Original article | Odaily Odaily( @OdailyChina )

Author|jk

In the crypto industry, compensation is consistently one of the most frequently discussed yet most difficult topics to reliably conclude . Whether it's founders setting internal compensation frameworks or candidates evaluating the reasonableness of an offer, reality often lacks supporting data. Industry discussions frequently rely on isolated cases, anonymous sharing, or emotional judgments rather than a universal compensation framework.

Against this backdrop, Dragonfly, a top venture capital firm in the crypto industry, released its first annual crypto salary report in 2023 , compiling a comprehensive survey to summarize universal crypto salary data. Two months ago, Dragonfly released the 2025 version . This report collected feedback from 85 crypto companies and, for the first time, expanded its research scope to companies outside of Dragonfly's portfolio, making the data closer to a true cross-section of the industry.

Data collection covers the period from the end of 2024 to the first quarter of 2025, and for the first time, it incorporates approximately 3,400 deduplicated employee and candidate-level data points. While the data isn't very recent, fortunately, salaries don't fluctuate as dramatically as cryptocurrency prices. The report shares detailed salary data for each function, level, and region, moving beyond simply providing "average salaries" or "rough ranges." Compared to the 2023 report, this research goes beyond simply answering "how much does the crypto industry pay?"; it begins to reveal "how money is allocated and how certainty and risk flow within organizations."

Let's take a look at what highlights are worth noting. Whether you're a recent graduate eager to enter the Web3 field or a mid-level manager considering a career in crypto , this report should offer a wealth of data that you can learn from.

All compensation units in this article are in US dollars/USDT, and all salaries are in cash, excluding currency rights/equity.

I. Overall Market Summary

TL;DR version: Here are the top ten summaries from the official Dragonfly report .

- Most crypto companies are in a growth phase, rather than a phase of rapid expansion.

- Crypto hiring has been global from the start; there are virtually no cases of hiring only within the United States.

- Europe has become the leading international recruitment hub.

- Salaries and token compensation declined across almost all job levels and regions.

- Remote work remains dominant, and companies have no plans to change this.

- The entry barrier to the crypto industry is high, with entry-level positions accounting for less than 10%.

- Engineering roles remain core. Product roles typically start at senior levels, while design roles place more emphasis on individual contributors rather than management.

- US salary levels have become the global pricing standard for engineering management.

From an overall perspective, the crypto industry compensation landscape from 2024 to 2025 exhibits a clear characteristic: it's a market undergoing a downward adjustment but gradually stabilizing. Despite the strong prices of mainstream crypto assets and the positive signals from the US policy environment in the short term, these macroeconomic changes haven't quickly translated into hiring and compensation. Companies remain cautious in hiring and pricing, resulting in a comprehensive contraction in both positions and salaries.

In terms of recruitment geographically, the globalization of the crypto industry has become even more solidified. Teams that recruit exclusively within the US are virtually nonexistent; cross-regional collaboration has been the default from the start. Europe has risen significantly in this cycle, becoming one of the most important international recruitment hubs, particularly in engineering and product-related functions.

Remote working is a very clear long-term trend in this report. Most companies have not shown a clear plan to return to an office-based system, which directly undermines the single logic that "location determines compensation." Compensation differences are beginning to reflect an individual's influence, scarcity, and boundaries of responsibility within the organization, rather than geographical location itself.

Entry-level positions were most significantly impacted, with substantial decreases in salaries and tokens, partially compensated by higher equity stakes. While entry-level positions in the US still offer a cash advantage , international counterparts typically receive 2-3 times the equity and higher token rewards. Mid-level positions faced overall pressure and limited growth potential; senior positions performed relatively more resiliently, with smaller salary reductions, more stable equity, and tokens increasingly concentrated at the top. The most significant salary increases occurred at the Senior Individual Contributor (Senior IC) and executive levels, creating a clear "barbell structure," particularly pronounced in product and engineering roles.

Engineering remains the core of the industry, but functions outside of engineering are showing a more pronounced hierarchical differentiation. Rewards are concentrated on senior talent and execution levels, while mid-level and junior positions face significant pressure to reduce compensation. Product roles almost always require extensive experience from the outset, while design roles are clearly more geared towards high-level individual contributors rather than management paths. Within design roles, the value of senior designers is less than that of management. In the US, senior individual contributors earn more in total compensation than design managers, and even some senior executives.

