If you're reading this on New Year's Day 2026, cryptocurrency whales may have already acted before you. While most retail investors are still waking up slowly, large wallets have started buying and selling earlier, revealing where big money wants to get ahead.

Some cryptocurrency whales are preparing for a seasonal rally, while others are taking advantage of the situation to withdraw due to clear warning signs. The overall picture of cryptocurrency whale activity on New Year's Day will reveal the next trends in the flow of large sums of money.

Chainlink (LINK)

Crypto whales started 2026 by buying Chainlink. The total amount of LINK held by whales increased from 505.34 million LINK on December 31st to 505.7 million LINK on New Year's Day. That's an increase of approximately 0.36 million LINK, equivalent to about $4.46 million at current prices. Early whale confidence is always significant, especially since January is typically the strongest month in history for LINK.

Want more Token analysis like this? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

LINK Whales: Santiment

LINK Whales: SantimentLINK previously increased by +25.3% in January 2025, +24.9% in January 2023, and as much as +100.7% in January 2021. The Medium increase in January was approximately +26.4%, which may be why whales have already secured their positions.

LINK Price Performance: CryptoRank

LINK Price Performance: CryptoRankIt's possible that whales are betting that the strong upward trend earlier this year will repeat itself.

The LINK price chart also needs to support this scenario. First, Chainlink needs to bounce up 2.5% to break through the $12.49 resistance level. If it breaks through, LINK could head towards $13.36 and $13.76, levels that have been strong resistance since December 12th. If it successfully conquers and holds above $13.76, the next target will be $15.01, and if it surpasses this level, LINK could aim for $16.77.

Chainlink Price Analysis: TradingView

Chainlink Price Analysis: TradingViewThis bullish scenario would weaken if the price falls below $11.71, which would shake the whales' optimism in January. If that happens, the whales' early-year accumulation could turn out to be a "wrong move."

Ethena (ENA)

Crypto whales are selling off Ethena (ENA) again on New Year's Day. Their total ENA holdings decreased from 6.31 billion ENA on December 31st to 6.29 billion ENA on January 1st. This means they sold 0.02 billion ENA, equivalent to 20 million ENA, and at the current price, approximately $4.20 million has left their wallets. This selling pressure is in stark contrast to the earlier accumulation of Chainlink , indicating a pessimistic sentiment towards ENA.

ENA Whales: Santiment

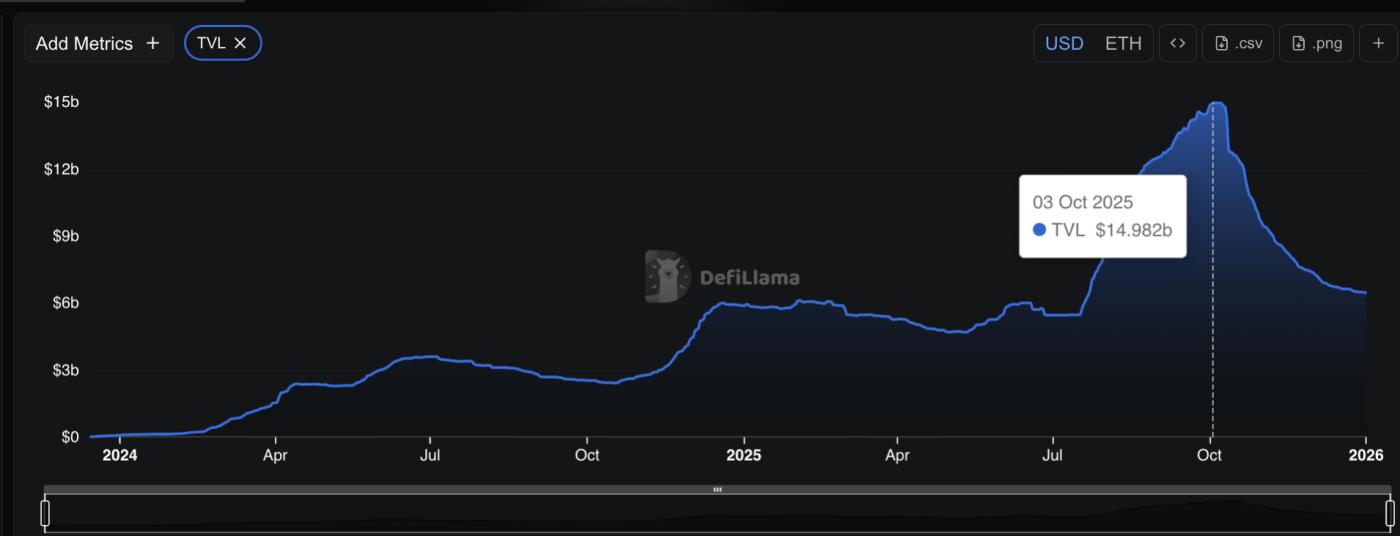

ENA Whales: SantimentThis caution also reflects what's happening on the "platform." Ethena's TVL (Total Value Locked) has plummeted from $14.98 billion on October 3rd to approximately $6.48 billion currently, a drop of over 56%. A more than 56% decrease in TVL indicates a sharp decline in the number of users, lending or borrowing activity, and weakened confidence in the project. This is why whales may be taking advantage of the situation to sell off at the beginning of the year.

