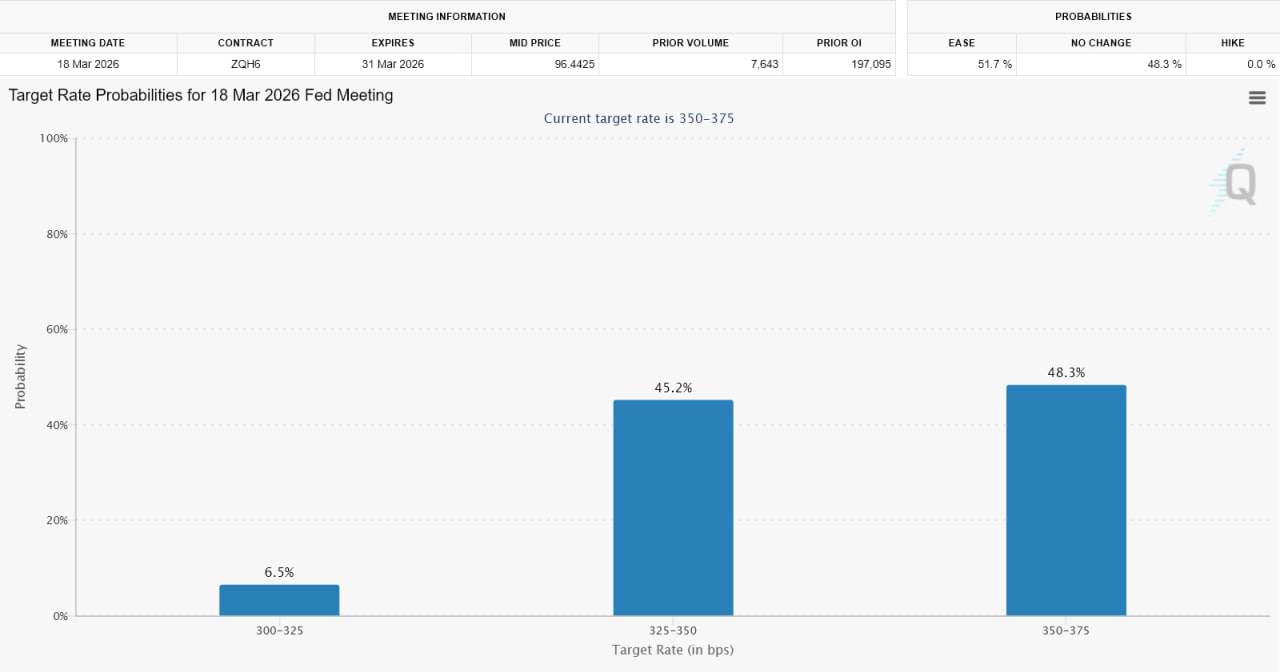

The market faces a challenge as the Fed signals it is not in a hurry to cut interest rates until March 2026. The crypto market is likely to start the new year under significant pressure after the Fed released the minutes of its December FOMC meeting. The minutes indicate that the Fed is not yet ready to accelerate its monetary easing cycle, thereby weakening expectations of interest rate cuts in the first quarter of 2026. According to the December 30 minutes, many policymakers supported pausing after the 25 basis point rate cut in December, and postponed the next XEM to at least March. The market has largely ruled out a January rate cut, and the FOMC's cautious tone has further diminished the prospect of a March rate reduction. The earliest scenario currently being discussed is April 2026. Against this backdrop, the stock market continues to fluctuate within a narrow range of $85,000–$90,000, indicating weak demand and a prevailing defensive sentiment. Medium market trading Volume remains low, declining sharply from $105 billion to $25 billion, reflecting the sluggish market conditions. The Fed emphasized that inflation remains a key factor, with price pressures yet to reach the 2% target, while job growth shows signs of slowing. With real yields remaining high and liquidation tight, the crypto market is likely to continue its consolidation phase and lack upward momentum in the short term, at least until clearer signals emerge regarding monetary policy easing.

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content