Finally, from a year-over-year perspective, founders are increasing their own compensation every year. The larger the funding round, the higher the founder's salary, while the lower their equity stake. American founders generally earn higher salaries, equity stakes, and tokens than their international counterparts.

Overall, salaries and token grants decreased across almost all job levels . US positions still lead in cash compensation, while international teams have narrowed the gap with higher equity and token allocations.

II. In-depth analysis of six major positions

2.1 Software Engineer: The Cornerstone of the Industry

Software engineers, as the technical backbone of the encryption industry, have consistently enjoyed top-tier salaries.

Salary advancement path in the US market:

The data shows that the career path for software engineers is quite clear. Entry-level salaries range from $89k to $138k, averaging around $113k. At the mid-level, salaries rise to $123k-$172k, averaging around $147k. Upon promotion to Principal or Senior level, which is approximately 7-8 years of experience, salaries see a significant jump, reaching $172k-$222k, averaging around $197k.

Software engineer salary

Upon reaching the Executive or Director level, the salary can reach $208k-$264k, averaging around $236k. From entry-level to executive level, salary increases nearly threefold.

Of particular note is the most significant leap from mid-level to senior engineer, that is, from 3-5 years of work experience to a Senior position with 7-8 years of experience, with a salary increase of over 40%. This demonstrates that companies are willing to pay a premium for engineers who can truly solve complex problems.

International Markets:

While international software engineer salaries are relatively low, they remain quite attractive. Entry-level salaries range from $63k to $109k, roughly equivalent to 400,000 to 700,000 RMB. This is a considerable income in many countries, especially in regions with lower living costs such as Eastern Europe and Southeast Asia.

Meanwhile, salaries for senior positions are rapidly catching up with US levels. Executive or Director positions can reach $200k-$253k, approaching the salary levels of their counterparts in the US. In other words, with the increasing prevalence of remote work and intensified global competition for talent, geographical differences are gradually narrowing. For capable engineers, the choice of where to work has become more flexible.

It's clear how important it is for engineers to learn English well.

2.2 Crypto Engineer: The Rewards of Specialization

Cryptographic engineers, also known as smart contract engineers, are a unique position in the industry, and their salaries exhibit a distinctive pattern.

US Market:

