Wall Street opened 2026 on a more positive note after a weak end to the year. The recovery in US stock index Futures Contract suggests that investor confidence is gradually improving and risk appetite is returning, albeit cautiously.

The early gains suggest that investor sentiment has adjusted, but this is not yet a stable long-term trend. While positive stock market sentiment may provide short-term support for crypto assets, investors remain cautious due to concerns about overall market liquidation .

The wave of optimism from the stock market has spread to the crypto market.

The market entered the new year after a rather volatile 2025, but the year still delivered good returns for the major indices.

This positive sentiment continued into 2026 as US stock Futures Contract rose on Friday morning, with major indices such as the S&P 500 , Dow, and Nasdaq all recording gains.

S&P 500 Futures Contract trading at the start of the session. Source: Investing.com .

S&P 500 Futures Contract trading at the start of the session. Source: Investing.com .The first few trading days of the year on Wall Street typically end in the green as investors rotate their portfolios, reflecting optimism and an increased risk appetite. Consequently, the prices of major cryptocurrencies also rise.

Bitcoin surged to $90,700 on Friday morning, while Ethereum also peaked at $3,130.

Because the crypto market is increasingly intertwined with technology and AI stocks , the resurgence of AI as a hot topic is also contributing to the rise in digital asset prices.

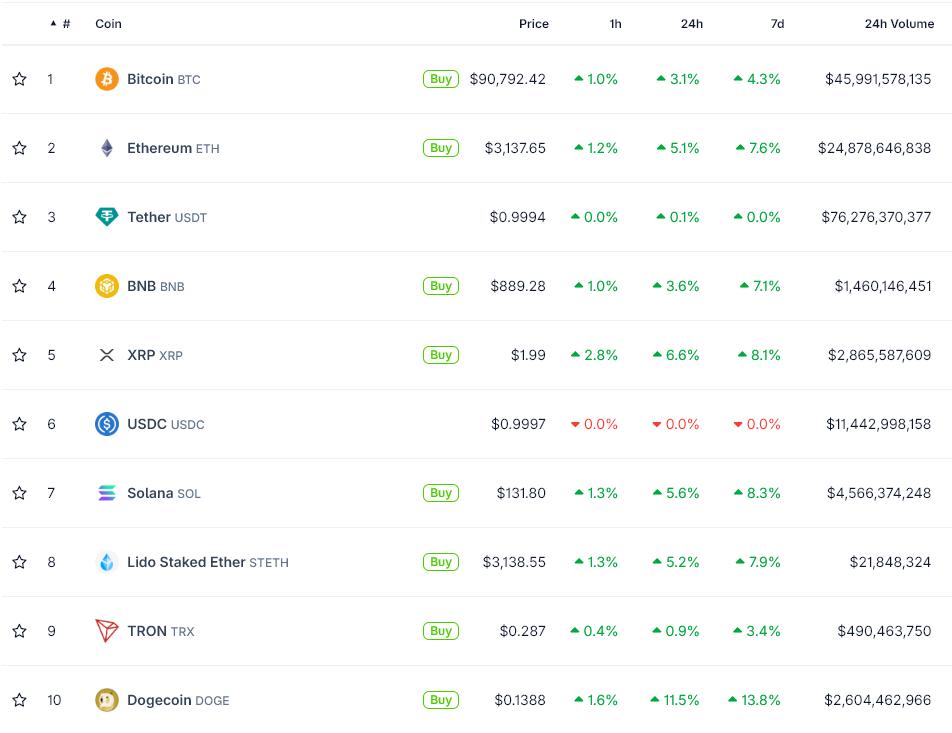

The crypto market turned green after a positive opening on January 2nd. Source: CoinGecko

The crypto market turned green after a positive opening on January 2nd. Source: CoinGeckoAI stocks led the early gains.

The "Magnificent Seven" group of stocks all rose in the first trading sessions of the year. Two prominent representatives, chipmaker Nvidia and Alphabet (Google's parent company), both recorded gains of more than 1%.

These developments reflect investor interest in companies leading the artificial intelligence (AI) race . In 2025, AI stocks were the biggest growth driver for the stock market, and continued positive performance in early 2026 further reinforces confidence in this growth story.

As a result, confidence in boldly investing in risky ventures remains. Historically, periods of stability or rebound in AI-related stocks have often helped mitigate downside risk for other speculative assets.

However, the first trading day of the year is often not a reliable indicator of the year's performance. Therefore, upcoming economic data and general market signals will play a decisive Vai in assessing XEM investors' risk appetite has truly improved.

Macroeconomic data will test future risk appetite.

Investors are closely monitoring key economic indicators that will influence their trading decisions throughout the year.

Although the US Federal Reserve (Fed) has signaled a more dovish monetary policy, Fed Chairman Jerome Powell has warned against further interest rate cuts . A key factor in determining this is the labor data, which will be released on January 9th.

If labor data is poor, concerns about recession or liquidation shortages will return. This will directly impact investors' risk appetite.

Meanwhile, AI stocks will remain the biggest pillar of market confidence. Although the market reacted positively today, the pressure on leading AI companies has never been higher.

Traders may begin demanding more concrete evidence of the profitability of large investments in AI. The fact that the Vai is concentrated in only a few large-cap Capital has led some investors to worry about the lack of widespread market participation.

If just a few AI companies struggle, the risk appetite of the entire market could plummet very quickly.