Foresight News gives you a quick overview of this week's hot topics and recommendations:

01 Digital Yuan 2.0

"Digital deposit currency" accrues interest; what other changes are there in Digital Yuan 2.0?

What does it mean that the RMB broke 7 and stablecoins traded at a discount to the US dollar?

02 Binance's Meme Coin's Opening Act of the Year

"2026 Opening Act: Abnormal Volatility in Binance's Altcoin BROCCOLI714 Earns Traders Millions of Dollars"

03 Saying goodbye to 2025 and stepping into 2026

Editorial Department's Year-End Reflections | What We Gained in 2025? What We Expect in 2026?

2025 Global Trading Guide: 11 Key Trades Amidst the Intertwining of Politics and Markets

Crypto Startups in 2026: Say Goodbye to Speculation, Focus on 5 Valuable Sectors

04 Industry Insights

"Breaking Through the Cutoff Line: Long-Term Speculation Becomes the Only Choice for Young People"

Vitalik: Decentralization without sacrificing commercial viability – A "symbiotic" solution from the perspective of balancing power.

Ethereum Staking Reversal: Inflows are Double the Outflows

Is the Korean stock exchange about to undergo a major overhaul? Regulators propose a 15%-20% shareholding cap for major shareholders.

01 Digital Yuan 2.0

Starting January 1, 2026, the digital yuan will undergo a major upgrade, bidding farewell to the era of interest-free "digital cash" and entering a new phase of interest-bearing "digital deposit currency." This upgrade not only allows users to earn interest on their wallet balances and receive deposit insurance protection, but also optimizes the ecosystem through smart contracts, the mBridge protocol, and other technologies. This article will break down the core points of this monetary system reform. Recommended reading:

" Digital deposit currency" earns interest; what other changes are there in Digital Yuan 2.0 ?

Unlike stablecoin systems that operate outside the banking system, the digital yuan in its 1.0 phase was more akin to an electronic extension of paper currency. The 2.0 version, however, is designed with institutional completeness in mind, adhering to a two-tier operating system of "central bank + commercial banks" and employing a hybrid model of "account system + coin chain + smart contracts."

Within this framework, the digital yuan uses accounts as its core to carry out identity verification, anti-money laundering, and reserve management, while introducing technologies such as blockchain in specific stages to improve clearing efficiency.

The goal of this design is to prevent digital currencies from expanding independently of the financial system, thereby weakening the central bank's ability to control money supply, liquidity, and financial stability.

The digital yuan 2.0 is essentially equivalent to bank deposits. The "Action Plan" explicitly includes the digital yuan in the banking liability system, and the balance of real-name wallets is included in the deposit reserve base. The digital yuan in commercial bank wallets is equivalent to deposits in terms of legal and economic attributes.

Through reserve management, 100% margin arrangements for non-bank institutions, and inclusion of the digital yuan in the monetary tier based on liquidity, the digital yuan has been brought back into the circulation of the modern banking system.

At the end of 2025, the foreign exchange and cryptocurrency markets experienced key changes. The offshore RMB exchange rate against the US dollar broke through the 7.0 mark, reaching a new high since the third quarter of 2024, while the USDT OTC price fell below 6.90, with a negative premium rate of 2.48%. Behind this unusual inversion are multiple factors, including a weakening US dollar, changing expectations for Federal Reserve policy, and tightening regulations on cryptocurrencies in China, which has also sparked in-depth discussions in the market about the RMB's trend and the risks of crypto assets. Recommended article:

What does it mean that the RMB broke 7 and stablecoins traded at a discount to the US dollar ?

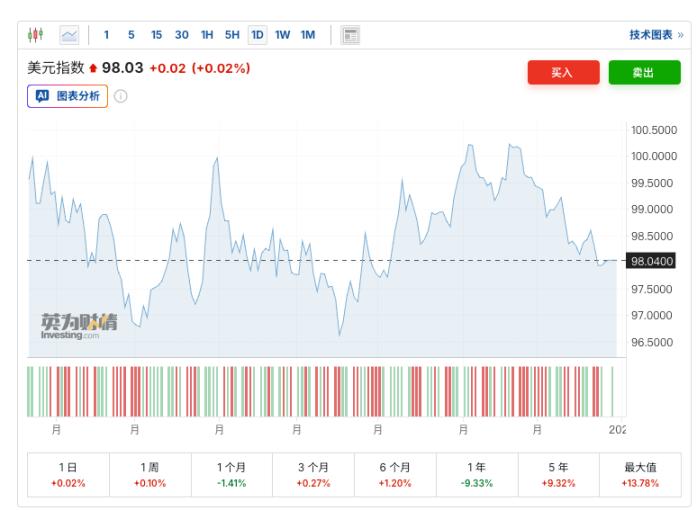

The depreciation of the US dollar in 2025 is the most important external background for the strengthening of the RMB.

