In the past 24 hours, approximately $107.1 million (about 146 billion won) of leveraged positions in the cryptocurrency market have been liquidated.

According to the current data, long positions accounted for the majority of the liquidated positions. By exchange, Hyperliquid, Bybit, and Binance experienced a large number of liquidations in that order.

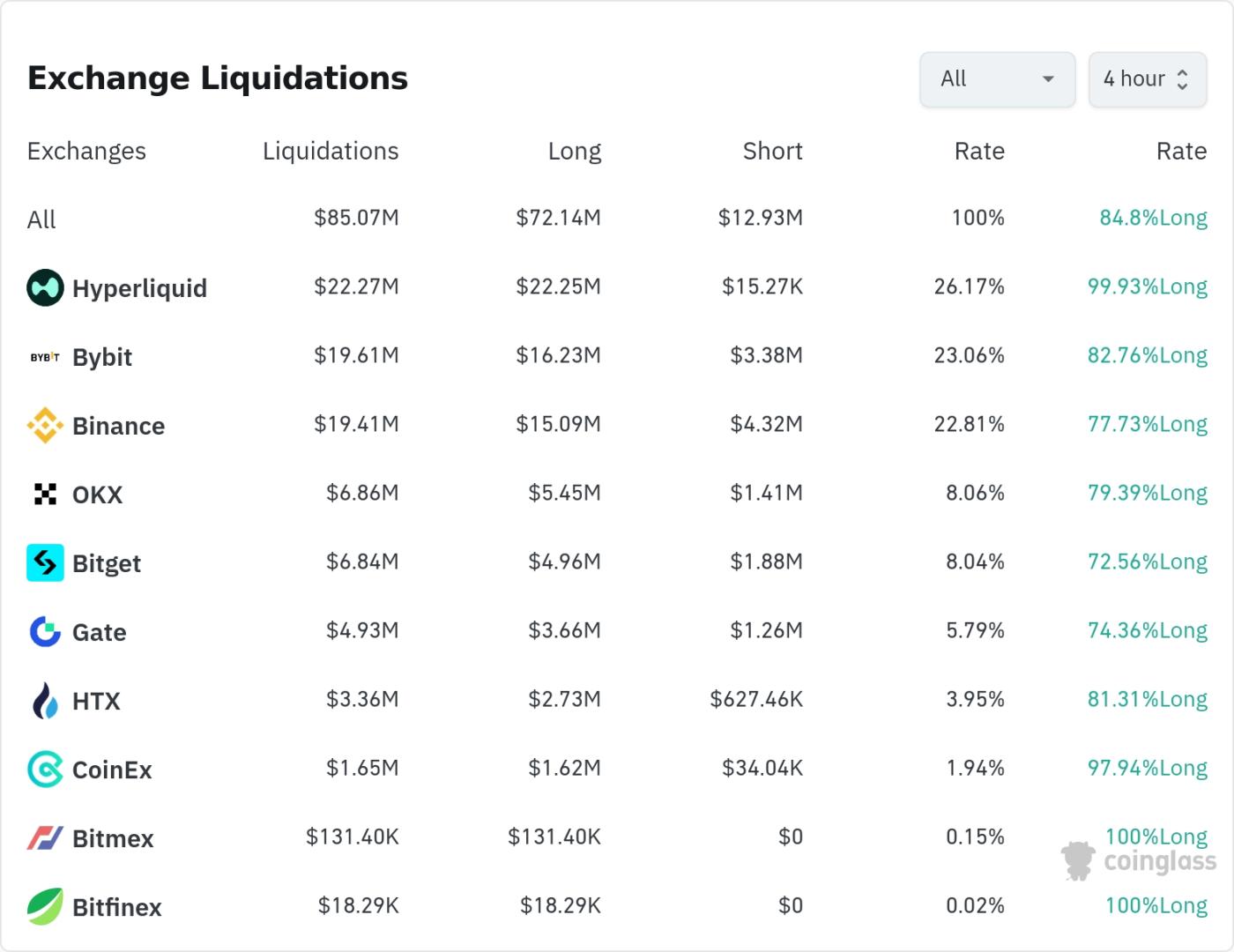

Looking at the liquidation data from various exchanges, Hyperliquid saw the most liquidations, amounting to $22.27 million, of which 99.93% were long positions. Bybit saw $19.61 million in liquidations (82.76% long positions), and Binance saw $19.41 million in liquidations (77.73% long positions).

OKX and Bitget experienced liquidations of $6.86 million and $6.84 million respectively, with over 70% of the liquidations on both exchanges being long positions. Gate, HTX, CoinEx, and other exchanges also saw substantial liquidations.

It is worth noting that BitMEX and Bitfinex experienced relatively small liquidations of $131,000 and $18,000 respectively, but both exchanges were 100% long positions liquidated.

By currency, Bitcoin (BTC) recorded the most liquidations. In the past 24 hours, Bitcoin-related positions totaled $50.31 million in liquidations; on a 4-hour basis, long positions liquidated $24.29 million, and short positions liquidated $570,000.

Ethereum (ETH) positions were liquidated in 24 hours, with approximately $26.8 million in positions being closed.

One notable altcoin is DOGE, which saw $7.42 million in liquidations within 24 hours. On a 4-hour timeframe, $5.98 million in long positions and $39,000 in short positions were liquidated. Analysts believe this is due to the downward trend in Dogecoin's price.

In addition, $2.97 million of long positions in XRP were liquidated within 4 hours, and $2.43 million of long positions in ADA were liquidated. Solana (SOL) also saw $1.09 million of long positions and $161,000 of short positions liquidated.

In terms of special currencies, LIGHT and RIVER recorded high liquidation volumes of $13.32 million and $7.48 million respectively within 24 hours, while FARTCOIN also saw liquidations of $5.94 million.

This large-scale liquidation reflects the recent increase in volatility in the cryptocurrency market, particularly highlighting the significant losses suffered by investors holding long positions. Market participants need to remain vigilant regarding leveraged trading in the current volatile market.

Article summary by TokenPost.ai🔎 Market Analysis

- Approximately $107.1 million in leveraged positions were liquidated in the past 24 hours. - The majority of liquidations were long positions, suggesting strong downward pressure on the market. - Ranked by liquidation size, Hyperliquid, Bybit, and Binance recorded the largest liquidations, with Bitcoin and Ethereum accounting for the largest amounts.💡 Key Strategies

- In the current highly volatile market, excessive leveraged trading carries risks. - Caution is advised regarding the price direction of Bitcoin and major altcoins. - In particular, there have been significant liquidations of long positions in altcoins such as DOGE, XRP, and ADA; therefore, short-term investors should exercise caution.📘 Terminology Explanation

- Liquidation: In leveraged trading, the forced liquidation of a position due to failure to meet margin requirements. - Long Position: A position bought in anticipation of an asset price increase. - Short Position: A position sold in anticipation of an asset price decrease. TokenPost AI Notes: This article uses a language model based on TokenPost.ai for summarization. The main content may be omitted or may not be factual.