Ethereum's price has been steadily rising over the past few sessions, indicating a slow but consistent recovery. However, ETH is still struggling to attract consistent support from retail investors, which is limiting the upward momentum.

This indecisiveness makes reaching the highly anticipated $4,000 mark even more difficult for the "king of altcoins," despite signs of improving overall market conditions.

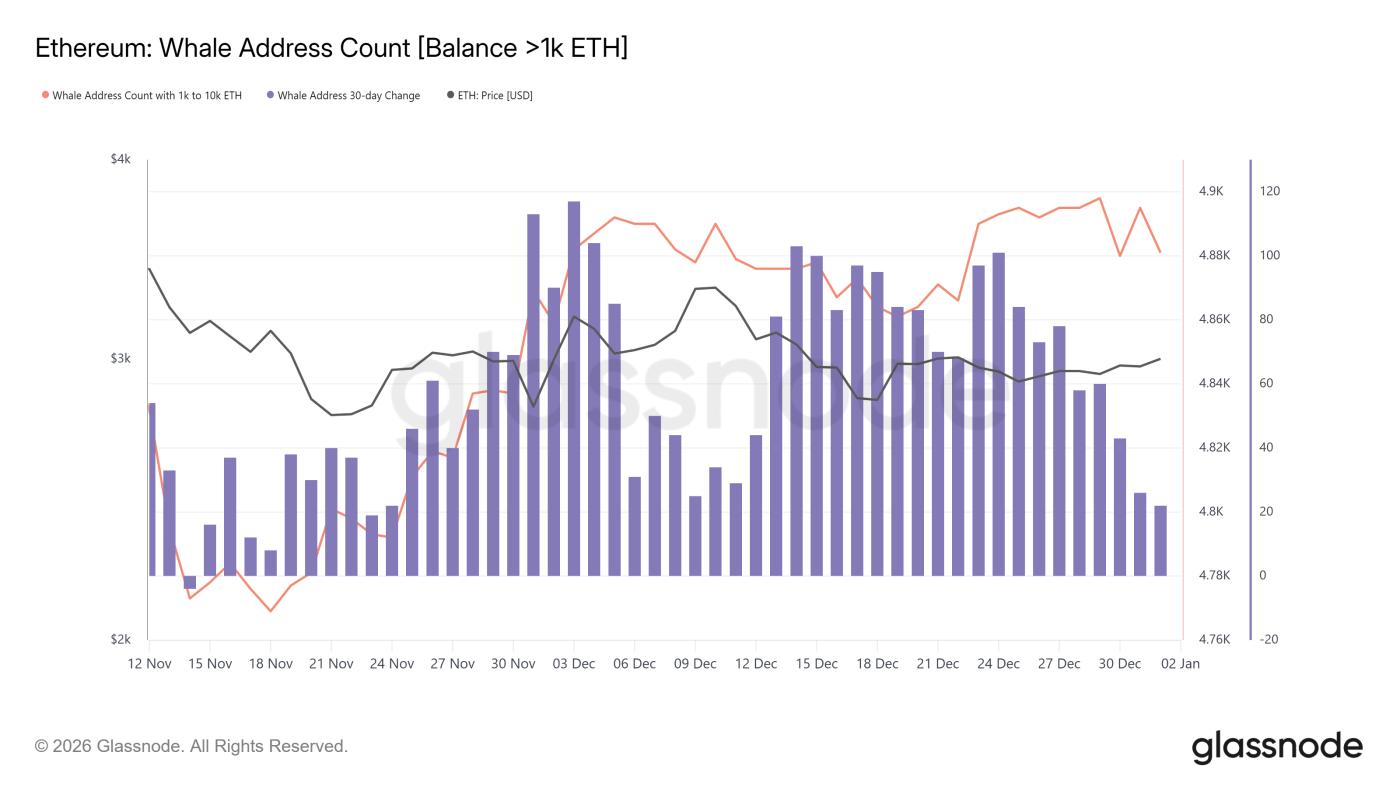

The number of Ethereum whales continues to decline.

The activity of Ethereum whales shows increasing caution from large Ethereum holders. Whale address tracking data shows a decrease in 30-day volatility, indicating that this group is reducing its participation in the market. When the number of whales maintaining or increasing positions decreases, this usually signals weakening confidence in a short-term price increase.

This withdrawal could indicate that whales are XEM their investments as the upside prospects are no longer clear. Typically, large investors accumulate aggressively when they are truly confident in the market. Their current pause in buying reflects a pessimistic short- and medium-term sentiment, putting pressure on Ethereum's potential for a strong rebound unless new demand emerges.

Want more insights on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Number of Ethereum whale addresses. Source: Glassnode

Number of Ethereum whale addresses. Source: GlassnodeSeveral macroeconomic indicators also suggest that the Ethereum market is facing significant challenges in its price recovery. ETH spot ETFs ended 2025 on a negative note, recording net Capital of up to $72 million. This reflects the cautious sentiment of major financial institutions amidst a volatile market.

At the start of the new year, institutional participation remains very cautious. In the past month, spot ETH ETFs have only seen increased Capital inflows five times. The withdrawal of Capital by institutional investors further reduces liquidation , thereby limiting the potential for sustainable growth due to a lack of significant momentum.

