Written by: Changan, Biteye Core Contributor

Edited by: Denise, a core contributor to Biteye

Over the past year, an intriguing phenomenon has repeatedly emerged:

While US stocks and precious metals have repeatedly hit new highs, driven by productivity dividends and AI narratives, the crypto market has fallen into a cyclical liquidity drought.

Many investors lamented that "the end of the crypto is the US stock market," and some even chose to leave the market altogether.

But if I told you that these two seemingly opposing paths to wealth are converging in a historic way through tokenization, would you still choose to leave?

Why are top global institutions, from BlackRock to Coinbase, unanimously optimistic about asset tokenization in their 2025 annual outlooks?

This is not a simple "stock transfer". This article starts from the underlying logic and provides you with a comprehensive analysis of the underlying logic of the US stock tokenization track, as well as a review of the in-depth views of trading platforms and leading KOLs currently engaged in stock tokenization.

01 Core: More Than Just On-Chain

Tokenization of US stocks refers to converting shares of US-listed companies (such as Apple, Tesla, and Nvidia) into tokens. These tokens are typically pegged 1:1 to the equity or value of real-world stocks and are issued, traded, and settled using blockchain technology.

In simple terms, it moves traditional US stocks onto the blockchain, turning stocks into programmable assets. Token holders can obtain economic rights to the stock (such as price fluctuations and dividends), but not necessarily full shareholder rights (depending on the specific product design).

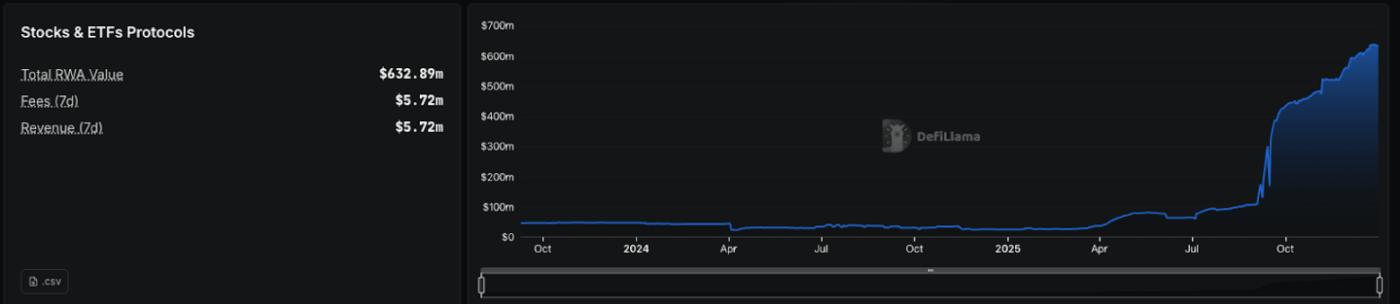

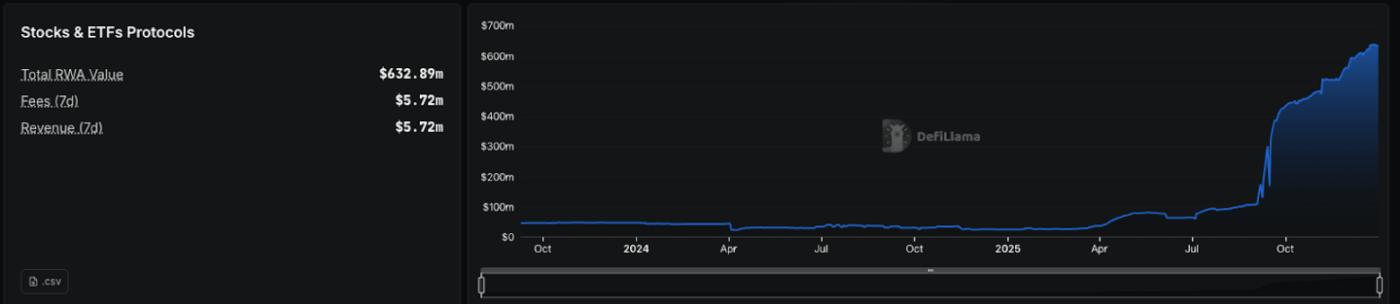

As shown in the figure, the TVL of tokenized US stocks has grown exponentially since the fourth quarter of this year.

(Image source: Dune)

After clarifying the basic definition of US stock tokenization and its differences from traditional assets, a more fundamental question arises: Since the traditional securities market has been operating for hundreds of years, why do we have to go through all the trouble of putting stocks on the blockchain?

