An 80% drop would typically mark the end of a speculative trade. But in the crypto ecosystem led by retail investors in South Korea, the opposite is true.

BitMine Immersion Technologies, a US-listed company backed by Tom Lee, has transformed itself into an "Ether storage facility," and is now second only to Alphabet in the top list of foreign stocks most purchased by South Korean investors in 2025.

South Korean retail investors continue to buy Tom Lee's BitMine stock despite a sharp drop.

This position remains secure even though BitMine's stock price has fallen by approximately 82% since its peak in July, nearly wiping out all the gains from the earlier surge this year.

BitMine (BTMNR) stock price performance from the YTD. Source: Google Finance

BitMine (BTMNR) stock price performance from the YTD. Source: Google FinanceAccording to on-chain analyst AB Kuai Dong, although both BitMine and Circle (the issuer of USDC) have fallen more than 70% from their peaks, they are still among the top 10 most purchased foreign securities by Koreans this year. BitMine is second only to Alphabet, the parent company of Google.

"The more losses the Korean investors in Vietnam incur, the more they buy," he Chia .

At the heart of this trend is the bold transformation of BitMine . Once just a small Bitcoin mining company, BitMine rebranded itself, transforming into an Ether savings fund modeled after the famous Michael Saylor, only using ETH instead of BTC.

This shift helped BitMine become a market phenomenon for a short time, with its stock price increasing by over 3,000% and peaking in July. The frenzy stemmed from a wave of retail investors buying shares to profit from the Ethereum accumulation momentum.

But the euphoria quickly subsided. BitMine's stock price plummeted, volatility soared, and Derivative financial products linked to the stock also fell sharply. Yet, South Korean investors continued to buy.

Data from the Korea Securities Depository, cited by Bloomberg, shows that South Korean retail investors have net injected $1.4 billion into BitMine shares in 2025. They even spent an additional $566 million on a 2x leveraged ETF based on the stock, despite growing losses.

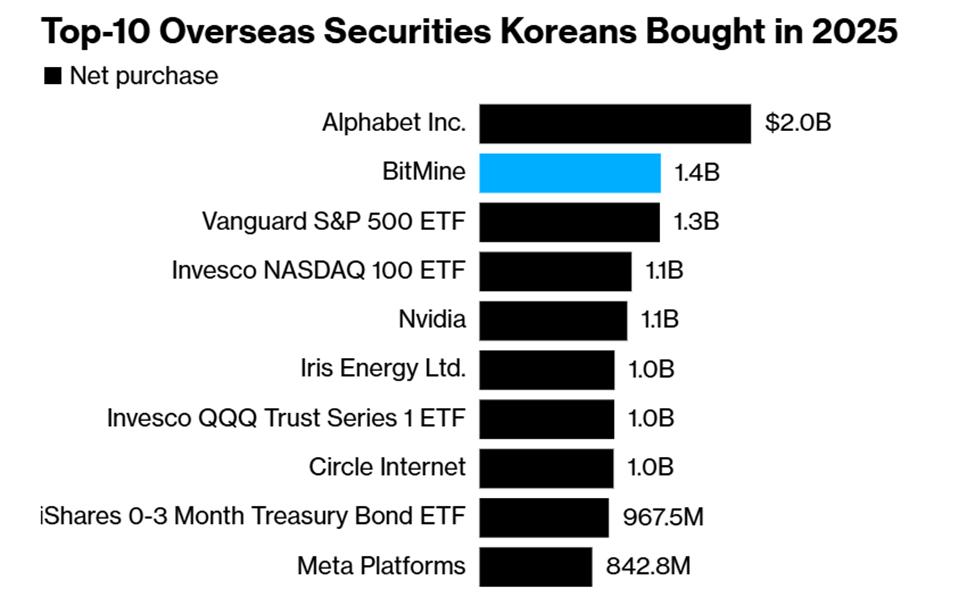

Top 10 most purchased foreign stocks by Koreans in 2025. Source: Korean Securities Depository

Top 10 most purchased foreign stocks by Koreans in 2025. Source: Korean Securities DepositoryFaith Capital, the logic of hoarding, and South Korea's willingness to take risks.

To outsiders, this action might seem illogical. But within the crypto community, this is familiar "hoarding logic." The Korean community believes that the strength of Capital flows based on confidence is not driven by short-term price fluctuations.

"The Capital of confidence ≠ price volatility; this wave in Korea is exactly like on-chain hoarding logic," one member Chia .

This perspective argues that the new infrastructure is the main factor, while the price drop is only temporary. If Ether is a long-term payment method, then the more the price falls, the more attractive companies holding ETH become. Community sentiment also leans towards this view.

"When it comes to loyalty in the crypto world, Koreans are the most confident in the world," another person commented , reiterating the long-standing observation that the level of trust among retail investors in Korea sometimes outweighs risk management factors.

Circle has become a parallel option as South Korean retail investors prioritize crypto infrastructure over price.

BitMine wasn't the only company to benefit from that sentiment. Circle Internet Financial – the issuer of USDC – also attracted a significant influx of South Korean investor funds.

South Korean investors have poured nearly $1 billion into Circle shares, making it one of the country's most favored crypto-related stocks, despite the volatile market conditions following its IPO .

The most likely reason stems from optimism about stablecoin regulation, both in the US and in South Korea under the new administration, as they push for the expansion of the crypto market and allow the issuance of domestic stablecoins.

According to BeInCrypto's October report, Circle recorded $2.4 trillion in stablecoin transactions in the Asia-Pacific region during the fiscal year from June 2024 to 2025.

In Japan, the Financial Services Agency (FSA) has approved JPYC as the first yen-backed stablecoin to be issued this year. Circle has also invested in JPYC through its Series A Capital round, raising a total of approximately 500 million yen.

BitMine and Circle both illustrate a broader trend. South Korean retail investors are not only trading Token, but they are also investing in crypto infrastructure through stocks, even amidst volatile markets.

In 2025, foreign Capital in South Korean equities exceeded $10 billion. A large portion of this money flowed into high-risk sectors , including crypto, AI, and semiconductors.

Is this foresight or simply accepting risk as normal? As institutions become increasingly optimistic about Bitcoin and digital assets heading into 2026, South Korean retail investors may be preparing early for a new cycle. Or perhaps, 2026 will be the time when they XEM accepting losses as an inevitable part of their investment philosophy.