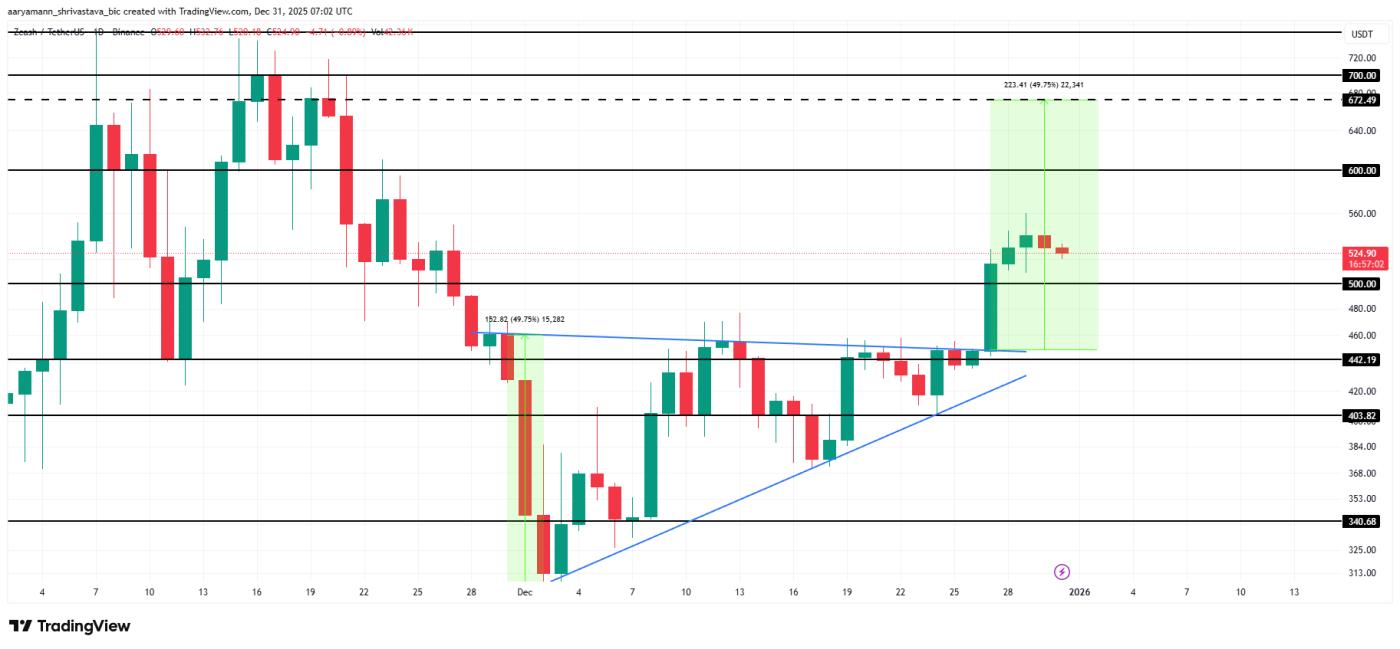

Zcash has rebounded strongly, pushing the price back above the $500 mark after a significant breakout. This move indicates renewed interest after weeks of sideways trading.

Despite the price increase, ZEC is still far from its growth target according to the technical model. To continue its upward trend, ZEC needs consensus from the overall market.

Zcash is following the "king".

