Matrixport: "Upward momentum will gain traction in 2026 as speculative overheating eases."

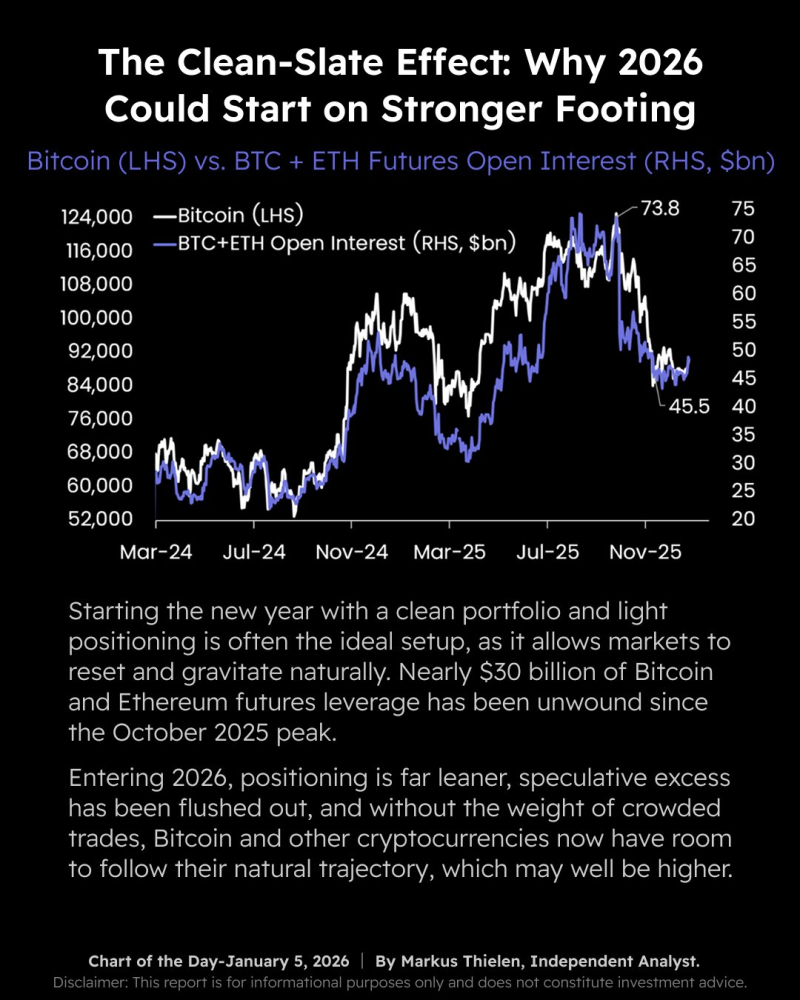

Since the virtual asset market peaked in October of last year, approximately $30 billion (KRW 43.458 trillion) worth of leveraged open positions in Bitcoin (BTC) and Ethereum (ETH) futures have been liquidated. This indicates that the virtual asset market is gradually shifting away from overheated speculative flows and toward a more stable state. A recent analysis report by Matrixport, a web3 financial services company, assessed this shift as a positive sign for the virtual asset market's resurgence this year.Matrixport analyzed that with the start of the new year, positions in the virtual asset market have become lighter, leverage levels have decreased, and speculative overheating is easing. With the market volatility caused by excessive leverage decreasing, prices of major virtual assets, including Bitcoin and Ethereum, are likely to return to a more natural course. This suggests that market rebalancing is fostering a healthy investment environment.

Matrixport positively assessed this market shift, stating, "With $30 billion in leverage liquidated, the virtual asset market is transitioning to a more stable and sustainable growth environment," and advised that this year will be a crucial time to capitalize on this new upward momentum.

Joohoon Choi joohoon@blockstreet.co.kr