The long position ratio of major stocks was confirmed numerically, with BTC and ETH at around 70% and SOL in the late 70% based on position, and XRP, SOL, and DOGE having coin margin ratios in the 80% range based on account, showing the position distribution of top traders.

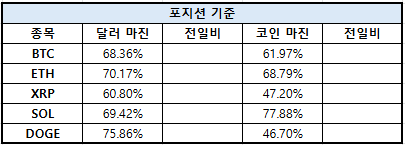

■ Status of long positions in major stocks

Based on position criteria, the long position ratio of Bitcoin (BTC) was calculated to be 68.36% for dollar margin and 61.97% for coin margin.

Ethereum (ETH) recorded a dollar margin of 70.17% and a coin margin of 68.79%. XRP recorded a dollar margin of 60.80% and a coin margin of 47.20%.

Solana (SOL) recorded a dollar margin of 69.42% and a coin margin of 77.88%. Dogecoin (DOGE) recorded a dollar margin of 75.86% and a coin margin of 46.70%.

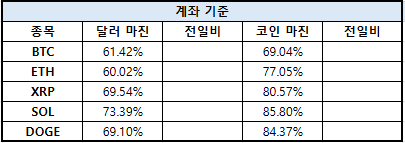

■ Proportion of accounts holding long positions

Based on the account, the long position holding ratio of Bitcoin (BTC) was 61.42% for dollar margin and 69.04% for coin margin.

Ethereum (ETH) recorded a dollar margin of 60.02% and a coin margin of 77.05%. XRP recorded a dollar margin of 69.54% and a coin margin of 80.57%.

Solana (SOL) showed a dollar margin of 73.39% and a coin margin of 85.80%. Dogecoin (DOGE) showed a dollar margin of 69.10% and a coin margin of 84.37%.

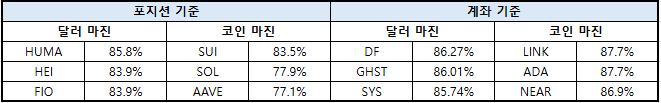

■ Top Trader Positions HUMA·FIO

[Editor's Note] The trading patterns of top cryptocurrency futures traders serve as a valuable indicator of future movements in the cryptocurrency market. Given their high trading expertise and market sensitivity, examining the stocks in which these groups concentrate their long positions can be helpful in understanding overall investment sentiment and direction. However, some may utilize futures contracts to hedge spot positions, requiring additional analysis when interpreting the data. CoinGlass defines top traders as investors with the top 20% margin balance.

The dollar margin market (U market) is primarily favored by institutional investors seeking stable returns, and is used for short-term trading and hedging to reduce volatility. The coin margin market (C market) is often used by cryptocurrency bulls or long-term holders seeking to increase their holdings through leverage. During a bull market, open interest in the C market increases, signaling market optimism. During a bear market, trading volume in the U market increases, signaling institutional inflows.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.