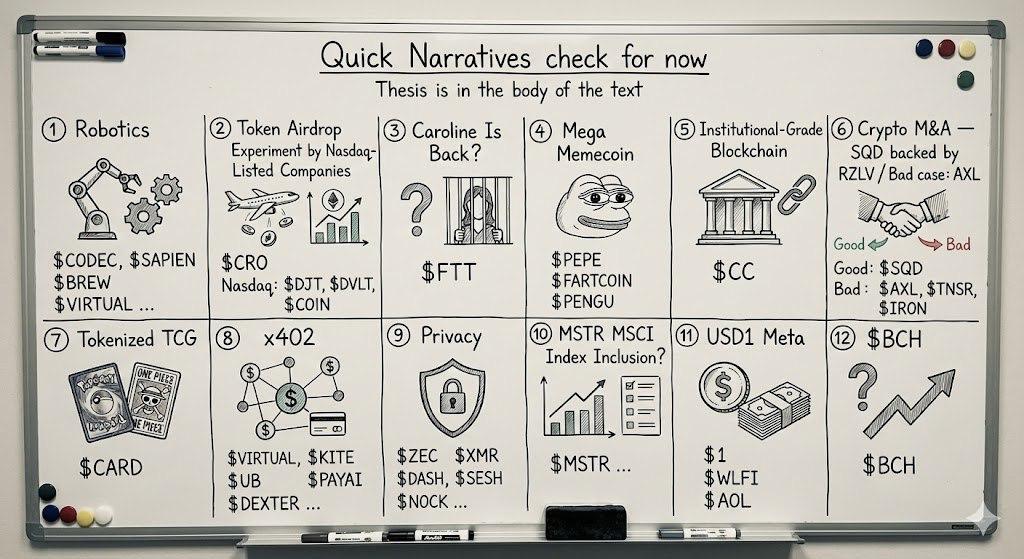

📊 MARKET INSIGHT: UPDATED NARRATIVES LEADING MONEY FLOWS IN EARLY 2026 The market has just undergone a slight correction following geopolitical news from Venezuela. However, the overall structure remains positive. In particular, if the first quarter sees indirect quantitative easing (QE) through the RMP, risk appetite will continue to be supported. Here are 12 key narrative trends to watch closely: 1️⃣ Robotics & AI: The Era of Application The argument: NVIDIA CEO Jensen Huang once predicted that 2026 would be the year the widespread adoption of robotics begins. The CES 2026 event, taking place in the next few days, is expected to be the main stage for this field. Tickers: $CODEC, $SAPIEN, $BREW, $VIRTUAL. 2️⃣ Experiment with Airdrop from publicly listed companies (Nasdaq) Thesis: A trend is emerging of public companies using blockchain to distribute benefits. $DJT Airdrop announcement via Cronos chain ($ CRO). $DVLT announces dividend payment in Token and growth of +60%. $BASE is also part of this larger on-chain distribution picture. Tickers: $ CRO, $DJT, $DVLT, $COIN. 3️⃣ Legal Event: Caroline Ellison & FTT Thesis: Caroline Ellison (former CEO of Alameda) is expected to be released on January 21st. History shows that $LUNA tripled during Do Kwon's trial. This is a noteworthy event regarding the volatility of $ FTT. Tickers: $ FTT. 4️⃣ The Mega Memecoin Wave Thesis: James Wynn's heavy allocation to $PEPE could Vai as a catalyst to trigger an upward trend for large- Capital meme. Tickers: $ PEPE, $FARTCOIN, $PENGU. 5️⃣ Institutional-Grade Blockchain (Infrastructure for organizations) Thesis: Focus on the needs of US financial institutions, including the Tokenize of Nasdaq shares and 24/7 trading/settlement infrastructure. Tickers: $CC. 6️⃣ M&A Activities in Crypto Thesis: The impact of M&A transactions needs to be clearly categorized: Good: Acquire both the team and the Token (Example: $RZLV acquires $SQD). Bad: They only acquire the development team (Acqui-hire) and abandon the Token, causing negative sentiment. Tickers: $SQD (Good); $ AXL, $TNSR, $IRON (Caution needed). 7️⃣ Tokenized TCG (Digital Trading Card) Thesis: Legendary IPs like Pokémon, One Piece, and Yu-Gi-Oh are entering a phase of convergence with blockchain. Events like the 30th anniversary of Pokémon are driving this growth. Tickers: $CARD. 8️⃣ x402 Standard (Agent Economy) The argument: x402 is the runway for an "Agentic" economy, enabling pure machine-native payments and autonomous commerce. Tickers: $VIRTUAL, $KITE, $UB, $PAYAI, $DEXTER. 9️⃣ Privacy The argument: As Naval Ravikant said, "Privacy is not optional." The recent recovery of $ZEC is proof that money is flowing back into the anonymous coin group. Tickers: $ ZEC, $ XMR, $DASH, $SESH, $NOCK. 10 MSTR & MSCI Index The argument: If MicroStrategy ($MSTR) is added to the MSCI index (decision expected on January 15th), ETFs and Index Funds will be compelled to buy this stock, creating significant passive demand. Tickers: $MSTR. 11 USD1 Meta Thesis: The strength of the USD ($1) is spreading to the crypto market, creating a memecoin wave centered around the theme "USD1". Tickers: $1, $WLFI, $AOL. 1️⃣2️⃣ Phenomenon $BCH Thesis: $BCH is experiencing a strong price increase, but the specific driving force remains unclear (a market unknown). Tickers: $ BCH. ➕ Other supporting areas: Prediction Markets. Peg Banks (Next-generation digital banks).

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content