Starting January 1, 2026, the digital yuan will officially transition from the era of "digital cash" to the era of "digital deposit currency" that can accrue interest.

Written by: Sanqing, Foresight News

On December 29, Lu Lei, Vice Governor of the People's Bank of China, published an article in the Financial Times entitled "Upholding Integrity and Innovation to Steadily Develop the Digital RMB," which detailed the People's Bank of China's upcoming "Action Plan on Further Strengthening the Management and Service System and Related Financial Infrastructure Construction of the Digital RMB" (hereinafter referred to as the "Action Plan"). The new generation of digital RMB's measurement framework, management system, operating mechanism, and ecosystem will be officially launched and implemented on January 1, 2026.

The article points out that among the projects being piloted and promoted by central banks around the world, the digital yuan is in a leading position, already possessing the capabilities of a universal, hybrid, programmable, efficiently regulated, and all-scenario currency. The digital yuan is not only a payment tool, but also a modern monetary cornerstone for building a "financial powerhouse."

Furthermore, the article argues that emerging "currencies" such as stablecoins and crypto assets, which are detached from central bank currency issuance and from the circulation and trading of currency by licensed and regulated financial institutions, are prone to self-circulation outside the financial system, leading to drastic fluctuations in financial asset prices and challenging the central bank's macroeconomic control capabilities.

From "non-interest-bearing cash" to "interest-bearing deposits"

Throughout the ten-year research and pilot program of the digital yuan, it has always been positioned as currency in circulation (M0), or "digital cash".

The digital yuan is mainly used in small-value retail payment scenarios, and the wallet balance does not accrue interest, which to some extent limits users' enthusiasm for holding and using it. The most direct change for users in digital yuan 2.0 is the "interest accrual" function.

According to the "Action Plan," banking institutions will pay interest on customers' real-name digital RMB wallet balances, and this interest rate will comply with the self-regulatory agreement on deposit interest rate pricing. This design breaks the previous boundary that pure M0 could not generate interest, and digital RMB wallet balances will be classified into the corresponding monetary tiers according to their liquidity.

From policy-driven promotion by banks to inclusion in the "bank liabilities" system

The deeper transformation of the digital yuan, which allows it to accrue interest, lies in the change of its liability nature. The Action Plan incorporates the digital currencies of banking institutions into the reserve requirement framework, with the balance included in the base for deposit reserves.

The new generation of digital yuan clarifies that it belongs to commercial bank liabilities in commercial bank wallets, rather than being solely a central bank liability as before, and banks can independently conduct asset and liability management of wallet balances.

This means that digital currency has been officially included in the deposit insurance coverage, enjoying a maximum compensation guarantee of RMB 500,000, the same level of security as traditional bank deposits. Banks can also use digital currency balances to issue loans and profit, rather than simply acting as an agent for the central bank.

From prepayment regulation to a programmable "umbrella wallet" ecosystem

The Action Plan clarifies the hybrid solution of "account system + coin string + smart contract" for digital RMB 2.0. It proposes to upgrade the existing account system, promote the application of emerging technologies based on the new account (digital RMB wallet), improve the digitalization and intelligence level of RMB issuance, circulation and payment, upgrade the digital RMB smart contract ecosystem service platform, and support the construction of an open source ecosystem for smart contracts.

The account system relies on banks to address regulatory requirements such as identity verification and anti-money laundering; the coin string is a form of digital RMB, which completes payment by delivering coin strings and simultaneously transfers ownership; and the smart contract is responsible for automatically directing the flow of coin strings between accounts when specific conditions are triggered.

On September 8, 2022, the Digital Currency Research Institute of the People's Bank of China released the first smart contract prepayment fund management product for digital RMB, "Yuan Guanjia", which can combine commercial contract terms with the circulation of digital RMB.

