In the past 24 hours, more than $30 million in leveraged positions in the cryptocurrency market have been liquidated.

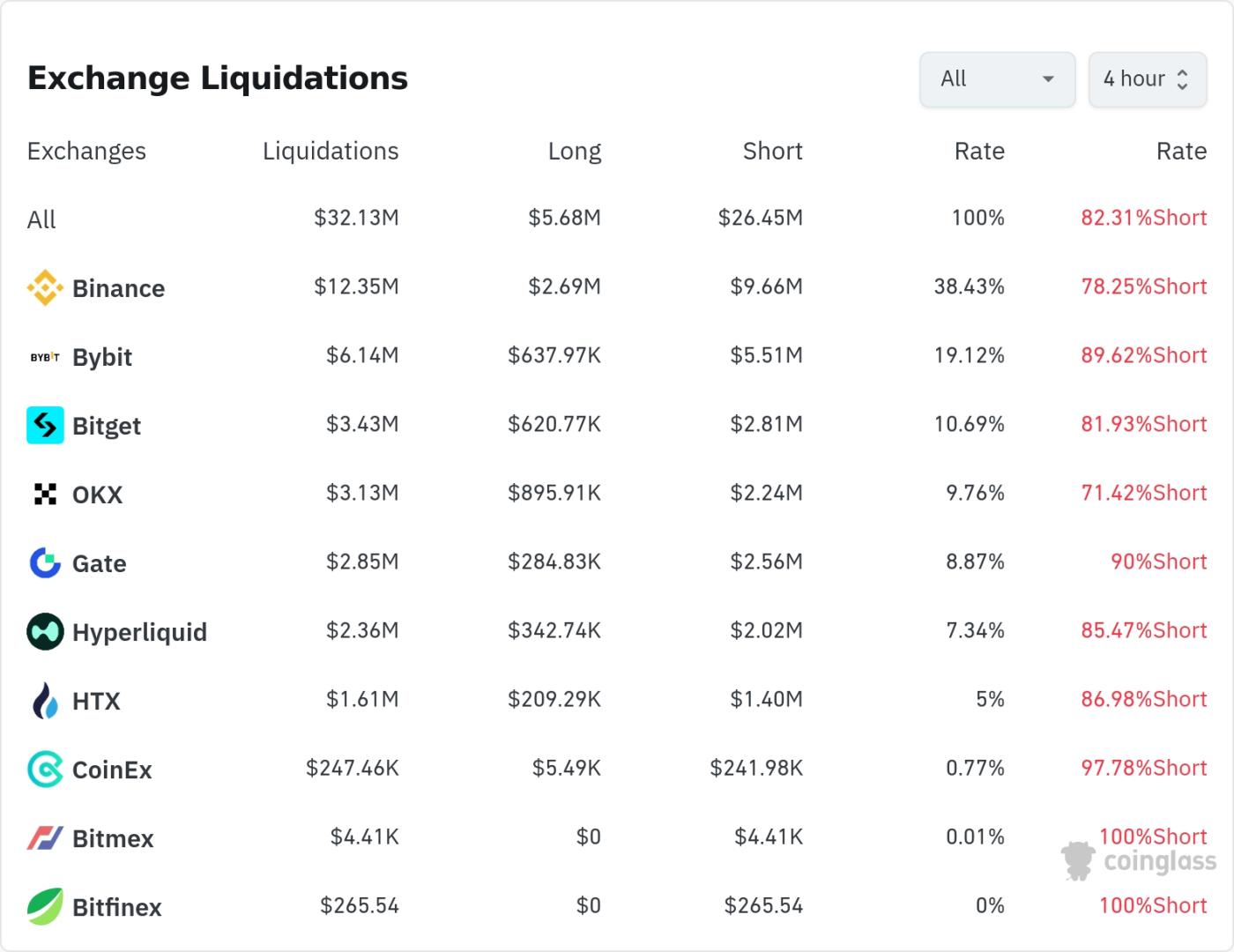

According to the current aggregated data, short positions accounted for 82.31% of the liquidated positions, while long positions accounted for 17.69%. This appears to be a result of the recent upward trend in the market.

In the past four hours, Binance saw the most position liquidations, totaling $12.35 million (38.4% of the total). Short positions accounted for 78.25% of these liquidations.

The exchange with the second-most liquidations was Bybit, with $6.14 million (19.1%) of positions liquidated, of which short positions accounted for 89.62%.

OKX experienced approximately $3.13 million (9.7%) in liquidations, with short positions accounting for 71.42%.

It is worth noting that the short position liquidation ratio of BitMEX and Bitfinex reached 100%, and CoinEx also showed a short position liquidation ratio as high as 97.78%.

By currency type, LIGHT token-related positions saw the most liquidations. Approximately $28.82 million in LIGHT positions were liquidated within 24 hours.

Approximately $18 million worth of Bitcoin (BTC) positions were liquidated in the past 24 hours. On a 4-hour basis, $268,000 of long positions were liquidated, while $6.24 million of short positions were liquidated. The current price of Bitcoin is $88,312, up 0.91% in the past 24 hours.

Ethereum (ETH) positions were liquidated in 24 hours, with approximately $13.52 million in positions being closed.

Solana (SOL) saw approximately $5.41 million liquidated in the past 24 hours. On a 4-hour basis, this includes $177,000 in long positions and $275,000 in short positions. The current Solana price is $125.72, up 1.14% in the past 24 hours.

Dogecoin (DOGE) saw a significant price increase of 7.41%, resulting in $3.96 million in liquidations within 24 hours. On a 4-hour basis, this included $126,000 in long positions and $508,000 in short positions.

In particular, meme coins like PEPE experienced a significant liquidation during a sharp price increase of 16.62%; AVAX, along with a sharp price increase of 10.29%, saw $9,400 of long positions liquidated and $1.02 million of short positions liquidated within 4 hours.

The HYPE token fell 5.25%, resulting in a significant liquidation of $690,000 in long positions within 4 hours.

In the cryptocurrency market, "liquidation" refers to the forced liquidation of leveraged positions when traders fail to meet margin requirements. This large-scale liquidation, occurring amidst the recent strong upward trend in the cryptocurrency market, is characterized by an overwhelming surge in short positions.

Article Summary by TokenPost.ai 🔎 Market Analysis: The cryptocurrency market has recently shown a strong upward trend, leading to a large-scale liquidation of short positions. The most liquidations occurred on Binance and Bybit, followed by LIGHT, Bitcoin, and Ethereum in descending order of liquidation amount. The significant price increases of Altcoin such as Dogecoin and AVAX are also noteworthy. 💡 Strategy Highlights: The current market shows strong upward momentum, short short positions risky. Especially for tokens like AVAX and PEPE, which have seen gains exceeding 10%, attention should be paid to the potential for further increases and volatility. In an uptrend, appropriate leverage control is crucial. 📘 Terminology: - Liquidation: The forced liquidation of a position in leveraged trading due to failure to meet margin requirements. - Long Position: A position bought in anticipation of an asset price increase. - Short Position: A position sold in anticipation of an asset price decrease. - Leverage: A form of lending that allows investors to trade with more than their own capital . TokenPost AI Notes: This article summary uses a language model based on TokenPost.ai. The main content of the text may be omitted or may not be consistent with the facts.