In 2025, the US dollar index plummeted by 9% throughout the year, marking its worst performance in eight years, which, to some extent, reflects a global capital market's re-evaluation of "US exceptionalism."

02 Binance's Meme Coin's Opening Act of the Year

On New Year's Day 2026, the small-cap cryptocurrency BROCCOLI714 on the Binance platform experienced sudden and abnormal volatility. A massive buy order of $26 million contrasted sharply with its market capitalization of $40 million, causing a deviation between spot and futures prices. Trader Vida, leveraging pre-emptive positioning, an early warning system, and accurate market analysis, profited over $1.6 million through long and short positions, serving as a stark warning about the risks of extreme market conditions in the cryptocurrency market. Recommended Article:

BROCCOLI714 (CZ's Dog) is a community-driven meme token on the BNB Chain, inspired by "Broccoli," the pet dog of Binance founder CZ. 714 represents the last three digits of the token's contract address. There are multiple Broccoli-themed meme tokens on the BNB Chain, and the last digit of the contract address serves as a quick way to distinguish them. The project's official website and community later interpreted "714" as the founding date of Binance, and it was ultimately listed on the spot market through a Binance community vote (March 27, 2025).

03 Saying goodbye to 2025 and stepping into 2026

The crypto space navigated a challenging year in 2025, with accelerated compliance and on-chain development, yet also hampered by a lack of innovation and market volatility. At the turn of the year, the Foresight News editorial team reflects on the achievements and regrets, analyzes the industry's biggest changes, and looks ahead to potential growth areas in 2026, predicting the trends of Bitcoin and Ethereum, providing a diverse perspective on industry development. Recommended Article:

Editorial Department's Year-End Reflections | What We Gained in 2025? What We Expect in 2026 ?

As 2025 draws to a close, we asked all editors and reporters at Foresight News four questions: 1. Looking back on 2025, what did you gain, and what regrets do you have? How does it compare to your 2025 predictions? 2. With 2025 coming to an end, what is the biggest change you've seen in the crypto world this year? 3. In the coming year, what crypto sectors and targets do you have the most confidence in? 4. Do you predict that Ethereum will outperform Bitcoin in 2026? What will be the highest prices for Bitcoin and Ethereum in 2026?

In addition, Foresight News editors and reporters disclosed their respective cryptocurrency holdings (for public information purposes only and not to constitute any investment advice).

In 2025, the global financial markets, amidst the interplay of politics and market forces, witnessed a drama of "high-certainty bets" and "rapid reversals." From the brief frenzy surrounding Trump-linked crypto assets to the surge in European defense stocks, and the reversal in Japanese government bond trading, 11 key transactions paint a complex picture. These transactions reveal market patterns and risk lessons, providing important insights for understanding the overall financial landscape of the year and preparing for 2026. Recommended Article:

2025 Global Trading Guide: 11 Key Trades Amidst the Intertwining of Politics and Markets

This is another year full of "high-certainty bets" and "rapid reversals".

From bond trading desks in Tokyo and credit committees in New York to foreign exchange traders in Istanbul, the markets brought both windfalls and dramatic volatility. Gold prices hit record highs, the stock prices of reputable mortgage giants fluctuated wildly like "meme stocks," and a textbook arbitrage trade collapsed in an instant.

Investors bet heavily on political upheaval, bloated balance sheets, and fragile market narratives, driving a surge in stock markets and a proliferation of yield trades, while cryptocurrency strategies relied heavily on leverage and expectations, lacking other solid support. Following Donald Trump's return to the White House, global financial markets initially suffered a sharp decline before recovering; European defense stocks surged; and speculators fueled wave after wave of market frenzy. Some positions reaped astonishing returns, but others suffered devastating losses when market momentum reversed, funding channels dried up, or leverage took a negative turn.

As the year draws to a close, Bloomberg focuses on some of the most compelling bets of 2025—including success stories, failures, and the holdings that defined the era. These deals have left investors worried about a host of "old problems" as they prepare for 2026: unstable companies, inflated valuations, and trend-following trades that "worked once but eventually failed."