The combination of stocks and blockchain will bring many innovations and benefits to the traditional financial system.

1. 24/7 Trading: Breaking the trading hours of the NYSE and Nasdaq, the cryptocurrency market can achieve uninterrupted trading 24/7.

2. Fragmented ownership lowers the investment threshold: Traditional stock markets only allow a minimum purchase of 1 lot (100 shares), while tokenization allows assets to be divided into tiny shares, enabling investors to invest $10 or $50 without paying the full price of the stock. This allows ordinary investors worldwide to equally share in the growth dividends of top companies.

3. Interoperability between Cryptocurrencies and DeFi: Once stocks are converted into tokens, they can interact seamlessly with the entire decentralized finance ecosystem. This means you can do things that are impossible (or difficult) to do with traditional stocks. For example, you can use tokenized stocks as collateral for cryptocurrency loans, or leverage tokenized stocks to form limited partners (LPs) and earn transaction fees.

4. Global Liquidity Convergence: In the traditional system, there is a certain disconnect between the liquidity of US stocks and the liquidity of other assets, and macroeconomic benefits often only "drive up one side." After US stocks are put on the blockchain, crypto funds can participate in high-quality global assets without any intervention. This is essentially a leap in liquidity efficiency.

BlackRock CEO Larry Fink also stated that the next generation of markets and the next generation of securities will be the tokenization of securities.

This also highlights a cyclical dilemma in the crypto market – when US stocks and precious metals perform strongly, the crypto market often suffers from liquidity shortages, leading to capital outflows. However, if the "tokenization of US stocks" matures and introduces more high-quality traditional assets into the crypto world, investors won't all choose to leave, thus enhancing the resilience and attractiveness of the entire ecosystem.

Of course, putting US stocks on the blockchain is not a utopian solution that eliminates all friction. On the contrary, many of the problems it exposes are precisely because it begins to truly integrate with the real-world financial order.

1. Putting US stocks on the blockchain is not true decentralized stock ownership.

Most current mainstream tokenized US stock products rely on real stocks held in custody by regulatory agencies, with corresponding tokens issued on-chain. Users actually hold claims on the underlying stocks, not full shareholder status. This means that asset security and redemption capabilities largely depend on the issuer's legal structure, custody arrangements, and compliance stability. Changes in the regulatory environment or extreme risks to the custodian institution could impact the liquidity and redemptibility of on-chain assets.

2. Price vacuum and de-anchoring risk during non-trading hours

During US stock market closures, especially in perpetual contracts or non-1:1 pegged products, on-chain prices lack real-time references from traditional markets and are largely determined by internal market sentiment and liquidity structure. When market depth is insufficient, prices are prone to significant deviations and even manipulation by large funds. This problem is similar to pre-market and after-hours trading in traditional markets, but it is amplified in the 24/7 on-chain environment.

3. High compliance costs and slow expansion speed.

Unlike native crypto assets, stock tokenization naturally falls within the realm of stringent regulation. From determining securities status and cross-jurisdictional compliance to designing custody and liquidation mechanisms, every step requires deep integration with the existing financial system. This makes it difficult for this sector to replicate the explosive growth path of DeFi or Memes, as each step involves legal structures, custody, and licensing.

4. A devastating blow to the narrative of imitation.

When high-quality assets like Apple and Nvidia can be traded directly on-chain, the appeal of purely narrative-driven assets lacking real cash flow and fundamental support will be significantly reduced. Funds are beginning to re-evaluate the trade-off between "high volatility and speculative potential" and "real-world returns." This shift is positive for the long-term health of the ecosystem, but fatal for some altcoins that rely on sentiment-driven growth.

In conclusion, the blockchain integration of US stocks is a slow, realistic, yet long-term certainty path for financial evolution. It may not create short-term frenzy, but it is likely to become a main thread in the crypto world, deeply integrated with real-world finance and ultimately becoming its infrastructure.

02 Implementation Logic: Custody Support vs. Synthetic Assets

Tokenized stocks are created by issuing blockchain-based tokens that reflect the value of a specific equity stake. Depending on the underlying implementation, tokenized stocks currently on the market are typically created using one of two models:

- Custodial-backed tokens: These are tokens issued on-chain by regulated entities that hold real-world shares as reserves in traditional securities markets. The tokens represent the holder's economic claim to the underlying shares, and their legal validity depends on the issuer's compliance structure, custody arrangements, and transparency in information disclosure.

