Bitcoin's price surged at the start of the new year, driven by renewed optimism and significant inflows into spot ETFs. Despite some geopolitical tensions following US actions in Venezuela, the "king" of crypto maintained its upward momentum.

The market remains stable, indicating that investors prioritize cash flow flexibility and institutional demand over short-term macroeconomic uncertainties.

Bitcoin whales change their minds.

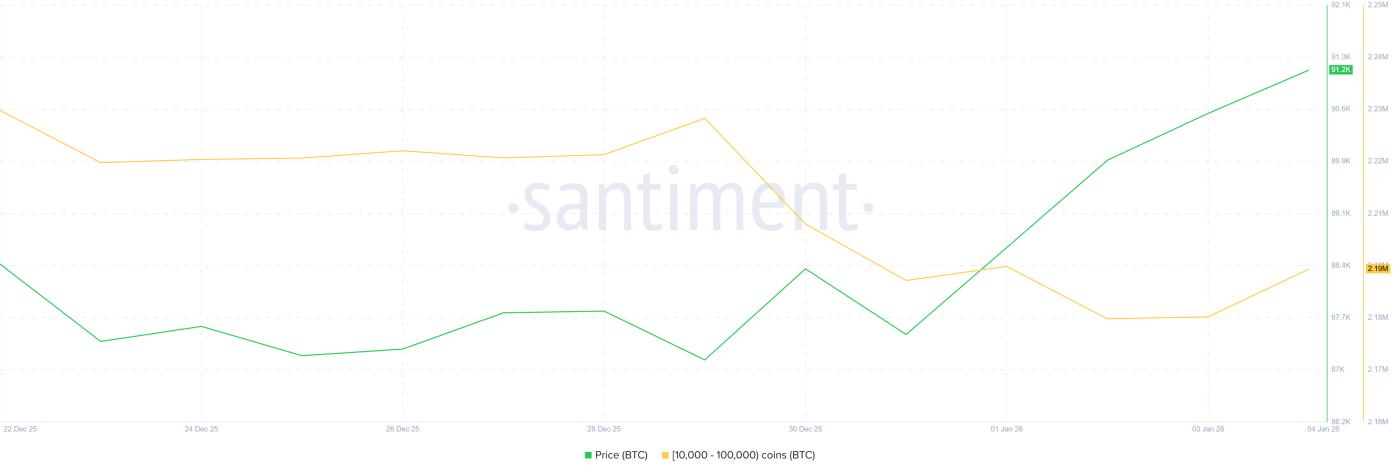

The behavior of Bitcoin whales has changed significantly in the last 24 hours. Wallets holding between 10,000 and 100,000 BTC have sold approximately 50,000 BTC between December 29th and January 3rd. This "Dump off" indicates caution as Bitcoin has yet to break through a strong resistance zone.

But in just the last 24 hours, these whale wallets have started accumulating again. They bought approximately 10,000 BTC, equivalent to $912 million, after Bitcoin surpassed the $90,000 mark. This accumulation move demonstrates the confidence of the "big players" and could help absorb short-term selling pressure.

Want to read more similar Token analyses? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

The amount of Bitcoin held by whales. Source: Santiment

The amount of Bitcoin held by whales. Source: SantimentWhales are often the "pillar" of liquidation during periods of high market volatility. Their return to buying indicates expectations of further price increases. If this accumulation continues, it could help Bitcoin hold its support level and maintain an uptrend in early 2026.

Are Bitcoin Miners a cause for concern?