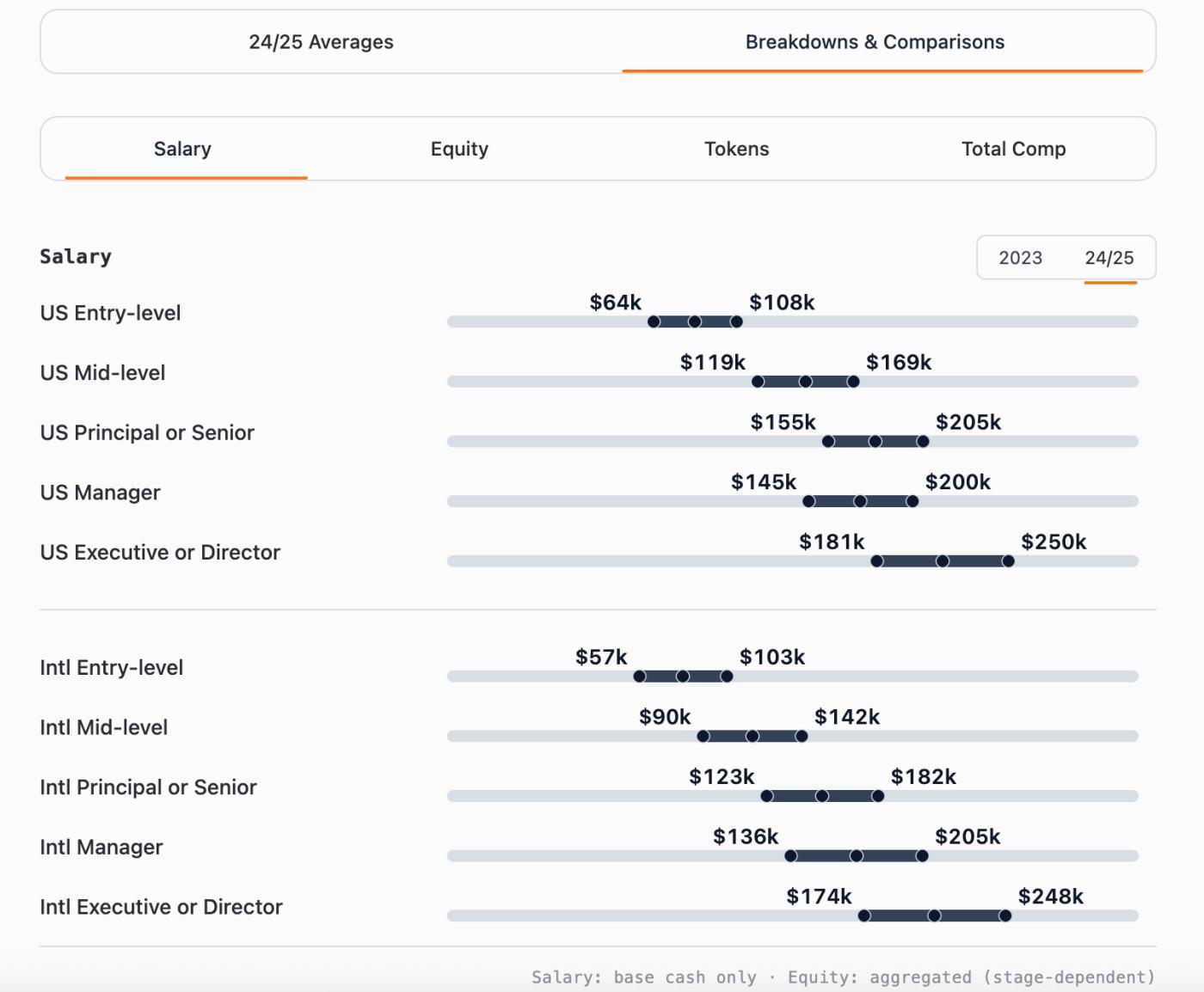

In the US market, the salary trajectory of crypto engineers reveals an interesting phenomenon. Entry-level salaries ($64k-$108k) are actually lower than those of traditional software engineers. This may be because newly qualified crypto engineers need more time to accumulate domain-specific knowledge, such as gaining a deep understanding of various consensus mechanisms and learning Solidity.

However, at the mid-level ($119k-$169k), professional advantages begin to show, with salary increases reaching an astonishing 85% . Continuing to advance to the senior level ($155k-$205k), salary growth continues to be strong. This steep growth curve illustrates an important fact: once you master core encryption technology, your value increases dramatically.

Smart contract engineer salary

Interestingly, cryptography engineers at the management level (Manager: $145k-$200k) earn slightly less than those on the pure technical track. This likely reflects a characteristic of the industry: deep technical expertise is valued more in this field than managerial skills, and talent who can truly understand and improve zero-knowledge proofs or optimize Layer 2 solutions is extremely scarce.

International Markets:

In the international market, mid-level crypto engineers are performing exceptionally well. Their salaries ($90k-$142k, RMB 600,000-1,000,000) even exceed those of senior positions in some traditional roles. The reason behind this phenomenon is simple: talent with expertise in blockchain, smart contracts, and other related fields is extremely scarce globally. Whether you're in Silicon Valley or Singapore, outstanding Solidity developers are highly sought after by companies.

2.3 Product Manager: A Dark Horse with Soaring Salaries

Product managers saw remarkable salary growth in 2024/25, especially at the senior level.

US Market:

The most striking data point is undoubtedly the salary of Executive-level product managers, reaching an astonishing $391k-$484k, far exceeding all other positions. This figure has even led many to question whether the data is incorrect. However, upon closer examination, this unusually high salary actually reflects several important pieces of information.

First, Web3 products are far more complex than traditional internet products. They require not only understanding user needs but also a deep understanding of technical details such as token economics, on-chain data, and cross-chain interactions. Second, product managers (PMs) who truly understand the technology and can translate it into user value are extremely rare in the market. Finally, the commercial value of a successful crypto product is enormous; a successful DeFi protocol or NFT platform can generate billions of dollars in transaction volume.

In other words, if you are determined to stick to this path to the end, there is a great chance of success.

