On January 1, 2026, a hacker took control of a market maker's Binance account and manipulated the price of BROCCOLI(714) by aggressively buying spot.

This event generated the first $1 million profit in the crypto market in 2026 when trader Vida detected an anomaly using an automated alert system, capitalized on the artificial pump, and quickly switched to a Short position. The incident exposed weaknesses in the exchange's risk control and security vulnerabilities in market maker accounts.

Hacker manipulates BROCCOLI(714) on Binance, trader earns $1 million in early 2026

The hacker allegedly took control of a market maker's account on Binance and attempted to withdraw funds by manipulating the price of a highly liquidation Token to create artificial liquidation .

The Token that the hacker chose was BROCCOLI(714), a coin with low liquidation and low order-book depth. This is an ideal condition to cause strong price fluctuations with only a small amount of Capital .

The attacker actively bought spot BROCCOLI(714) with the compromised account, and opened leveraged futures positions in multiple different accounts.

The objective appears to be to trade back and forth internally, driving up spot prices, leveraging the Derivative market , and quietly transferring value out of the system.

The order Order Book is confusing.

This forced trading volume drastically distorted the market, driving spot prices up while futures prices lagged behind and the volume of buy orders increased irrationally—a level no shrewd "whale" would achieve. However, this strategy left a clear mark and caught the attention of one trader early on.

Trader Vida, who held both spot and futures positions with BROCCOLI(714), was alerted almost immediately by the system. According to Vida, the automated tools he installed detected an unusual price increase of more than 30% in just 30 minutes, along with a strong discrepancy between spot and futures prices.

What caught Vida's attention was not only the price movement but also the trading structure. According to Vida, Binance's order book spot unexpectedly piled up tens of millions of USDT on the buy side for a Token with a market Capital of only about $30-40 million at the time. Conversely, the futures market had very thin buy orders.

“Looking at that, I thought either the account was hacked, or the market maker program malfunctioned, because no whale would do charity work like this—nobody would put money down so aggressively in a spot like that,” Vida Chia .

This isn't the typical FOMO effect; it's a deliberate buying compulsion.

Follow the wave of manipulation — then reverse.

Recognizing the anomalous nature of the situation, Vida decided to buy early, following the artificial pump created by the hacker to transfer funds. As the spot pressure intensified, the price surged, confirming his prediction.

But Vida had already made a plan to offload the goods.

He closely monitored the order book spot, looking for key signals: large buy orders suddenly disappearing. For Vida, this was likely a sign that Binance's risk control system was getting involved, limiting the activity of hacked accounts.

That signal appeared after 4:30 AM Chinese time. The large buy orders disappeared completely, and this time they didn't return.

Vida immediately closed all his Longing positions, selling both his previously held Token and newly accumulated holdings. Shortly afterward, he switched to opening a large Short position in futures as liquidation dried up and prices began to fall sharply.

The wave of selling happened quickly. BROCCOLI prices (714) fell sharply as the virtual buying power disappeared, just as the scenario had predicted.

A transaction that should never have existed.

At the end of this chain of events, Vida earned a profit of approximately $1 million— XEM his first major successful trade of the new year. This profit didn't come from predicting price trends, but rather from correctly identifying unusual market behavior, understanding the underlying motives, and acting promptly when the structure was broken.

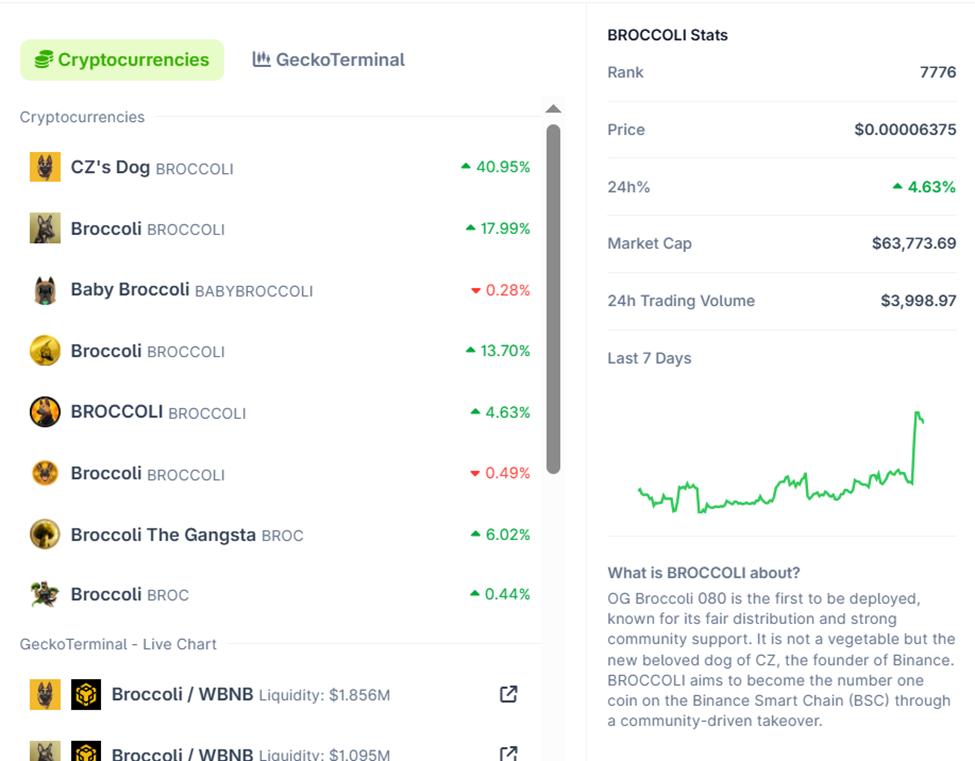

This event caused all BROCCOLI-related Token to surge in price, with many even experiencing double-digit increases.

Price fluctuations of BROCCOLI Token . Source: CoinGecko

Price fluctuations of BROCCOLI Token . Source: CoinGecko"Why I didn't catch the broccoli wave: I was sleeping… I wasn't waiting for good news, and then I got hacked. What a shame, I missed the chance to grab the vegetables while I was sleeping. Thinking back, I should probably set an alarm, because from the moment the price pumped up to 150 million, it lasted almost an hour, so those who were stuck in their positions before still had time to adjust. New Year's lesson: sleeping too much makes it hard to get rich!" one user commented .

This incident shows that in the crypto market, prices can be misleading, stories can be deceptive, but order books are very difficult to lie about.

This time, the hacker's attempt to exploit market mechanisms created massive volatility in a short period—and thanks to the warning system and experience, someone turned that turn into the first $1 million win of 2026 in crypto.