As of January 3rd, the virtual asset market showed strong buying and individual stock-driven gains. In particular, Gamebuild (GAME2), Akash Network (AKT), and Pepe (PEPE) attracted investor attention with their rapid, short-term gains.

[Period-by-period increase rate]

Pepe (PEPE/KRW) has successfully rebounded in the short term, rising 41.44% over the past week and 22.11% over the past month. Zerobase (ZBT/KRW) has shown a 30.12% increase over the past week and 28.57% over the past month, while Chiliz (CHZ/KRW) continues its mid-term rebound, rising 41.11% over the past month and 32.02% over the past six months. Conversely, despite short-term gains, Story (IP/KRW) and Plasma (XPL/KRW) are still down over 70% over the past three months.

[Top 10 Weekly Growth Rates]

#1 Gamebuild (GAME2/BTC): +100.00%

2nd place: Akash Network (AKT/BTC): +70.05%

3rd place: Pepe (PEPE/KRW): +46.53%

4th Story (IP/KRW): +42.26%

5th place: Mira Network (MIRA/BTC): +40.48%

6th Plasma (XPL/KRW): +37.56%

7th place: Storage (STORJ/BTC): +35.61%

8th place: WalletConnect (WCT/BTC): +34.58%

9th place: Render Token (RENDER/BTC): +34.25%

10th place: Nervos (CKB/BTC): +33.33%

Story (IP) and Plasma (XPL) have recently emerged as hot stocks, rising 42.26% and 37.56%, respectively, through short-term rallies. Gamebuild took the lead, showing extreme volatility of +100.00%.

[Top 5 Daily Buying Strength]

1st Shin Futures (F/KRW): 500.00%

2nd place Basic Attention Token (BAT/KRW): 500.00%

3rd place Milk (MLK/KRW): 500.00%

4th place Superbus (SUPER/KRW): 500.00%

5th Storage (STORJ/KRW): 500.00%

All top stocks recorded over 500% trading volume, demonstrating overwhelming buying power. In particular, Shin Futures (F/KRW), Basic Attention Token (BAT/KRW), and Superbus (SUPER/KRW) are emerging as new leaders in supply and demand.

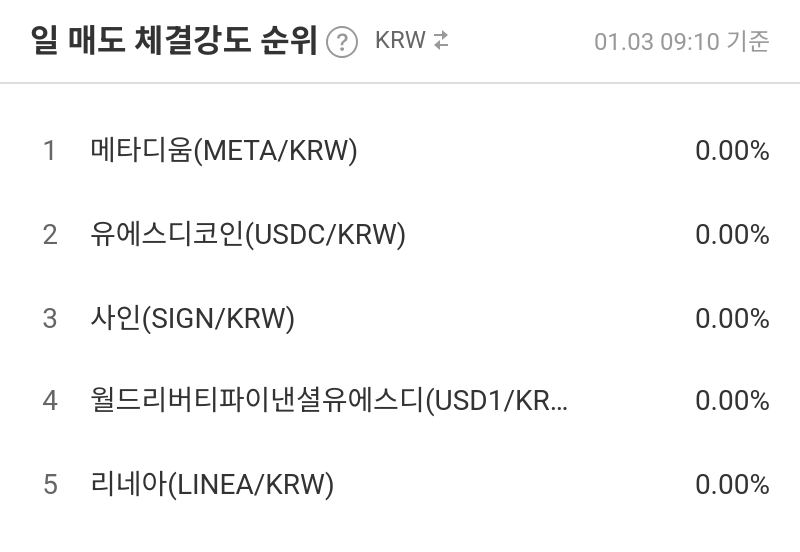

[Top 5 Daily Selling Strength]

1st place Metadium (META/KRW): 0.00%

2nd place USD Coin (USDC/KRW): 0.00%

3rd place Sign (SIGN/KRW): 0.00%

4th place: World Liberty Financial USD (USD1/KRW): 0.00%

5th place Linea (LINEA/KRW): 0.00%

These stocks are classified as severely undersold, recording a trading intensity of 0%. This can be interpreted as a lack of actual liquidity movement, requiring careful consideration of actual trading flow.

This week, volatility has increased significantly due to the simultaneous occurrence of short-term surges and strong buying pressure in some stocks. Investors should closely monitor the technical rebound and the fundamentals of each stock, and adopt a cautious entry strategy.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.