For product managers who are just starting out or in the mid-career stage, the salary of an entry-level PM ($95k-$140k) is second only to that of a software engineer. By the mid-level ($153k-$203k), the salary of a PM has surpassed that of all technical positions , becoming the highest-paid position in the same level.

But this only applies to the United States.

International Markets:

Compared to the frenzied US market, PM salaries in the international market appear more rational and much lower. Executive-level salaries range from $145k to $194k, nowhere near as exaggerated as in the US. Meanwhile, entry-level PMs earn similar salaries to their counterparts in smart contract engineers and software engineers, and remote work is sufficient for someone earning an average of 750k RMB to live comfortably.

2.4 Designers: Underrated but on the Rise

Design roles have long been undervalued in the crypto industry, but data shows that this is changing.

US Market:

The salary trajectory of designers is an interesting story. Entry-level starting salaries ($53k-$103k) are among the lowest of all positions, which is very much in line with the current state of the crypto industry: for a long time, crypto projects have focused more on technical implementation and neglected user experience, resulting in many early DApps having terrible interfaces. Even projects that have raised tens of millions of dollars in funding often have poor interaction and other experiences.

But the situation is changing rapidly. As designers advance to the Senior level ($139k-$182k), salaries see a significant jump. This leap indicates that the market is finally recognizing the importance of an experienced designer with 7-8 years of experience who can lead a team to product success.

However, mid-level designers face the biggest challenge of all positions. Their salaries ($80k-$120k) grow slowly, increasing by only about 30% compared to entry-level positions. This "mid-life crisis" may lead to talented designers leaving for other industries or transitioning to other functions.

International Markets:

Interestingly, designer salaries in the international market are relatively more balanced. Especially at the mid-to-high levels, the salary gap between designers and other functions is smaller. This provides designers with a more equitable development environment. If you are a designer, you might want to consider opportunities in the international market when choosing a work location.

2.5 Marketing: The Backbone of Steady Growth

Marketing is playing an increasingly important role in the crypto industry, and salary data reflects this trend.

US Market:

Marketing salaries exhibit a steady and balanced growth pattern. Entry-level salaries ($58k-$108k) provide a reasonable starting point, neither the highest nor the lowest. Mid-level salaries ($90k-$139k) show a stable increase of approximately 55%. Senior-level salaries are $127k-$176k, while Executive-level salaries reach $166k-$225k. This reflects the shift in roles within marketing professionals from executing marketing strategies to developing them. In the crypto industry, marketing experts who can understand complex technical concepts and translate them into compelling narratives are invaluable.

Characteristics of the international market:

Marketing positions in the international market exhibit a more standardized salary structure, with relatively small differences between levels and a steady upward trend.

2.6 Business Development (BD/Go to Market): Growth Engine

BD/GTM roles play a crucial role in the success of crypto projects, and salary data reflects this importance.

US Market:

