As per your request, we have compiled cryptocurrency market liquidation data into an HTML article. Using the data you provided, it includes content on BTC and ETH, supplemented with information on noteworthy tokens.

```html

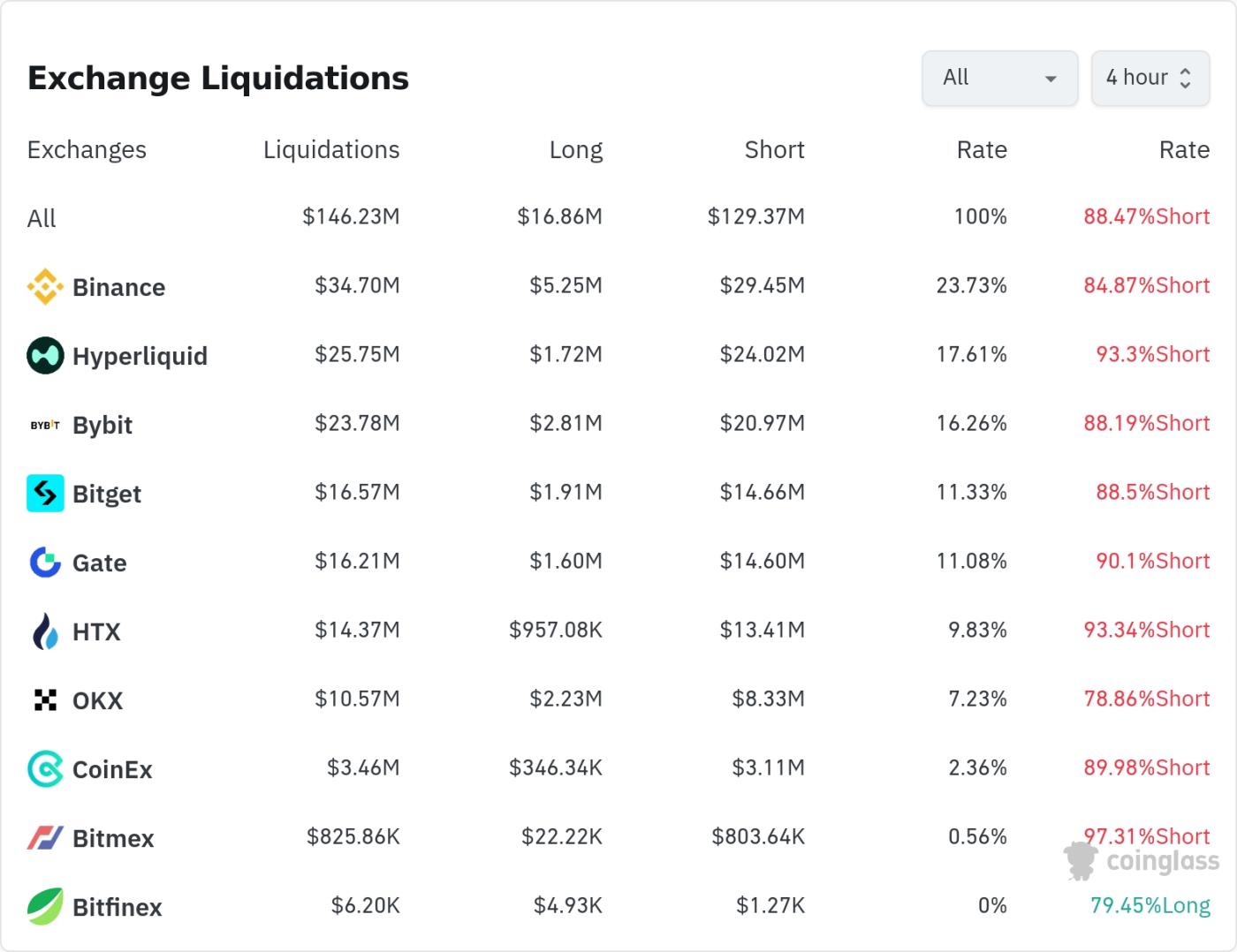

In the past 24 hours, approximately $146.23 million (about 214.5 billion won) of leveraged positions in the cryptocurrency market have been liquidated.

According to the currently compiled data, among the liquidated positions, long positions amounted to $129.37 million, accounting for 88.5% of the total; short positions amounted to $16.86 million, accounting for 11.5%.

Binance experienced the most position liquidations in the past 24 hours, totaling $34.7 million (23.7% of the total). Of these, long positions amounted to $29.45 million, or 84.9%.

The exchange with the second-most liquidations was Hyperliquid, with $25.75 million (17.6%) of positions liquidated, of which $24.02 million (93.3%) were long positions.

Bybit experienced approximately $23.78 million (16.3%) of liquidation, with long positions accounting for 88.2%.

It is worth noting that although Bitfinex had a relatively small liquidation scale (US$6.2 million), the liquidation ratio of long and short positions reversed, with the long position liquidation ratio actually being higher, reaching 79.5%.

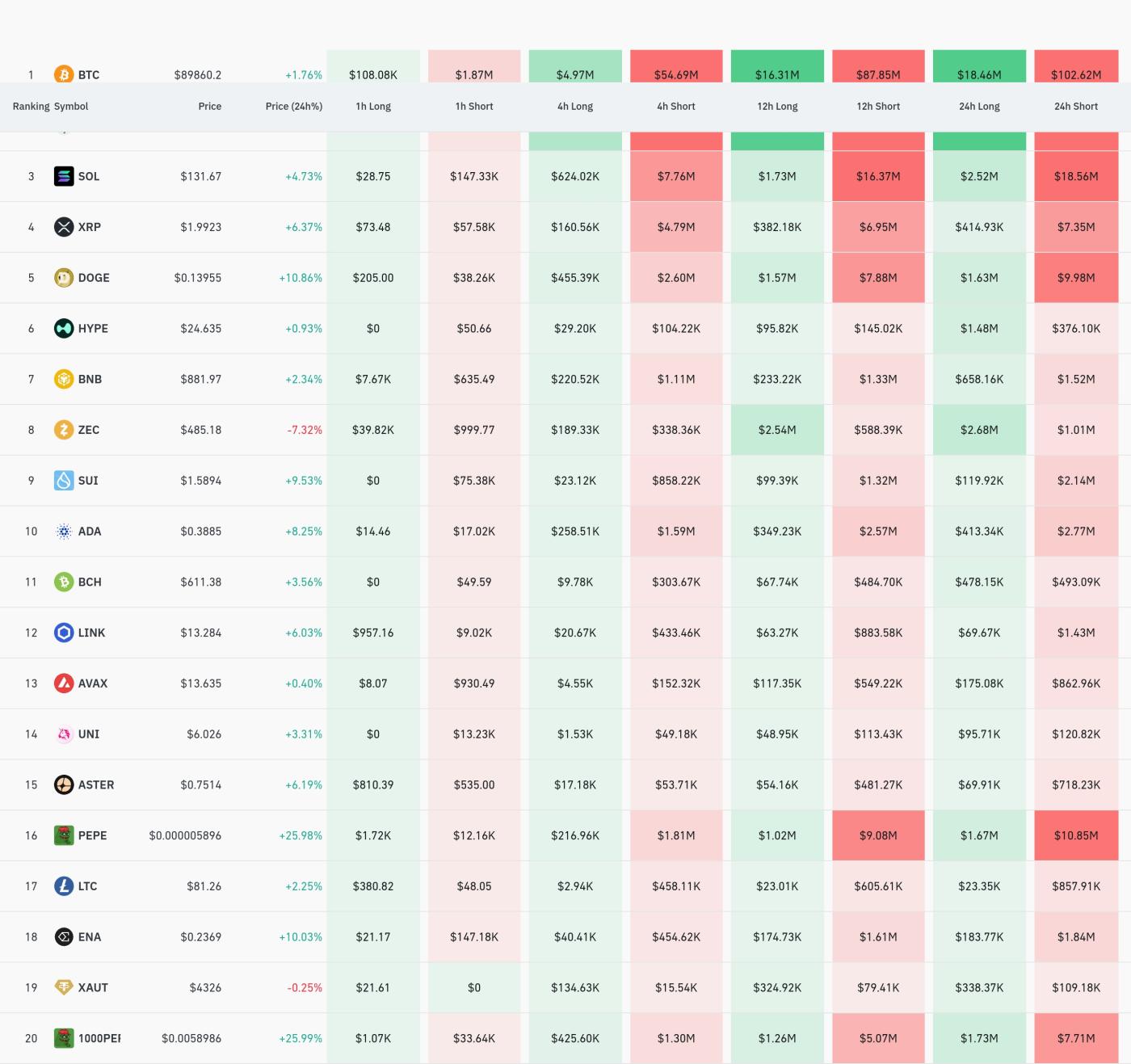

By token, Ethereum (ETH) and Bitcoin (BTC) related positions saw the most liquidations. In the past 24 hours, approximately $125.41 million in Ethereum positions were liquidated, while $121.08 million in Bitcoin positions were liquidated.

Regarding Bitcoin (BTC), at the current price of around $89,860.2, $4.97 million of long positions were liquidated and $1.87 million of short positions were liquidated in the past 4 hours.

Solana (SOL) liquidated approximately $21.09 million in the past 24 hours. Based on a 4-hour timeframe, long positions were liquidated at $624,020, while short positions were liquidated at $7.76 million. Notably, the scale of short position liquidations exceeded that of long positions, exhibiting a unique pattern.

