Author: zhou, ChainCatcher

2025 is destined to be a year that crypto investors and practitioners will repeatedly ponder.

That year, the market accelerated its concentrated liquidation of financing illusions and narrative bubbles, and began to shift from speculative-driven false prosperity to a stock clearing based on practical results.

The illusion of liquidity has dissipated, and once-promising pioneers have fallen one after another. The industry is also undergoing painful rebirth, forcing every practitioner to re-examine the rules of survival here.

A Portrait of Project " Death " in 2025 : From Narrative Clarification to Logical Judgment

On December 30th , RootData updated its list of crypto industry projects that have died in 2025. These projects have either ceased operations or gone bankrupt, or have been deemed "dead" due to their websites being unusable for an extended period. The list is still being updated.

Source: RootData

Looking back at the data, in 2021 , the market was still in the early stages of a bull market, with risks yet to emerge, and 67 failure cases were recorded. Subsequently, in 2022 and 2023 , the number of failed projects soared to 250 and 230 respectively due to the chain reaction triggered by black swan events such as the collapse of FTX and the collapse of Luna . In 2024 , as the market gradually stabilized, the failure rate dropped to 171 .

Unlike past bankruptcies caused by defaults, current bankruptcies are more indicative of the collapse of business logic under extreme pressure, and are highly concentrated in popular sectors that were once heavily invested in by capital.

Specifically, the GameFi sector was hit hardest, with a large number of projects, including COMBO , Nyan Heroes , and Ember Sword, shutting down. The NFT sector was similarly devastated, with once-popular platforms such as Royal , RECUR , and X2Y2 all on the list.

Furthermore, competition at the infrastructure level is becoming increasingly fierce. Projects such as CLV and Vega Protocol have exited the market due to weak ecosystems, while automated market makers like Bunni , which suffered a fatal blow from hackers, reflect the devastating impact of a lack of security boundaries on the survival of protocols.

In addition to the explicit list of dead projects, RootData 's "zombie project" compilation exposed hundreds of projects on the verge of collapse. Most of these projects were born at the 2022-2023 cycle transition point. Although they have not declared bankruptcy, the projects have become inactive and have not updated product features or carried out any operational activities in recent years.

Among them are remnants of metaverse and game narrative ( Spatial , GameSwift , etc.), once highly anticipated DeFi protocols ( finance.vote , Set Protocol , AutoFarm , etc.), and infrastructure and developer platforms ( Reach , Pinknode , Unlock Protocol , etc.).

Source: RootData

The Evolution of the Industry's Underlying Logic: From Narrative Illusion to Value Reconstruction

The root cause of the wave of project bankruptcies in 2025 lies in the fundamental reversal of the industry's underlying business logic.