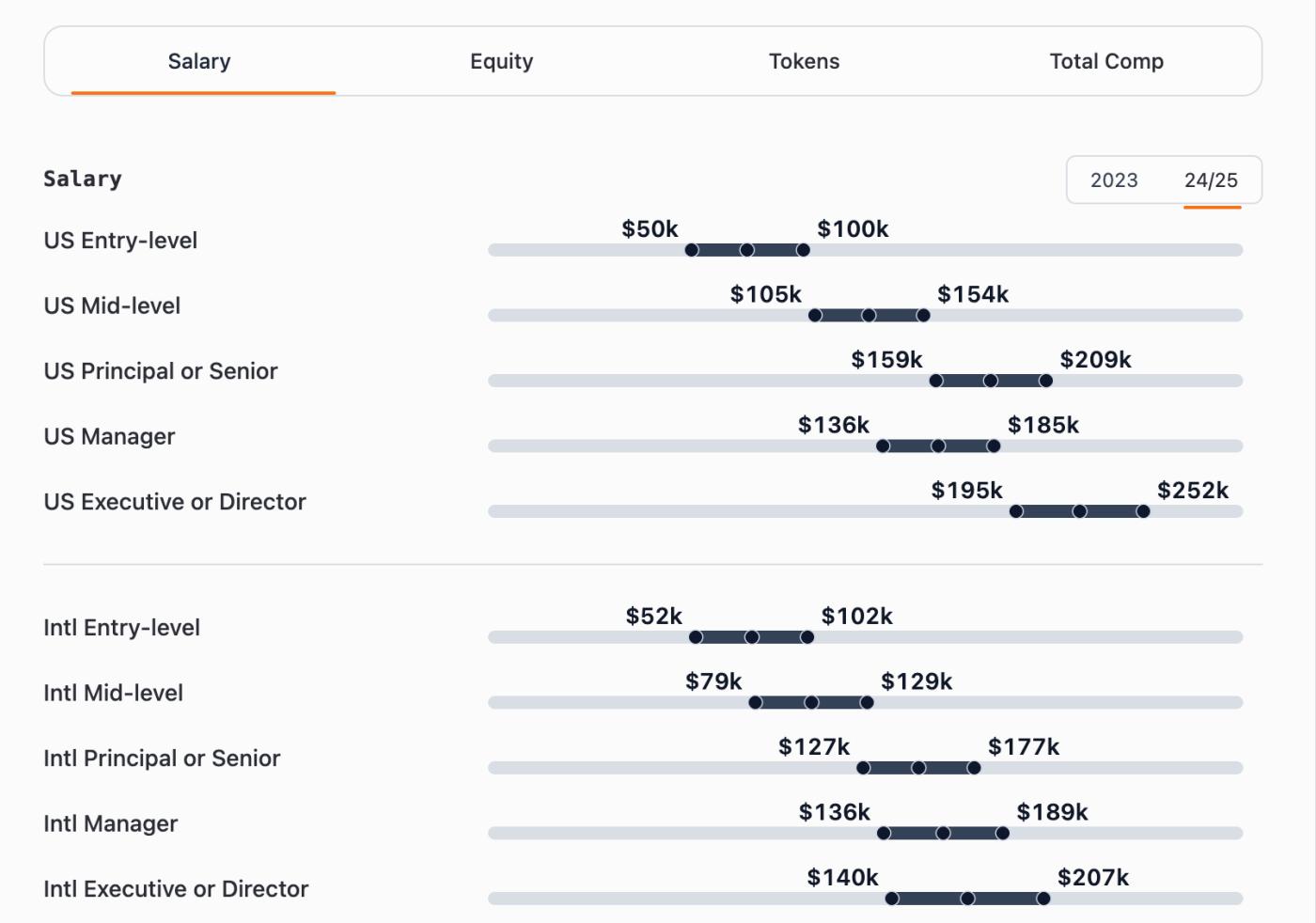

The salary stories for Business Development (BD) positions are perhaps the most inspiring. Entry-level salaries ($50k-$100k) are the lowest of all positions, but don't be intimidated by that number. Look at the mid-level figures ($105k-$154k), where salaries more than double! That means your salary can double in 3-5 years—the largest increase among all positions. At the Executive level ($195k-$252k), the salaries of outstanding BD leaders demonstrate their crucial role in company growth.

A newcomer to business development might just be sending cold emails, attending meetings, and conducting preliminary market research. But once you build your network and understand how the ecosystem works, your value will increase dramatically.

Consider this: a skilled Business Development (BD) professional can help a project connect with major exchanges, establish key partnerships, and open up new markets. In the current market environment of "building during a bear market and reaping during a bull market," BD talent who can drive actual business growth is naturally highly valued. They not only need to understand the business but also the token economy, the characteristics of various public chains, and the operational mechanisms of DeFi protocols. Such multi-skilled talent is in high demand everywhere.

International Markets:

There's a particularly interesting phenomenon in business development (BD) salaries in the international market. Principal/Senior level salaries ($127k-$177k) are exceptionally high in the international market, while Manager level salaries ($136k-$189k) even exceed those of their counterparts in the United States.

The reason behind this is not hard to understand: international markets rely more on localized business development capabilities. If you can help US projects land in Asia, or help Asian projects enter the European and American markets, your value is enormous.

As can be seen, US positions lead in both cash compensation and total compensation across almost all job levels.

