The year 2026 began amidst considerable uncertainty about how the crypto market would unfold this year. This anxiety was particularly evident after 2025 ended in stark contrast to widespread investor expectations.

Amidst Chia opinions, one major question remains: Will 2026 be the year the crypto market enters its worst bear market yet? BeInCrypto spoke with numerous industry experts to predict what might happen this year.

Bitcoin's four-year cycle may no longer determine its 2026 outlook.

Previously, BeInCrypto indicated that the forecast for the crypto market in 2025 was very optimistic, due to the US president's support for crypto and favorable macroeconomic factors such as the US Federal Reserve lowering interest rates and injecting more liquidation into the market.

Despite these drivers, the market ended the year in the red. Bitcoin fell 5.7% by the end of 2025, while the sharp sell-off in the fourth quarter caused Bitcoin to drop 23.7% – its worst fourth quarter since 2018.

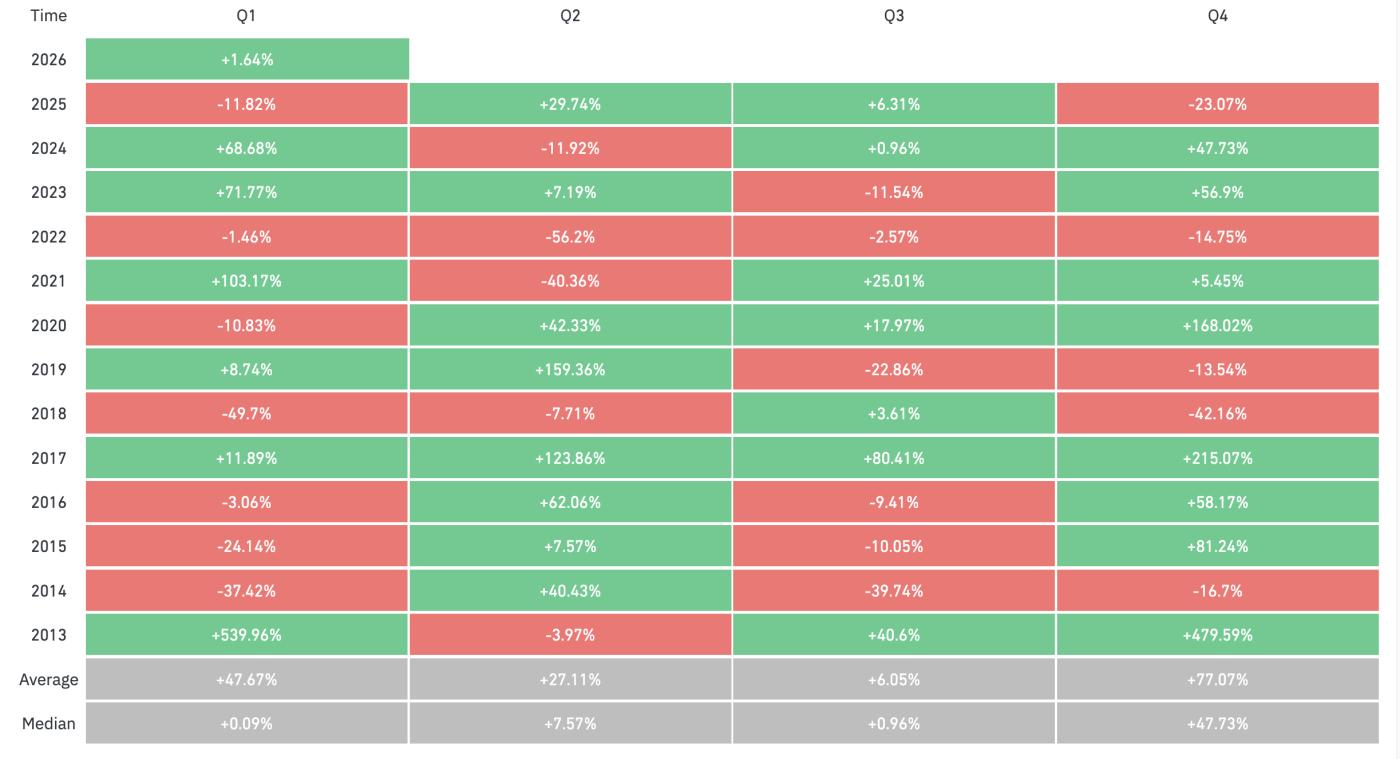

Bitcoin's quarterly performance. Source: Coinglass

Bitcoin's quarterly performance. Source: CoinglassThis disappointing result has forced many experts to revise their predictions and question future market trends. During periods of uncertainty, investors often look back at historical patterns to find direction.

