World Liberty Financial's price continued its upward trend that began in mid-December 2025, recording further gains last week.

Token associated with the Trump family reacted strongly after former President Donald Trump launched an attack on Venezuela and arrested Nicolás Maduro. These geopolitical developments increased volatility, pushing WLFI prices to new highs recently.

WLFI holders recorded impressive returns.

on-chain data shows that the percentage of investors making a profit is increasing rapidly. Profits from WLFI increased from approximately 25% to 40% in just 24 hours following news of the US action.

As prices accelerated, the proportion of total supply in the profitable range also reached its highest level in four months, indicating a widespread recovery across different wallet groups.

This development benefits early participants who accumulated WLFI during the initial offering phase . Many of these investors experienced the initial sharp decline and are now seeing their investments return to a profitable state.

As profitability increases, market sentiment typically improves. However, this can also lead some retail investors to want to take profits after reaching a certain level of gain.

Want to stay updated on the Token market? Sign up for the Daily Crypto newsletter from editor Harsh Notariya here .

WLFI Supply In Profit. Source: Santiment

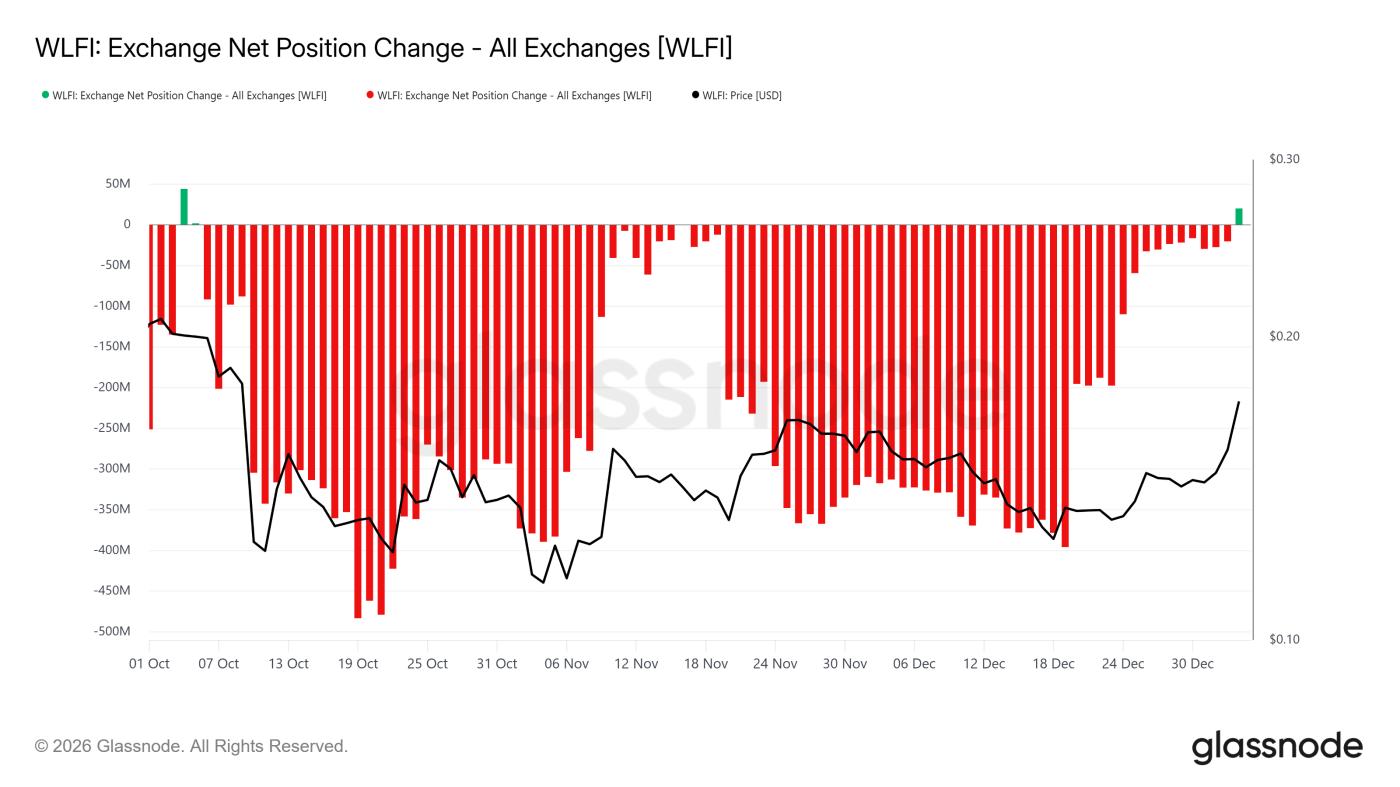

WLFI Supply In Profit. Source: SantimentDespite improved returns, macroeconomic data suggests that the majority of WLFI investors lack the patience to hold long-term. The net position change data on the exchange has shown a green bar – the first time this has been recorded in nearly three months. This indicates a larger amount of WLFI has moved onto the exchange, which is typically a signal of distribution – selling off – rather than accumulation.

Selling pressure often emerges quickly when investors turn profitable after a prolonged period of losses. WLFI investors seem ready to sell as soon as the market recovers.

This action could potentially limit WLFI's further upward momentum, as a larger number of Token on the exchange will increase supply, absorbing some of the demand from new buyers.

WLFI Exchange Net Position Change. Source: Glassnode

WLFI Exchange Net Position Change. Source: GlassnodeWLFI price is waiting to break out of the pattern.

WLFI is trading around $0.172 at the time of writing, after recovering from a Dip of $0.143 earlier this week. The Token has risen approximately 11% in the last 24 hours, reaching the upper boundary of an expanding rising wedge pattern. This structure reflects increased volatility, but does not yet indicate a clear direction.

Although the price is approaching a resistance zone, the likelihood of a strong breakout in the short term is quite low. Many retail investors, upon returning to profitable areas, may continue to take profits, thereby putting pressure on the price.

In this scenario, the WLFI price could return to the lower support zone, with $0.154 XEM the next technical support level.

WLFI price analysis. Source: TradingView

WLFI price analysis. Source: TradingViewFor a sustainable upward move, WLFI needs to establish a strong support level at $0.172. This requires a reduction in selling pressure and a return of new buying demand.

If the upward momentum continues and there isn't much selling pressure, WLFI could break through the resistance zone and head towards $0.182, thus rejecting the neutral or negative outlook.