Vida : Born in the 2000s, founder of Equation News, specializing in algorithmic trading, he once shared his story of earning tens of millions of dollars in the crypto market.

Background: At 01:23 AM Beijing time on January 1, 2026, Equation News detected that a market maker's Binance account was highly suspected of being compromised. Potential attackers are suspected of using approximately $10 million to $20 million of funds in the account to manipulate the price of the BROCCOLI714 -USDT trading pair on the Binance spot market.

The following is Vida's complete recap :

Prerequisites and infrastructure:

I had a $200,000 position in BROCCOLI714 held at a cost of 0.016, which I bought around the beginning of November this year. I had both spot and futures positions. After buying it, I got stuck with a losing position, and I didn't even dare to look at it.

- In October and November, the style of market manipulation by major players was to quickly raise prices within a few hours and then immediately sell off with a large bearish candlestick. Therefore, I set a reminder in advance for my small-cap cryptocurrency positions if the price increases by more than 30% within 1800 seconds.

- I also have a $500,000 BROCCOLI 714USDT perpetual contract on Binance Futures funding rate arbitrage position with an average opening price of around 0.015.

When a huge price difference occurs between spot and futures contracts: my short-term price increase alert program and spot-to-contract price difference alert program are both going off like crazy, making me rush to my computer to get to work.

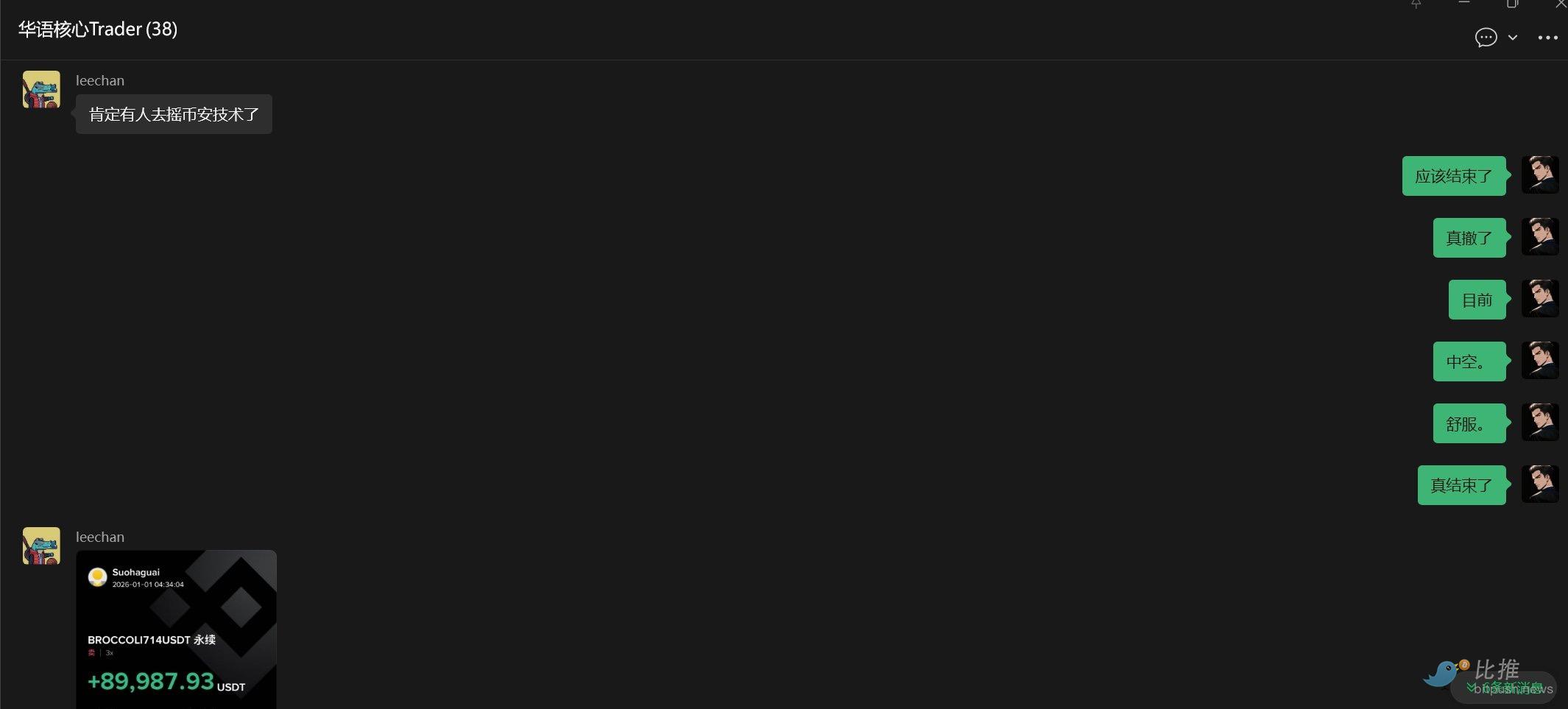

I immediately notified the core Chinese language group that I had detected this situation:

My first reaction was to quickly close my arbitrage positions. My original 500,000 USDT arbitrage hedging position had become 800,000 USDT in spot and 500,000 USDT in contracts. Closing all my arbitrage positions immediately would allow me to secure a profit of 300,000 USDT.

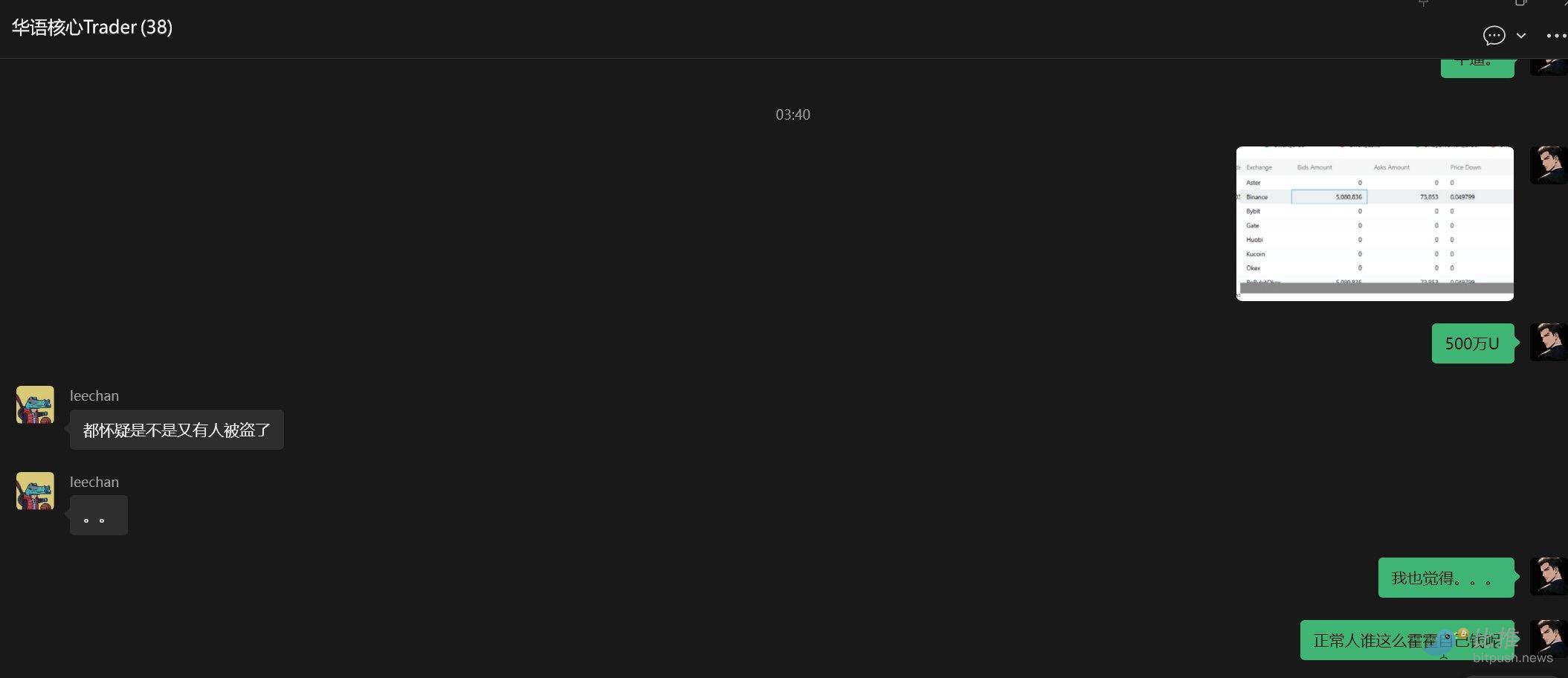

However, upon reflection, this seems highly unusual, as historically, no market maker would so drastically drive up spot prices regardless of price spreads. I checked the order book depth and was shocked to find that Binance's spot bid depth of 10% had 5 million USDT in buy orders, while the futures bid depth of 10% was only 50,000 USDT. Some people suspect that someone's Binance account has been hacked, which I also find plausible.