2.6 Founder Salaries: How much do the bosses pay themselves?

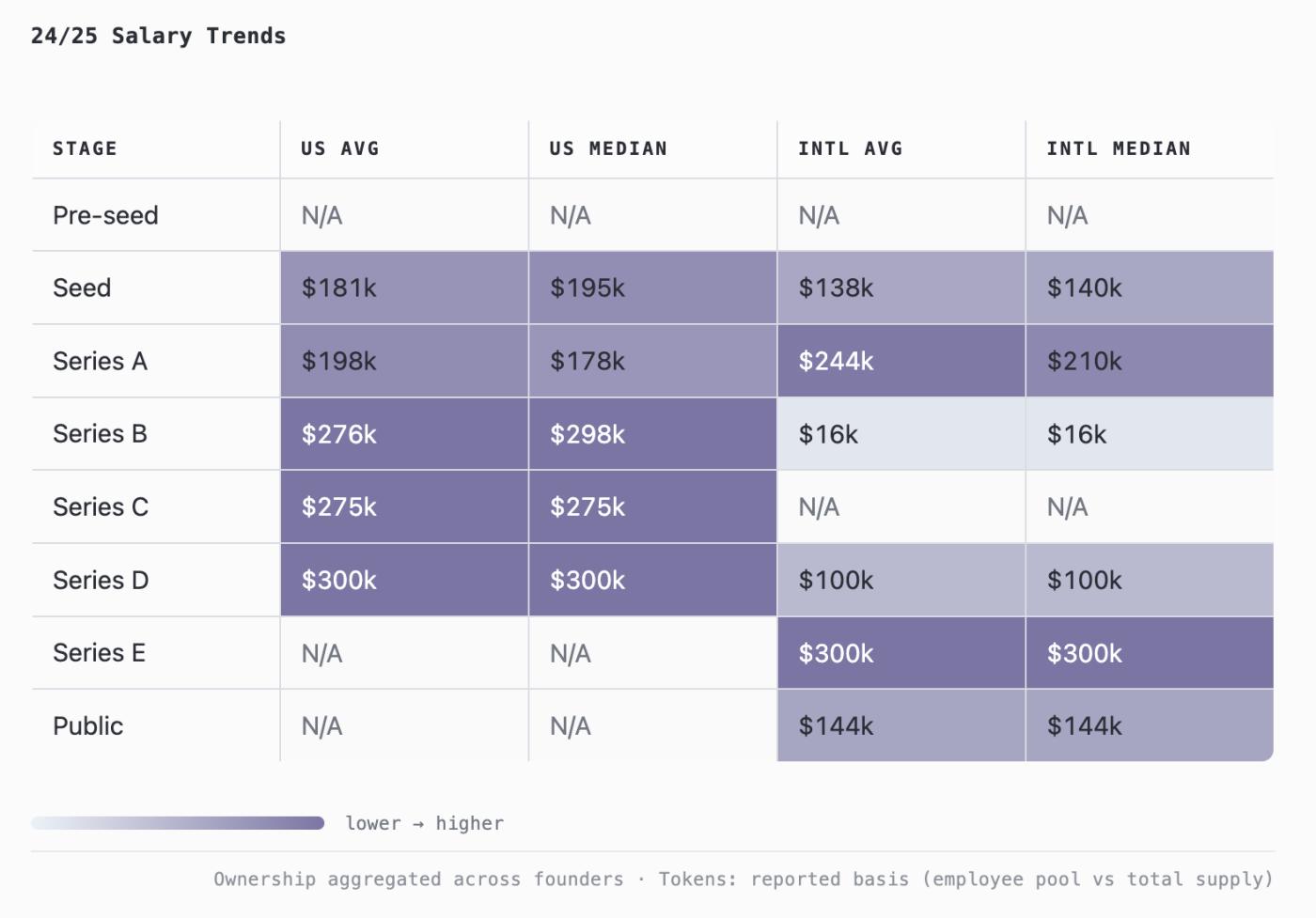

We can see a very interesting phenomenon: the founder's salary is clearly positively correlated with the company's funding stage, but this growth is not linear, and the US and international markets show very different patterns.

US Market:

In the US market, founder salaries show a stepped increase with each funding round. Starting at $181k (median $195k) in the Seed round, the increase is relatively moderate, rising slightly to $198k in Series A. The real leap occurs in Series B, where the average salary surges to $276k (median $298k), an increase of over 40%.

