Prediction markets are emerging as one of the biggest growth stories in the crypto sector heading into 2026. Once a niche within DeFi, these platforms have now attracted billions of dollars in volume, interest from major financial institutions, and are seeing increasing progress in their regulatory frameworks.

These conditions could greatly benefit small - cap altcoins related to infrastructure and prediction markets.

Small-cap Capital could benefit from market growth predicted in 2026.

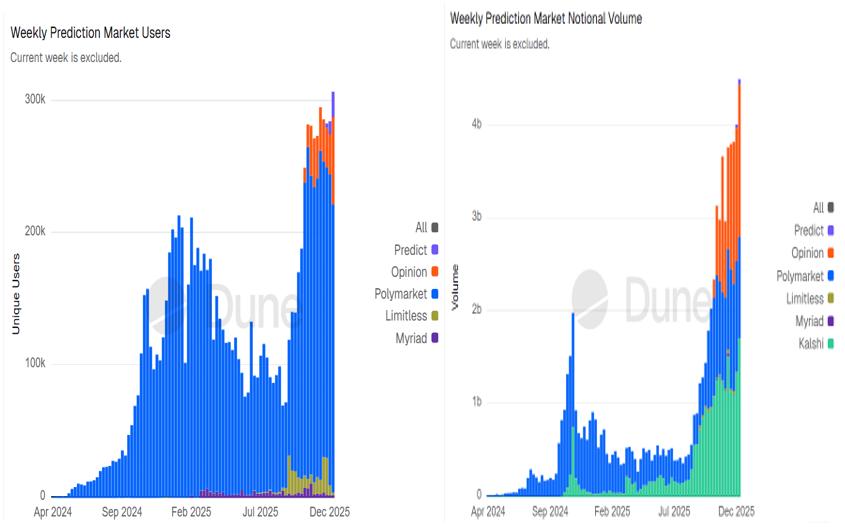

By the end of December 2025, prediction markets had recorded over $4.5 billion in weekly notional volume , setting a new record for the industry. This figure represents an increase of approximately 12.5% compared to the previous week.

Chia to expert Martins, the Kalshi prediction platform alone accounted for over $1.7 billion, equivalent to nearly 38% of total weekly transactions.

This growth indicates that prediction markets are developing strongly, far exceeding their earlier experimental phase.

The growth of prediction markets has been evident throughout 2025. In November alone, prediction markets reached $9.5 billion in monthly volume , significantly surpassing meme coins and Non-Fungible Token.

While meme coins only generated around $2.4 billion and Non-Fungible Token around $200 million during the same period, more and more traders are shifting to platforms based on real-world results, with more practical applications and clearer informational value.

From a speculative market to a utility-focused market.

The renewed interest in prediction markets reflects a major shift in the behavior of the crypto community. Instead of simply chasing fleeting trends, traders are turning to platforms where they can profit from predictions about politics, sports, macroeconomics, and crypto events.

Data from Dune shows nearly 279,000 weekly active users, over $4 billion in nominal volume per week, and 12.67 million transactions, proving this is not a temporary speculative frenzy but sustained user participation.

Prediction Markets' user base and volume reached record highs this week. Source: Dune

Prediction Markets' user base and volume reached record highs this week. Source: DuneMotivation from larger institutions is also increasing, driving faster adoption. Coinbase is reportedly preparing to launch prediction markets , while Gemini 's affiliate has already been licensed to operate prediction markets in the US.

Trump Media & Technology Group has also announcedplans to enter this field . Overall, these events show that prediction markets are gradually transforming into regulated financial instruments rather than just experimental DeFi products.

As the market develops, the demand for both reliable user interface platforms and backend infrastructure (especially Oracles that confirm accurate results) is increasing. In this context, several small-cap Capital are becoming a focal point of attention.