For Bitcoin, the 4-year cycle model used to be the most frequently cited frame of reference for predicting the market's next move. According to this model, 2026 would typically be the starting point for a bear market.

So does this mean the market will continue to decline? That's not necessarily true. More and more experts are suggesting that this model may no longer hold true.

Nic Puckrin, an analyst and co-founder of Coin Bureau, said the four-year model is no longer the most appropriate analytical framework for Bitcoin. According to him, market dynamics have changed significantly since the introduction of ETFs and the strong influx of institutional money.

“While 2025 might be considered a disappointing year in terms of performance, that's not the case when considering the acceptance and participation of large institutions. From now on, the main drivers of the market will likely come from macroeconomic or geopolitical factors, rather than being based on time. Bitcoin is increasingly behaving like other financial assets, no longer just following the rhythm of halving events,” Puckrin Chia .

Jamie Elkaleh, Marketing Director of Bitget Wallet, also added that traditional macroeconomic cycles have now become more reliable. He stated:

“Bitcoin’s sensitivity to global liquidation , M2 money supply expansion, and Fed policy now far outweighs the mechanical impact of the halving event. We are witnessing a ‘unpacking’ process of the crypto halving cycle, as Capital flows from institutional ETFs help stabilize prices and mitigate volatility caused by supply shocks.”

Similarly, Andrei Grachev, Managing Partner at DWF Labs, also emphasized that while halving still has an influence, it is no longer the sole factor driving the market.

He Chia that as crypto gradually becomes an asset of institutions, it increasingly behaves like a global asset class, rather than a closed system. This makes cyclical predictive models less accurate than before.

Why won't 2026 follow the traditional bull-bear market model?

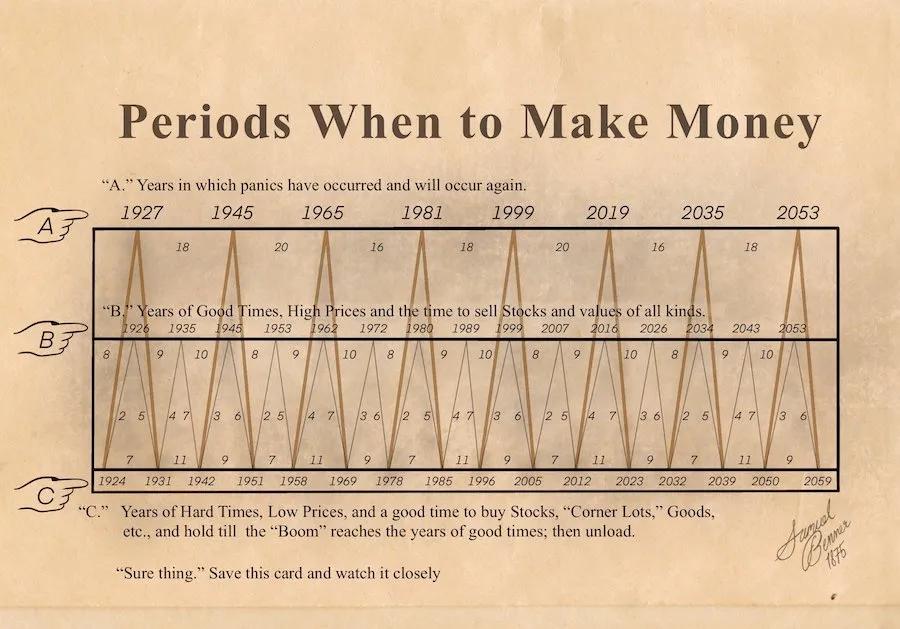

Instead of relying on the 4-year cycle, some analysts offer a longer-term reference framework such as the Benner Cycle. According to this model, 2026 is projected to be "The Year of the Bullish Period, with high prices and a good time to sell stocks and other assets."