Ethereum ETF Capital flows. Source: SoSoValue

Ethereum ETF Capital flows. Source: SoSoValueETH price faces a critical supply zone.

Ethereum's price has shown initial signs of recovery in 2026. ETH has just reclaimed the $3,000 mark, breaking through this resistance level for the first time in 10 days. This is an important psychological milestone, but it's only the first step on the journey towards the larger target of $4,000.

The next challenge for ETH lies at the current 32% higher level, where ETH is trading around $3,014. The price remains stuck in a Falling Wedge pattern. For a clear breakout, ETH needs to decisively surpass the $3,131 mark, which could attract new buying interest and reverse the market trend.

ETH price analysis. Source: TradingView

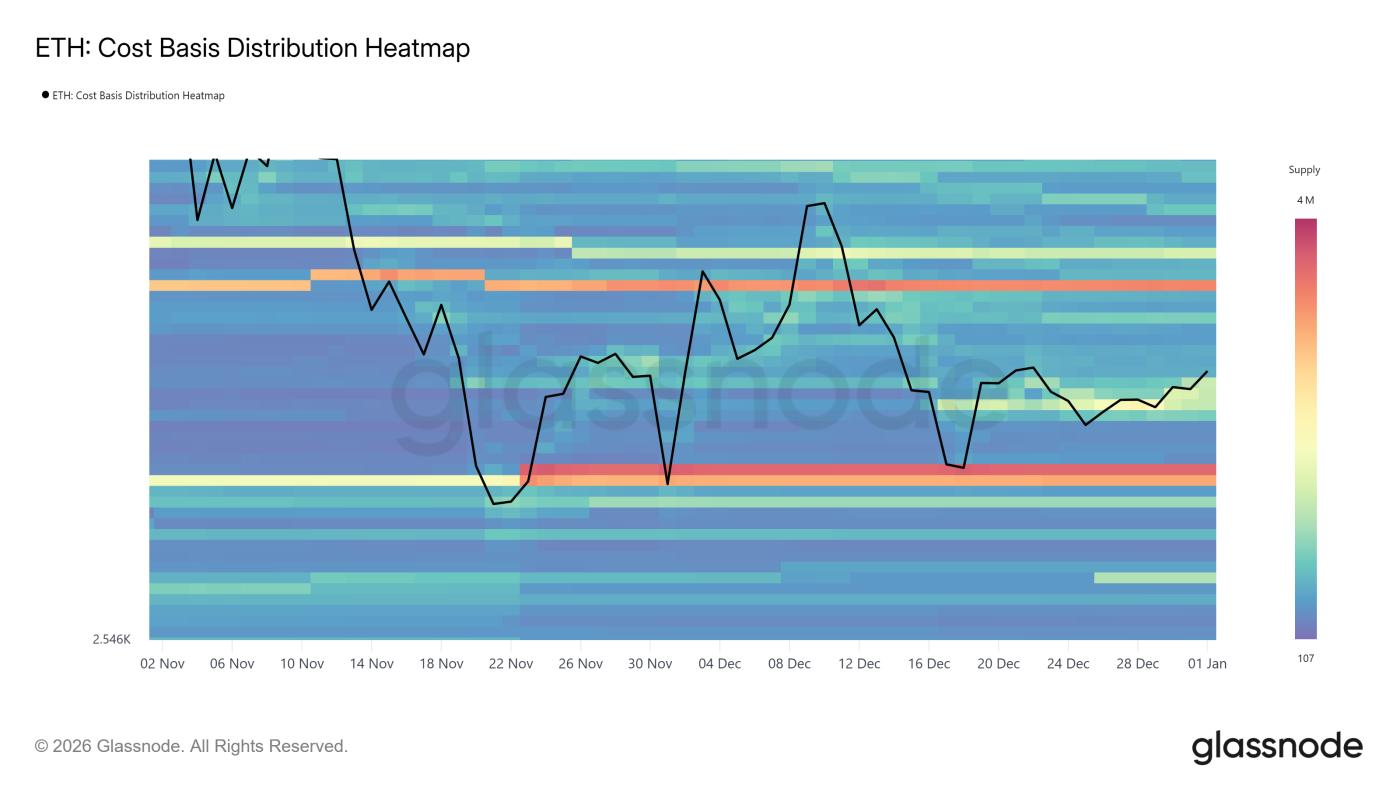

ETH price analysis. Source: TradingViewReaching this level is not easy due to the large supply of sell orders in this price range. The Capital distribution heatmap shows that approximately 2.83 million ETH were accumulated in the price range of $3,151 to $3,172. This area forms resistance because many people will tend to sell when the price approaches it to recover Capital.

Without strong buying pressure, Ethereum is likely to continue trading sideways below $3,131. The price may fluctuate around this level as sellers remain dominant while buyers hesitate. This sideways movement suggests the market is waiting for a more definitive signal rather than making a strong bet on higher prices.

Ethereum's cumulative Capital heatmap (CBD Heatmap). Source: Glassnode

Ethereum's cumulative Capital heatmap (CBD Heatmap). Source: GlassnodeThis pessimistic picture can only be refuted if there is strong renewed participation from whales and positive macroeconomic factors. If large Capital flows into Ethereum through spot markets or ETFs, it would indicate a return of investor confidence. With consistent participation from financial institutions, ETH could surpass the $3,131 mark and move towards $3,287, regaining its upward momentum.