Bitcoin and the crypto market in general enter the new year facing renewed pressure as the Federal Open Market Committee (FOMC) releases the minutes of its December meeting.

The FOMC meeting minutes clearly show that policymakers are not in a hurry to cut interest rates again in early 2026.

High interest rates are impacting crypto market sentiment.

Minutes released on December 30, 2025, showed that leaders wanted to keep interest rates stable after the 25 basis point cut in December , while also projecting expectations for the next cut as early as March.

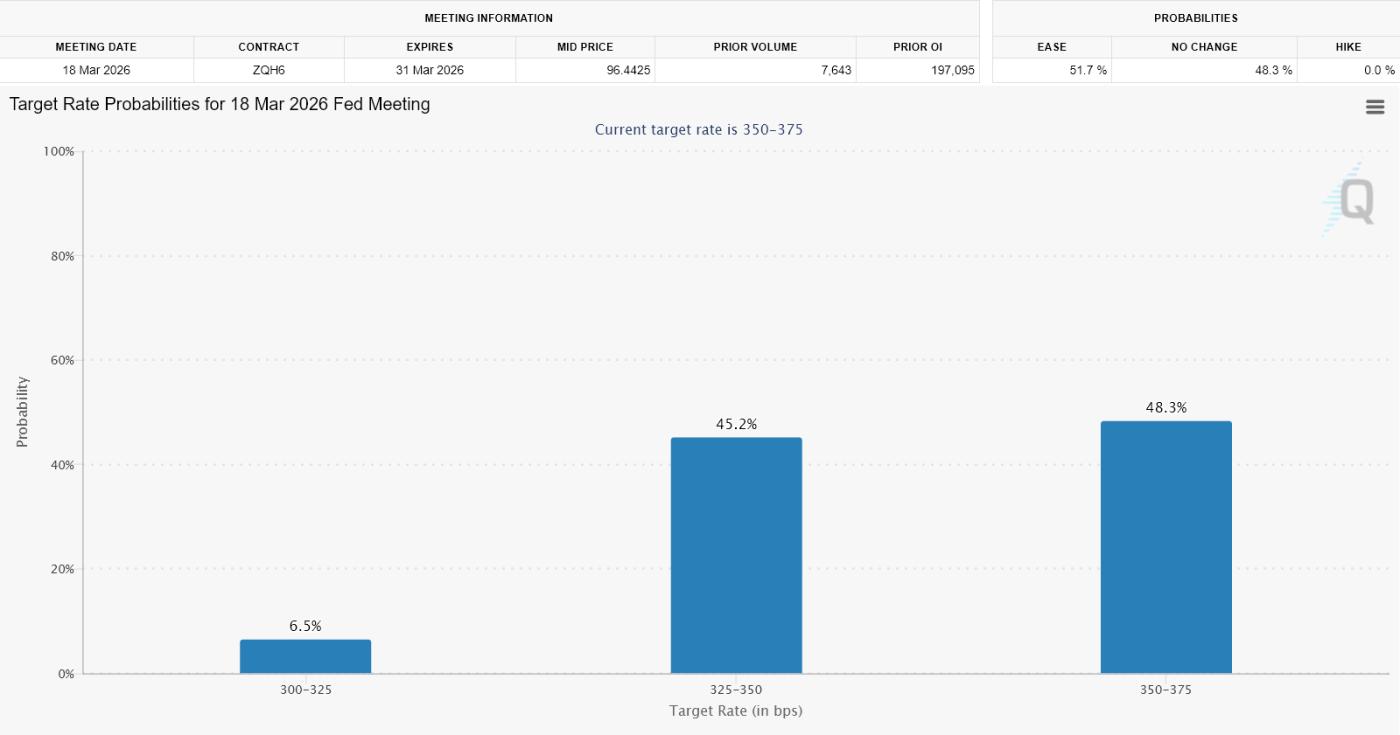

The Capital market had already ruled out the possibility of an interest rate cut in January, and the language in the minutes further reinforced this view. The FOMC minutes didn't even offer much hope for a rate cut in March 2026.

Therefore, the earliest possible time for a reduction in interest rates is April.

The market largely does not expect an interest rate cut in March 2026. Source: CME FedWatch

The market largely does not expect an interest rate cut in March 2026. Source: CME FedWatchBitcoin has recently been trading within a narrow price range, around $85,000 to $90,000.

Bitcoin's price remains volatile as it has yet to break through key resistance levels, while sentiment indicators suggest a cautious rather than optimistic trend.

Overall, daily crypto volume remains low. The market has yet to regain its risk appetite since the sharp correction in December.

According to the minutes, some leaders believe it is "appropriate to maintain the current interest rate target for the foreseeable future" to monitor the delayed impact of recent easing measures.

Others commented that the December interest rate cut was a “carefully considered” decision, and that there was no rush to take further action unless inflation had significantly improved.

Inflation remains a major concern . Policymakers also acknowledge that price pressures “have not come close to the 2% target over the past year” despite a weakening labor market.

The FOMC also cited import tariffs as the main reason for the continued high inflation of goods, while inflation of services has gradually improved.

At the same time, the Fed also warned of the increasing risk of job losses . Leaders noted that hiring is slowing, businesses are becoming more cautious, and anxieties are rising among low-income households.

However, most members still want to wait for more economic data before deciding to adjust policy.

For the crypto market, the message is clear. With high real yields and tight liquidation , the factors driving short-term price increases have yet to materialize.

Bitcoin's recent short-term consolidation clearly reflects this sentiment, as investors both hope for upcoming easing and must accept the reality that interest rates will remain high for the foreseeable future.

Overall, the crypto market suggests that the downward momentum remains strong. Source: CoinMarketCap

Overall, the crypto market suggests that the downward momentum remains strong. Source: CoinMarketCapLooking ahead, March is currently the earliest possible timeframe for an interest rate cut, provided inflation continues to cool and the labor market weakens further.

Until then, the crypto market may struggle to regain upward momentum. Prices are likely to remain under pressure if macroeconomic data in early 2026 proves disappointing.