2025 will be a landmark year for Ethereum. As Ethereum Foundation member @renaissancing stated in his annual summary, "Ethereum in 2025: From Experiment to World-Class Infrastructure," Ethereum has officially shed its role as a "social experiment" and taken on the responsibility of being a "global financial infrastructure."

If we consider cryptocurrency price as a yearly performance indicator, then this year has likely been tough for those who bought ETH at the beginning of the year. ETH is still down at least 15% year-to-date, and even after reaching an all-time high of $4,953 in August, its current price is near a five-month low.

Despite the fluctuating price of Ethereum, upgrades at the protocol layer, a gradually clearer regulatory framework, and deep institutional investment all indicate that the fundamentals are developing in a more stable direction. This article will provide an in-depth analysis of Ethereum's important turning points and milestones in 2025, look ahead to its strategic deployment in 2026, and explore how this "world computer" is transforming from a prudent and conservative organization into a global financial settlement empire.

Two major upgrades completed in just seven months

Ethereum completed two major core upgrades in 2025: Pectra (May) and Fusaka (December). These two upgrades focused on improving user experience and performance through scaling, respectively.

Pectra Upgrade: Enhanced user experience and reduced burden on validators. Allows regular wallets to have smart contract functionality; for example, users can pay gas fees with stablecoins or authorize multiple transactions at once without requiring multiple manual confirmation steps. Increased staking flexibility for validators, raising the staking limit for a single validator from 32 ETH to 2,048 ETH, improving capital efficiency and reducing the overall number of active validators in the network, thus reducing network burden.

Fusaka Upgrade: Addressing Layer 2 data bottlenecks and improving Ethereum's performance. Through PeerDAS technology, validators can verify validity without downloading all data, allowing Ethereum to handle up to 8 times more data while reducing Layer 2 costs. Combined with the gradual increase in the mainnet gas limit from 30M at the beginning of the year to 60M, Ethereum's throughput has doubled.

From the injection of funds from ETFs to the rise of DAT.

If technological upgrades are the core evolution of Ethereum, then the injection of institutional funds will be the most powerful external variable in 2025.

With the SEC releasing staking guidelines and the passage of the GENIUS Act, compliance uncertainties are gradually dissipating. This indirectly ignited the powder keg for Ethereum ETFs. From the end of May to the end of August 2025, Ethereum spot ETFs experienced a rapid inflow of funds, marking the first large-scale shift in Wall Street demand towards Ethereum, viewing it as a strategic asset on par with Bitcoin. But an even more noteworthy change is the rise of Ethereum Treasury companies.

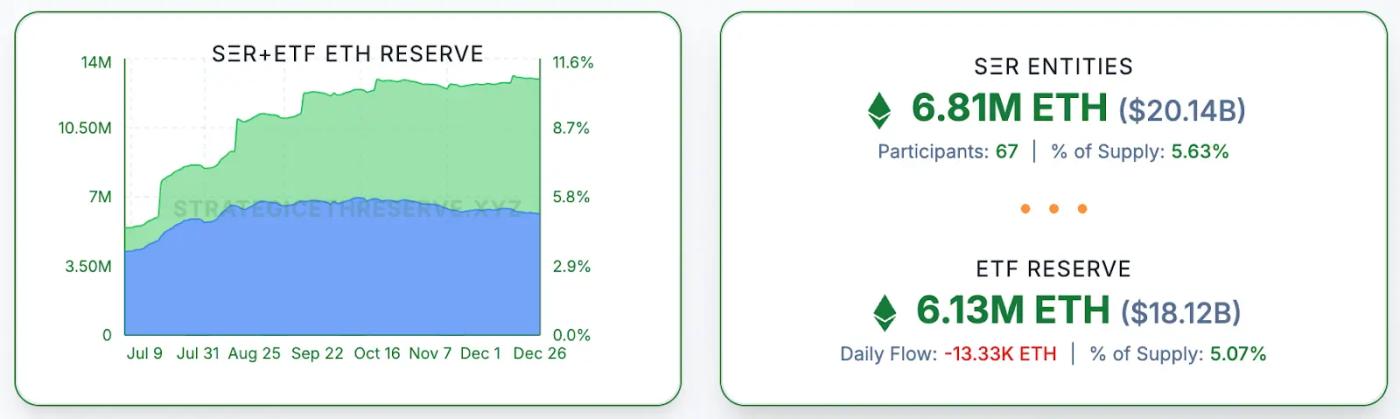

Data prior to the deadline showed that DAT and ETF together held a total of 10.7% of the circulating supply of ETH. The former held a total of 6.81 million ETH (approximately US$20.14 billion), while the latter held 6.13 million ETH (approximately US$18.12 billion). This also indicates that the market supply structure of Ethereum has undergone a qualitative change, and institutional holdings are anchoring the lower limit of Ethereum's value.

Despite fierce competition among public blockchains, it has solidified its core position as a "global asset settlement center".

Despite facing strong challenges from Solana, BNB Chain, and emerging public chains in the competition for on-chain activities, Ethereum has consolidated its core position as a "global asset settlement center".