Dogecoin (DOGE) also saw $11.62 million in liquidations, with $455,390 in long positions and $2.6 million in short positions liquidated in the past four hours.

Of particular note are the liquidation volumes of 1000PEPE and PEPE tokens. A total of $9.45 million of 1000PEPE was liquidated, and PEPE also recorded a considerable liquidation volume. Based on a 4-hour timeframe, $216,960 of long positions were liquidated and $1.02 million of short positions were liquidated.

XRP is also one of the tokens that experienced significant liquidations, with $160,560 in long positions liquidated and $4.79 million in short positions liquidated in the past 4 hours.

In the cryptocurrency market, "liquidation" refers to the forced liquidation of positions when traders holding leveraged positions fail to meet margin requirements. This liquidation data shows a high proportion of long positions being liquidated in major tokens, suggesting a recent shift in market expectations from upward to downward.

Article summary by TokenPost.ai

🔎 Market Analysis: Approximately $146.23 million in leveraged positions were liquidated in the past 24 hours, the majority (88.5%) of which were long positions. This indicates that market participants anticipated an upward trend, but a decline actually occurred.

💡 Key Strategy Points: It's worth noting that among major tokens, the liquidation of short positions in Solana and XRP significantly exceeds the volume of long positions. This suggests that these tokens may be experiencing a stronger-than-expected upward trend.

📘 Terminology Explanation: Liquidation refers to the action taken by an exchange to forcibly terminate a trader's position in leveraged trading when the value of the collateral falls below the maintenance margin. A long position is a trade in anticipation of a price increase, while a short position is a trade in anticipation of a price decrease.

```

TokenPost AI Notes

This article uses a language model based on TokenPost.ai to generate an article summary. The main content of the text may be omitted or may not be factual.