UMA

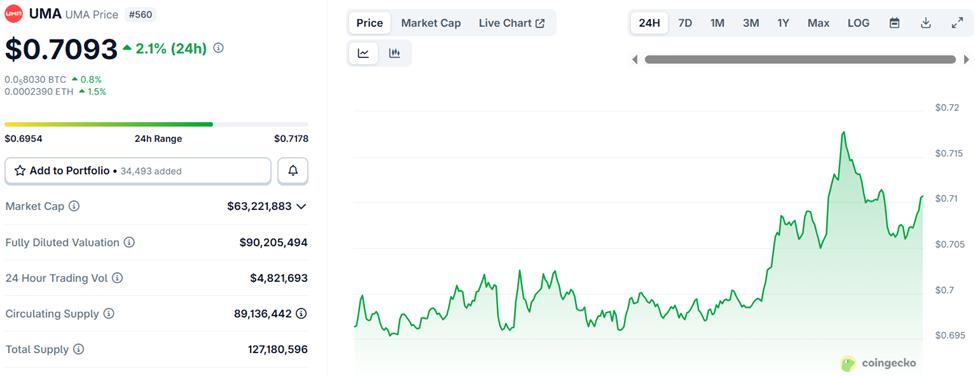

With a market Capital of approximately $63 million, UMA is a fundamental component of the prediction markets ecosystem. This protocol serves as the foundation for Polymarket, one of the leading decentralized prediction platforms .

Oracle, using UMA 's optimistic approach, will default to assuming data is correct unless someone claims otherwise. This model has proven effective when scaled up.

According to UMA, since 2021, approximately 99% of comments have been uncontested, and the rate of contests continues to decline with better technology integration.

UMA 's dispute resolution mechanism is now being applied more broadly in areas such as intellectual property protection (e.g., Story Protocol), not just prediction markets.

At the time of writing, UMA is trading around $0.71, showing a slight increase on the day. While price volatility has been relatively low recently, UMA 's strength lies in the demand for infrastructure in prediction markets, rather than speculative buying by retail investors.

Price fluctuations of UMA Protocol (UMA). Source: CoinGecko

Price fluctuations of UMA Protocol (UMA). Source: CoinGeckoTherefore, UMA could potentially benefit in the long term if prediction markets continue to expand in 2026.

Unlimited

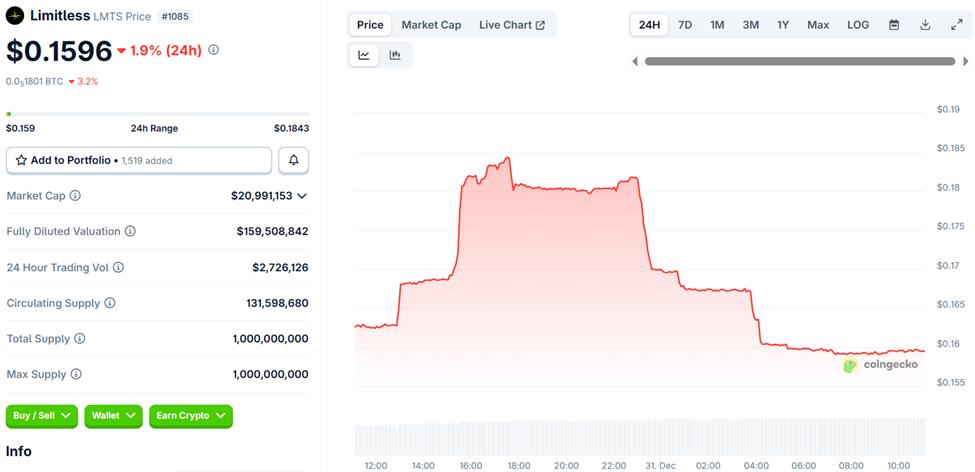

Limitless is also a small - cap altcoin project that has recently received a lot of attention, with a market Capital of approximately $21 million. In December alone, the platform recorded over $760 million in notional volume – a significant increase from around $8 million in July.

Many in the community appreciate the steady growth in the number of monthly traders and its expansion into various other areas, including sports.