In 2026, the crypto industry moved beyond the speculative frenzy and entered a new phase of value cultivation. Crypto technology, with its core advantages such as global capital flow, instant settlement, and privacy protection, is fostering new opportunities in five major sectors: internet capital markets, censorship-resistant applications, decentralized science, stablecoins, and on-chain company governance. This article, based on firsthand practical insights, breaks down entrepreneurial directions in each sector to help uncover the real-world commercial value of crypto technology. Recommended Articles:

Crypto Startups in 2026 : Say Goodbye to Speculation, Focus on 5 Valuable Sectors

First, I summarized the core advantages of encryption technology compared to the traditional financial system, and these advantages are the starting point for us to explore entrepreneurial directions...

Based on these core strengths, I have divided the entrepreneurial concept in this article into five major directions, each relying on the core value of multiple encryption technologies:

- Internet Capital Market: Leveraging three major advantages: global capital flow, programmability and composability, and permissionless openness.

- Censorship-resistant applications: leveraging three major advantages: privacy protection, permissionless openness, and global capital flow.

- Decentralized Science (DeSci): Leveraging the two major advantages of global capital flow, programmability, and composability.

- Stablecoins: encompassing all the core advantages mentioned above

- On-chain company governance: relying on the core advantage of transparency and traceability

04 Industry Insights

With traditional paths to wealth accumulation completely blocked, AI eroding career prospects, and social media constantly raising expectations for life, young people are trapped in a predicament of "being able to survive but struggling to move forward." They abandon the old advice of "focusing on their main job" and flock to fields like cryptocurrencies and prediction markets, seeking a sense of control and a way out through high-risk speculation. Long-term speculation has quietly become a reluctant choice for this generation to break free from their financial prison. Recommended article:

" Breaking Through the Cutoff Line: Long-Term Speculation Becomes the Only Choice for Young People "

We're not betting on the wins or losses of a single speculator, but on the sustainability of this phenomenon. The underlying economic reality driving young people into high-risk speculation won't change easily. Platforms that profit from transaction fees will grow in tandem with their user base. Those trapped in financial prisons will keep betting, endlessly.

In the 21st century, the three major forces of "big government," "big corporations," and "mob groups" have grown increasingly powerful, driving social progress while also raising numerous concerns due to the concentration of power. Vitalik Buterin focuses on this power dilemma in his article, delving into the roots of people's fear of these three forces from the perspective of power balance. He further explores a "symbiotic" solution that balances decentralization and commercial viability, offering new insights into solving the problem of power concentration. Recommended article:

In the future, more projects should clearly consider two core issues: not only designing a "business model"—that is, how to acquire resources to support their own operations; but also designing a "decentralized model"—that is, how to avoid becoming a node of concentrated power, and how to deal with "the risks that may come from wielding power".

Decentralization is relatively easy to achieve in some scenarios: for example, few people mind the dominance of English, nor worry about the widespread use of open protocols such as TCP, IP, and HTTP. However, decentralization is quite challenging in other scenarios—because certain applications "require entities to have clear intentions and the ability to act." How to retain the "advantage of flexibility" while avoiding the "disadvantages of centralized power" will be a significant long-term challenge.

