surpass that of retail B2C for the first time, and institutions will regard forecasting markets as a core consensus pricing tool, driving the sector's transformation into enterprise-level infrastructure. The supply chain analytics market size reached $9.62 billion in 2025 and is projected to grow at a CAGR of 16.5% to 2035. As a "consensus pricing tool," forecasting markets can be embedded in AI-driven demand forecasting and risk management systems.

12. Prediction markets that are "non-cryptocurrency-issuing and low-speculation" will go further.

In 2026, the market will reward restrained design. In 2025, Kalshi, without a native token, achieved a peak monthly trading volume of over $500 million and captured over 60% of the market share; Polymarket, while confirming the launch of its POLY token in Q1 2026, still saw low-speculative operations dominate growth throughout the year. By 2026, restrained design is expected to prevail in terms of regulatory friendliness, genuine liquidity, and institutional trust, with low-speculative platforms gaining an advantage in long-term valuation and sustainability.

III. AI × Prediction Market

13. AI agents will become one of the major players in the prediction market.

This is not speculation, but continuous participation and automatic calibration. By the end of 2025, infrastructure such as RSS3's MCP Server and Olas Predict already supported AI Agents in autonomously scanning events, purchasing data, and placing bets on platforms like Polymarket and Gnosis, with processing speeds far exceeding those of humans; Prophet Arena tests showed that Agent participation significantly improved market efficiency. By 2026, with the maturation of the AgentFi ecosystem and more open interfaces for protocols, AI Agents are expected to contribute more than 30% of trading volume, becoming major liquidity providers rather than short-term speculators through continuous calibration and low-latency responses.

14. Human predictions will increasingly become "training data" rather than the basis for transactions.

Prediction markets are beginning to serve models, not humans. In 2025, benchmarks from Prophet Arena and SIGMA Lab showed that market probabilities involving humans were widely used to train and validate large models, resulting in significant accuracy improvements; the massive amounts of money-weighted data generated by these platforms have become high-quality training sets. By 2026, this trend is expected to deepen, with prediction markets prioritizing AI model optimization, human betting serving more as signal input than the core agent, and platform design evolving around model requirements.

15. Multi-agent predictive game theory will become a new source of alpha.

Prediction markets are transforming into a multi-agent game arena. By 2025, projects like Talus Network's Idol.fun and Olas have already viewed prediction markets as a battleground for collective agent intelligence, where multiple agents compete and generate predictive accuracy exceeding that of a single model; Gnosis conditional tokens support complex interactions. By 2026, multi-agent game theory is expected to become the primary alpha generation mechanism, and the market will evolve into an adaptive multi-agent environment, attracting developers to build customized agent strategies.

16. The illusion that prediction markets will conversely constrain AI

Judgments that "cannot be placed" will be considered low-reliability outputs. In 2025, Kalshi collaborated with Grok and tested in the Prophet Arena, using money-weighted market probability as an external anchor to effectively correct AI biases; the related models performed poorly on outputs without market validation. By 2026, this constraint mechanism is expected to be standardized, and judgments that "cannot be placed in the predicted market" will be automatically downweighted by the AI system, improving the overall reliability of outputs and resistance to illusions.

17. AI will drive the prediction market from "probability" to "distribution".

More than just a number, it's an entire outcome curve. In 2025, platforms like Opinion and Presagio introduced AI-driven oracles, outputting complete probability distributions rather than single numbers; Prophet Arena showed that distribution predictions are more accurate in complex events. By 2026, the distribution outputs of AI models will be deeply integrated with the market, providing fine-grained outcome curves, significantly improving the pricing accuracy of long-tail events, and platform UIs and APIs will have default support for distribution views.

18. Prediction markets will serve as an external interface to the world model.

Real-world changes → Market pricing → Model updates form a closed loop. By the end of 2025, protocols such as RSS3 MCP Server have implemented real-time context streaming, supporting agents to update the world model from market probabilities; Prophet Arena has formed an initial feedback loop. By 2026, this closed loop is expected to mature, with prediction markets becoming the standard external interface for AI world models. Real-world events will be rapidly reflected in pricing, driving model iteration and accelerating AI's understanding and adaptation to the dynamic world.

IV. Financial and Business Model Judgment

19. Transaction fees are not a predictor of the market's endgame model.

The true value lies in data, signals, and influence. In 2025, Kalshi achieved significant revenue through transaction fees, but Polymarket, adhering to a low/zero fee strategy, captured dominance through data distribution and influence—its cumulative trading volume exceeded $200 billion, attracting investment from traditional giants like ICE. With mainstream platforms like Google Finance and CNN integrating predictive data by 2025, data licensing and signal subscriptions are expected to become the main revenue source by 2026, contributing over 50% of platform revenue. Institutions will pay for real-time probability signals for overall hedging and risk modeling, and platform valuations will shift from trading volume to data asset weighting, driving sustainable business evolution.

20. Predictive signal APIs will become core commercial products.

Especially in the financial, risk control, policy, and macroeconomic sectors. In 2025, unified APIs such as FinFeedAPI and Dome began serving institutions, providing real-time OHLCV and order book data from Polymarket and Kalshi; Google Finance officially integrated the probability signals from both in November, allowing users to directly query event predictions. By 2026, with accelerated institutional adoption (as highlighted in the regulatory clarity in Grayscale and Coinbase's outlooks), prediction signal APIs will evolve into standard products, similar to a complement to the Bloomberg terminal—institutional paid subscriptions for automated risk control, policy simulation, and hedging Federal Reserve decisions, etc. The market size is expected to expand from the current billions of dollars to hundreds of billions of dollars, with leading platforms dominating through exclusive licensing.

