Arthur Hayes, co-founder of BitMEX, has just made significant strides into the DeFi space by shifting Capital from Ethereum to Token of protocols that he believes will experience a strong recovery in 2026.

on-chain data shows that Hayes has invested over $3.4 million in four DeFi assets: $1.97 million in ENA, $735,330 in ETHFI, $515,360 in Pendle , and $259,960 in LDO.

What Token is Arthur Hayes accumulating for 2026?

This accumulation is taking place while these Token are trading at prices significantly lower than their previous peaks, reflecting the overall downturn in the DeFi sector.

Lookonchain stated that Hayes also converted an additional $5.5 million from Ethereum to a range of other DeFi protocols, including:

- 4.86 million ENA Token, worth $986,000.

- 697,851 ETHFI Token, worth $485,000.

Approximately 50% of Hayes's portfolio is focused on Pendle, a yield Tokenize protocol.

Arthur Hayes consistently accumulates these Token whenever the price drops, demonstrating his belief in their long-term value. According to crypto analyst Ted Pillows, these withdrawals have been recently validated.

“Arthur Hayes continues to buy DeFi Token. Today, he just withdrew $1,969,780 worth of ENA, $735,330 worth of ETHFI, $515,360 worth of Pendle , and $259,960 worth of LDO,” Ted Chia .

This continuous accumulation reflects an investment strategy based on core value, rather than short-term speculation.

Factors driving Arthur Hayes' bets: from ETF potential to revenue growth.

Each Token that Hayes has invested in is tied to a unique growth expectation.

ENA could benefit as Bitwise has just filed for a new ETF encompassing 11 cryptocurrencies , opening up the possibility of attracting institutional Capital .

Pendle recorded strong revenue despite the Token price remaining low, providing investors with a stable quarterly cash flow.

“The financial report shows that cash continues to flow in, and the pace is increasing in key areas. For Pendle, 2025 is expected to continue the clear cycle. Revenue reached $12.88 million in Q1, $7.52 million in Q2, $16.17 million in Q3, and $8.02 million in Q4,” Peg Nguyen commented .

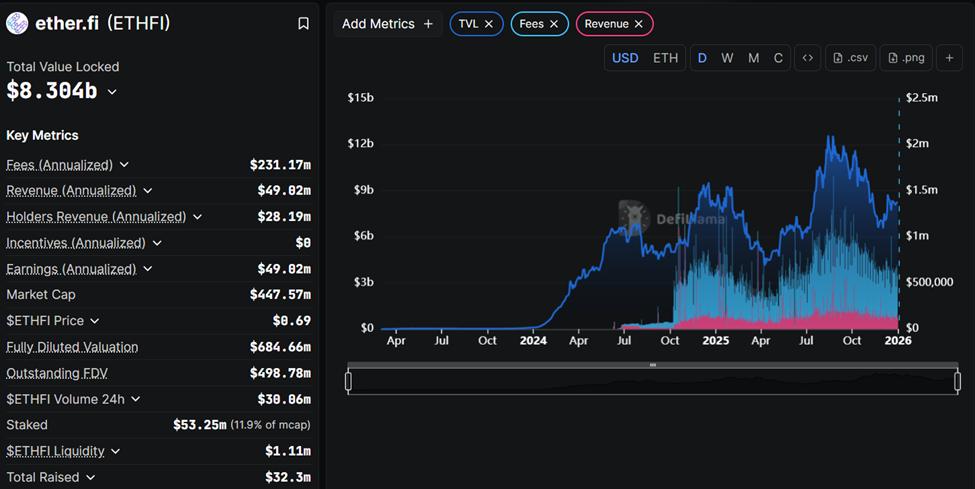

Ether.fi (ETHFI) also recorded record revenue after rebranding as a Neobank , with monthly card payment volume nearing $50 million.

This protocol is implementing a Token buyback program worth between $500,000 and $1.5 million per week, which is expected to be combined with a reduction in Token Issuance starting in 2026, helping to limit selling pressure.

Ether.fi's on-chain index. Source: defillama

Ether.fi's on-chain index. Source: defillamaInvesting in Lido's LDO allows participation in Ethereum Staking . Lido controls nearly 25% of the ETH Staking supply — more than double that of its biggest competitors.

In addition, Ether.fi's large treasury and market leadership will help the protocol keep up with the increasing demand for Staking in the future.

Although these moves suggest Hayes believes in the recovery of DeFi, the market remains subdued. Factors such as ETF approvals, Token Issuance schedules, and competition in Staking could all impact investment outcomes.

Concentration risk is noteworthy, with over 60% of Hayes' portfolio still tied to a sector that has just experienced a sharp downturn.

However, Hayes's consistent buying at low prices suggests he's pursuing a long-term strategy. By shifting Capital away from Ethereum and focusing on DeFi protocols with revenue, market share, and the potential to attract institutional Capital , Hayes is preparing for a potential resurgence in the sector in 2026.