This model is closer to the traditional financial system in terms of compliance and asset security, and has therefore become the mainstream implementation path for tokenization in the current US stock market.

- Synthetic tokens: Synthetic tokens do not hold real stocks. Instead, they track stock price movements through smart contracts and oracle systems, thus providing users with price exposure. These products are closer to financial derivatives, and their core value lies in trading and hedging rather than the transfer of asset ownership.

Due to the lack of real asset backing and inherent flaws in compliance and security, pure synthetic models, represented by Mirror Protocol, have gradually faded from mainstream view.

With increasingly stringent regulatory requirements and the influx of institutional funds, the model based on real asset custody has become the mainstream choice for US stock tokenization in 2025. Platforms such as Ondo Finance and xStocks have made significant progress in compliance frameworks, liquidity access, and user experience.

However, at the implementation level, this type of model still requires coordination between the traditional financial system and the on-chain system, and its operating mechanism also brings some noteworthy engineering differences.

1. Differences in execution details brought about by batch settlement mechanisms

Platforms generally use net bulk settlement, executing real stock trades in traditional markets (such as Nasdaq and NYSE). While this inherits the deep liquidity of traditional markets, resulting in extremely low slippage for large orders (typically <0.2%), it also means:

1) During non-US stock market opening hours, there may be brief delays in minting and redemption;

2) In extreme market volatility, the execution price may deviate slightly from the on-chain pricing (due to platform spread or fee buffering).

2. Centralized Custody and Operational Risks

Since the shares are concentrated in the hands of a few regulated custodians, in the event of operational errors by the custodians, bankruptcy, liquidation delays, or extreme black swan events, the token redemption may theoretically be affected.

Similar issues exist in Perpdex, which trades US stocks. Unlike the 1:1 peg to spot prices, contract trading encounters the following extreme situations during US stock market closures:

1. Risk of decoupling

On normal trading days, the contract price is forcibly anchored to the Nasdaq price through funding rates and oracles. Once it enters a non-trading day, the external spot price remains static, and the on-chain price is entirely driven by funds within the crypto community. If there is a sharp fluctuation in the crypto market or large-scale dumping at this time, the on-chain price will deviate rapidly.

2. Poor liquidity makes it easy to manipulate.

On non-trading days, open interest (OI) and market depth are often relatively thin, allowing large traders to manipulate prices with high-leverage orders, triggering a chain of liquidations. This is similar to the pre-market contracts, resembling the price action seen with $MMT and $MON, where large traders violently drive up prices, triggering a chain of liquidations when investor expectations are highly aligned (collectively hedging short short).

03 Three Major Tracks for US Stocks on Blockchain: Spot Trading, Futures Trading, and Pre-IPO Trading

For most investors, the most crucial question is: in the vast crypto ecosystem, which projects have actually turned this vision into a tangible reality?

The current tokenization market is no longer a mere testing ground, but has evolved into three mature tracks: spot trading, futures trading, and pre-IPO tokenization. Below is a map of the most noteworthy projects in the market and their key developments:

1. Spot goods

(1) Ondo @OndoFinance ( Official Twitter XHunt, ranking: 1294)

Ondo Finance is a leading RWA tokenization platform focused on bringing traditional financial assets to the blockchain. Launching Ondo Global Markets in September 2025, it offers 100+ tokenized US stocks and ETFs (for non-US investors), supporting 24/7 trading, instant settlement, and DeFi integrations (such as collateralized lending).

The platform has expanded to Ethereum and BNB Chain, and plans to launch on Solana in early 2026, supporting over 1,000 assets. TVL is growing rapidly, exceeding several hundred million US dollars by the end of 2025, making it one of the largest platforms in the tokenized stock space.

Ondo has raised hundreds of millions of dollars in total funding (including early rounds). There were no new large-scale public funding rounds in 2025, but its TVL surged from hundreds of millions of dollars at the beginning of the year to over $1 billion by the end of the year, indicating strong institutional support (such as partnerships with Alpaca and Chainlink).

On November 25, 2025, Ondo Global Markets was officially integrated into the Binance Wallet, listing over 100 tokenized US stocks directly in the "Markets > Stocks" section of the app. This represents a deep collaboration between Ondo and the Binance ecosystem, allowing users to trade on-chain (such as Apple and Tesla) without an additional brokerage account, and supporting DeFi applications (such as collateralized lending).