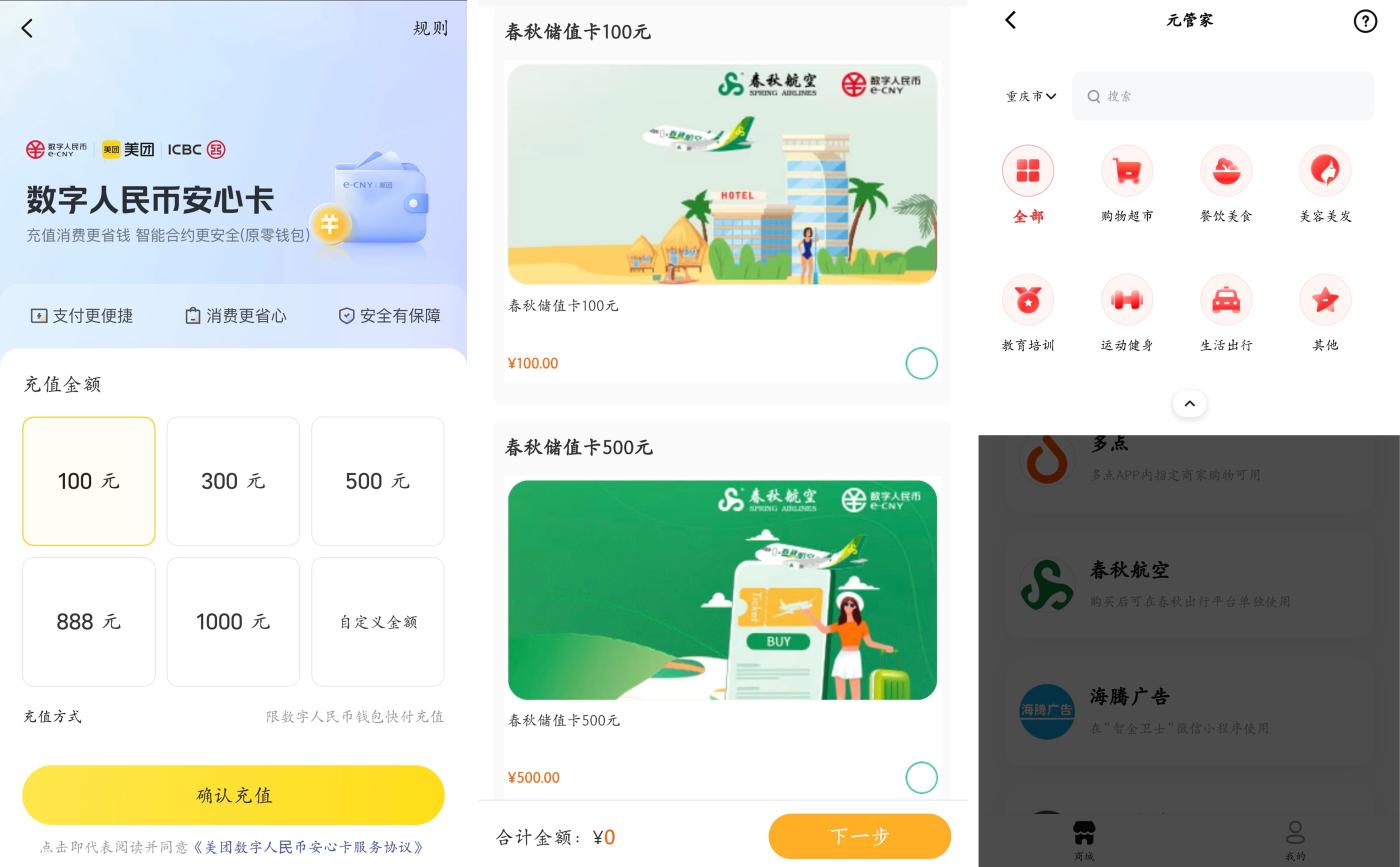

According to the 2024 annual report released by Postal Savings Bank of China, one of the operators of the digital yuan, as of the end of the reporting period, the number of merchants using the "Yuan Guanjia" platform had reached 551. Furthermore, according to a report by Beijing Business Today on March 14, 2025, over 1,300 merchants have issued "Yuan Guanjia" prepaid consumption cards, covering areas such as education and training, sports and fitness, beauty salons, supermarkets, and restaurants, catering services.

