Tom Lee is urging BitMine shareholders to approve a significant increase in the number of shares authorized for issuance. This move would make it easier for the company to raise Capital in the future as BitMine continues to strengthen its holdings of Ethereum as a key asset in its treasury.

In his New Year's message, Tom Lee urged investors to support raising the limit on the number of shares that can be issued from 500 million to 50 billion shares. The vote will close on January 14, 2024, ahead of BitMine's annual shareholders meeting on January 15, 2024, in Las Vegas.

Controversy surrounding BitMine's share dilution related to Ethereum.

Tom Lee Chia that increasing the number of shares does not mean BitMine will issue all of them immediately.

He emphasized that this would give the company more flexibility for future Capital needs, as well as the ability to carry out a stock Chia if the share price rises sharply.

Last year, BitMine shifted its focus to using ETH as its primary reserve asset. Since then, the company has steadily increased its ether holdings and is gradually transforming its model, moving away from being just a traditional mining company, towards a leveraged Ethereum asset ownership model.

In just the past month, BitMine has purchased over $1 billion worth of Ethereum .

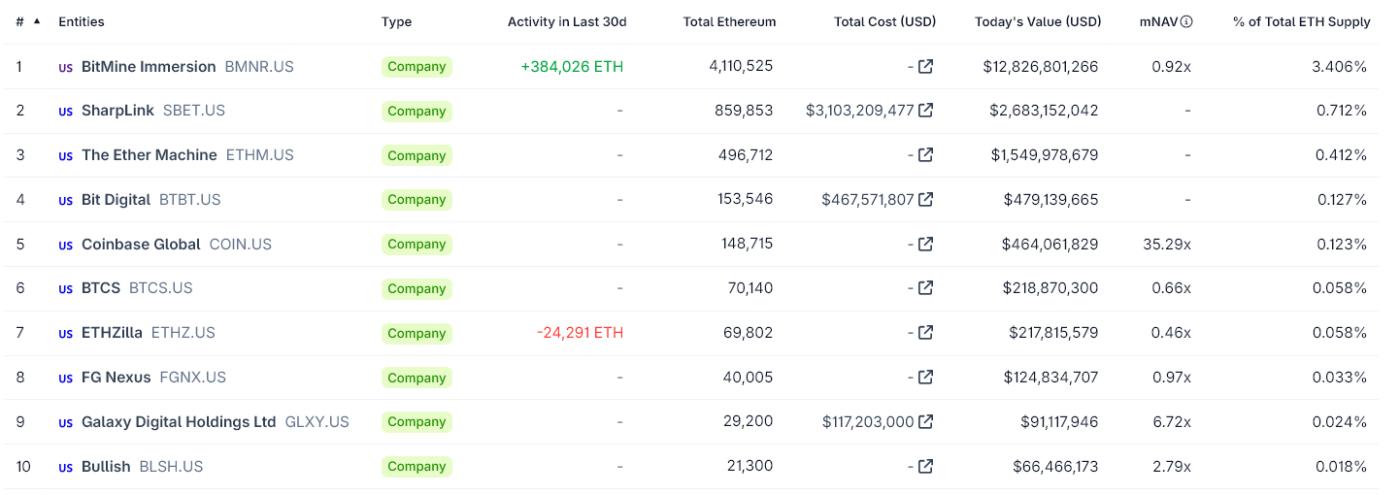

Top 10 companies holding the largest amount of Ethereum. Source: CoinGecko

Top 10 companies holding the largest amount of Ethereum. Source: CoinGeckoLee also told shareholders that BitMine's stock price had tended to move in line with ETH more than with the company's traditional performance indicators.

According to him, ifthe price of Ethereum rises sharply in the near future, issuing additional shares to buy ETH could still benefit shareholders, even if each person's ownership percentage decreases.

If this proposal is approved before the shareholders' meeting on January 15, 2024, in Las Vegas, BitMine will have a much larger number of shares to issue, for the following purposes:

- Raising Capital, including with the goal of buying more Ethereum.

- Mergers or strategic partnerships

- The purpose of stock Chia is to keep the stock price "affordable" for retail investors, as Lee said.

Lee assured investors that approving the increase in the number of shares was merely a facilitation, and that actual share dilution would only occur when the company issued new shares.

BitMine's stock price since the company switched to the Ethereum treasury model. Source: Google Finance

BitMine's stock price since the company switched to the Ethereum treasury model. Source: Google FinanceHe further explained that a stock Chia is a key reason for this proposal. If BitMine's stock price rises along with the price of ETH, the company needs to implement a Chia to keep the stock price affordable for small investors. Increasing the number of shares would make this process more convenient.

However, this proposal raises questions for shareholders. Agreeing to increase the number of shares would not immediately reduce ownership percentages but would expand the potential for future dilution, especially as BitMine continues to be tied to Ethereum's volatility.