While timelines scream “no yield,” the data says otherwise.

$1B+ incentives, double-digit APYs/APRs, and fresh vaults across Monad, Plasma, and Ethereum.

Lets have a look 🧵👇

-------------------------------

➢ The governance and revenue sharing token of @beefyfinance surged over 200% on Dec 25. It briefly toched around $400 before cooling off.

The rally was driven by its very low circulating supply which is only 80,000 tokens, rather than new protocol changes or yield improvements.

-------------------------------

➢ RWA DeFi protocols now hold about $17 B in TVL, surpassing DEXs to become the fifth‑largest category in DeFi. This shows money is flowing into more stable, yield‑bearing tokenized Treasuries and private credit products instead of speculative liquidity pools.

-------------------------------

➢ The @helloSQD Network introduced revenue pools where participants can lock SQD tokens to help support enterprise services and earn a share of real customer payments in stablecoins.

This is a different take on yield that links rewards to actual usage and revenue rather than inflationary token incentives.

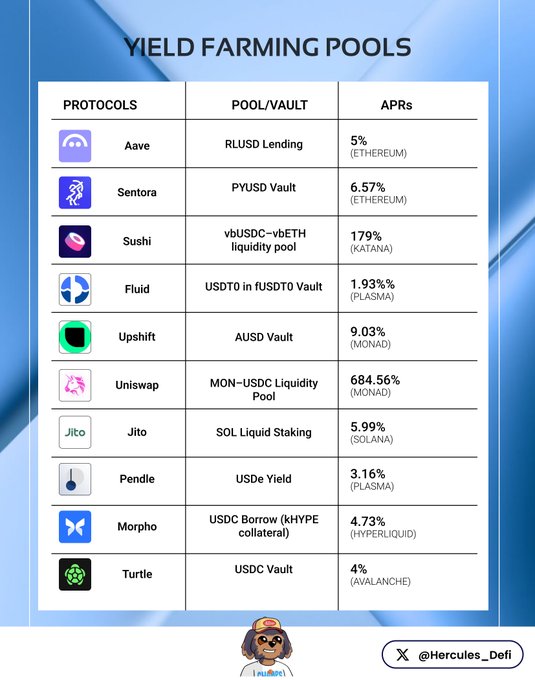

𝐘𝐢𝐞𝐥𝐝 𝐅𝐚𝐫𝐦𝐢𝐧𝐠 𝐏𝐨𝐨𝐥𝐬

➢ RLUSD Lending

DApp : @aave core

Chain: Ethereum

APR: 5%

➢ PYUSD Vault

DApp : @SentoraHQ

Chain: Ethereum

APR: 6.57%

➢ vbUSDC–vbETH liquidity pool

DApp: @SushiSwap

Chain: Katana

APR: 179%

➢ USDT0 in fUSDT0 Vault

DApp: @0xfluid

Chain: Plasma

APR: 1.93%

➢ AUSD Vault

DApp : @upshift_fi

Chain: Monad

APY: 9.03%

➢ MON–USDC Liquidity Pool

DApp : @Uniswap

Chain: Monad

APY: 84.56%

➢ SOL Liquid Staking

DApp : @jito_sol

Chain: Solana

APY: 5.99%

➢ USDe Yield

DApp : @pendle_fi

Chain: Plasma

APR: 3.16%

➢ USDC Borrow (kHYPE collateral)

DApp: @Morpho

Chain: Hyperliquid

APR: 4.73%

➢ USDC Vault

DApp: @turtledotxyz

Chain: Avalanche

APR: 4%

Which is your favorite?

Commuting

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content