This leap is quite interesting. Series B typically marks the stage where a company truly begins to scale, product-market fit has been validated, and the business model is essentially mature. At this point, the founder transitions from "entrepreneur" to "CEO," needing to manage a larger team and handle more complex business operations. The significant salary increase reflects this role shift and increased responsibility.

In Series C and D, salaries remain stable in the $275k-$300k range. Series C salaries ($275k) are even slightly lower than Series B, while Series D only rises back to $300k.

International Markets:

Data from the international market presents a completely different picture. Founder salaries in the early stages (Seed to Series A) are relatively reasonable, increasing from $138k-$140k (Seed) to $210k-$244k (Series A). However, in Series B, data shows only $16k, which may be due to a small sample size or the fact that founders in certain regions have indeed opted for extremely low salaries to keep their companies running.

Even more surprising is the data for Series E: founders in international markets earn $300k, comparable to the level of Series D in the US. This may reflect a trend: companies that can raise Series E funding in international markets are usually already unicorns or near-unicorns in their respective regions, and their founders' salaries naturally align with international standards.

The salaries of founders of publicly traded companies ($144k) are relatively low because after going public, the founders' main source of wealth shifts to equity/currency value rather than cash compensation.

3. Where do the employees work?

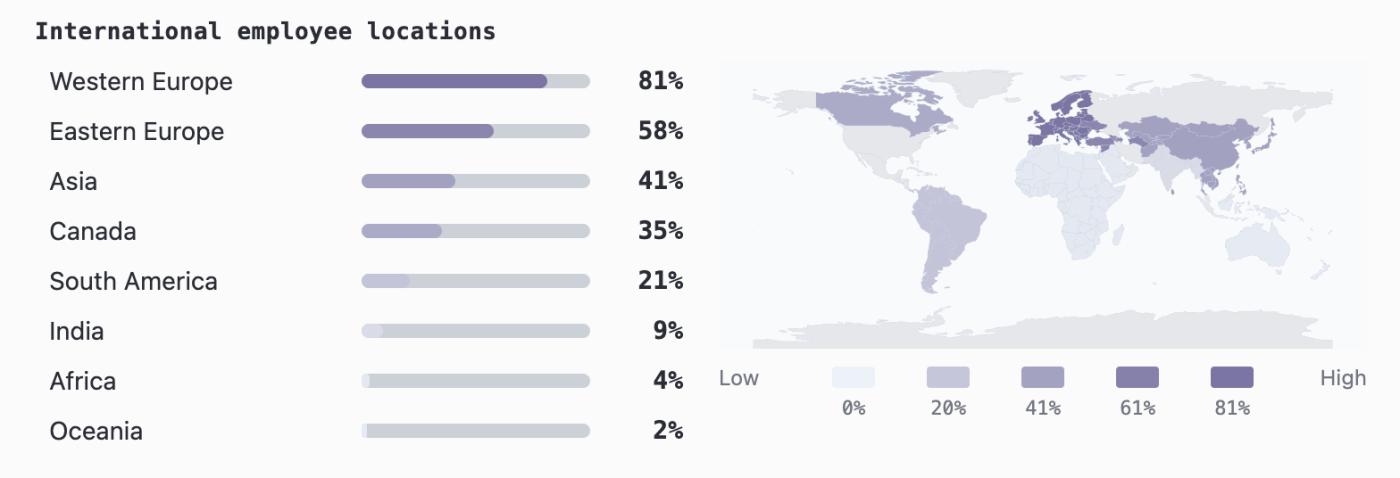

Dragonfly data shows that Western Europe is the leading international recruitment hub.

Changes in regional hiring typically occur when a company enters Series B or later . As the company matures and the need for local operational capabilities increases, the team begins to expand into regions such as Asia, Canada, and Eastern Europe.

At the same time, this may also reflect that this data report is very different from the Asian crypto projects we usually see that are benchmarked against domestic salary standards; among these thousands of data points, the vast majority of salaries may be offered for European positions, so they will rise accordingly.

However, you wouldn't know unless you saw it; these people are really having a great time!

Dragonfly's official summary tells us:

Among companies in Series B to Series E stages, 84% employ staff in Western Europe; the same proportion is observed among companies that have raised more than $40 million .