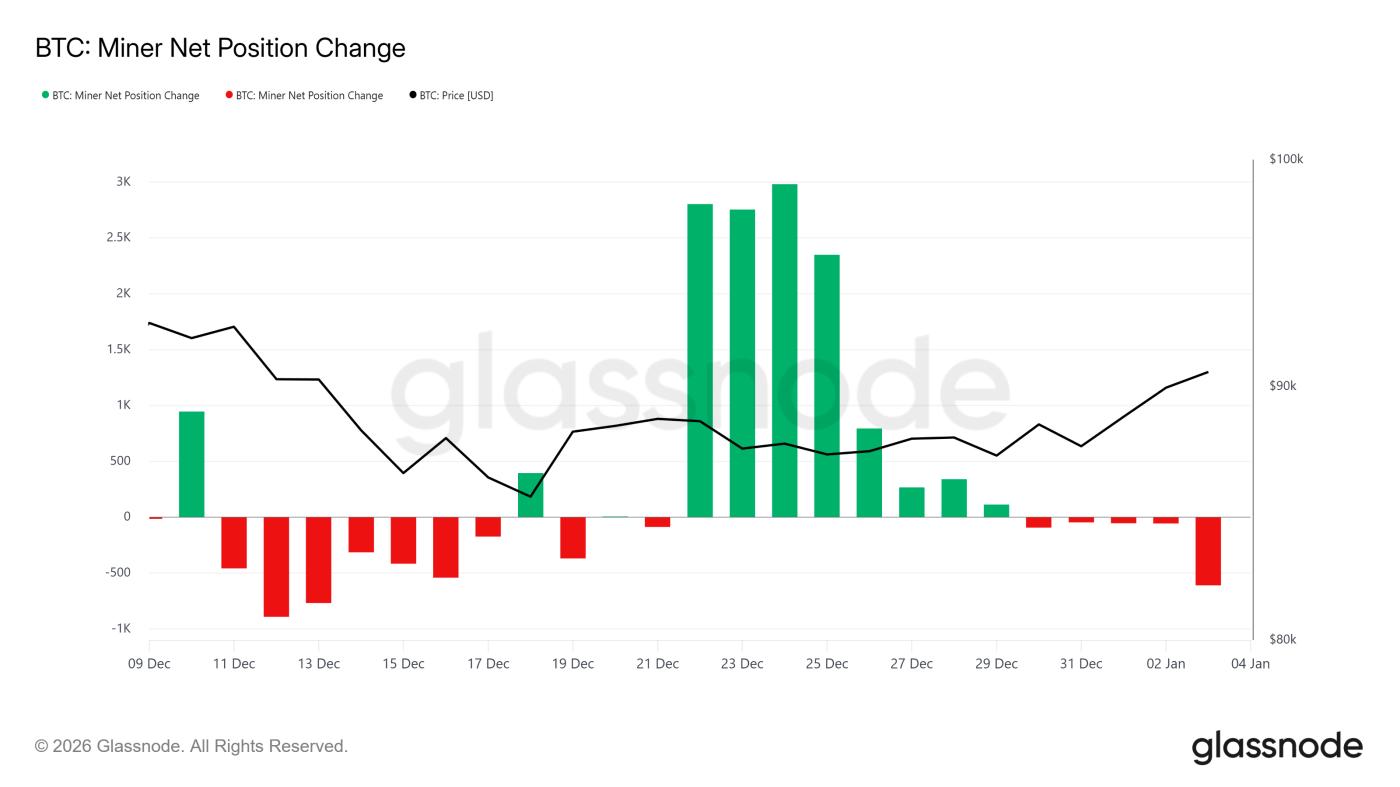

Miner activity is creating headwinds against the optimistic trend. According to data on net Miners position changes, selling volume has increased sharply in the past 24 hours. The amount of BTC flowing out of miner wallets has increased from 55 BTC to 604 BTC as they took profits at high prices.

Although this number is not large compared to the total supply, the selling by Miners still has some impact on short-term trends. When new supply increases while demand slows, the upward momentum may stall. This activity could slow the rate of Bitcoin's price increase , but it will not cause an immediate reversal.

The position of a Bitcoin Miners . Source: Glassnode

The position of a Bitcoin Miners . Source: GlassnodeTypically, Miners sell when prices are strong to cover operating costs. This action doesn't necessarily reflect a pessimistic view. However, combined with a general profit-taking trend, increased supply could slow the breakout until new buying power absorbs all the selling.

BTC price awaits confirmation before a breakout.

Bitcoin has just broken out of a 6-week Falling Wedge pattern in the last 24 hours and is trading around $91,327 at the time of writing. This breakout from the pattern suggests that bullish momentum is strengthening.

To maintain its upward momentum, Bitcoin needs to hold the support level of $92,031. The next target would then be $95,000.

Bitcoin price analysis. Source: TradingView

Bitcoin price analysis. Source: TradingViewTo confirm a sustainable uptrend, Bitcoin needs to break above key moving Medium . Currently, the 50-day EMA around $91,554 and the 365-day EMA at $97,403 are Vai as resistance.

If these levels can be converted into support, the bullish reversal trend will become clearer and the likelihood of returning to the region above $100,000 will improve.

Bitcoin's EMA lines. Source: TradingView

Bitcoin's EMA lines. Source: TradingViewShort-term risks remain tied to the reaction of global markets. When markets reopen on Monday, US actions in Venezuela could cause significant volatility in investor sentiment.

If the global market reacts negatively, it could put pressure on Bitcoin's price , pushing it back to the $90,000 range or lower and weakening its potential for short-term gains.