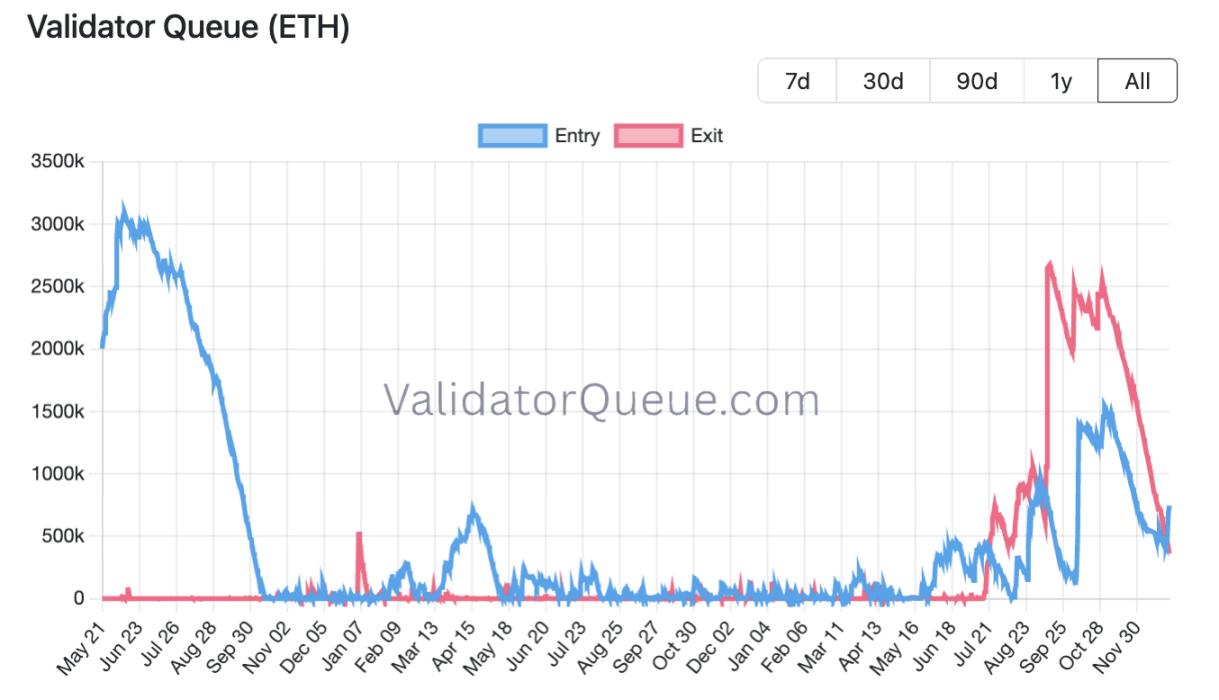

At the end of 2025, the Ethereum staking ecosystem reached a crucial turning point. Data shows that approximately 739,800 ETH are currently waiting in the staking queue, double the 349,900 ETH that left the queue, bringing the total staked amount to 35.5 million ETH. This reversal not only signifies an easing of market selling pressure but, driven by factors such as the large-scale staking at BitMine and the Pectra upgrade, lays the groundwork for enhanced security and capital accumulation for Ethereum in 2026. Recommended Article:

Ethereum Staking Reversal: Inflows are Double the Outflows

The reversal of Ethereum validators "entering the queue" over "leaving the queue" marks the initial formation of a net inflow-dominated staking pattern for the first time since July. This change is not merely a numerical leap, but a key signal of rebuilding market confidence. Of course, whether this leading trend can be sustained and solidified remains to be seen.

While Ethereum spot ETFs have not yet shown significant net inflows, the improvement in on-chain fundamentals is evident. As Joseph Chalom, co-CEO of SharpLink Gaming, stated this month, the surge in stablecoins, tokenized RWAs, and growing interest from sovereign wealth funds could drive Ethereum TVL to grow tenfold by 2026.

As we approach the end of 2025, is Ethereum ready for a surge in 2026? Only time will tell.

In late 2025, the South Korean Financial Services Commission proposed in its "Second Phase Legislation on Virtual Assets" that the shareholding cap for major shareholders of the four leading cryptocurrency exchanges—Upbit, Bithumb, and others—be set at 15%-20%, directly addressing the current issues of concentrated power and privatization of interests within exchanges. While this move aims to promote industry standardization, it also puts pressure on the four exchanges to restructure their shareholdings, raising concerns about industry vitality and capital flows, and disrupting the South Korean cryptocurrency market landscape. Recommended Article:

Is the Korean stock exchange about to undergo a major overhaul? Regulators propose a 15%-20% shareholding cap for major shareholders .

Behind this proposal is the regulator's clear intention to promote a "highly institutionalized" crypto market—to transform the extensively developing crypto exchage industry with the mature systems, risk control capabilities, and compliance culture of traditional finance, thereby reducing systemic risks.

Some analysts believe that forcing major shareholders to reduce their holdings is essentially paving the way for traditional financial institutions such as banks and securities firms to enter the market, with well-capitalized financial giants potentially becoming the acquirers of the shares. This could accelerate the "high institutionalization" of the South Korean cryptocurrency market.

However, the controversy is equally prominent. From an innovation perspective, will this stifle the original vitality of the crypto industry? According to a view cited by KBS, forcibly applying the equity dispersion rules of traditional securities exchanges to the virtual asset exchange industry is "forcing a square peg into a round hole." Forcing founders to sell their assets seriously infringes on private property rights and may lead to management instability, which is ultimately detrimental to the protection of investors.