- Altcoin-focused treasury companies are the first to face exit risks, while treasuries centered on major assets are also under pressure.

- Pure asset holding models are unsustainable; yield generation and liquidity management will determine long-term survival.

- Alignment with ETF/ETE standards, alongside stronger compliance and transparency, will be critical for the industry’s future.

Amid market corrections and intensifying competition, most digital asset treasury companies are likely to be flushed out, with survivors relying on yield management, liquidity optimization, and standardized compliance frameworks.

MARKET VOLATILITY SHAKES THE INDUSTRY

In 2025, digital asset treasury companies (DATs) expanded rapidly, offering institutional investors a convenient channel to gain exposure to digital assets. Their portfolios spanned a wide range of assets, from major cryptocurrencies such as Bitcoin and Ethereum to Solana, XRP, and selected altcoins. This broad exposure model attracted growing attention from Wall Street participants seeking alternative asset access through equity-like structures.

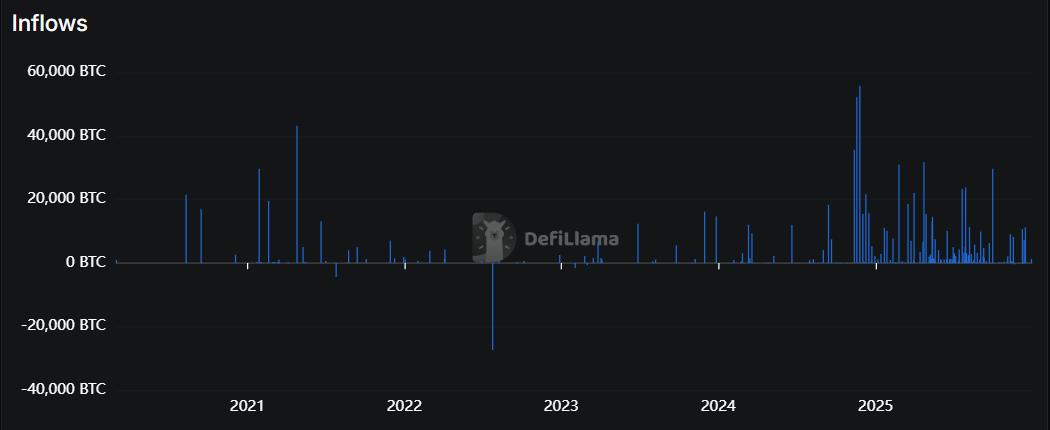

However, market conditions deteriorated in the second half of the year. Heightened volatility and sustained price corrections across digital assets triggered sharp declines in the share prices of many DATs. As asset values fell and liquidity conditions tightened, the industry began facing a dual challenge: balance sheet revaluation and operational liquidity pressure. Investor sentiment weakened significantly, raising fundamental questions about the long-term viability of many treasury-focused companies.

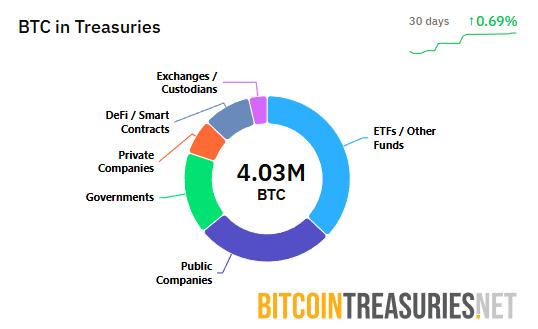

Figure 1: BTC Holdings Distribution Across Treasury Entities

ALTCOIN TREASURIES FACE DISPROPORTIONATE RISK

Industry analyst Altan Tutar has pointed out that DATs centered on altcoins are structurally more vulnerable during market downturns. These companies typically hold assets with weaker liquidity profiles and lower institutional acceptance, making it difficult for their market capitalization to remain sustainably above net asset value (mNAV).

During periods of declining market confidence, such treasury structures are often the first to lose investor support, increasing the likelihood of delisting, restructuring, or outright exit. While treasuries focused on major assets such as Ethereum, Solana, or XRP benefit from deeper liquidity and broader recognition, they are not immune to sustained market stress. As the crypto market undergoes structural adjustment, portfolio construction, risk management discipline, and operational efficiency have become decisive factors in determining which firms survive and which are forced out.

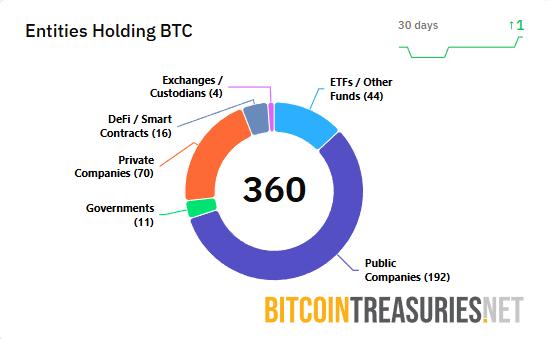

Figure 2: Entity Type Distribution of Bitcoin Treasury Holders

SINGLE-ASSET STRATEGIES LOSE THEIR EDGE

Ryan Chow, co-founder of Solv Protocol, has emphasized that companies built solely around holding Bitcoin or a single digital asset lack long-term sustainability. In 2025, the number of listed or quasi-listed companies holding Bitcoin increased sharply. Yet the subsequent market downturn exposed a fundamental weakness: the absence of effective yield and liquidity management capabilities.