Ethereum's TVL (TVL) share has demonstrated remarkable resilience. Starting at 56%, it dipped to 51% in early May but rebounded to 62% in August, ultimately closing with a solid 58%. While speculative capital chases the next opportunity and new chains, Ethereum's TVL moat remains unbreakable, maintaining its stable position year after year.

Ethereum's stablecoin supply increased by 45% year-on-year , from $111.8 billion to $162.5 billion. Furthermore , Ethereum has been the preferred choice for almost all major financial pilot programs, including JPMorgan Chase's first tokenized money market fund, MONY, and BlackRock's BUIDL fund, whether for government bond tokenization or credit products. Currently, Ethereum holds a 65.46% market share in RWA, far exceeding the second-place BNB Chain (9.83%).

In summary, despite the dramatic ups and downs in Ethereum's price in 2025, the resilience of Ethereum's underlying fundamentals, from technological upgrades and the reshaping of the regulatory environment to structural changes in institutional holdings, has delivered a satisfactory performance to the market.

Ethereum's goal for 2026 is to move towards the global financial settlement layer.

1. Glamsterdam and Kohaku upgrades: accelerating institutional fund inflows.

In 2026, Ethereum will address performance and privacy concerns raised by institutional participants through two major upgrades:

Glamsterdam (expected mid-2026): Glamsterdam will introduce "parallel transaction processing" and "built-in proposer-builder separation (ePBS)". Simply put, Ethereum used to be like a one-way street, where one transaction had to be completed before the next could begin. The upgrade aims to achieve parallel processing, turning Ethereum into a multi-lane highway while maintaining its decentralized nature. Additionally, with the Gas Limit expected to increase from 60M to 200M, this will significantly improve Ethereum's throughput, enabling it to provide a stable and fast settlement experience in financial environments.

Kohaku (expected by the end of 2026): Its goal is to drive privacy upgrades on Ethereum, providing users with more comprehensive privacy protection. This upgrade will introduce the "Railgun privacy protocol" and "Privacy Pools," which can help businesses and individuals shield transaction information while proving the legitimacy (compliance) of their funds, without disclosing wallet balances and transaction secrets to the entire network. This effectively addresses the privacy concerns of individuals and institutions.

However, according to Cryptoslate's analysis, Glamsterdam's core vulnerability lies in the fact that it forces validators to shift from "re-executing blocks" to "verifying ZK-proofs." If the system responsible for generating proofs experiences delays or even crashes during high-frequency trading or when the network is extremely busy, validators will be unable to verify the authenticity of transactions, potentially causing the entire network to shut down.

Furthermore, while ePBS achieves parallel processing, it also introduces the "free option problem." Research shows that on days of extreme market volatility, this can lead to up to 6% of block production being disrupted, thereby threatening the immediacy and stability of financial settlements. For financial institutions that pursue second-level settlements, this will seriously threaten the stability and immediacy of transactions.

2. dAI Strategic Roadmap: Laying the Infrastructure for the AI Economy

In September 2025, the Ethereum Foundation announced the formation of the decentralized artificial intelligence project team, dAI Team, dedicated to making Ethereum the preferred settlement and collaboration platform for artificial intelligence and the machine economy over the next 10 years. Project leader Davide Crapis also released a 2026 roadmap at the end of the year , defining the ERC-8004 and x402 protocols as key pillars.

ERC-8004 aims to establish decentralized "digital identities" and "credit reports" for AI agents. This protocol provides AI with verifiable identities and historical reputation records through ZK proofs or a TEE trusted execution environment, ensuring that its task execution results are authentic and meet expectations. This enables secure collaboration and automated contract signing between machines or between humans and machines without intermediaries, laying the foundation of trust for the machine economy.