In the later stages of the company, 63% recruited in Eastern Europe, mainly benefiting from the strong local supply of engineers and relatively cost-effective talent costs.

The presence of employees in Asia has nearly doubled year-on-year, increasing from 20% to 41% , to accommodate stronger user adoption and market demand. Therefore, it appears that the number of employees in Asia is not actually the majority.

Among companies in Series B to Series E stages, 38% expanded to Canada, leveraging its geographical proximity to the United States, relatively favorable regulatory environment, and mature developer ecosystem as a risk hedging option.

In Series B to Series D phases, only 13% of companies expanded into South America.

Relatively rare exceptions include India (9%), Africa (4%), and Oceania (2%).

IV. What can we learn?

3.1 Entry-level talent

If you have a technical background, congratulations, you've already won at the starting line. Software engineers, smart contract engineers, and product managers have the highest starting salaries; even entry-level positions can earn six figures annually in the US market. This would likely require several years of experience in traditional industries.

But here's a suggestion: don't just focus on the starting salary. Learning opportunities and growth potential are more important. Choosing a team that allows you to grow quickly is more valuable than earning an extra ten or twenty thousand dollars in starting salary, because the salary jump from entry-level to mid-level is huge , and the key is how quickly you can make that transition.

While Business Development (BD) and Marketing start with lower salaries, don't be discouraged. Look at their growth curves, especially BD, where salaries can double from entry-level to mid-level. If you're good at building relationships and understand business logic, BD can be an excellent choice. The first year or two might be tough and the salary low, but once you establish a reputation and network in the industry, your value will grow exponentially.

3.2 Intermediate-level talent

It's no coincidence that mid-level PMs command higher salaries than all other positions. The market is frantically searching for hybrid talent who understand both technology and users. If you're an engineer but find yourself constantly thinking, "Do users really need this feature?" or "Is there a problem with this product logic?", then transitioning to product management might be a good option.

For Business Development (BD) professionals, the intermediate stage is truly golden. At this stage, you've accumulated enough experience and connections to independently drive significant collaborations. You know how to interact with different stakeholders and understand how the ecosystem works. In the crypto industry, reputation is everything. Participate in industry events, share your insights on Twitter, and build your professional image in your specific field. These investments will yield huge returns when you seek your next opportunity.

3.3 Regional Strategy

Choosing where to work involves more than just salary. While salaries in the US market are indeed high, don't forget the cost of living. Earning $150,000 in San Francisco might not provide the same comfort as earning €80,000 in Berlin. Furthermore, the US market is exceptionally competitive, and the work pressure is typically higher.

The international market offers a better quality-of-life balance. Many European crypto companies offer more flexible work arrangements, longer holidays, and a relatively relaxed work environment. If you value work-life balance, the international market may be a better fit for you.

Most importantly, remote work is a game-changer. More and more U.S. companies are willing to hire international remote workers, and while salaries may be adjusted, they remain very attractive.

Here's an interesting arbitrage opportunity: accessing international market salaries in low-cost regions. For example, you could live in Eastern Europe or Southeast Asia and work remotely for a company that pays "international market" salaries. Even if the salary is lower than the US standard, your quality of life might actually be higher.

The geographical disparity for certain positions is rapidly narrowing, particularly for senior engineers. If you're a senior engineer, you can likely earn a very good salary regardless of your location. Companies are more interested in your problem-solving abilities than in where you sit and write code.

Conclusion

The 2025 crypto industry salary data reveals a market brimming with both opportunities and challenges. Technical talent continues to command premiums, product managers are emerging as rising stars, and growth roles such as business development and marketing are demonstrating significant potential.

For job seekers, choosing the right position and career path is more important than simply pursuing a high salary. The industry's rapid development means that today's entry-level employees may become field experts within a few years. The key is to keep learning, build networks, and find your unique value in this exciting industry.

For businesses, establishing a fair and competitive compensation system is only the first step. The real challenge lies in creating an environment that attracts, develops, and retains top talent. In an industry where talent defines success, investing in human capital will yield the highest returns.

As the crypto industry continues to mature and evolve, we can expect to see more segmented roles, more specialized skill requirements, and a more global talent market. Those individuals and organizations that can adapt to these changes and continuously learn and grow will be best positioned in this digital future.