XRP is struggling to regain momentum after failing to break above the $2.00 mark. The overall market uncertainty is also limiting the upward trend, keeping XRP price constrained and moving within a narrow range.

However, as the new year approaches, XRP is once again receiving attention due to increased demand for ETF products related to investment strategies tied to XRP.

Roundhill wants to launch a differentiated XRP ETF.

Roundhill Investments – a US asset management company specializing in themed ETFs – has updated its XRP related product filings with the US Securities and Exchange Commission (SEC). This move indicates increasing regulatory acceptance of XRP as a benchmark asset in structured investment products, marking a significant step towards integrating XRP into traditional financial markets.

Despite the interest, this ETF is not a spot XRP fund and will not directly hold XRP Token. Instead, the product aims to generate returns based on option fees associated with other XRP based ETFs. Simply put, the fund will leverage XRP price volatility to seek profits rather than actual ownership, and the product launch could be in 2026.

Many retail investors are flocking to XRP.

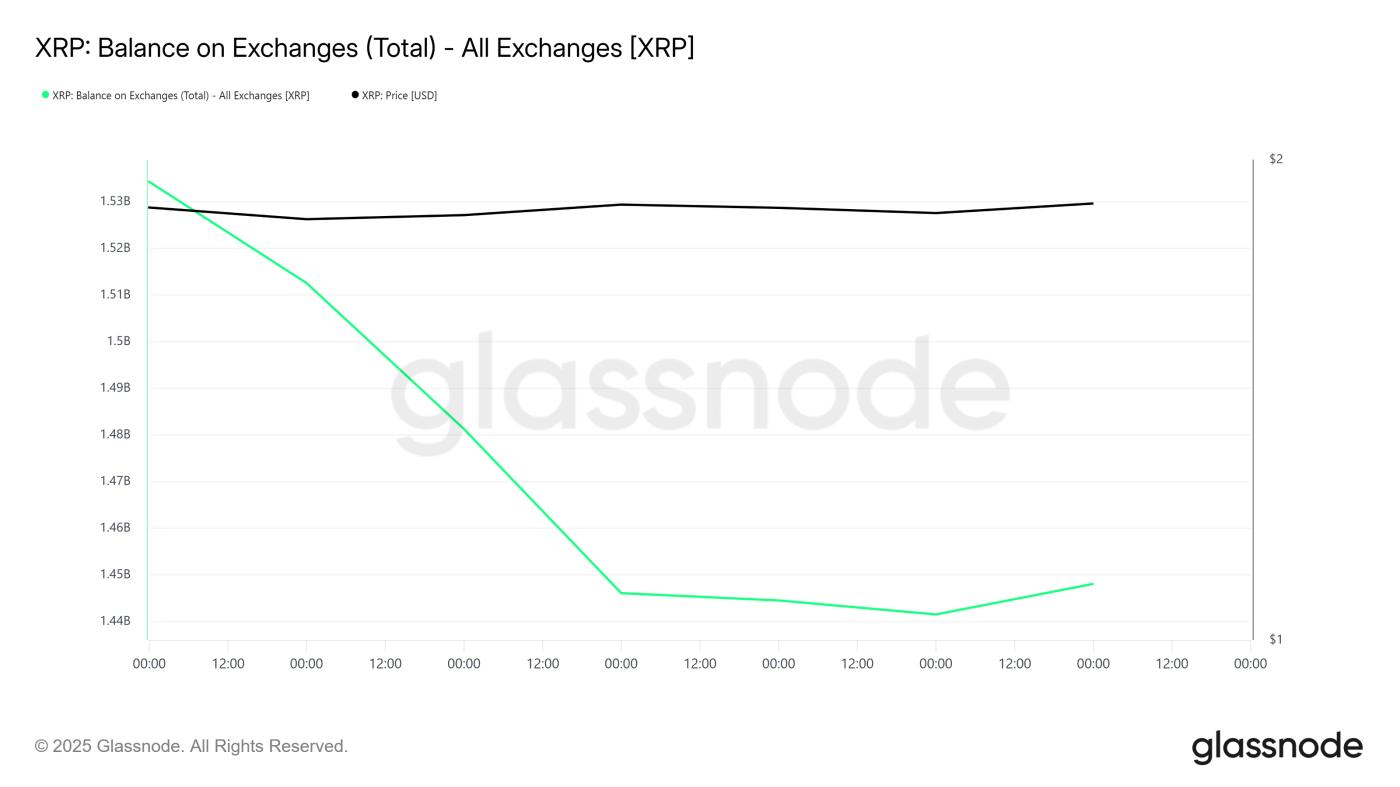

Despite recent developments, existing XRP investors remain cautious. Data from exchanges shows little volatility in recent days, indicating that investors are neither rushing to buy nor aggressively sell XRP Token. This trend reflects hesitation as traders await a clearer market trend.

Although the lack of new money flowing into the market has limited short-term price upside potential, the absence of a major sell-off has also eased downward pressure. This neutral stance reflects caution, not necessarily a negative signal. For XRP, price stability at the current level could lay the foundation for a new trend if stronger signals emerge.

Want to stay updated on more Token ? Sign up for the daily Crypto newsletter compiled by Editor Harsh Notariya here .