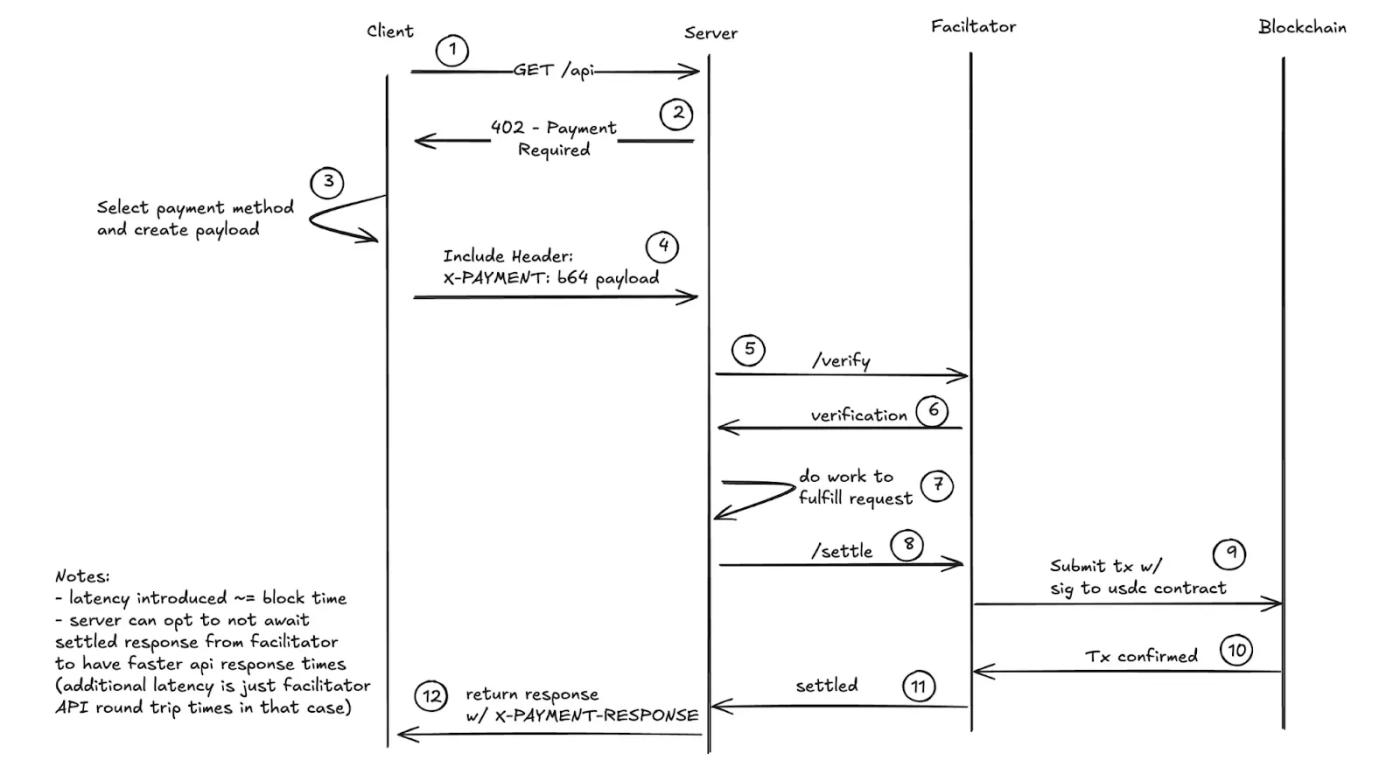

The x402 protocol, designed by Coinbase, aims to enable machine-to-machine "autonomous economic transactions." By reviving the HTTP 402 status code, this protocol embeds payment functionality directly into the underlying network protocol, establishing the payment infrastructure for interactions between AI agents. This completely solves the "pain point" of AI's inability to hold credit cards in the traditional financial system, enabling an AI agent to automatically initiate micropayments or renewals when calling upon another AI's services.

ERC-8004 solves the "trust" problem in AI, while x402 solves the "payment" capability. The combination of the two enables AI agents to autonomously complete economic settlements in a decentralized manner without human intervention, bridging the "last mile" in the financialization of AI and the machine economy.

3. Etherealize: The Crossroads of Wall Street and Ethereum

Backed by funding from the Ethereum Foundation and Vitalik Buterin, and co-led by Wall Street veteran trader Vivek Raman and Ethereum core developer Danny Ryan, the establishment of Etherealize marks a major shift in Ethereum's strategic focus: no longer just on underlying code, but to become "Wall Street's digital logistics hub."

Etherealize addresses Ethereum's long-standing pain point of being "technically powerful but lacking marketing and financial integration channels." Its focus is on deeply integrating traditional finance with the on-chain ecosystem.

Asset Tokenization (RWA): Helps banks convert "inefficient" assets such as mortgages, bonds and credit products into tokenized assets on Ethereum to free up liquidity.

Establish a modern settlement engine: Develop settlement tools for institutional workflows, with the goal of optimizing the traditional T+1 or T+2 settlement process into 24/7 instant settlement using Ethereum (and its Layer 2), thereby enhancing capital efficiency.

Value advocacy and compliance: Communicating the value of ETH as an asset with ETF issuers and companies through the publication of institutional-grade reports, and consulting with regulators to ensure Ethereum's "non-fungibility" in capital markets.

Etherealize is considered a key driver in initiating the "Ethereum-institutional merger." Its emergence demonstrates that Ethereum is proactively developing tools that meet the needs of traditional finance in a pragmatic manner, enabling global financial assets to truly and legally operate and settle on the Ethereum settlement machine.

2026 will be a test of how to find a balance between efficiency and decentralization.

Looking back at the end of 2025, we draw some profound observations: on the one hand, fundamental data (58% TVL share, 10.7% institutional holdings, and 65% RWA share) are strong; on the other hand, price performance and community confidence are relatively weak. This divergence reveals that Ethereum is undergoing a painful but important "transformation." Entering 2026, all the strategic pieces are in place, but the challenges at the underlying technology level have also escalated.

According to Cryptoslate's analysis, the success or failure of the Ethereum 2026 roadmap hinges on the structure of the "Proving Markets." If the generation of ZK proofs becomes too concentrated in the hands of a few specific players, Ethereum could fall into a centralized dependency trap similar to the current MEV Relay, which contradicts its original intention of pursuing decentralized infrastructure.

Ethereum has now moved beyond the stage of closed-door development. 2026 will be a crucial year to test whether this "world computer" can ultimately prove its indispensability in the game of risk and performance.