Ondo has become the world's largest tokenized securities platform, with TVL exceeding $1 billion by the end of the year, directly challenging traditional brokers.

(2) Robinhood @RobinhoodApp ( Official Twitter XHunt, ranking: 1218)

Traditional brokerage giant Robinhood is breaking down financial barriers with blockchain technology, bringing US stock trading into the DeFi ecosystem. In the EU market, it offers tokenized stocks as derivatives built on MiFID II regulations, operating as an efficient "internal ledger."

In June 2025, Arbitrum officially launched its tokenized stock and ETF products for EU users, covering more than 200 US stocks, supporting 24/7 trading and offering commission-free trading. Future plans include launching its own Layer 2 blockchain, "Robinhood Chain," and migrating assets to that chain.

Robinhood's stock price surged over 220% year-to-date thanks to innovations such as prediction markets, expansion into crypto, and stock tokenization, making it one of the best-performing stocks in the S&P 500.

(3) xStocks @xStocksFi ( Official Twitter for XHunt, ranking: 4034)

xStocks is the core product of Backed Finance, a Swiss-compliant issuer, offering 1:1 custody of tokens issued by real US stocks (60+ types, including Apple, Tesla, and NVIDIA). It is primarily traded on platforms such as Kraken, Bybit, and Binance, and supports leverage and DeFi uses (such as staking). It emphasizes EU regulatory compliance and high liquidity.

Backed Finance raised millions of dollars in early funding and has no new public rounds in 2025, but its product trading volume exceeds $300 million and its partner expansion is strong.

In the first half of 2025, it was launched on a large scale on Solana/BNB Chain/Tron, resulting in a surge in cumulative trading volume; it is regarded as the most mature custody model, and plans to expand to more ETFs and institutional-grade products in the future.

(Image source: Dune)

2. Contract

Unlike spot trading, tokenized equity contracts in the futures market require 1:1 physical custody of the underlying assets. Its core logic is to rely on oracles to capture real-time transaction prices from exchanges like Nasdaq and use these prices as the mark price for the on-chain protocol. During off-market hours, contract prices are driven by liquidity in the on-chain market, similar to after-hours trading.

(1) @StableStock @StableStock ( Official Twitter XHunt, ranking: 13,550)

StableStock is a crypto-friendly neobroker backed by YZi Labs, MPCi, and Vertex Ventures, dedicated to providing global users with borderless access to financial markets through stablecoins.

StableStock deeply integrates the licensed brokerage system with the native crypto-financial architecture of stablecoins, enabling users to directly trade real-world assets such as stocks using stablecoins without relying on the traditional banking system, significantly reducing the barriers and friction in cross-border finance. Its long-term goal is to build a global trading system centered on stablecoins, serving as an entry point for tokenized stocks and a wider range of real-world assets. This vision is gradually being realized through concrete product offerings.

StableBroker, the core brokerage product, was launched for public beta testing in August 2025. In October, it partnered with Native to launch tokenized stocks on BNB Chain, supporting 24/7 trading. Currently, the platform supports over 300 US stocks and ETFs, with thousands of active users and daily US stock spot trading volume approaching one million US dollars. Asset size and various data continue to grow.

(2) Aster @Aster_DEX ( Official Twitter XHunt, ranking: 976)

Aster is a next-generation multi-chain perpetual contract DEX (formed by the merger of Astherus and APX Finance), supporting stock perpetual contracts (including US stocks such as AAPL and TSLA), with leverage up to 1001x, hidden orders, and yield collateral. It spans BNB Chain, Solana, Ethereum, and more, emphasizing high performance and an institutional-grade experience.

The seed round was led by YZi Labs, and the market value is expected to exceed $7 billion after TGE in 2025.

Trading volume exploded after TGE in September 2025, accumulating to over $500 billion for the year; launched stock perps, a mobile app, and Aster Chain Beta; had over 2 million users, and TVL exceeded $400 million by the end of 2025, becoming the second largest perps DEX platform.

It is worth noting that CZ has publicly stated that he bought Aster tokens on the secondary market, which is enough to show Aster's strategic position in BNBChain.

3. Pre-IPO

Instead of directly developing on-chain stock products, the Hyperliquid team fully decentralized asset issuance rights through the HIP-3 protocol, attracting third-party projects such as Trade.xyz and Ventures to independently build pre-IPO trading markets on the HL ecosystem.

