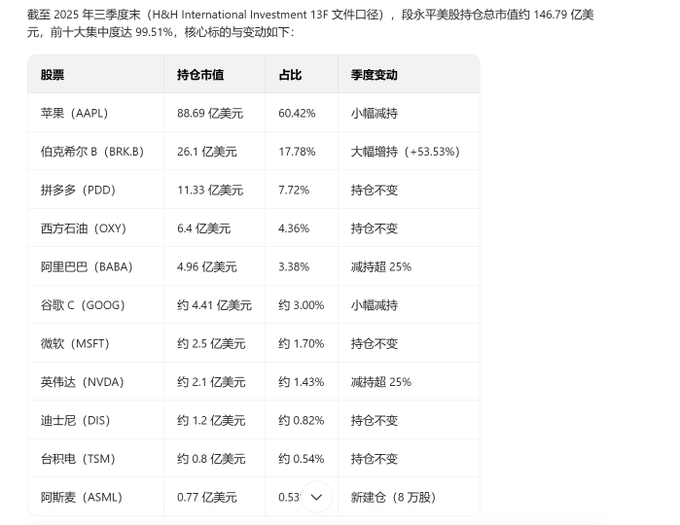

As of the third quarter of 2025, Duan Yongping's total US stock holdings were worth approximately $14.679 billion, with his top ten holdings accounting for 99.51%. He demonstrated an extremely concentrated investment style, even more Buffett-like than Buffett himself: - Apple (AAPL), his absolute ballast, still accounted for 60.42% of his portfolio and was also his most profitable stock. - He significantly increased his holdings in Berkshire Hathaway (BRK.B) by 53.53%, jumping to second place (17.78%), as the market sought a safer haven with greater certainty. - He reduced his holdings in Alibaba (BABA) and Nvidia (NVDA) by over 25%; in contrast, he maintained his holding in Pinduoduo (PDD) and established a new position in semiconductor monopolist ASML (ASML). Duan Yongping's success is not replicable; his core investment philosophy is that buying stocks is buying companies. He never tries to appear smart through frequent trading; he only earns money he understands. His recent portfolio adjustments demonstrate his composure and restraint during the high point of the US stock market, preferring to earn less windfall profits in order to make his asset structure more stable.

This article is machine translated

Show original

链研社

@NB

01-02

段永平在雪球晒了一个盈利了 3300万刀的图片,据说这只是他 50 个账号的其中之一……(贫穷限制了我的想象力)。

2011年,乔布斯离世,苹果失去了它的灵魂,市场一片质疑。 就在那个迷茫的深秋,段永平入场重仓买入苹果。

14 年后的今天:

收益率: +1,881.8%

单账号盈利: $33,920,767(约 2.4

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content