The cryptocurrency market showed mixed performance as of the morning of the 1st.

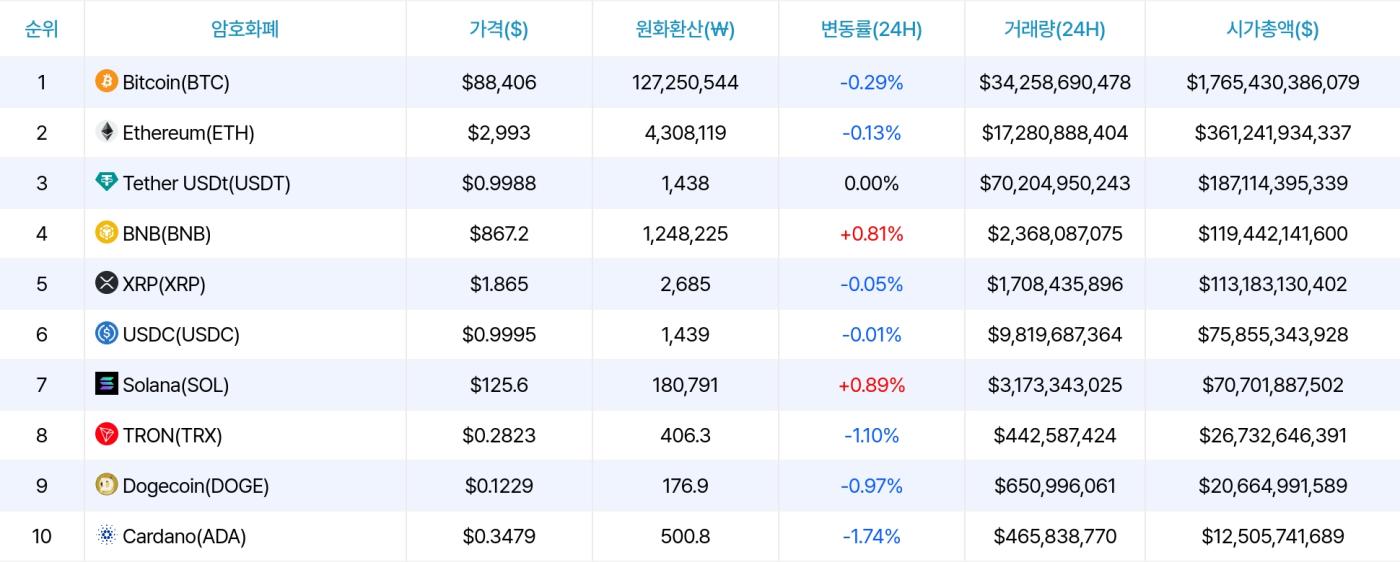

According to TokenPost market data, at 00:01 on January 1, 2026 (Korean time), the price of Bitcoin (BTC) was $88,370.99 (approximately 127.47 million Korean won), a decrease of 0.46% from the previous day.

Ethereum (ETH) was trading at $2,989.39 (approximately 4.31 million South Korean won), down 0.10% from the previous day.

Price changes of mainstream altcoins

Most mainstream altcoins showed mixed price movements.

- XRP -0.40% ▼

- BNB +0.39% ▲

- Solana +0.49% ▲

- Dogecoin -1.57% ▼

- Cardano -2.06% ▼

- Tron -1.11% ▼

Market size and transaction volume trends

The total market capitalization of the cryptocurrency market is $2.9882 trillion (approximately 4310 trillion Korean won).

The total 24-hour cryptocurrency trading volume was approximately $86.2 billion (about 124 trillion Korean won).

Changes in Bitcoin and Ethereum market share

Bitcoin's market share was 59.04%, a decrease of 0.08% from the previous day.

Ethereum's share is 12.07%, an increase of +0.02% from the previous day.

Some analysts believe this indicates that some investors' funds are flowing into altcoins.

DeFi and Stablecoin Market Trends

The DeFi market is showing signs of contraction.

- Total DeFi market capitalization: $70.449 billion

- DeFi transaction volume (24 hours): $11.792 billion

- 24-hour change rate: -3.74% ▼

The stablecoin market is trending downwards.

- Total market capitalization of stablecoins: US$286.886 billion (approximately 413 trillion Korean won)

- Stablecoin trading volume (24 hours): US$85.505 billion (approximately 123 trillion Korean won)

- 24-hour change rate: -0.49% ▼

Changes in trading volume in the derivatives market (futures and options)

The atmosphere in the cryptocurrency derivatives market has also slowed down.

- Derivatives trading volume (24 hours): US$814.312 billion (approximately 1174 trillion Korean won)

- Change rate compared to the previous day: -1.81% ▼

Article summary by TokenPost.ai

🔎Market Analysis : Bitcoin and Ethereum showed weakness, but some altcoins rose, and the market continued to show mixed performance.

💡Key Strategy Points : Based on changes in BTC and ETH share, it is currently necessary to adjust altcoin positions from a risk diversification perspective.

📘Terminology Explanation : DeFi refers to decentralized financial services, and stablecoins are cryptocurrencies with stable value.

TokenPost AI Notes

This article uses a language model based on TokenPost.ai for summary generation. The main content may be omitted or may differ from the facts.