AAVE is preparing for a major governance vote; the platform will XEM Chia a portion of its non-core protocol revenue with retail investors holding AAVE Token and will submit a formal proposal to the community.

The update posted on January 2nd, 2025, immediately improved market sentiment. The price of AAVE surged over 10% in a single day as traders reacted to signals indicating increasing consensus between the development team and the DAO.

These are the topics that AAVE 's new proposal will address.

According to the founder of AAVE Labs , the upcoming proposal will explain how revenue generated outside the main lending protocol can be Chia with retail investors holding AAVE .

This revenue typically comes from AAVE's official app, swap integrations in the user interface, and future products for individual or organizational users built on the AAVE platform.

The proposal would also introduce safeguards to protect the interests of the AAVE DAO and prevent sudden changes that could harm small investors holding the Token.

Post from AAVE founder Stani Kulechov. Source: AAVE Governance

Post from AAVE founder Stani Kulechov. Source: AAVE GovernanceAnother key focus will be control over the AAVE brand and its user access channels. This includes the websites, domain names, and social media accounts that represent AAVE to the public.

The proposal would clarify who owns these assets, how they are used, and the limitations on exploiting and monetizing these assets without DAO approval.

Furthermore, the proposal also outlines AAVE's long-term development strategy . According to AAVE Labs, the protocol needs to expand beyond traditional lending, reaching out to real-world assets, and offering products aimed at both mainstream consumers and large organizations.

These plans will be tied to major upgrades such as AAVE V4 and the expanded use of GHO , AAVE's stablecoin.

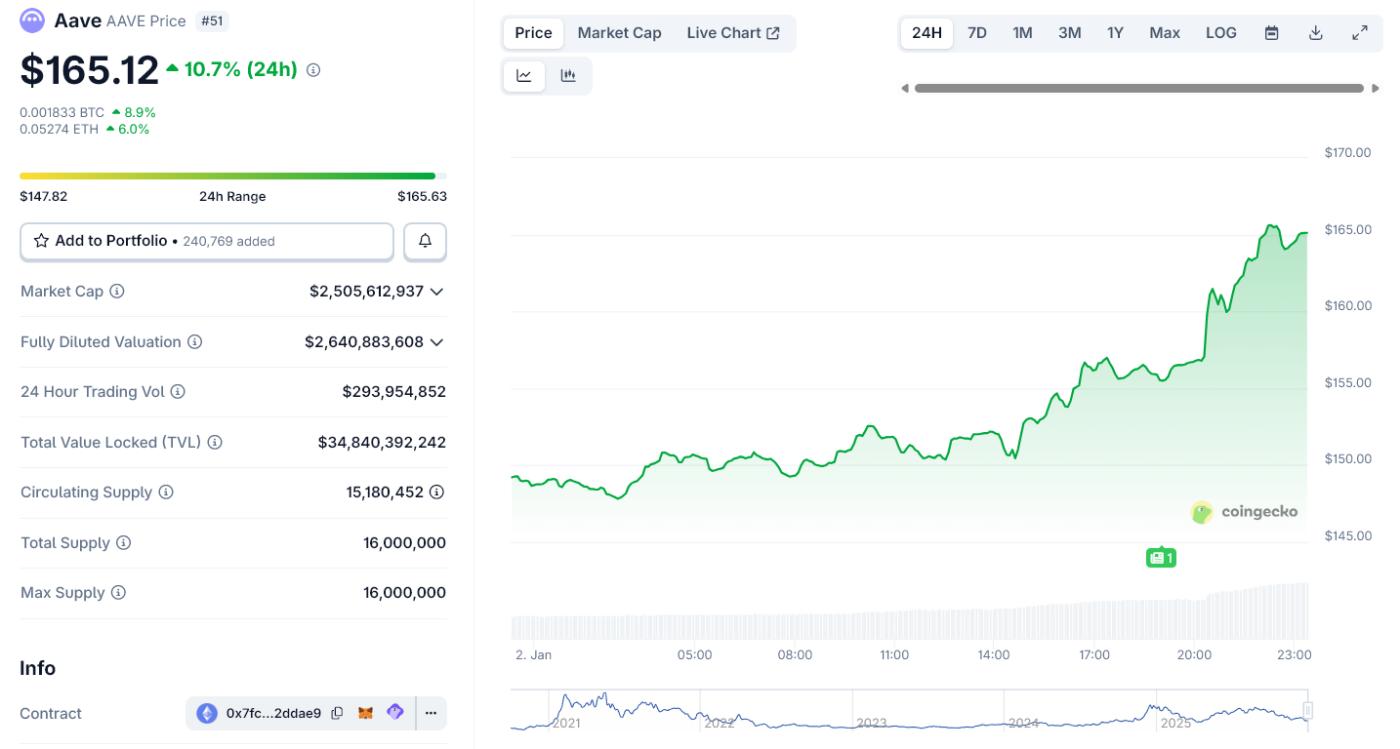

AAVE price surged after the announcement of its revenue Chia plan. Source: CoinGecko

AAVE price surged after the announcement of its revenue Chia plan. Source: CoinGeckoWhy is this important for DAOs?

This move comes after weeks of public disagreements within the AAVE ecosystem.

Recently, some representatives have argued that AAVE Labs is exerting too much control over the project's revenue streams and media channels. They warn that a lack of transparency regarding governance and ownership has caused AAVE price to plummet in recent weeks.

In response, DAO representatives welcomed the change but also stressed the need for clear and enforceable commitments. They argued that vague promises were insufficient and that specific regulations regarding ownership, revenue Chia , and accountability were necessary.

AAVE is among the top 15 highest-revenue crypto platforms in 2025. Source: X/Phoenix

AAVE is among the top 15 highest-revenue crypto platforms in 2025. Source: X/PhoenixThe upcoming DAO vote will determine whether this new governance framework will be adopted.

If accepted, internal project tensions could be reduced, and a better balance between growth and governance could be achieved. Otherwise, disputes over control and development direction will continue.