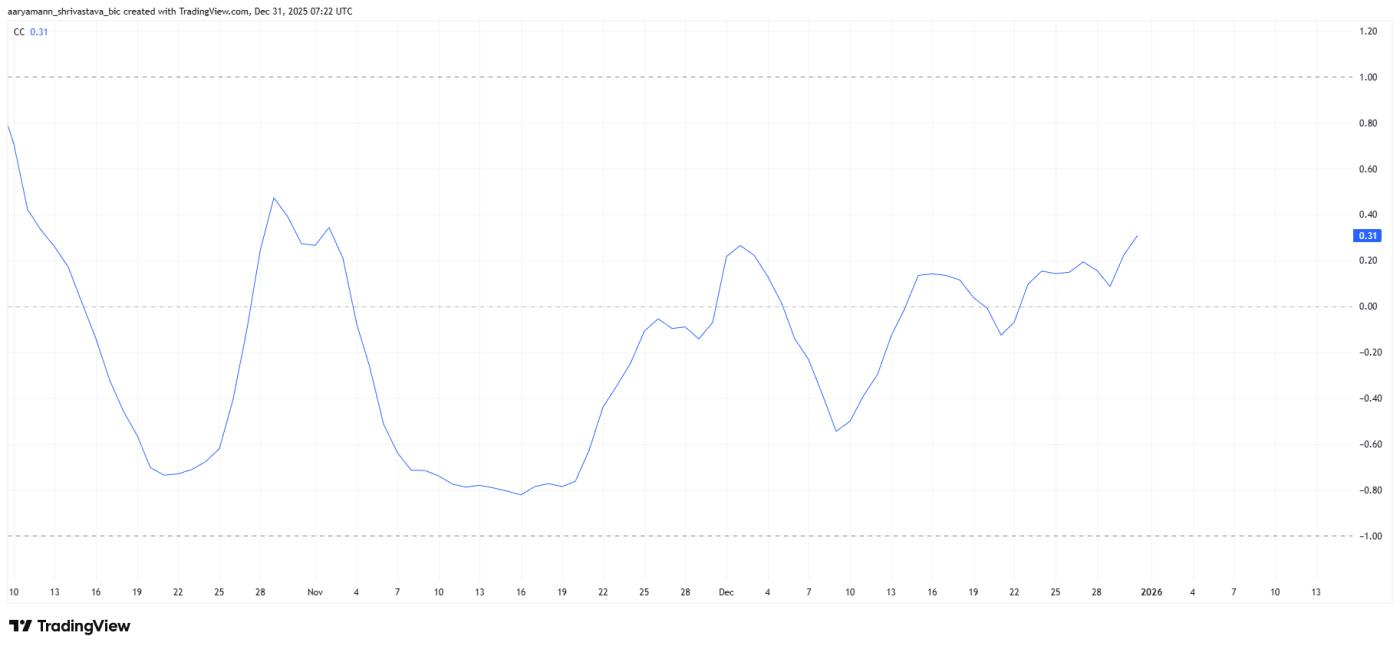

The correlation between ZEC and Bitcoin has risen to its highest level in two months, suggesting that the prices of the two cryptocurrencies are becoming more closely linked. This means that Zcash is increasingly being influenced by Bitcoin's volatility rather than being based on independent demand.

This correlation presents both opportunities and risks. If Bitcoin maintains its upward momentum, ZEC is likely to benefit as well. Conversely, if Bitcoin undergoes a sharp correction, correlated altcoins, including Zcash, are also likely to experience a sell-off.

Want to receive more information about Token like this article? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

The correlation between ZEC and Bitcoin. Source: TradingView

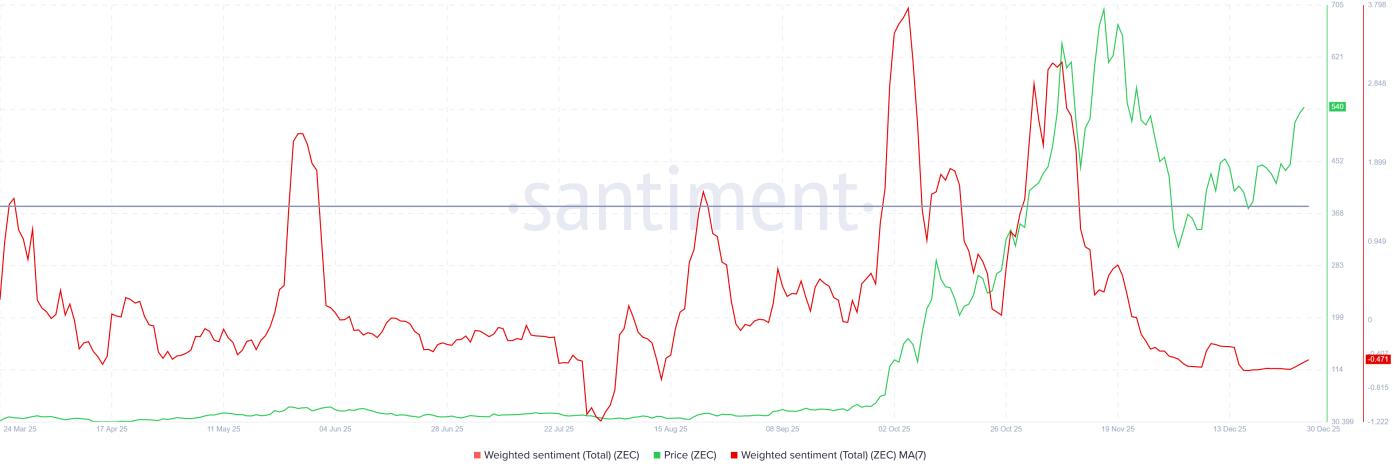

The correlation between ZEC and Bitcoin. Source: TradingViewRetail investor sentiment towards Zcash remains quite weak . Market confidence is currently at its lowest level in months, despite the price breakout. When sentiment is weak, rallies are often difficult to sustain because retail investors are more likely to take profits quickly rather than hold for the long term.

This is concerning because retail investor confidence directly impacts buying demand. When sentiment is positive, there will be more new buyers, thereby supporting an upward price movement. Without a clear shift, the potential for further price increases for ZEC may be limited, even though technical indicators support an uptrend.

Zcash psychological index. Source: Santiment

Zcash psychological index. Source: SantimentZEC prices are heading towards the next growth phase.

Prior to its breakout last weekend, ZEC had been consolidating within an ascending triangle pattern. The price breaking out of this pattern indicates strong buying pressure. At the time of writing, Zcash is trading around $524, holding above previous resistance levels.

This pattern suggests the next target is $672, representing a 49% increase from the breakout point and approximately a 27% increase from the current price range. If the price holds above $600 and turns this area into support, the uptrend will be further strengthened.

ZEC price analysis. Source: TradingView

ZEC price analysis. Source: TradingViewHowever, conflicting macroeconomic signals are making retail investors more cautious. If the overall market deteriorates, ZEC could lose its upward momentum. If the price falls below $500, selling pressure could drag ZEC down to the $442 region. At this point, the breakout signal would no longer be valid, and the uptrend would be negated.