Benner cycle. Source: Business Prophecies of the Future Ups and Downs in Prices

Benner cycle. Source: Business Prophecies of the Future Ups and Downs in PricesIf this model is correct, it would suggest a favorable market outlook. However, does this necessarily lead to a new price surge? Experts emphasize that the answer is no longer so simple.

Elkaleh told BeInCrypto that the market's failure to meet growth expectations in 2025 marks a clear shift from a highly speculative market to an asset class tied to macroeconomic factors.

“Instead of just two scenarios—up or down—2026 is becoming a period of market structural consolidation. Excessive leverage has been washed away, but new foundations—such as ETFs, corporate Capital , and some clear regulatory frameworks like the GENIUS Act—suggest that even if there is a price drop, the new price level could be higher than previous cycles. As interest rate cuts help stabilize the cost of Capital, this consolidation phase could translate into a more sustainable and stable growth phase by the end of 2026, rather than just speculative price surges as before,” he Chia .

Mr. Grachev also shared this view, suggesting that 2026 may not follow the traditional up-and-down pattern of the past.

“I don’t think 2026 will follow a clear bull/bear pattern like before. Instead, we’ll see more divergence. Bitcoin will still be the market leader, but I’m not sure other crypto assets will rise in sync as in previous cycles,” he stated.

This expert also suggested that while altcoins may still experience significant volatility, the amplitude will be much wider than in previous years. All these developments indicate that the crypto market is gradually moving towards a more stable, disciplined, and supply-demand-sensitive phase.

Grachev emphasized that the “painful reset” during the October 10th downturn had helped put the market in a healthier state. From now on, the market will no longer be as fragile as before and will be more sensitive to demand.

Finally, Puckrin described the past few months as a revaluation period, in which long-term "OG" investors sold off and institutions bought the excess.

"In the next few months, I still expect the market to rebalance, paving the way for a new price peak next year. However, there will certainly still be a lot of volatility and challenges ahead," he Chia .

Crypto bear market scenario in 2026: What could happen?

While the overall outlook remains somewhat optimistic, history shows that markets can always move against predictions. BeInCrypto consulted experts on the factors that could realistically cause the crypto market to enter an extreme bear cycle in 2026.

According to Puckrin, for a strong bearish scenario to occur, several factors need to converge. These include tight global liquidation , a prolonged risk-averse environment, and a structural shock.

For Bitcoin, this shock could occur when a large number of funds holding the digital asset sell off simultaneously while the Capital market is already weak and unable to absorb such a large supply.

"The bursting of the AI bubble could also be a factor dragging the crypto market down. However, if money flows and demand return, this bear scenario is less likely to occur in 2026," the analyst commented.

Elkaleh argues that if an extreme bear market emerges in 2026, the primary cause will be external shocks, rather than inherent weaknesses within the crypto sector.

“Key risks include the bursting of the AI bubble causing US stocks to plummet, the Fed tightening policy if inflation Dai , or systemic confidence crises such as the collapse of major exchanges or the bankruptcy of over-leveraged digital asset holders. If institutional capital flows halt due to geopolitical instability and a lack of new buyers, Capital could flee more quickly, pushing prices back to the $55,000–$60,000 range, as has been seen historically,” this leader analyzed.

Konstantins Vasilenko, co-founder of Paybis, believes that if a bear market occurs in 2026, it will be a continuation of the current situation, primarily due to institutional control and limited participation from retail investors.

"If institutional cash flow slows down or stays on the sidelines while retail investors remain inactive, downward pressure could persist without a clear impetus for recovery," Vasilenko commented.

Maksym Sakharov, co-founder and CEO of WeFi Group, warned that future pressure on the market could stem from leverage.

“There could be a ‘safe yield’ product or Algorithmic Stablecoin that works well until it becomes unstable. Or it could be an exchange operating with insufficient reserves that users are unaware of. Leverage is always a major cause, often lurking in very hard-to-detect places,” he Chia with BeInCrypto.

How can the market avoid a bear market cycle?

Conversely, experts also point out factors that could completely refute the bear market scenario and help the market enter a new growth cycle. Grachev argues that the negative outlook on the market will weaken mainly due to two factors: healthier leverage in the market and a greater influx of long-term investment Capital .

He explained that, compared to previous cycles, the reduced level of excess risk has led to a more disciplined market. In addition, more practical legal regulations have made it easier for organizations to participate in the market.