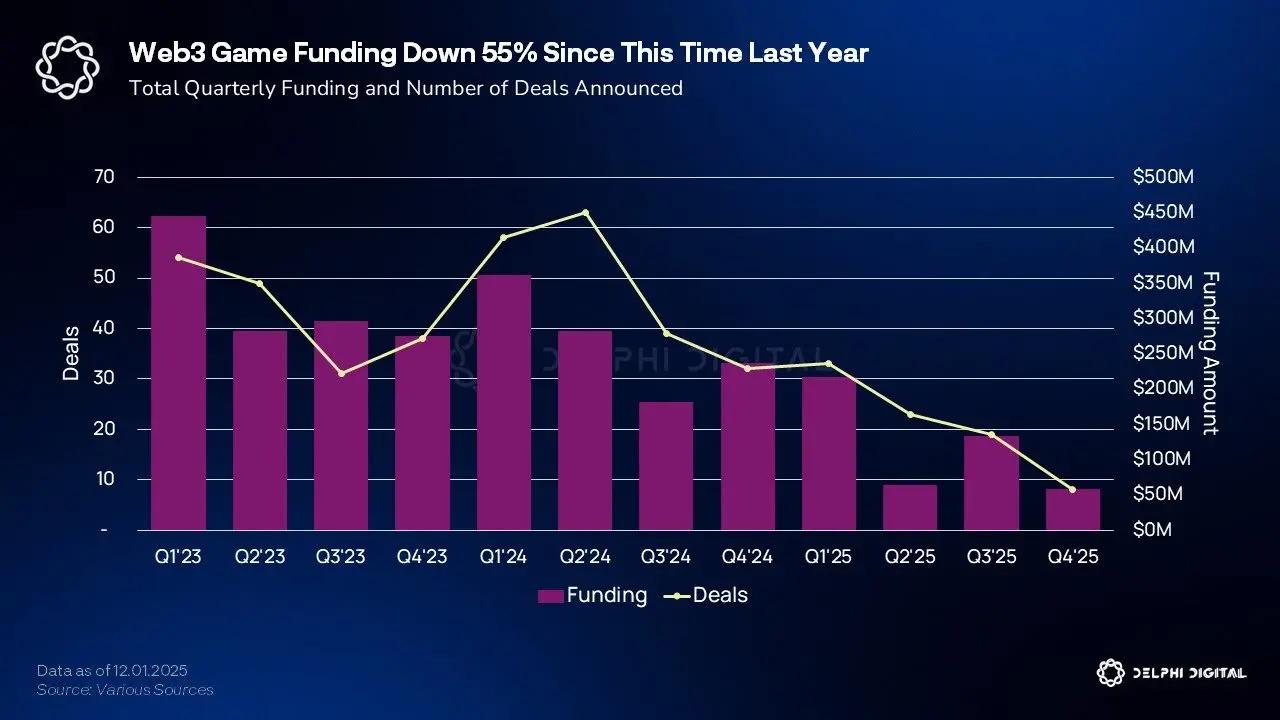

Taking the GameFi sector as an example, Delphi Digital points out that the industry performed extremely poorly in 2025 , with funding plummeting by more than 55% year-on-year. Some highly anticipated star products performed poorly after launch, causing market enthusiasm to quickly freeze. Data shows that the GameFi market size shrank from $ 23.75 billion at the beginning of the year to $ 9.03 billion at the end of the year, a drop of more than 60%.

This dismal situation reveals the inherent fragility of the previously prevalent " play-to- earn" model: without a continuous influx of external funding, the high-inflation token economy model not only cannot be sustained but also accelerates user churn. Although many projects attempted to find a lifeline by migrating to Telegram mini-programs, the ecosystem disruption caused by the stagnation of mainnet operations resulted in the failure of most user migrations, with transaction volume across the entire sector plummeting by over 70% .

