By 2025, crypto will no longer be shaped by the best product builders or traders. The market will be dominated by individuals capable of bringing crypto to the center of politics, currency, and power.

In 2025, crypto will no longer operate as a closed playground for traders and builders. It will have entered a different phase: a direct clash with politics, traditional finance, and national power. In this context, the influential figures are not those who talk the most, but those who leave the most visible impact.

This list isn't meant to glorify those with massive social media Watcher . A truly influential figure in crypto is someone whose every decision leaves a lasting mark on the market: shifting money flows, repositioned prices, changing expectations.

Donald Trump: An indispensable name.

If you had to choose one person to make crypto "dizzy" the fastest in 2025, it wouldn't be a builder, nor a CEO of an exchange, but the President of the United States - Donald Trump. For the first time in history, crypto is no longer on the periphery of the American financial system, but has been pulled straight into the center of political power.

It all started in a very "Trump" way. In early 2025, his family successively appeared in the meme coin wave, creating price surges of tens of billions of dollars in a short period of time. To many, it was noisy speculation. But viewed more broadly, this signaled that crypto had entered the soft power space: a tool for influence, testing market reactions, and mobilizing attention right within America.

After that point, Washington's approach to crypto began to shift significantly. The SEC gradually moved away from its litigation-based approach towards a more transparent Token classification framework. The CFTC officially recognized Bitcoin and Ethereum as commodities, allowing their use as collateral. The OCC opened the federal banking system to crypto companies. And the GENIUS Act placed stablecoins within the federal legal framework, making them a recognized form of digital dollar. These moves led many to believe that Trump was leaning toward crypto.

But that's only half the story. Shortly after the initial launch of the meme coin, Trump restarted his tough tariff policy: imposing high tariffs on Chinese goods, expanding export controls, and repeatedly signaling protectionist economic policies.

These decisions aren't directly aimed at crypto, but they strike directly at global risk appetite. Each round of tariff tensions triggers a wave of sell-offs in risky assets, and crypto is always one of the quickest and strongest to react. A prime example is the multi-billion dollar liquidation in April 2025, or the crypto "dark day" of November 10th, 2025, when Trump unexpectedly imposed 100% tariffs on China.

This very contrast reveals the true nature of Trump's Vai . Trump didn't turn crypto into a "darling." He made it part of the American rules of the game. Legalized, but also subject to the full impact of politics, commerce, and geopolitics. For crypto, it's a step forward. But it's a step forward that comes at a very high price...?

Michael Saylor and the Bitcoin gamble.

Michael Saylor's 2025 story is no longer about "believing in Bitcoin." That's long over. The issue is that he's buying with corporate funds, buying consistently, buying in large quantities, and showing no signs of stopping. Therefore, every move he makes is being closely watched.

Michael Saylor's strategy began in 2020, when Strategy—the software company he runs—decided to use Bitcoin as a reserve asset. Since then, the approach has remained largely unchanged. While most publicly traded companies still prefer cash or bonds, Strategy has consistently shifted Capital into Bitcoin, then raised more to buy more.

By the end of 2025, the scale of this investment had far exceeded all precedents. According to filings released on November 3rd, Strategy purchased an additional 397 Bitcoin in just one week, bringing its total holdings to over 641,000 BTC. At an Medium purchase price of approximately $74,000 per Bitcoin, the total Capital amounted to approximately $47.5 billion, a figure sufficient to make Strategy the world's largest listed Bitcoin holder, surpassing many countries.

The impact of this strategy is evident in the Capital markets. From mid-2020 to the present, Strategy (MSTR) stock has increased by more than 3,300%, far exceeding Bitcoin's approximately 1,000% increase and outpacing the S&P 500 approximately 115% gain over the same period.

By now, Saylor's Vai is no longer about whether he was right or wrong. He has gone far enough to make every subsequent move a point of reference.