"If institutions start disbursing funds again after the end of the year (which is a common occurrence) and if regulations continue to become clearer, the crypto market will have more favorable conditions for healthy growth," Grachev emphasized.

Elkaleh argues that the bearish scenario would weaken significantly if there were signs of countries adopting or Tokenize financial assets on a large scale. He notes that if a G20 country included Bitcoin in its strategic reserves, or if US regulators allowed widespread Tokenize of Capital markets , the narrative about Bitcoin's scarcity would shift from speculative to essential.

“At the same time, the practical applications of RWAs, stablecoin payments on the blockchain, and favorable policies in the US will maintain real demand for the market. Combined with the possibility of a liquidation supercycle – due to fiscal stimulus packages or a weakening USD – all these factors could outweigh cyclical pressures and fuel a new growth phase, with prices potentially reaching $150,000 or higher,” commented the Marketing Director of Bitget Wallet.

Mark Zalan, CEO of Gomining, offers a longer-term perspective, arguing that the inherent strength of the crypto industry will emerge when natural demand outweighs cyclical factors. He highlights three key drivers:

- Macroeconomic and policy factors: Countries that adopt or recognize Bitcoin as a strategic asset, or interest rate trends that cause strong Capital flows into "hard" assets.

- Institutional Capital flows remain stable: ETFs and corporate funds continue to buy, absorbing supply even when prices correct.

- Practical applications are increasing: Bitcoin is being used more widely in payments, as collateral, or as a hedge against risk, beyond speculative purposes.

How to recognize a crypto bear market before prices fall.

Whether 2026 is a bear market, a bull market, or a transitional period, early monitoring of warning signs will be crucial for predicting the future.

For Puckrin, what he cares about is not short-term price volatility but the market structure. He points out that Bitcoin's consistent drops below the 50-week and 100-week moving Medium , along with multiple failures to hold key resistance levels, are signs that warrant special attention.

“Around $82,000 is XEM the true Medium – the Medium Capital of active investors – so this is a very important level to watch. Similarly, $74,400 is Strategy’s Capital , another very important milestone. If Bitcoin falls below these levels, it doesn’t necessarily signal an extreme bear market, but it’s certainly a warning sign,” he told BeInCrypto.

Elkaleh stated that before price action clearly confirms a deep bear market, there are often some on-chain chain . If the number of wallets holding between 100 and 1,000 BTC is steadily decreasing, this suggests that experienced investors are reducing their participation.

He also added that if on- chain buying demand weakens while prices remain stable, it usually means the market is being supported by leverage rather than genuine investor demand. At the same time, the continued increase in stablecoin supply is also a sign of rising pressure, as Capital shifts to a defensive position but remains within the crypto ecosystem.

Conversely, Sakharov believes that if the opposite trend occurs, it would be more worrying. He Chia ,

“Forget about the price, and focus on where the money is going. If the stablecoin market Capital drops, that’s a clear sign that Capital is completely leaving the ecosystem. This is different from a price drop where money is just circulating or waiting on the sidelines. I’ll also monitor actual usage on stablecoin platforms. If the infrastructure remains active, then the correction is just a ‘cleanup’ process.”

Meanwhile, Grachev argues that the earliest signs often appear in the Derivative and liquidation sectors, as this is where changes in risk appetite are most clearly demonstrated.

If negative funding rates persist, open interest decreases, and order book depth diminishes, it signals that investors are shifting to a defensive stance, reducing risk exposure, and Capital flows are becoming more cautious.

“When large-volume transactions easily influence prices, it means liquidation is draining and the market’s risk tolerance is shrinking. You’ll also see pressure quickly emerge in projects heavily reliant on incentives. If activity drops sharply after incentives end, it means demand is primarily a temporary reflex rather than sustainable. As the market matures, such structural signals will become more important than short-term price fluctuations. Prices may fluctuate in the short term, but liquidation, depth, and Capital flow behavior are much harder to manipulate,” the expert said.

As we enter 2026, the crypto market will be increasingly influenced by macroeconomic conditions, the actions of large institutions, and liquidation fluctuations, rather than relying on fixed historical cycles. While the risk of further decline remains, experts believe the market is entering a consolidation and differentiation phase, where structural signals and Capital flows will be far more important than simply classifying it as a Bull or bear market.