Bitcoin has been showing a sideways trend in recent trading sessions, suggesting a relatively quiet end to 2025. The price hasn't fluctuated much, reducing the likelihood of significant volatility as the year draws to a close.

Although stability offers greater predictability, some investors remain frustrated by the lack of growth momentum, especially after months of volatile market conditions.

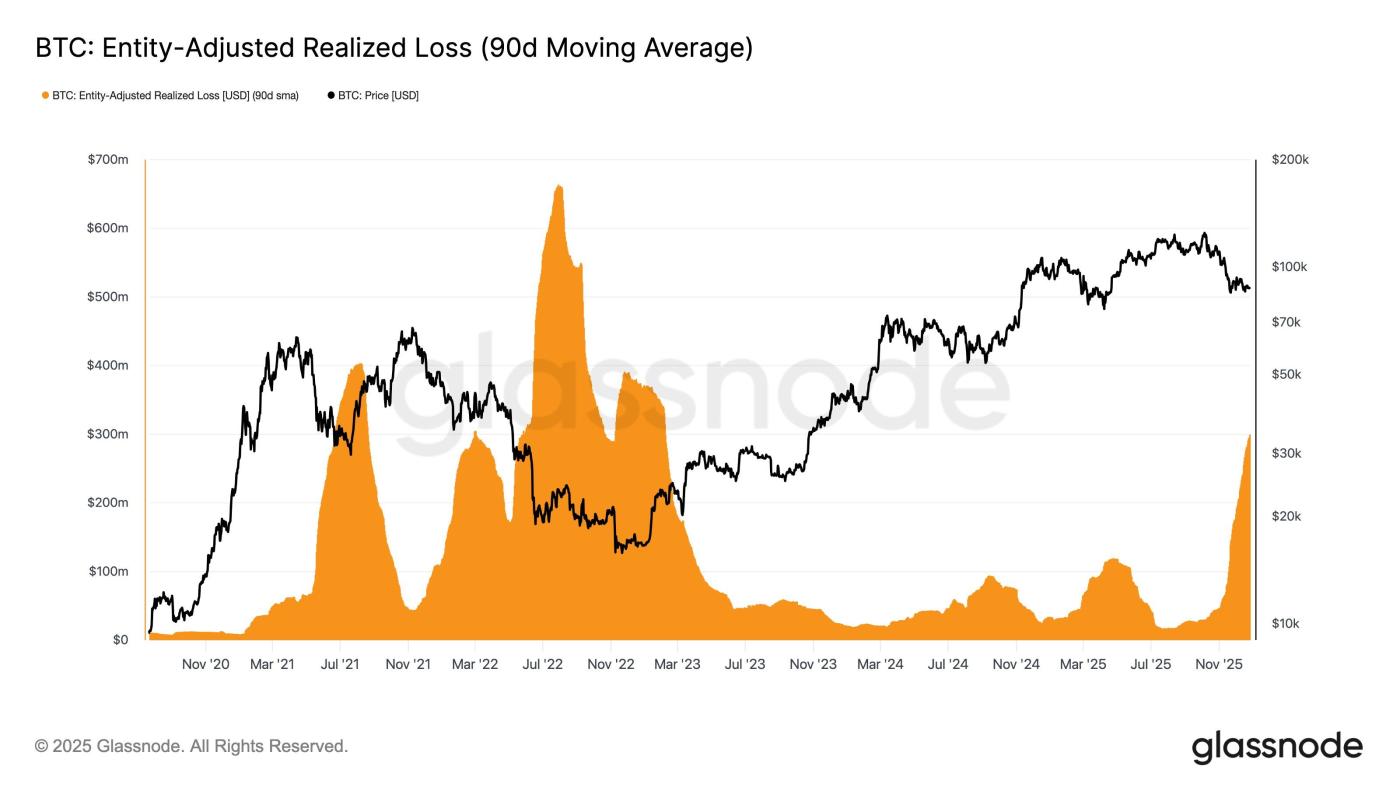

Investors holding Bitcoin are selling at a loss.

Since the final weeks of 2025, trading activity has decreased significantly. Sideways price movements combined with the holiday season caused many traders to leave the market. Volume on major exchanges have fallen sharply, indicating lower speculative interest and a cautious sentiment.

Unless there are unexpected disruptive factors, the Bitcoin market, as well as altcoins, are experiencing their quietest two weeks since the same period last year. This suggests that investors are cautiously managing their expectations, prioritizing patience over aggressive trading amid uncertain short-term signals.

Want to receive more information about Token like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

Crypto Token Volume . Source: Santiment

Crypto Token Volume . Source: Santimenton-chain data shows that selling pressure persists, even though Bitcoin's price remains stable. The actual loss volume (excluding insider trading and smoothing with the 90-day moving Medium ) is currently around $300 million per day. This indicates that many market participants are still accepting losses.

Bitcoin remains above its true market mean of $81,000, but selling pressure hasn't eased significantly. Investors who bought near the peak seem increasingly impatient. Therefore, the distribution of Token from this group is causing the overall market trend to lean slightly downward, limiting the potential for a short-term recovery.

The actual amount of Bitcoin loss. Source: Glassnode

The actual amount of Bitcoin loss. Source: GlassnodeBTC prices are highly volatile.

Currently, Bitcoin is trading at $88,410, holding firm above the key support level of $88,210. Despite this stability, the price of BTC is still down approximately 5.5% YTD, ending 2025 in negative territory. As we approach 2026, traders expect the market to see renewed volatility after this prolonged period of sideways movement.

Technical indicators also support this view. Bitcoin's Bollinger Bands are narrowing, suggesting that volatility is being compressed. Historically, this state often leads to a major price surge. Therefore, if selling pressure eases and macroeconomic conditions become more favorable for risk assets, a breakout trend is entirely possible.

Bitcoin price analysis. Source: TradingView

Bitcoin price analysis. Source: TradingViewUnless there are significant fluctuations, the price of Bitcoin could continue to trade sideways around $88,210 in 2026. However, if selling pressure increases, the price could fall to $86,247 or lower, negating any bullish prospects and prolonging the current period of instability.