The LMTS Token is a core element of this ecosystem, and although it experienced a slight decline during the day, adoption indicators show that the platform is genuinely being used, not just experiencing speculative effects.

Limitless Price Performance (LMTS). Source: CoinGecko

Limitless Price Performance (LMTS). Source: CoinGeckoIf the markets are projected to continue expanding into 2026, platforms like Limitless could benefit from being pioneers with proven user engagement, even though their current Capital capitalization is relatively small.

Predict.fun

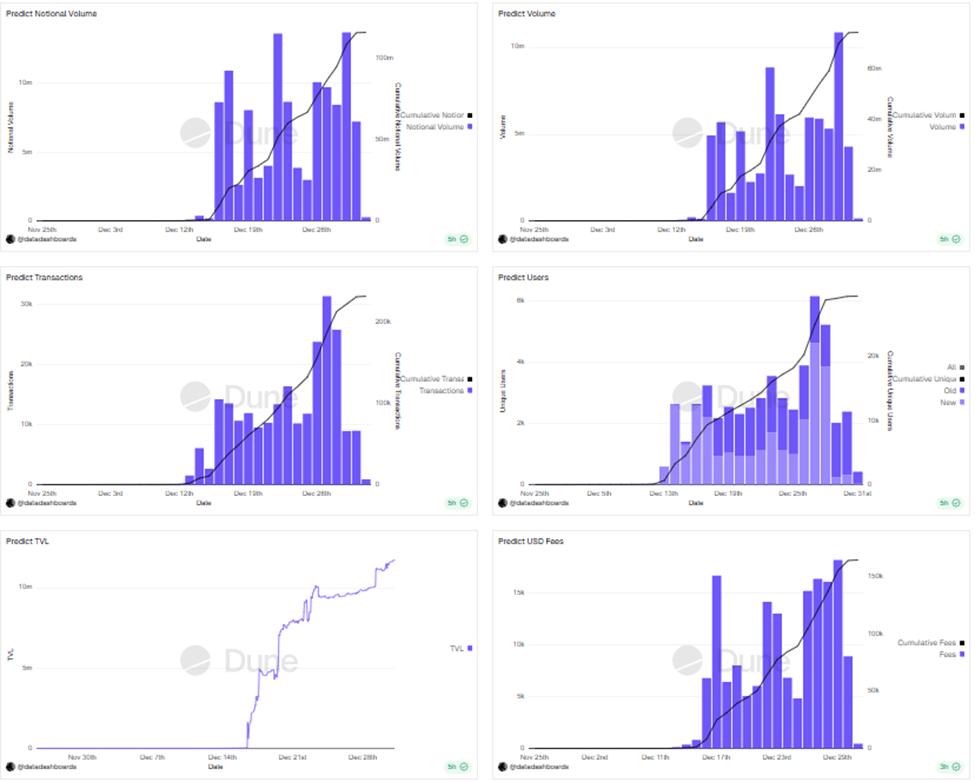

Predict.fun, built on the BNB Chain, is a new project that has quickly gained attention. Despite its recent launch, the platform has achieved over $100 million in notional volume , recorded over 30,000 transactions per day, and attracted over 6,000 independent users during peak activity. TVL recently surpassed $11 million.

Statistics from Predict.fun. Source: Duna Analytics

Statistics from Predict.fun. Source: Duna AnalyticsBacked by YZi Labs, Predict.fun is distributing weekly Airdrop through its Predict Points system to encourage greater liquidation and increased user participation.

Initial data suggests the platform has captured approximately 1% of the total projected market volume – a rather impressive figure for a new project.

Market forecast until 2026

Prediction markets are no longer just experimental betting tools; they are becoming data-driven financial products with significant implications for large organizations.

As volume increases and regulations become clearer, small-cap Capital associated with this sector may have more opportunities but also come with more risks.

Projects like UMA , Limitless, and Predict.fun demonstrate various ways retail investors can access this trend. If current developments continue, 2026 could be a landmark year for the prediction market and the small- Capital Token supporting it.