(1) Trade.xyz @tradexyz ( Official Twitter XHunt, ranking: 3,843)

Trade.xyz is an emerging pre-IPO tokenization platform focusing on equity in unicorn companies (such as SpaceX and OpenAI). It issues tokens through SPV-custodied real shares, supporting on-chain trading and redemption. It emphasizes low barriers to entry and liquidity.

There is no publicly disclosed record of large-scale financing; it is an early-stage project that relies on community and ecosystem growth.

The testnet will launch in some markets in 2025, integrating perps with Hyperliquid HIP-3; trading volume is moderate, and plans are in place to expand to more companies and DeFi integrations in 2026.

(2) Ventuals@ventuals ( Official Twitter XHunt, ranking: 4,742)

Ventuals is built on Hyperliquid and uses the HIP-3 standard to create perpetual valuation contracts for pre-IPO companies (not actual shareholding, but price exposure, such as OpenAI and SpaceX). It supports leveraged long/short positions and pricing is based on valuation oracle.

Incubated by Paradigm, HYPE’s staking vault attracted $38 million in 30 minutes in October 2025 (for market deployment).

The testnet was launched in 2025, and it quickly became a major player in the Hyperliquid ecosystem's pre-IPO perps; in October, the mainnet deployed multiple markets, and trading volume grew rapidly; plans are in place to expand to include more companies and settlement mechanisms, positioning itself as an innovative futures provider.

(3) Jarsy @JarsyInc ( Official Twitter XHunt, ranking: 17,818)

Jarsy is a compliance-oriented pre-IPO platform that tokenizes real private shares (such as SpaceX, Anthropic, and Stripe) on a 1:1 basis, with a minimum investment of $10. After testing demand through a pre-sale, real shares are purchased to issue tokens, supporting public proof-of-reserve and on-chain verification.

In June 2025, the company completed a $5 million pre-seed round, led by Breyer Capital, with participation from Karman Ventures and several angel investors (such as Mysten Labs and Anchorage).

Officially launched in June 2025, it quickly adds popular companies; it emphasizes transparency and compliance, and TVL is growing; future plans include expanding dividend simulation and compatibility with more DeFi.

04 KOL Perspectives: Consensus, Disagreements, and Vision

Jiayi (XDO Founder) @mscryptojiayi (XHunt Ranking: 2,529): Looking ahead, stock tokenization is unlikely to be an explosive growth curve, but it has the potential to become a highly resilient infrastructure evolution path in the Web3 world.

Roger (KOL) @roger9949 (XHunt Ranking: 2,438): Top 10 Core Beneficiaries of Tokenization (RWA) in US Stocks in 2025

Ru7 (KOL) @Ru7Longcrypto (XHunt Ranking: 1,389): Stock tokenization is not about "copying stocks onto the blockchain." It's more about linking traditional capital markets with an open, composable, decentralized financial system.

Blue Fox (KOL) @lanhubiji (XHunt Ranking: 1,473): The tokenization of US stocks is a fatal blow to crypto projects. There will be absolutely no chance for altcoins in the future.

Lao Bai (Amber.ac Consultant) @Wuhuoqiu (XHunt Ranking: 1,271): The essence of US stocks going on the blockchain is the "digital migration" of assets: Just as the Internet allowed information to flow freely and dismantled old intermediaries, blockchain is reconstructing the underlying logic of stock assets by eliminating settlement costs, breaking geographical boundaries and decentralizing power.

05 Conclusion: From a Financial "Parallel World" to a "Twin System"

Returning to the initial question: Why are all the top institutions unanimously optimistic about tokenization in their annual outlooks?

From a first-principles perspective, tokenization is liberating assets from the traditional silos of geography, institutions, and transaction times, transforming them into globally programmable and composable digital assets. When the growth dividends of top companies are no longer limited by national borders and transaction times, the foundation of trust in finance is also shifting from centralized intermediaries to code and consensus.

The tokenization of US stocks is far more than just the on-chain transfer of assets; it represents a fundamental restructuring of financial civilization.

Just as the internet dismantled the walls of information, blockchain is lowering the barriers to investment.

The crypto industry is also venturing into the deeper waters of the real world.

It is no longer just the opposite of traditional finance, but is evolving into a twin financial system that is deeply coupled with and runs parallel to the real-world financial system.

This is not only a leap in trading efficiency, but also a crucial step for global investors to move from passive participation to financial equality.

In 2026, this migration of asset liquidity will only just begin.