XRP balance on exchanges. Source: Glassnode

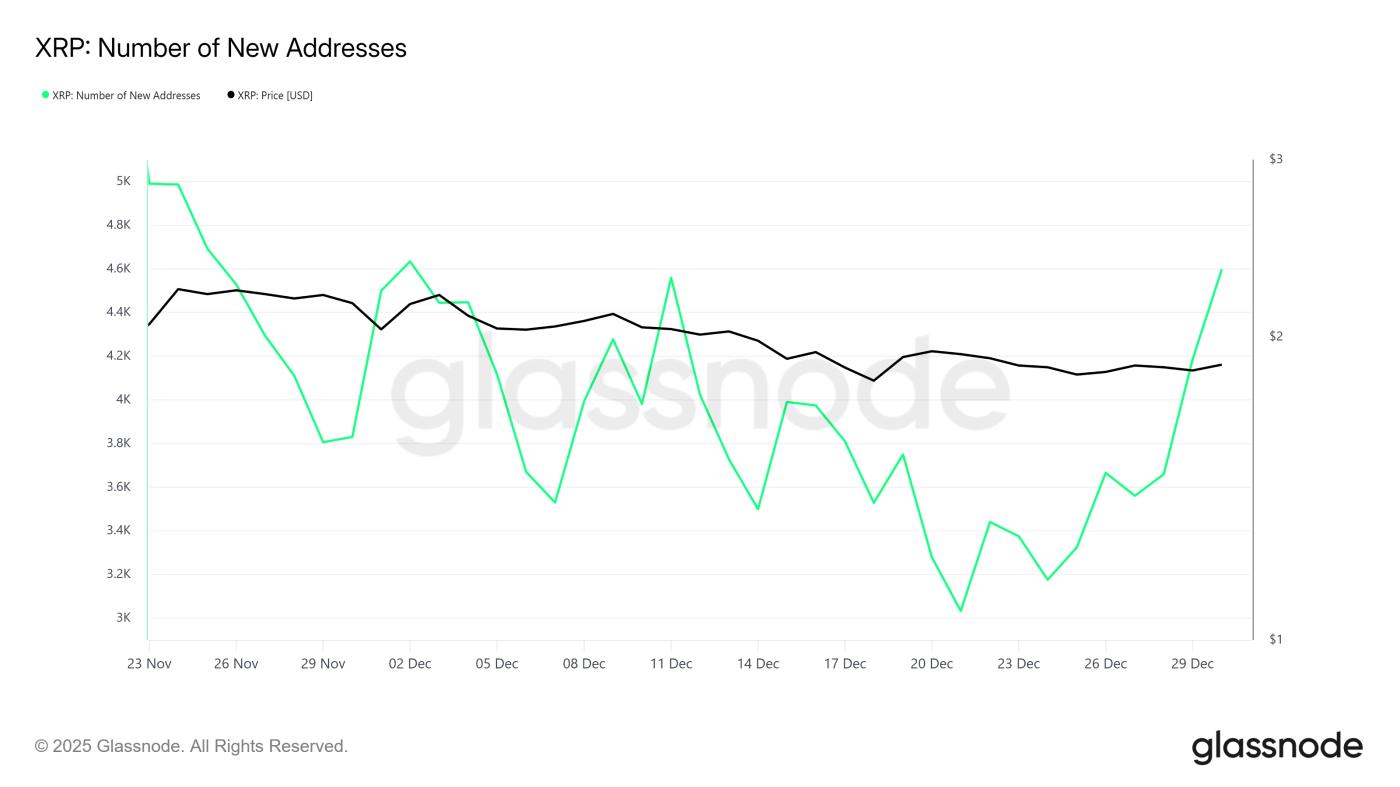

XRP balance on exchanges. Source: Glassnodeon-chain data reveals underlying changes. The number of new XRP addresses has surged, reaching a monthly high. This trend likely stems from a wave of new investors seeking to enter the market ahead of potential price-boosting events, including news about ETFs.

If this influx of new addresses translates into long-term investment capital, market momentum could improve. Typically, new investors drive demand, thereby supporting price increases. However, an increase in new addresses alone is not enough to confirm an uptrend unless accompanied by high volume and holding ratios.

The new XRP address. Source: Glassnode

The new XRP address. Source: GlassnodeXRP price will recover slowly.

XRP is trading around $1.87 at the time of writing, holding above the $1.86 support zone. The price of XRP has been fluctuating around this area for several sessions, indicating a balance between buyers and sellers. This sideways price action reflects the overall market sentiment.

For XRP to rebound strongly, it needs more new investment capital and accumulation by retail investors. For XRP to conquer the $2.00 mark, it must first break through the resistance zone around $1.93. If it can steadily break through this level, the uptrend could be strengthened and short-term upside prospects will become clearer.

XRP price analysis. Source: TradingView

XRP price analysis. Source: TradingViewThe risk of a correction remains if market sentiment deteriorates. If the $1.86 mark is broken, XRP could fall further to the $1.79 region. If this happens, XRP 's upside potential will be negated, and the market will continue its sideways trend until strong buying pressure emerges again.