Vitalik Buterin: Ethereum's "Guardian" of 2025

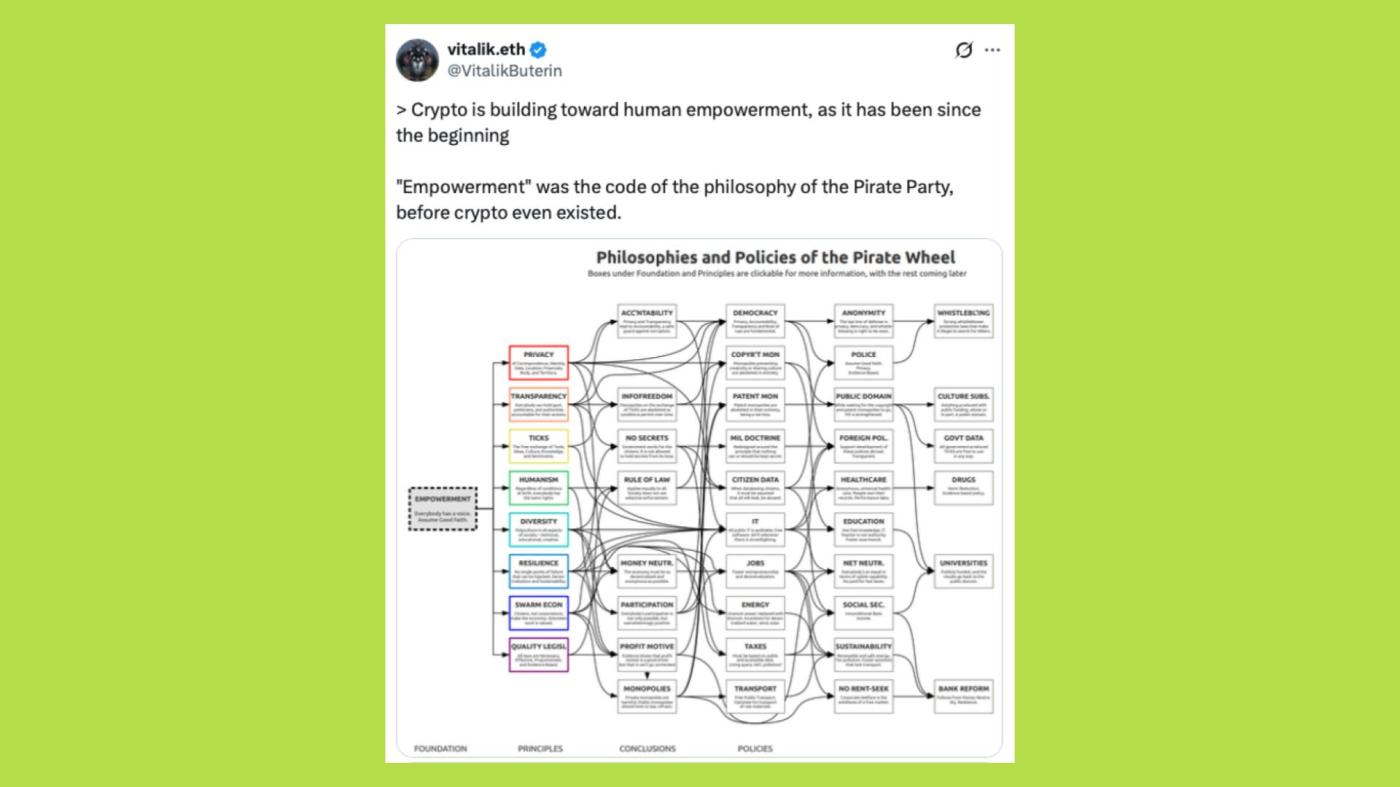

Despite all the debate about speed, low fees, or emerging chains, Ethereum in 2025 will remain the pivot of DeFi. It liquidation , the most core protocol, and the most important experiments will still take place there. And if we have to point out why Ethereum hasn't lost that position, the name that can't be overlooked is Vitalik Buterin.

Vitalik's Vai this year isn't about "pushing up the price of ETH," but about keeping Ethereum going in the long run. While competitive pressure forces many blockchains to choose speed at all costs, Vitalik takes a different approach: controlled upgrades, addressing real bottlenecks, but without sacrificing security and decentralization—the very things that made Ethereum what it is in the first place.

This is clearly demonstrated by major Ethereum upgrades such as the Pectra upgrade, which will be implemented between March and May 2025, or most recently, the Fusaka upgrade at the end of the year.

Changpeng Zhao and the kind of power that doesn't require a CEO position.

Changpeng Zhao (CZ) is no longer the CEO of Binance, but looking at how the market reacted in 2025, it's hard to say his influence has diminished. On the contrary, CZ is in a different position: not directly in charge, but still retaining the ability to trigger market sentiment faster than almost anyone else.

It's not hard to see that on X. CZ is consistent, speaks little, and rarely gives lengthy explanations. His statements are short and vague enough for the community to interpret on their own. For example, at the end of October, when CZ wrote that "Bitcoin outperforms gold and will sooner or later surpass gold's market Capital ," the "digital gold" debate immediately resurfaced, leading to a significant increase in interaction and Volume .

Alongside the debates surrounding Bitcoin, CZ has also been very prominent in the coin meme wave. He participates directly through interactions, jokes, posts, or vague allusions. Just mentioning his name once is enough to boost Volume and create a narrative.