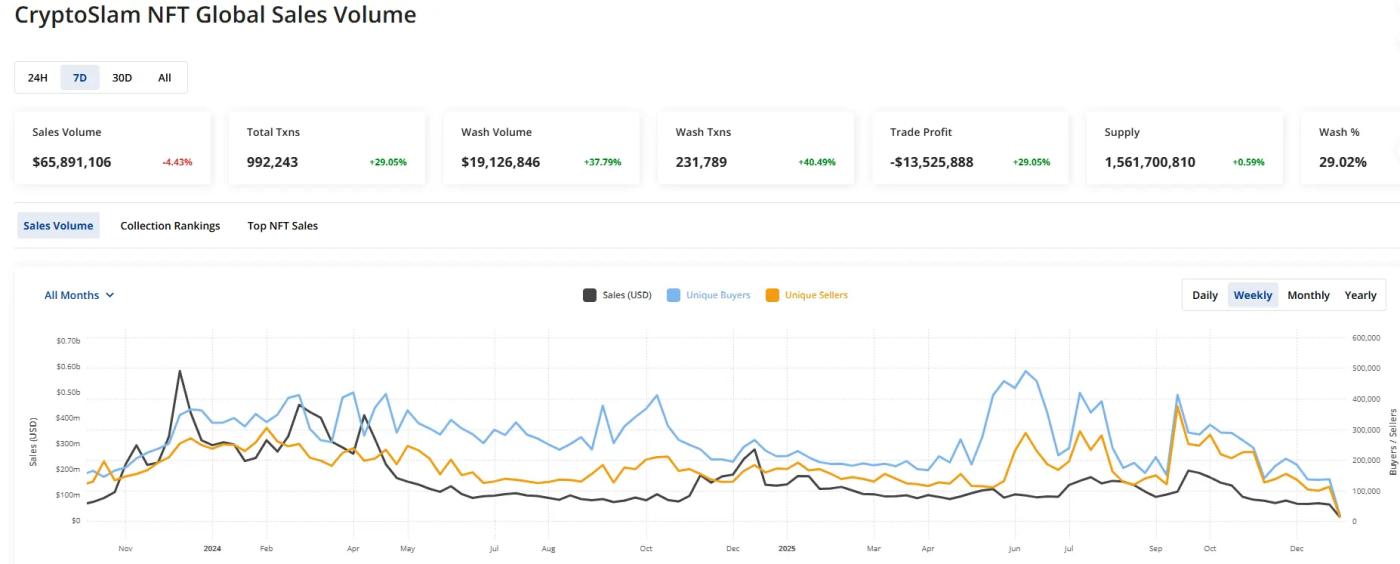

The collapse of the NFT market is even more alarming. Data shows that the NFT market hit its lowest point of the year in December , with total valuation plummeting from $ 9.2 billion in January to $ 2.5 billion, a drop of 72% . At the same time, market activity shrank dramatically; according to CryptoSlam data, the number of sellers fell below 100,000 for the first time since April 2021 .

The root cause is the lack of practicality, which has become the fatal flaw of NFTs . According to Bloomberg, the crypto elite has begun to restructure their asset allocation, choosing to shift their focus from digital art to more certain physical scarce assets.

In fact, the collapse of GameFi and NFTs did not happen overnight. Many GameFi projects showed signs of trouble as early as 2022 , with user churn and inflation problems accelerating, while NFTs continued to slump after the secondary market liquidity dried up, and are now entering the final clearing phase.

Furthermore, the DeFi sector was not spared either, with total value locked ( TVL ) falling by more than 20% throughout the year. On the one hand, frequent and high-value hacks undermined users' trust in the security boundaries of protocols; on the other hand, the depletion of yields under the zero-sum game led to a rapid outflow of a large amount of " free-floating capital " chasing high interest rates.

Looking at the bigger picture, the growing pains of 2025 prove that projects with "low effort and high leverage" have lost their foothold. The crypto market is undergoing a paradigm shift from speculation-driven to value-driven, and only entities with sustainable business models will be able to stand firm in the new order.

The Failure of Capital Endorsement: The Collective Collapse of Star Projects

In the wave of liquidations in 2025 , the large amount of financing and the endorsement of top institutions failed to become a " safe haven " for the projects.

Data shows that even those targets that were once lauded by top VCs such as a16z , Pantera , and Polychain still failed when they lacked real traction and self-sustaining capabilities.