21. Content creation capabilities will become a crucial competitive advantage in the prediction market.

Explaining predictions is more important than the predictions themselves. In December 2025, CNN signed a data collaboration agreement with Kalshi, embedding probability into its reporting and relying on the platform to explain market fluctuations; mainstream media frequently cited consensus changes from Polymarket and Kalshi as "instant public opinion indicators." By 2026, pure probability providers will be marginalized, and content-based explanations (such as in-depth analysis of consensus dynamics behind the market, long-tail insights, and visual narratives) will become the key competitive advantage—platforms with strong explanatory capabilities will be prioritized by AI systems, think tanks, and institutions, creating a network effect; monetization of influence will surpass transactions, similar to how traditional media builds authority through data interpretation.

22. Prediction markets will become the underlying tool for new research institutions.

Prediction markets are not media, but research engines. By 2025, prediction market data was being used for benchmarking by institutions such as the University of Chicago's SIGMA Lab, and its superior accuracy compared to traditional polls propelled it into general research. With integration into Google Finance, users can generate probability charts and analyses using Gemini AI. By 2026, with deeper institutional adoption (such as the capital-weighted consensus emphasized in the outlooks of Vanguard and Morgan Stanley), prediction markets will be embedded in new research frameworks as real-time decision-making engines—serving corporate risk assessment, government policy early warning, and AI model validation—evolving into "research infrastructure," similar to the role of data terminals in the financial sector, driving a comprehensive transformation from front-end trading to back-end tools.

V. Regulation and Situation Assessment

23. In 2026, the regulatory focus will shift from "whether it can be done" to "how it will be used".

The focus is no longer on prohibition, but on usage and boundaries. In 2025, the US CFTC approved Kalshi and Polymarket to operate legally in specific categories (such as sports and macroeconomic events). While election-related markets remain restricted, non-financial events have received a clear green light. Several prediction platforms under the EU's MiCA framework have entered the regulatory sandbox for testing. By 2026, with accelerated institutional funding inflows and widespread mainstream media citation (such as CNN and Bloomberg using probability as a standard indicator), the regulatory focus is expected to shift to usage regulations—such as anti-manipulation rules, disclosure requirements, and cross-jurisdictional boundaries—rather than existential bans. This shift will resemble the maturing path of the derivatives market, driving the scaling of compliant platforms globally.

24. Compliance prediction markets are more likely to start from "non-financial uses".

Examples include policy assessments, supply chain analysis, and risk warnings. In 2025, Kalshi successfully circumvented political restrictions, shifting its focus to economic indicators and the sports market, achieving a cumulative transaction volume exceeding $170 billion. Internal enterprise applications (such as supply chain risk prediction) have proven higher accuracy at companies like Google and Microsoft. By 2026, compliant platforms are expected to prioritize expansion from non-financial uses—policy assessments (such as climate event probabilities), enterprise risk warnings, and public events (such as Olympic medal distribution). These areas face the least regulatory hurdle but attract institutional and government clients. CFTC and EU regulatory trends indicate that this entry point will open the door to the mainstream, avoiding the gambling label.

25. Leading prediction companies won't win by traffic, but by being "cited".

Whoever gets invoked by AI, institutions, and research systems will be the winner. By 2025, the probabilities from Polymarket and Kalshi were widely integrated and cited by Google Finance, Bloomberg terminals, and mainstream media (such as Forbes and CNBC) as indicators of immediate consensus, outperforming traditional polls; academic benchmarks like SIGMA Lab further enhanced their authority. By 2026, with the explosive growth in demand from AI agents and research institutions, competition among leading platforms will shift to the frequency of invocation—being used as an external validation source by models like Gemini and Claude, or embedded in the risk control systems of institutions like Vanguard and Morgan Stanley; while traffic is important, the network effect of invocation will determine the winner, forming an infrastructure status similar to the Chainlink oracle.

26. The ultimate competition in the prediction market lies not between markets, but in whether or not one becomes infrastructure.

After 2026, prediction markets will either become as essential as water, electricity, and gas, or be marginalized. In 2025, traditional financial giants like ICE invested in Polymarket, with TVL exceeding billions of dollars, and data streams beginning to be embedded in mainstream terminals; AgentFi and MCP protocols laid the foundation for AI closed loops by the end of the year. By 2026, the essence of competition will shift to infrastructure attributes—whether it becomes the real-time interface for AI world models, the standard signal layer for financial terminals, and the underlying consensus engine for decision-making systems; the successful will become indispensable like Bloomberg or Chainlink, while pure trading platforms may be marginalized; this watershed will determine whether the track completely shifts from crypto narratives to global information infrastructure.

Conclusion

Prediction markets no longer need to prove "feasibility." The real watershed moment lies in whether they begin to be used as decision-making signals, rather than just trading tools. The role of prediction markets has already changed when prices are repeatedly cited by researchers, institutions, and systematic models.

By 2026, the focus of competition in the prediction market will no longer be on popularity and traffic, but on the stability, credibility, and frequency of signal usage. Whether a signal can become a long-term, usable information infrastructure will determine whether it moves to the next stage or remains confined to a cyclical narrative.