An investigation into the Lighter (LIT) Token ecosystem has caused concern among many investors, after blockchain data revealed coordinated sales transactions totaling $7.18 million since the Token Generation Event (TGE).

This activity is raising alarm bells about the potential for insider trading and transparency issues in the Lighter project, a decentralized finance (DeFi) protocol built on Ethereum.

Coordinated deposits and questionable patterns overshadowed positive sentiment.

Five linked wallets received nearly 10 million LIT Token from the recent Airdrop , representing approximately 4% of the total circulating LIT supply. These wallets have begun selling off a significant portion of their Token holdings.

Analysts have noted that the way these wallets deposit, allocate, and sell Token appears to be a deliberate strategy, rather than natural market trading activity.

A blockchain researcher nicknamed MLM was the first to discover these activities, stating that an organization deposited approximately $5 million USDC into Lighter's liquidation protocol (LLP) around April 2025.

This amount was Chia equally among 5 wallets, with each wallet receiving a total of 9,999,999.60 LIT Token (approximately $26 million USD at the time of distribution).

List of major wallets used to deposit into LLP:

- 0x30cD78B301192736b3D6F27Bdad2f56414Eb6164

- 0x9A6D9826742f1E0893E141fe48defc5D61866caD

- 0x7c5d228B0EB24Ad293E0894c072718430B07Dfe3

- 0xc0562d68b7C2B770ED942D28b71Bc5Aa0209bbee

- 0xfdBf615eC707cA29F8F19B7955EA2719036044bf

This even and uniform allocation has attracted considerable attention, as it represents 1% of the total supply and 4% of the circulating LIT Token . As such, this group has a significant influence on the market.

In addition to the Token received from the Airdrop, these wallets also earned an extra $1–2 million from farming profits on LLP, further increasing the total value of assets held by this group.

The sale of $7.18 million worth of shares has raised concerns in the community.

Since TGE, these linked wallets have sold 2,760,232.88 LIT Token , equivalent to approximately $7.18 million. Many believe that this consistent selling pattern is concerning, indicating a strategic profit-taking strategy rather than a normal market reaction.

Comments from blockchain investigator ZachXBT suggest that this is most likely an insider's opportunistic act. Meanwhile, analyst Henrik also questioned the consequences for the LIT community as a whole.

"If this is true, it's a really big concern for all retail investors holding $LIT, especially since the Lighter team hasn't made any transparent announcements," Henrik Chia .

The most significant issue is the silence from the Lighter team. Many investors say they have yet to receive any official information regarding Token allocation, Token distribution schedule, or distribution methods.

Without transparency, it is difficult to distinguish between normal market transactions and insider selling.

This controversy comes at a time when DeFi is facing numerous risks related to crypto airdrops and Token distributions.

Airdrop are typically created to reward early users and encourage decentralized ownership. However, if an organization exploits this mass deposit and Token Chia model, they may end up with rewards that are excessively large compared to the general market.

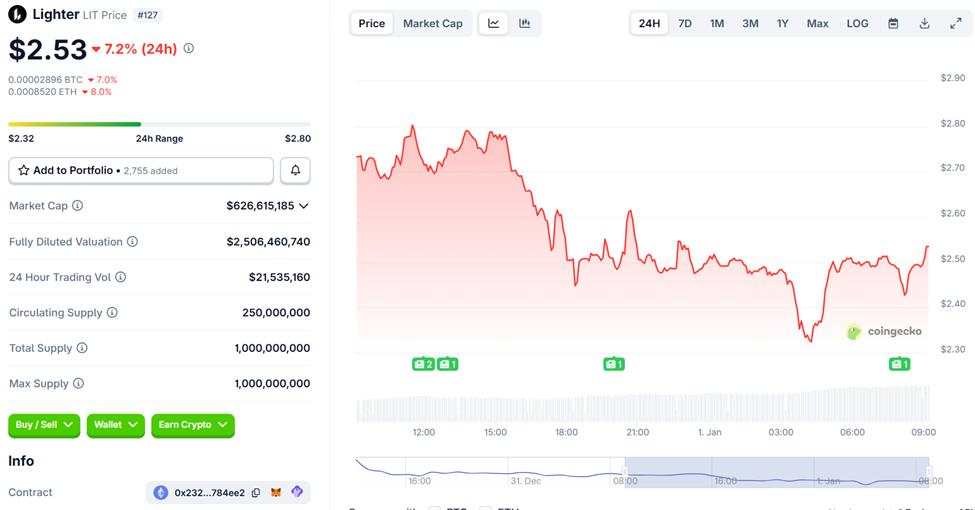

Reported selling activity is putting downward pressure on the Token 's price and raising concerns within the community about governance and consensus within the development team. At the time of writing, Lighter's LIT Token price has fallen by more than 7% and is trading around $2.53.

Lighter (LIT) price volatility. Source: CoinGecko

Lighter (LIT) price volatility. Source: CoinGeckoIf another 7 million LIT Token are sold from these wallets, the LIT market could become even more volatile.