According to Chow, future survivors will treat digital assets not merely as passive stores of value but as capital that can generate yield and support liquidity strategies. This shift requires treasury companies to move beyond directional price exposure and build mechanisms that actively enhance capital efficiency. Without such capabilities, firms remain overly dependent on market cycles, leaving them vulnerable during prolonged downturns.

YIELD AND LIQUIDITY AS CORE COMPETENCIES

Chow further notes that DATs with stronger survival prospects tend to implement multi-layered yield management strategies. These may include staking, lending, or selective participation in DeFi protocols, combined with dynamic portfolio rebalancing to respond to changing market conditions. Equally important is liquidity optimization, which ensures sufficient flexibility to manage redemptions, rebalance positions, and navigate stressed market environments.

Such active management capabilities significantly enhance resilience during downturns. They also help stabilize investor expectations by shifting the narrative from pure asset appreciation to risk-adjusted return generation. In a volatile market, yield and liquidity management are no longer optional enhancements but foundational pillars of competitiveness.

Figure 3: Bitcoin Treasury Inflows & Outflows Trend (2021-2025)

ETE PRODUCTS EMERGE AS STRUCTURAL COMPETITORS

Vincent Chok, CEO of First Digital, has highlighted the growing competitive pressure from crypto ETEs (Exchange-Traded E-products). Compared with DATs, ETE structures typically offer superior price transparency, regulatory clarity, and liquidity management. These advantages make them increasingly attractive to institutional and conservative investors seeking compliant digital asset exposure.

Chok argues that for DATs to remain relevant, they must progressively align their governance, audit standards, and asset management practices with those of ETFs. Without such alignment, DATs risk being marginalized by regulated investment vehicles that deliver similar exposure with lower perceived risk and higher transparency.

INTEGRATING INTO TRADITIONAL FINANCIAL INFRASTRUCTURE

As the digital asset industry matures, deeper integration between DATs and traditional financial infrastructure has become a strategic necessity. Establishing robust compliance frameworks, conducting regular audits, and adopting standardized asset management processes can significantly enhance investor confidence and operational stability.

In practice, this requires DATs to comply with KYC and AML requirements, provide consistent and transparent disclosures, and engage third-party auditors to verify asset existence, financial integrity, and risk controls. By institutionalizing these practices, treasury companies can reduce valuation volatility and narrow the credibility gap between crypto-native firms and traditional financial products.

Ultimately, aligning operational standards with those of ETFs allows DATs to achieve comparable levels of governance and professionalism, positioning them as legitimate participants within the broader financial system rather than peripheral or speculative vehicles.

INDUSTRY CONSOLIDATION AND STRATEGIC DIRECTION

By 2026, the DAT sector is expected to undergo significant consolidation. Market corrections, the limitations of single-asset strategies, and deficiencies in compliance and transparency will drive a large-scale shakeout. Surviving companies are likely to share several defining characteristics: a core allocation to major assets such as Bitcoin, Ethereum, and Solana; well-developed yield and liquidity management frameworks; and operational standards aligned with ETF or ETE benchmarks.

Future strategic priorities for DATs include reducing single-asset volatility, improving portfolio stability, enhancing capital efficiency through innovative yield strategies, and strengthening investor trust through transparency and governance. Firms that successfully integrate these elements will not only improve profitability and competitiveness but also contribute to the broader professionalization of the digital asset management industry.

CONCLUSION

Digital asset treasury companies are entering a decisive phase of industry restructuring, with 2026 likely to determine long-term winners and losers. Market volatility, intensifying competition, and disparities in yield and liquidity management capabilities will collectively shape survival outcomes. Companies that rely solely on passive asset holding are increasingly likely to exit the market, while survivors will differentiate themselves through diversified portfolios, active yield generation, and standardized compliance frameworks. As consolidation accelerates, the industry will become more concentrated and professionalized, with high-standard operators and major-asset-focused treasuries emerging as dominant players. This evolution signals the gradual maturation and institutionalization of digital asset treasury management as a credible segment of global financial markets.

Read More:

DAT (Digital Asset Treasury): The Strategic Evolution of Crypto-Native Corporations

What is Digital Asset Treasury(DAT)? 5 Must-Know Insights

〈Outlook for crypto asset treasury companies in 2026〉這篇文章最早發佈於《CoinRank》。