Ethena TVL: defillama

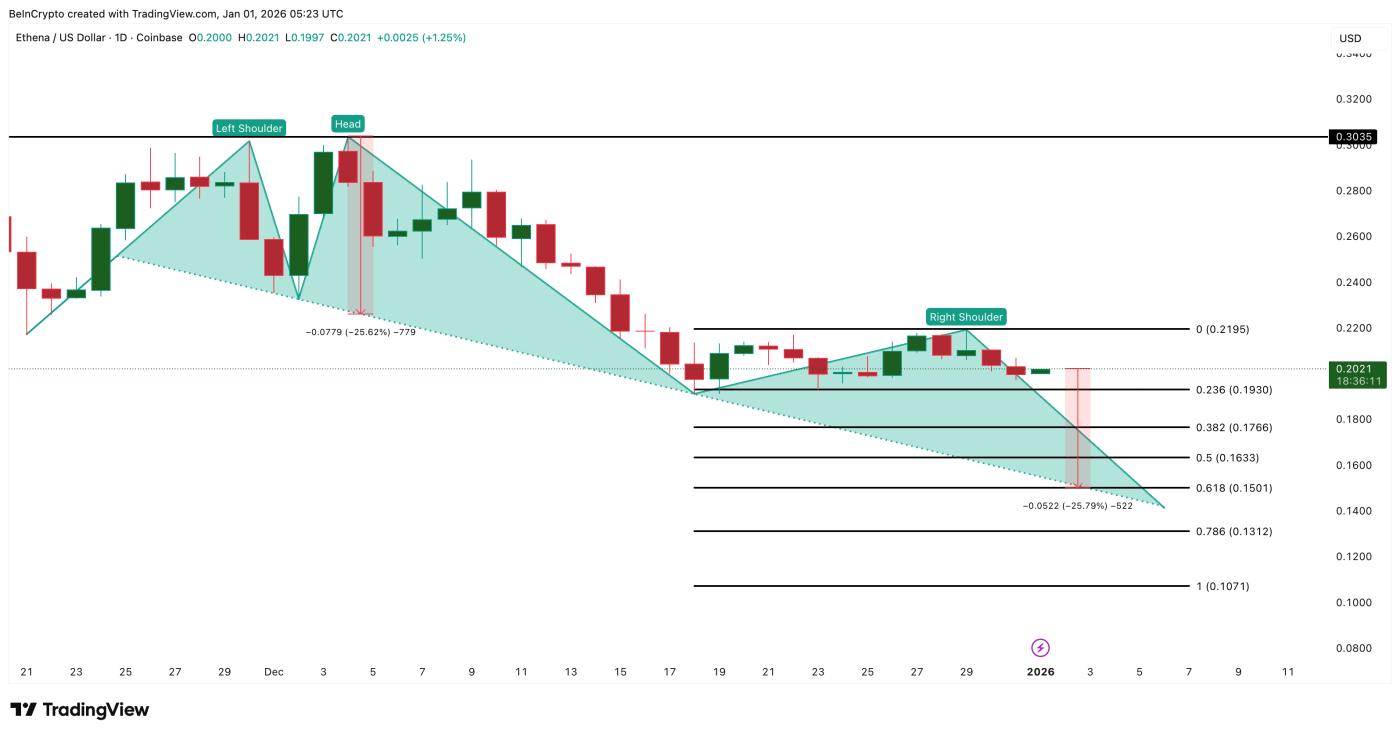

Ethena TVL: defillamaThe ENA price chart also reflects this cautious sentiment. A Vai-and- Vai pattern is forming, and the downward sloping neckline indicates that selling pressure is continuously creating lower support levels.

This scenario carries significant risks because each time the price bounces up, it quickly reverses and falls again. If it breaks through support, the risk of a complete collapse increases. If the neckline around $0.15 is breached, the price of ENA could fall by approximately 25%, heading towards the $0.10 region.

This bearish pattern maintains the risk of a further decline for ENA even before reaching the neckline, with the first key support zone at $0.17.

ENA price analysis: TradingView

ENA price analysis: TradingViewFor buyers, there are several crucial price levels. If the price breaks above $0.21, selling pressure will significantly decrease. If it regains the $0.30 level, the “head” pattern on the chart will be invalidated, and market sentiment could reverse positively.

Currently, continuous whale selling, a 56% drop in TVL, and a rather negative chart structure are the main reasons why ENA is being classified as a sell opportunity as cryptocurrency whales prepare to enter 2026.

Pendle (Pendle)

Whales are buying Pendle on New Year's Day despite the price chart signaling risk. The amount of Pendle held by whales increased from 193.54 million Pendle on December 31st to 194.31 million Pendle, meaning they accumulated approximately 0.77 million Pendle, worth about $1.42 million at current prices. This cautious buying activity is quite unusual because Pendle has just risen 7.7% in the past seven days, even though the trend on the chart is not yet favorable.

Pendle Whales: Santiment

Pendle Whales: SantimentOn the chart, Pendle is forming a “bear flag” pattern after falling 42% from its November 2025 peak.

Furthermore, this model warns that if the support level is breached, the price could continue to fall further. The first and most important support zone is at $1.81. If this level is lost, the price could easily fall to $1.65; if it breaks through $1.65, the market is likely to plummet. Therefore, the accumulation of whales in this area is quite unusual: they are accepting the risk of further price declines.

There's still another reason why whales are taking such risks. The Smart Money Index has just crossed above the signal line, indicating that experienced traders have started buying. It's possible that whales are following their belief in this flow of smart money.

Pendle price analysis: TradingView

Pendle price analysis: TradingViewIf Pendle breaks above $1.94, there's a high probability it will test the $2.31 level. If it breaks through $2.31, the bear flag pattern will no longer be valid, and market sentiment will likely reverse to a more positive direction.

Currently, Pendle is the most interesting case among the three. Whales are buying despite the risk of a decline, and smart money is also accumulating. If Pendle holds at $1.81 and surpasses $1.94, this will be an attractive breakout point for speculators. But if it falls below $1.65, this confidence will lose its value, and a bear flag pattern could cause the price to plummet further.