Image: From left to right, Meituan, Spring Airlines, and the digital RMB application interface.

The funds belong to the consumer until they are actually consumed. Only after the smart contract confirms the service is completed will the funds be automatically transferred to the merchant, thus technically eliminating the risk of funds being misappropriated or the merchant "running away with the money".

According to a report by Yicai on July 24, 2024, after the large chain fitness brand "Wubai Youpin Fitness" in Qingdao closed due to abnormal operations, 51 consumers who purchased memberships through the Postal Savings Bank's "Smart Financial Guardian" platform received refunds on July 5, which were automatically triggered by smart contracts.

mBridge Protocol and International Operations Center

In terms of cross-border payments, Digital Yuan 2.0 is more of an institutional defense against the impact of private stablecoins and an attempt to maintain control over the base money supply.

According to the Action Plan, mBridge (Multilateral Central Bank Digital Currency Bridge) uses distributed ledger technology (DLT) to build a peer-to-peer settlement layer, with the core purpose of balancing the monetary sovereignty of various countries.

Although the cumulative transaction volume has reached 387.2 billion yuan, the digital yuan accounts for as much as 95.3%, which objectively reflects that the liquidity of the system is still highly dependent on Chinese nodes and has not yet formed a truly multilateral international ecosystem.

The Shanghai Digital RMB International Operation Center, scheduled to launch in 2026, will be based on the Chengfang Chain platform and implement a "unified ledger, business-domain-specific" model. Its design goal is to achieve atomic trading of assets (such as bills, trade finance instruments, and carbon emission rights) and settlement instruments (e-CNY) within the same ledger. This Chengfang Chain platform is more like a permissioned, compliant Layer 0, replacing the game-theoretic mechanism of Web3 bridges by adding regulatory nodes and utilizing real-time data for risk identification.

Digital Yuan 2.0 vs Stablecoins and Crypto Assets

In the Web3 ecosystem, the core narrative of stablecoins and crypto assets is built on "permissionless," "trustless," and "disintermediation." Stablecoins are typically minted by private institutions, often with reserves held in short-term government bonds or other financial assets such as fiat currency, and promise a 1:1 exchange rate with external parties.

The expansion of stablecoins essentially depends on the issuer's asset allocation capabilities, custody transparency, and market trust. While this model gradually shifts money creation, liquidity, and risk-bearing outside the traditional financial system, it does not rely on a single national account system and naturally possesses global reach and high liquidity.

In scenarios such as cross-border payments, on-chain transactions, and fund transfers, it provides a near-instantaneous and low-friction settlement experience. At the same time, stablecoins, as universal collateral, have high composability, enabling rapid iteration of on-chain financial products, which is an efficiency advantage that other systems cannot match.

Unlike stablecoin systems that operate outside the banking system, the digital yuan in its 1.0 phase was more akin to an electronic extension of paper currency. The 2.0 version, however, is designed with institutional completeness in mind, adhering to a two-tier operating system of "central bank + commercial banks" and employing a hybrid model of "account system + coin chain + smart contracts."

Within this framework, the digital yuan uses accounts as its core to carry out identity verification, anti-money laundering, and reserve management, while introducing technologies such as blockchain in specific stages to improve clearing efficiency.

The goal of this design is to prevent digital currencies from expanding independently of the financial system, thereby weakening the central bank's ability to control money supply, liquidity, and financial stability.

The digital yuan 2.0 is essentially equivalent to bank deposits. The "Action Plan" explicitly includes the digital yuan in the banking liability system, and the balance of real-name wallets is included in the deposit reserve base. The digital yuan in commercial bank wallets is equivalent to deposits in terms of legal and economic attributes.

Through reserve management, 100% margin arrangements for non-bank institutions, and inclusion of the digital yuan in the monetary tier based on liquidity, the digital yuan has been brought back into the circulation of the modern banking system.