– I glanced at the order book on Binance's main site again and was shocked to find that BROCCOLI714, a coin with a market capitalization of 40 million USDT at the time, had a bid of 26 million USDT. From this, I deduced that someone's account must have been hacked or there must have been a bug in the market-making program, because no market maker would be foolish enough to do something so charitable, and no market maker would play like this in the spot market.

- After seeing that the hacker had 26 million USDT worth of ammunition in the spot order book, I knew his goal was to pump and dump spot orders, then raise contract prices, and then exit the contract market.

- After seeing that the hacker had 26 million USDT worth of ammunition in the spot order book, I knew his goal was to pump and dump spot orders, then raise contract prices, and then exit the contract market.

So I monitored Binance's orderbook changes on one screen, and I knew that as long as the hacker didn't withdraw the $20 million buy order in the spot market, the price of BROCCOLI714 would keep rising.

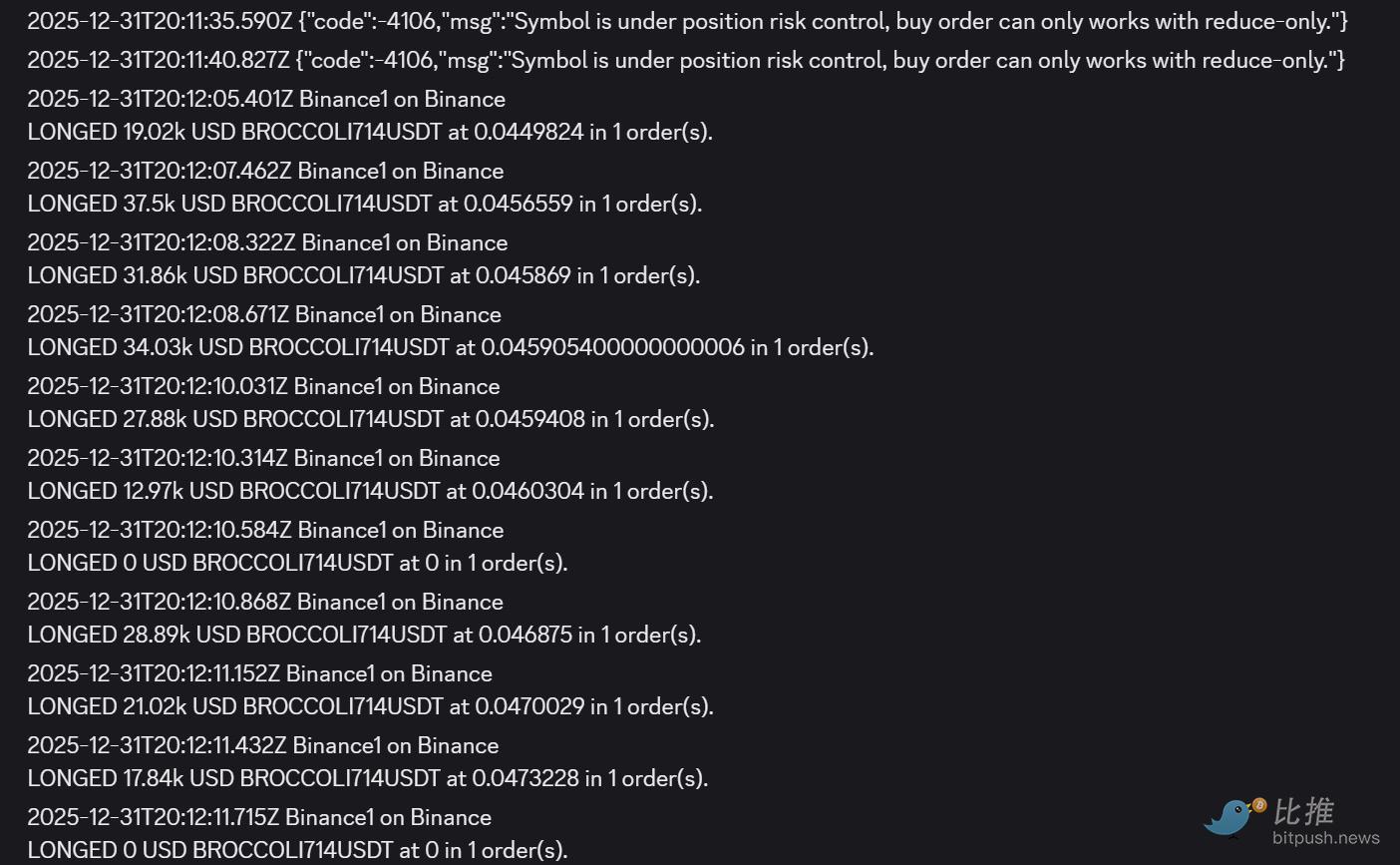

My first thought was to long on Binance contracts, but I found that Binance contracts had already triggered the "circuit breaker protection mechanism" that only allowed for position reduction.