1. Misalignment between vision and reality: Liquidation of highly financed assets

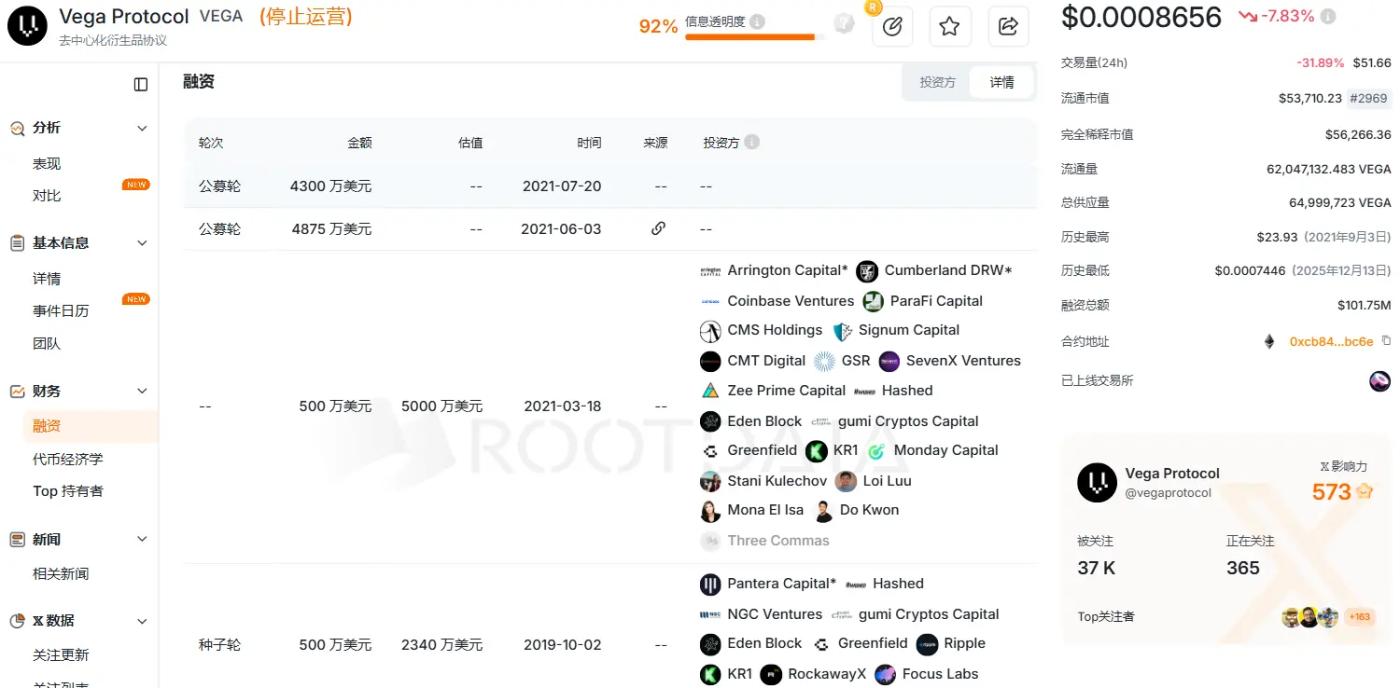

Among the publicly disclosed failed projects, Vega Protocol, which had raised a significant amount of funding, secured over $ 100 million in investment from 29 top-tier investors, including Coinbase Ventures and Ripple , based on its vision of decentralized derivatives. However, its mainnet TVL remained stagnant at the hundreds of thousands of dollars level for a long time, far less than competitors like Hyperliquid . Ultimately, squeezed by both sluggish user growth and depleted resources, the project shut down its Layer 1 mainnet by community vote and shifted its focus to software development.

2. The Bursting of the NFT Bubble: A Chain Reaction Triggered by Liquidity Depletion

The collective collapse of the NFT sector exhibits a clear characteristic of " narrative collapse. " Royal , a music NFT platform (which raised $ 71 million), despite the support of a16z and celebrity endorsements, still suffered a cash flow crisis due to a 66% plunge in secondary market trading volume and its inability to overcome mainstream limitations in practicality. Similarly, RECUR (which raised $ 55 million), valued at over $ 300 million based on its brand IP , and MakersPlace (which raised $ 30 million), both established platforms, gradually exited the market due to market saturation, revenue collapse, and a precipitous drop in user engagement.

3. Market Squeeze and Ecosystem Decline: The End of the Technology Narrative

In the infrastructure sector, the rise and fall of the ecosystem directly determines the life or death of a project. CLV ( Clover Finance ), after receiving $ 47.1 million in investment from OKX Ventures , Polychain , and others, ultimately shut down due to the decline of the Polkadot ecosystem, delisting from multiple exchanges, and liquidity depletion. Fractal Network , under pressure from the dominant players in the ZK track, was forced to shut down due to its excessively long technology implementation cycle and low market adoption rate.

4. Structural flaws: From the ebb and flow of the metaverse to protocol security

Futureverse (which raised $ 54 million ) entered liquidation due to the double blow of the metaverse decline and insufficient revenue; COMBO (which raised $ 40 million ) ran out of funds due to the failure of its GameFi model and the failure of user migration. In addition, DELV , a DeFi protocol that was once valued at over $ 300 million, ultimately chose to cease operations due to the high cost of fixing core vulnerabilities and the lack of market fit for its product.

These cases send a clear signal: in the current climate of conservative investment attitudes, the size of financing and the prestige of institutions are no longer a guarantee of success.

Projects lacking genuine user base and sustainable business models, no matter how high the entry barrier, will quickly fall into a dead end of broken capital chains once they lose external capital injection.

Conclusion

Growing pains are an inevitable part of maturing. In the crypto world, high funding, star VCs , and popular sectors cannot guarantee survival.

In this painful struggle between life and death, the industry will eventually understand that all revelry that deviates from common business sense will ultimately end in reckoning.

After all, crypto has no eternal winter or summer; survival is the only narrative.