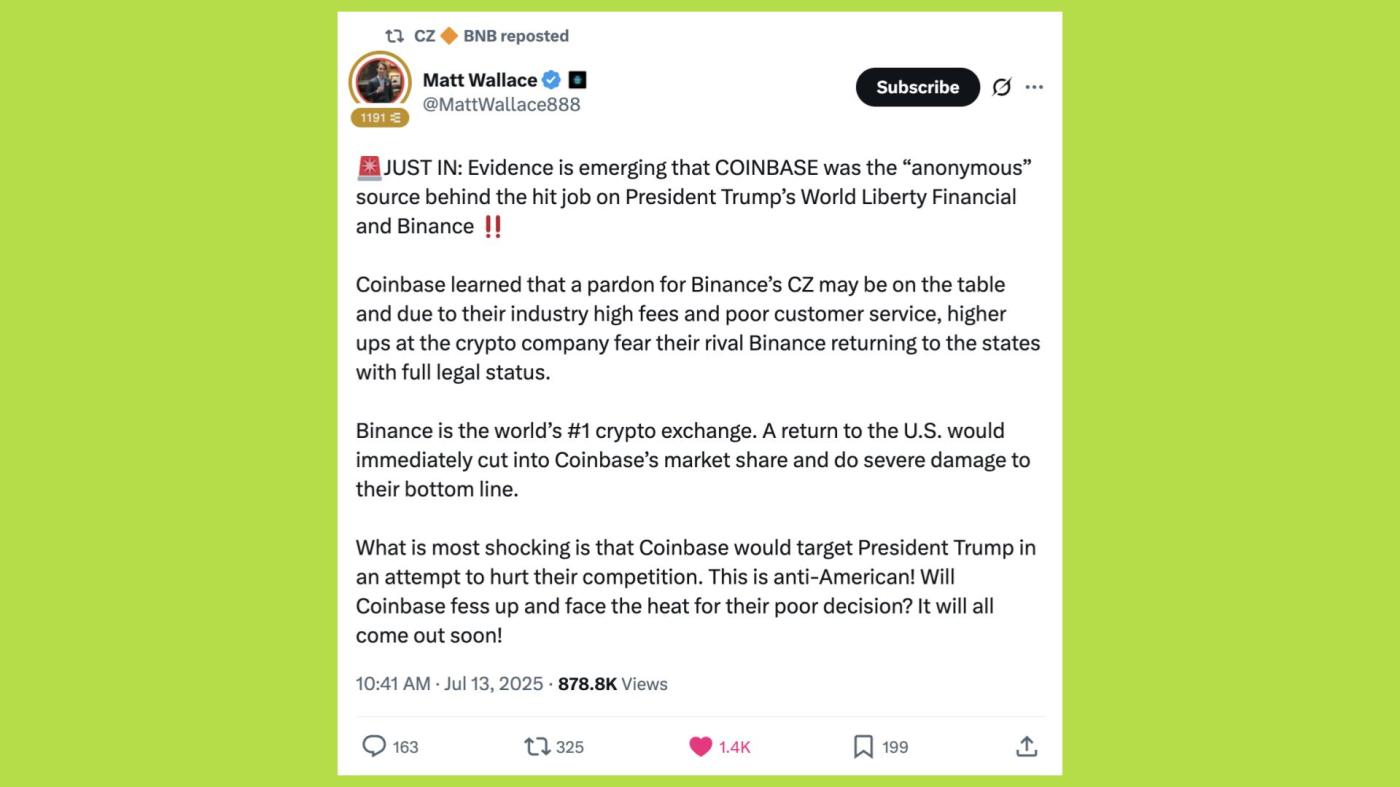

Or, for example, one detail that makes CZ's Vai in 2025 even more sensitive is his public conflict with Coinbase. In several statements and interactions on X, CZ accused Coinbase of being behind negative influence campaigns targeting Donald Trump, World Liberty Financial, and Binance. According to CZ's argument, the goal was not just to compete for market share, but to prevent his pardon and block Binance's return to the US market.

Although these allegations have not been independently verified, the community's reaction reveals something noteworthy: the story quickly transcended the realm of "industry drama." It was interpreted as a power struggle between two crypto models in the US: on one side, Binance/CZ, associated with a global community and decentralized narrative, and on the other, Coinbase, a listed company adhering strictly to the US legal framework.

In 2025, CZ will no longer have executive power. But he will retain another kind of power – the ability to lead the market's voice. When he appears, the market listens. When he speaks, the narrative is formed. And when he is silent, that silence is interpreted. With the BNB ecosystem, that's enough to make a difference.

Jerome Powell: The "Hypnotist" of Crypto Money Flows

While the world holds its breath watching every tumultuous move from Donald Trump's White House, in a quiet corner of Washington, there is a man whose mere clearing of the throat can send billions of dollars in crypto market Capital soaring or vanishing in the blink of an eye. That man is Jerome Powell – the "hypnotist" of money flows, the man holding the remote control of the entire financial market in 2025.

Powell's power doesn't stem from hatred or support. His most fearsome weapon is his rational indifference. In 2025, Powell accomplished something no law could: He brought crypto down from its "self-governing oasis" to the same level as technology stocks or government bonds. Since then, the dream of a separate cryptocurrency world for crypto has ended. Now, every time the Fed sneezes about inflation, Bitcoin immediately catches a cold.

As we enter 2025, the market will no longer be trying to predict "what Powell will do," but rather deciphering "what Powell is thinking." Look at the events of June 2025 as a prime example of this art of hypnosis. Simply by using the phrase "gradual maturation" to describe cryptocurrency assets, the crypto market immediately reacted positively.

For Powell, crypto is just a small variable in the macroeconomic equation. But for crypto, Powell represents the harshest reality they face: To become a true financial asset, you have to accept playing by the rules of the brake.