At that time, the spot price of BROCCOLI was already 0.07, while the Binance futures contract was capped at 0.038 due to the circuit breaker mechanism, and the Bybit futures contract had risen to 0.055. Therefore, I chose to try to long order for Binance BROCCOLI 714USDT perpetual contract every 5-10 seconds on my trading terminal. As long as the order was successfully placed, it would mean that the circuit breaker mechanism had expired, which would mean that the Binance futures contract would be liquidated.

I successfully seized this opportunity and added approximately 200,000 USDT of long positions at a contract entry cost of 0.046.

- I know this incident must have been caused by a bug in the hacker's or market maker's program, and the price increase was too high in a short period of time, so the final outcome will definitely be a complete disaster.

- I know this incident must have been caused by a bug in the hacker's or market maker's program, and the price increase was too high in a short period of time, so the final outcome will definitely be a complete disaster.

So I kept an eye on Binance's spot order book.

The hacker canceled the order book once midway, leading me to believe that he had been sanctioned by Binance's risk control department. So, at 04:20:52.732 on January 1, 2026 (China time), I started frantically selling all my previously accumulated and later long positions in BROCCOLI714 spot and futures contracts, regardless of cost.

My initial position of 200,000 USDT, plus an additional 200,000 USDT acquired later, netted me approximately 1.5 million USDT. (Many of my initial positions were held in the futures market, which prevented me from capturing as much of the premium.)

After being scared away by the hacker's cancellation of the buy order at 4:21, the unscrupulous hacker put the buy order back on about a minute later and immediately drove the price down to 0.15.

But I know he will eventually be sanctioned by Binance's risk control department. And once his account is flagged for risk control and his bid is withdrawn, Broccoli will collapse. It's just that because it's currently at version 1.1, the staff are a bit lazy and haven't been flagged for risk control yet.

So I kept a close eye on the order book.

Later, at 4:31, I discovered that the hacker had indeed removed all the bids. At 4:32, they were all removed completely. And this time, after waiting a long time, they didn't reappear. Group members said that someone must have used Binance's technical skills, and he's likely been sanctioned.

So I started short. I opened a short position of approximately 400,000 USDT on Binance futures, with an average cost of around 0.065 USDT. The final closing price was approximately 0.02 USDT.

Let's review why I was able to seize this opportunity:

1. Price Anomaly Alerts for Small Coin Strategies

- I've set up short-term price surge alerts for my altcoin strategy. If any altcoin in my holdings experiences a significant price increase within a short period, a mandatory alert will be triggered, guaranteed to wake me up. – In my funding rate arbitrage strategy, I've also set up monitoring: once a large price difference between the spot and futures prices is detected, a mandatory alert will be triggered.

2. Identifying Abnormal Price Behavior and Verifying the Order Book: When I observed clearly abnormal price behavior, I immediately checked the order book to determine how much "market maker" had. I discovered that a coin with a market capitalization of only $30 million was listed with 20 million USDT on Binance's spot bid platform. Based on this, I concluded that this couldn't be normal market manipulation by a large player; it was more likely a hack or a system bug in the market maker's system (no large player would recklessly and foolishly pump and dump spot prices).

3. It's still important to communicate with experts. Brainstorming among several experts can often clarify the gameplay of the entire scenario in the shortest amount of time.

4. I understand the rules for the second part very well:

I was waiting for the hacker to be sanctioned by Binance's risk control department and for their bids to be withdrawn, then I waited for this opportunity to short. So after the first wave of selling was completed, I kept a close eye on the order book, waiting for this opportunity to appear. After waiting for more than ten minutes, I actually got my chance.

One action made me suspect that the hacker BROCCOLI714 was wrapping up his work, because at 4:28:15 China time, he bought SOLUSDT spot regardless of cost, driving up the price by about 5% >>> This triggered my pre-set alert once again.

I suspect that some of his accounts were already restricted by Binance from placing new orders on the BROCCOLI714 market, so in desperation, he bought SOL.

Sure enough, the price of Broccoli collapsed within 3 minutes.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush